So it’s been about a year since BRK and 3G Capital acquired Heinz (HNZ). This is old news to most of you as the 10-Q for the first quarter was posted more than a month ago. It is pretty amazing to read and you will see how incredible the 3G folks really are. To find…

Category: Uncategorized

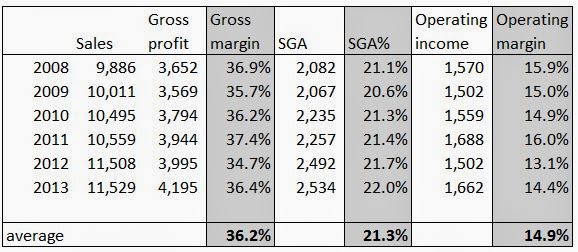

Is Coke Undermanaged?!

OK, now that’s a silly idea. Coke (KO) is one of the most respected companies and known to be very well managed. It is an excellent company for sure. One great thing about running a blog is that I can just think out loud here and sometimes someone pulls on a thread and gets…

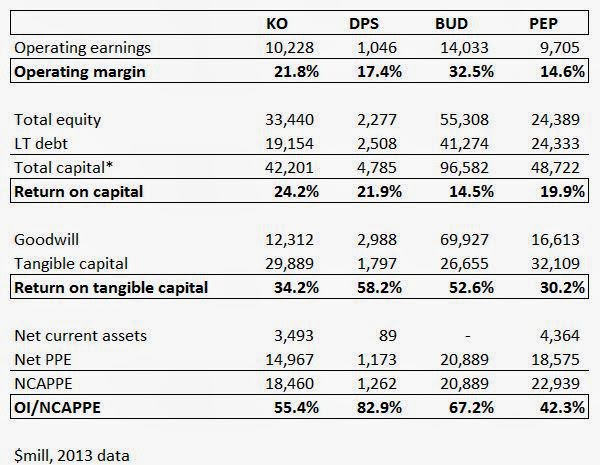

Big Dream: Anheuser-Busch InBev (BUD) / Coca-Cola (KO) Merger

This morning KO’s stock price popped up on a comment by David Winters that Buffett and 3G are planning to take KO private. He said that there are indications that something is going on, including press reports in Brazil regarding something related to 3G, KO and Buffett. Now, I don’t want to speculate on mergers…

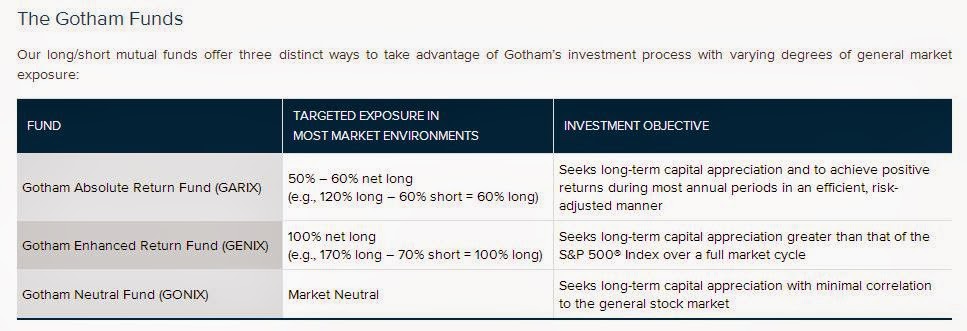

What To Do in this Market II: Gotham Funds

Many people seem to be worried that the market is a little toppy. This is kind of strange because the market is basically flat and hasn’t done anything. But OK, the market was up 30% last year so if you include that (and the whole rally since the 2009 low) the market has come up…

