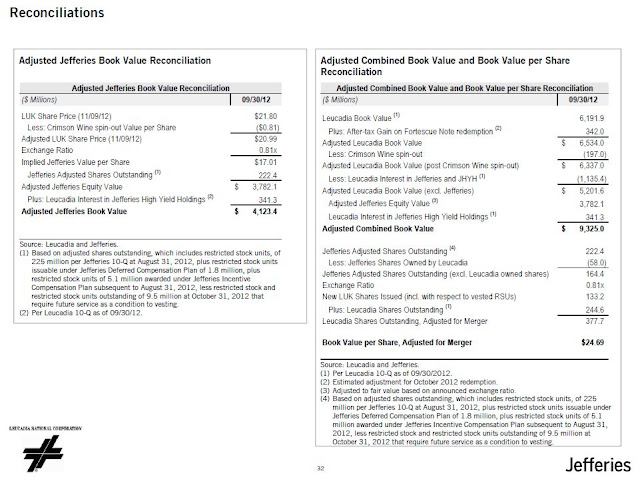

So after posting my initial look at the merger, a couple of points have been raised. Or I should say one was raised (in the comments section in the previous post) and that lead to another point. One is the issue of dilution. I said that this merger would have a 4.7% or so dilutive effect…

Leucadia-Jefferies Merger

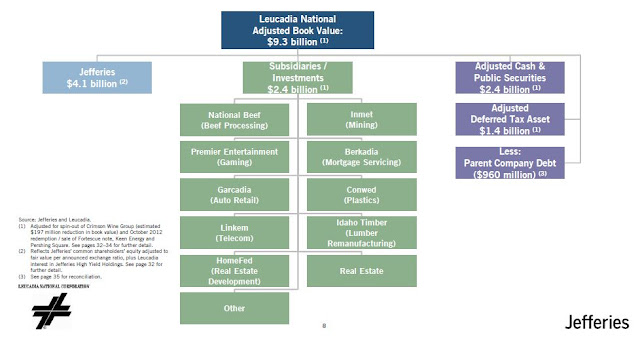

So this is what it comes down to. Leucadia (LUK) buys Jefferies (JEF) and solves some problems with one deal: Succession: since Handler will become CEO of the post-merger Leucadia, succession is no longer an issue. Handler is well regarded and is known to be a very solid, conservative manager. I have no problem with Handler at…

Buffett on CNBC

Buffett was on CNBC this morning. Who has time to sit in front of the TV from 7:00 – 9:00 am? And only the hardcore Buffett-heads would click through and watch all the videos or read the full transcript. (Also, I tell people to listen to Buffett but I know most don’t have the time to…

Crash!!?

This is not a market-timing blog or anything like that, but every now and then I get the itch to make a post about it even when I have no real information or analysis to offer. So most can skip reading this post. Anyway, last October and November, I made a bunch of bullish posts…

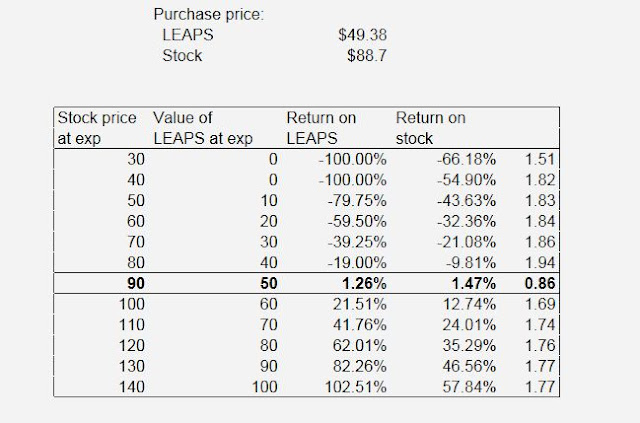

Recapitalizing Berkshire Hathaway

So I had a conversation recently and I mentioned LEAPS and leveraged recapitalizations (or synthetic recapitalizations) as one idea mentioned in Greenblatt’s You Can Be a Stock Market Genius (see the book here). Actually, Greenblatt calls this “creating your own stub stock”. A stub stock is the post recapitalized shares of a company that borrowed a…

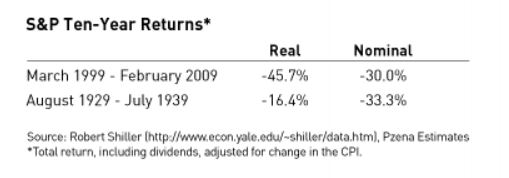

The Deep Value Cycle (and the Case for Value Investing)

OK, so this is sort of a continuation of my PZN post. Listening to conference calls, you can tell that Pzena spends a lot of time thinking about value and deep value investing. I guess that’s because he spends a lot of time talking to potential clients and he has to sell them on the…

Pzena Investment Management (PZN)

OK, so here’s another nail that we can hammer down with our asset management company valuation model. I have been following this company since the IPO but haven’t really taken a close look at it recently. This is a pure, deep-value investment company run by Richard Pzena. In case you are wondering, this is the…

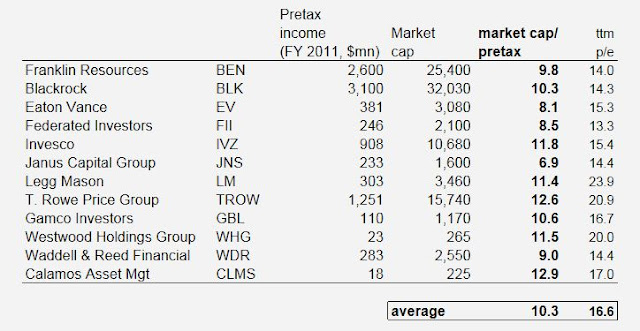

WisdomTree Investments (WETF)

OK, so I mentioned WisdomTree Investment (WETF) in my last post. In my other post looking at DoubleLine, I sort of got a feel for what money management firms are worth. I got comfortable with the fact that asset managers currently trade for around 10x pretax profits and that’s pretty consistent across asset manager types….

The Big Secret, Magic Formula, WisdomTree etc.

I just finished reading The Big Secret for the Small Investor, and thought it was really good. I know, I know. This is old news. It’s been blogged and discussed to death, I think. But I haven’t kept up with my reading and I just happened to come across this at the local library so I checked…

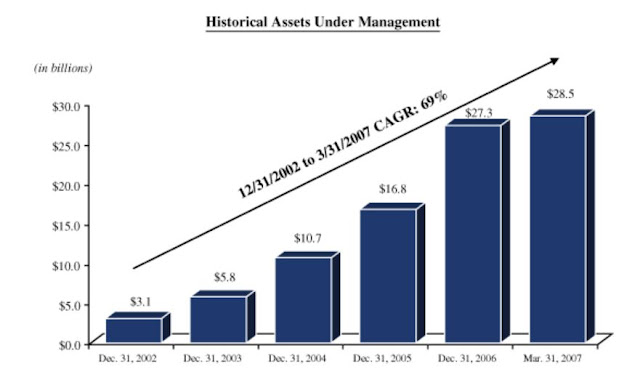

DoubleLine Capital Valuation Hint

So here’s another followup post, this time for my OAK/DoubleLine post (here). Jeffrey Gundlach was on CNBC yesterday and talked about the markets and surprisingly talked about what he sees for the future of DoubleLine. Gary Kaminsky conducted the interview and he asked a really good question that lead to Gundlach’s discussion of DoubleLine’s future…