So here’s another name that we like to follow around here. Loews Corp is a respected (not by all, I know… there are people who think L needs a big shakeup) value investor and has a good long term track record. Recently, things haven’t looked too good, but it’s still worth tracking what they are…

Category: Uncategorized

13F Fun

So, for fun, I wrote a script that grabs manager holdings and compares the portfolio since the last time a 13F was filed. This is available at places like dataroma.com but I wanted to be able to check out my own institutions that may not be superinvestors. When I wanted to diff the 13F files, I…

Scary Chart Part III: Missing the Trees for the Forest

OK, so this is a continuation of the scary chart series (not really intended to be a series, and not really intending to be so actively posting!). Whenever I see these big charts showing how the markets are overvalued and whatnot, I usually just go back to looking under the hood on what’s really going…

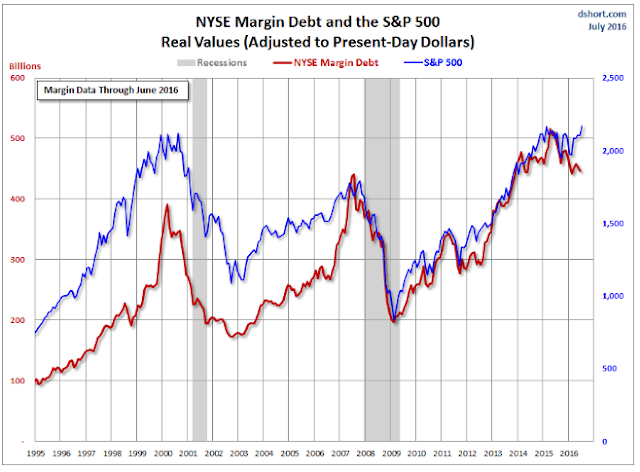

Scary Chart Part II

OK, so there was some feedback from my post about the scary chart. A bunch of other scary charts were offered up along with a presentation by the great Stanley Druckenmiller. I am a huge fan of Druckenmiller; he is no doubt one of the greatest traders of all time. When I started out in…

Scary Chart!

Another post! Don’t assume this is going to be the normal frequency going forward. I think my previous pace of 1-4 posts a month is the best you should expect. Anyway, I came across (again) a scary looking chart, and I hear people screaming to sell everything now, so I thought I’d revisit the issue…

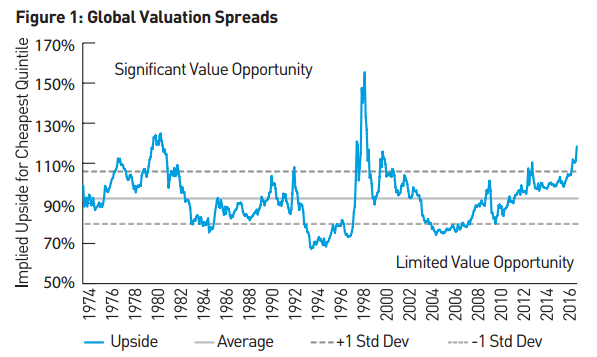

Record Valuation Spreads!

It’s been a while, I know. I was browsing around the net as usual and came across something that was at the back of my mind for a while now and it was graphically illustrated convincingly so I thought it would be a great excuse to break radio silence here. Which, by the way, is…

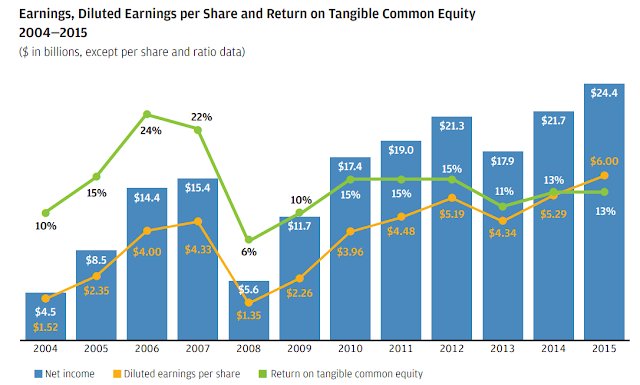

JPM Annual Report 2015

It’s been a while since I last posted. The only explanation, I suppose, is inertia. When you post a lot, you post a lot. When you don’t post for a while, then you stop posting. It’s true I started getting busy in September last year (kid/family stuff, mostly, so good stuff). And then you just…

AMETEK, Inc (AME)

Seriously, I am not stalking Lou Simpson at all (or at least any more than any other ‘great’ investor). But this sort of jumped out at me. It’s sort of old news as the 13-F’s came out in November. Sometimes, some investors just buy or own stuff that just resonates with me, like that time…

Superinvestor Portfolio Winners and Losers

This is sort of just an administrative post: I added to the ‘pages’ section a winners and losers sort of the Superinvestor portfolios. This, I guess, is the companion to the Superinvestor screens. It’s just sorts the stocks in the portfolio by year-to-date returns. I’m guessing with all of the volatility in the markets these…

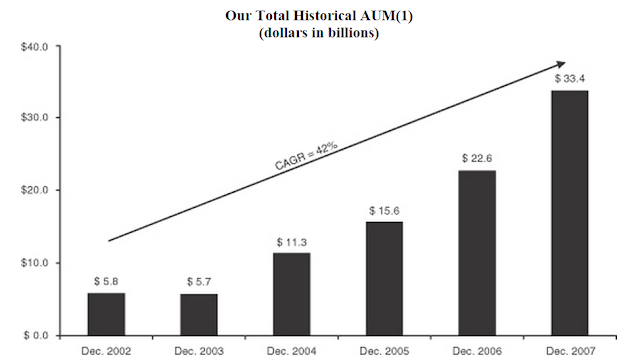

12% Dividend Yield?! (Och-Ziff Capital Management Group (OZM))

The alternative management companies have been getting crushed in the recent correction. A lot of these guys were trading ‘cheap’ to begin with so I was wondering if there was some opportunity here. I’ve talked about some of these in the past, but other than OAK, have not invested in any of them. That’s mostly…