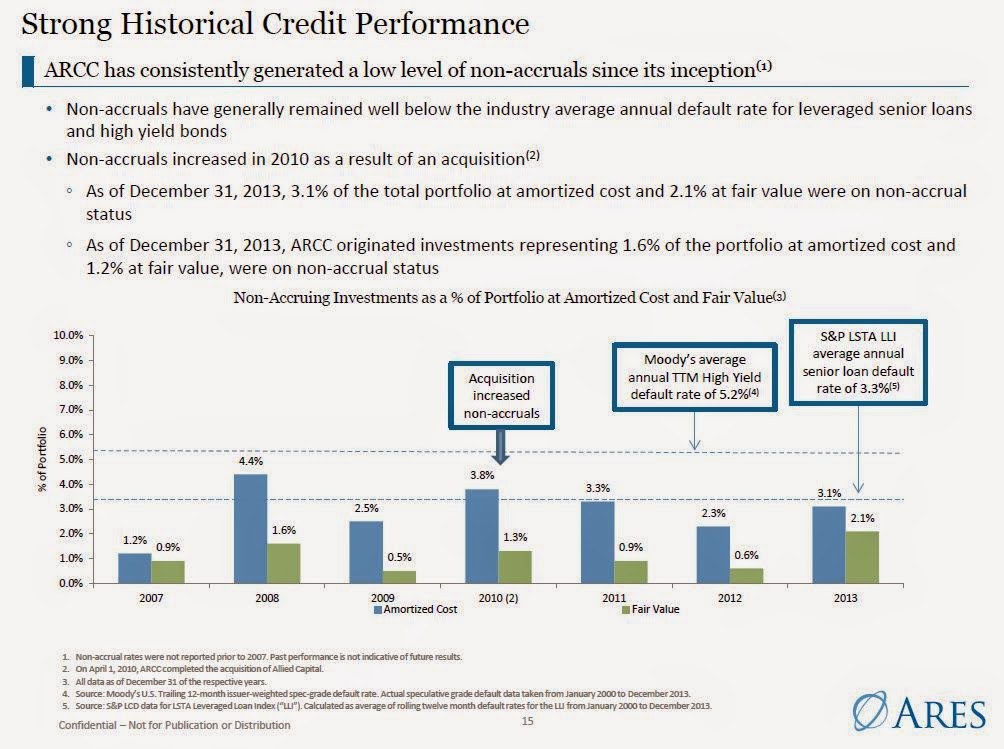

ARES: Ares Management, L.P.

As we all hold our breath for the Alibaba IPO filing (OK, or maybe not. I am actually looking forward to it even though I have no intention of buying any shares), here’s a look at another S-1 filed by Ares Management (ARES) recently. (As I was finishing this up, it turns out that the…

JPM Annual Report 2013

So the JPMorgan Chase (JPM) annual report is out. After the Berkshire Hathaway report, this is my favorite read of the year. I say “annual report”, but I actually just mean “letter to shareholders”. Anyway, here are some comments as usual. This is not meant to be a comprehensive summary or anything close to that;…

$24 Billion Wealth Transfer?!

So David Winters is upset about the “biggest transfer of wealth from shareholders to management” in history. According to Winters Coke’s (KO) new 2014 Equity Plan may cause 14.2% dilution to shareholders over the next four years. His calculation is that there are 4.4 billion shares outstanding so 14.2% of that is 625 million shares,…

10x Pretax Earnings! Case Studies: KO, BNI etc.

So, one of the great things about writing a blog is that I get feedback from some pretty intelligent people. Most of us don’t have a Munger to call, but a blog works well too. If I say something wrong, I’m sure someone would jump in to point it out. 10% Pretax for Stocks Too?…

Buffett the Market Timer? Part 5: The Berkshire Years 2005-2013

OK, so here we go. Hopefully this will be the last part in this marathon series. BRK LTS 2005 So 2005 turns out to be an interesting year. After years of not doing much in the stock market, Buffett initiates positions in Anheuser-Busch, Walmart, and “substantially” increases his position in Wells Fargo. It’s been a…

Buffett the Market Timer? Part 4: The Berkshire Years 1991-2004

So we continue. Let’s see what he says in 1991: BRK LTS 1991 Our outsized gain in book value in 1991 resulted from a phenomenon not apt to be repeated: a dramatic rise in the price-earnings ratios of Coca-Cola and Gillette. These two stocks accounted for nearly $1.6 billion of our $2.1 billion…