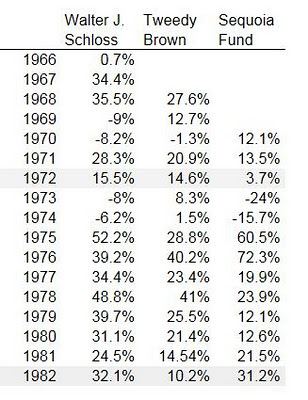

Continuing on the “stocks are no good” theme, it is interesting to look at what the Superinvestors did during the long flat market period between 1965 and 1982. I think the Dow hit 1,000 back then and didn’t go above it for good until late 1982. The talk now is that the U.S. may go…

Category: Uncategorized

Ungold!

Gold has done really well the last decade or so and more and more people are talking about the inevitability of gold as a wealth saving asset (protection against inflation, monetary pump-priming etc…). However, a lot of what we hear today sounds a lot like Howard Marks’ first-level thinking (see here what that means). Central…

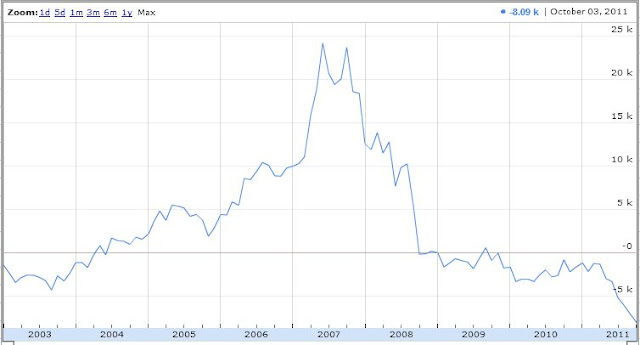

Renault-Nissan: The Stub Trade from Hell?

Here is a stub trade that doesn’t seem to get talked about much. I remembered that Renault owns a big chunk of Nissan and that it is very valuable. The talk a while back was that if you backed out Renault’s ownership of Nissan and Volvo, you can get the Renault auto business for free. Well,…

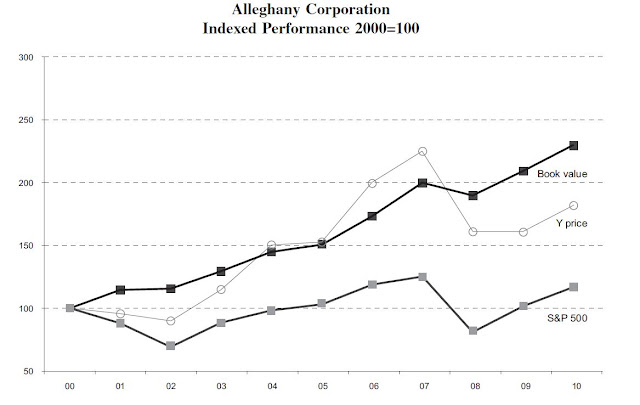

Alleghany Corp (Y)

To continue the boring pattern of featuring companies with great track records being offered by Mr. Market at a discount, here is Alleghany Corp (Y), an insurance company/conglomerate. This currently looks like an insurance company but acts more like a conglomerate. This is one of those companies where the annual reports are very well written…

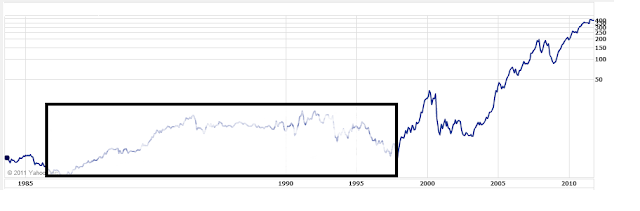

Goodbye Steve Jobs

Apple Stock Price Since 1984 Apple’s stock was IPO’ed on December 12, 1980 at $22/share. On a split-adjusted basis, that’s $2.75/share. Apple closed yesterday at around $378/share for an annualized return of +17.8%/year. Pretty incredible given the long period that Apple went nowhere and did nothing (after they fired Jobs until he came back). The…

Are Stocks Expensive Now?

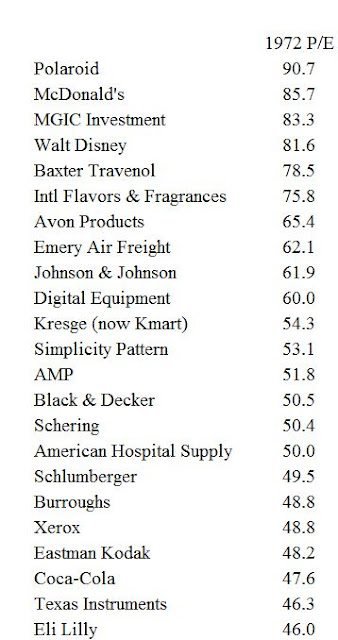

I couldn’t find a list of the nifty fifty stocks of the early 70’s and their p/e ratios to illustrate the difference between then and now, but I did find some lists with p/e ratios of some popular stocks back in 1972. I found this on the internet and just cut and pasted it (sorry…

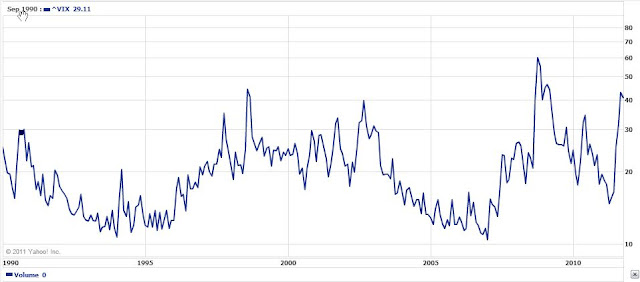

VIX: The Fear Index

We all know that we have to be greedy when others are fearful and fearful when others are greedy. Well, here’s an interesting chart: The VIX index: 1990 – Now I don’t intend to make market calls, bottoms and things like that. That’s really not my thing at all. But I will mention things when…

Loews Corp

I might as well write about this old, classic sum-of-the-parts investment too. It’s well known in the value investing community, so nothing new here either except a fresh update. For those who this is new to, it’s a conglomerate that is run by the Tisch family. Of course, I think many people know Larry Tisch,…

Crude Oil Prices

Crude oil prices have been tanking recently with the stock market and other commodities. I just thought I’d mention an interesting thing about crude oil prices which might have some relevance for people looking at oil company stocks and oil price ETFs. The November 2011 contract for WTI crude closed today at $77.12, quite a…

6201: Toyota Industries

OK, this is one of the oldest stub trades ever and hasn’t really been an exciting one. Marty Whitman of the Third Avenue Value fund has owned it forever. For those interested in actionable ideas right now, look at some of the financials. You can skip this post. Also, I’m sure many value investors have…