Bank of America announced their earnings and it looks OK. Of course, there is still an issue with low interest rates and loan growth like at other banks. This is not intended to be a full recap of BAC’s second quarter. I don’t want to comment on every quarterly announcement of companies I talk about…

Category: Uncategorized

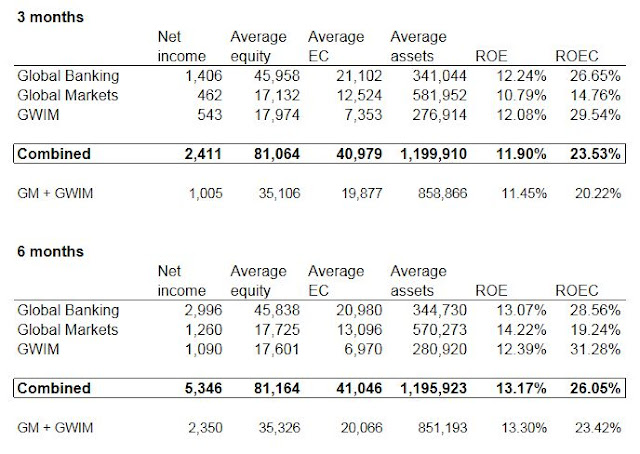

Wall Street Firms Only for Employees?

So I keep hearing people say that Wall Street firms exist only for their employees. One guy on Bloomberg TV said that GS only exists for it’s employees; why not get that compensation down and return some of it to shareholders? As proof that GS exists only for the employees, he states that compensation is…

Howard Marks on Macro etc.

Howard Marks was on Bloomberg TV yesterday and it was a great interview. I think Bloomberg TV is way better than CNBC these days as they seem to ask better questions and give the guests more time to answer questions (rather than trying to make them say things that the interviewer wants to hear, or…

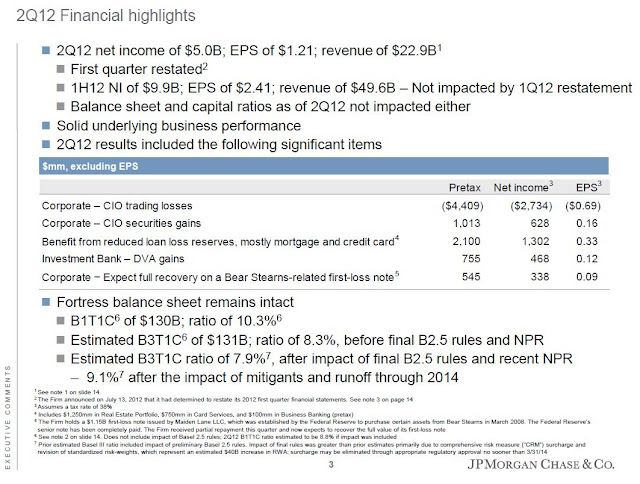

JPM: 2Q Conference Call

This must have been one of the most anticipated corporate conference calls ever. I have to admit to looking forward to it too. Anyway, we finally see the big number. This is not a summary of the conference call which lasted two hours, but just some thoughts. Whale Loss Rumors of losses were as high as…

Stubbing Bank of America

OK, I have to stop with these misleading post titles. You can’t really do a stub trade on Bank of America (BAC) as a stub can only happen when the piece you want to back out is publicly traded. Anyway, with News Corp breaking up (after repeatedly saying it’s not going to happen) and many…

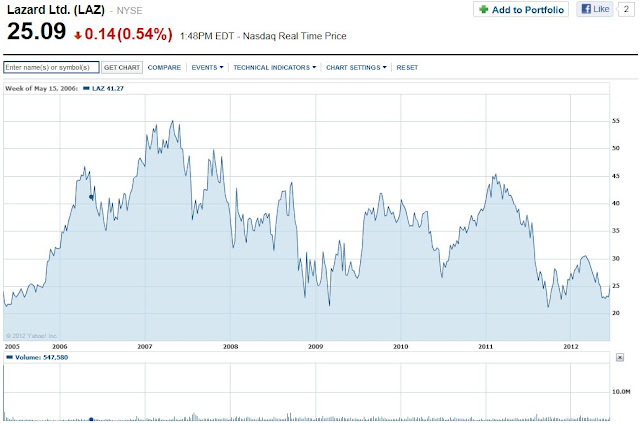

Lazard: Countercyclical Finance Play?

Nelson Peltz’s Trian Partners bought a 5.1% stake in Lazard recently and has supported Lazard’s new strategic plan. I haven’t looked at these independent advisory firms too closely in the past as they have usually traded at very high levels. The other independent advisory firms are Evercore Partners (EVR) and Greenhill & Co (GHL). Also, revenues are correlated to…

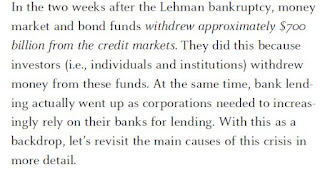

The Real Cause of Financial Crisis: Money Market Funds

OK, so that’s a dramatic statement. This post will no doubt come across as way too sympathetic to banks, but since I see that the SEC is looking into money market funds, I thought I’d make a post about it. This has been a pet peeve of mine for a while. The banks have been…

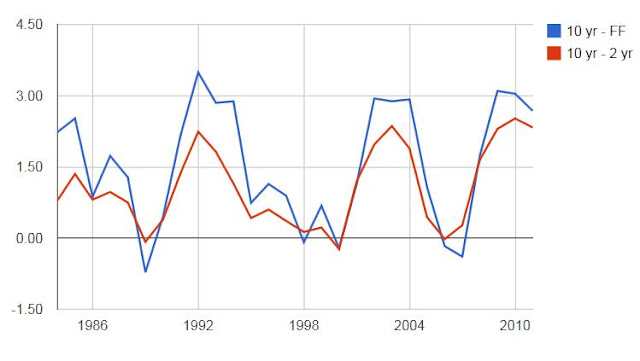

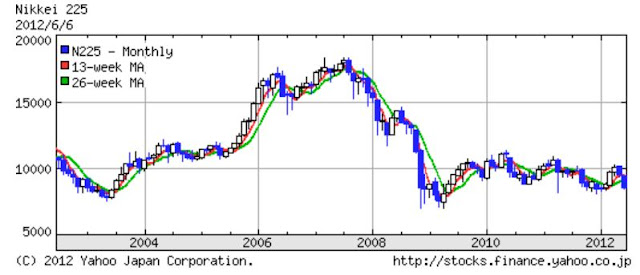

Net Interest Margins etc.

I mentioned recently that what I fear most for U.S. banks is what happened in Japan; low interest rates for a long time. If long term interest rates keep going lower, this will put pressure on bank net interest margins and therefore profits. So I decided to take a quick look at this and found…

Market Volatility

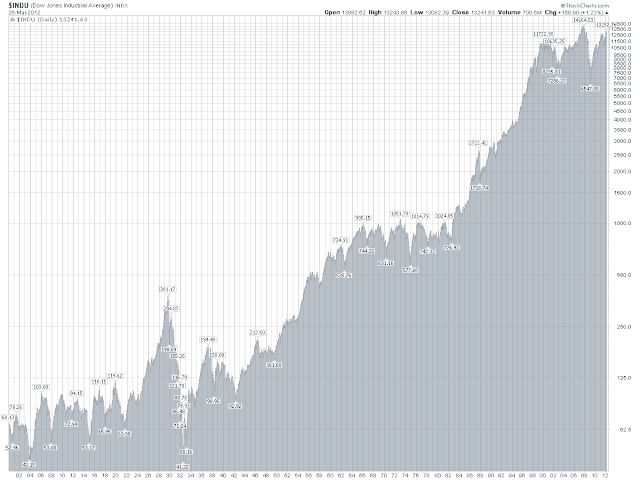

So I hear this a lot: “With HFT (High Frequency Trading), hedge funds, ETFs and instant trading via iPad apps (and mobile smart and dumb phones), the volatility in the stock market is intolerable. I can’t take it anymore. I’m out!” Or, “with so many darn MBA’s, PHD’s and rocket scientists trying to outsmart the…

Tokio Marine Holdings: Japan Fund with Negative Management Fee?

So this is just a quick look at an old trade. Tokio Marine Holdings has always been known to own a lot of equities and the stock often traded at a discount to it. A long time ago before insurance companies started to mark their stockholdings to market, it was a classic value play where…