So JCP tanked this week on bad earnings; it closed the week at $26.29/share. I think this is an interesting situation but haven’t done anything here yet, but things are getting interesting at this price. The Situation I assume most people in the market knows what’s going on here. Bill Ackman of Pershing Square along…

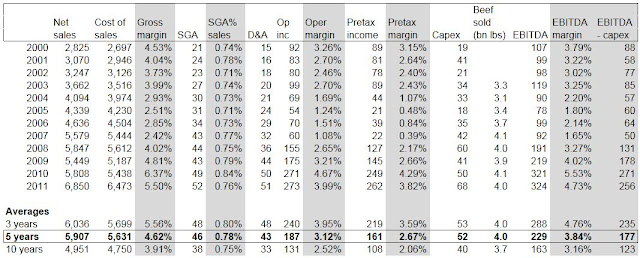

National Beef

This is just some housekeeping stuff for LUK. National Beef is a major purchase and it may be at the center of LUK’s plan to turn it into a fortress entity; a cash flow producing going concern that will generate cash even in bad times and less emphasis on deal-making to create wealth. This is…

Natural Gas Prices

This comment by Tom Mara at the Leucadia annual meeting got me really curious about this guy, Arthur Berman, a petroleum geologist who has done extensive research on shale natural gas. I think the comment was that shale gas is uneconomical under $7.00/mcf over the longer term implying that when natural gas prices get back up there,…

GLRE: David Einhorn at Book

So David Einhorn is in the news again lately and I do notice that GLRE is trading around book value so I thought I’d post an update on this. I posted before that GLRE is a way to get hedge fund exposure at book value. I did say then that this is the same as…

Leucadia National Annual Meeting Notes 2012

I know the annual meeting excitement today is in Florida (J.P. Morgan), but I went to the “boring” one today in midtown. Again, I am not the greatest note-taker and this is not meant to be a comprehensive summary although I tried to jot down most major points. There may also be some errors too,…

JPM: Oops…

OK, so since I am a big Dimon and JPM fan, how can I not post something on this? So JPM held an emergency conference call to announce that they have $2 billion in losses and people seem to be going crazy. The Volcker rule crowd, of course, love this. “Told ya so!”. People keep…

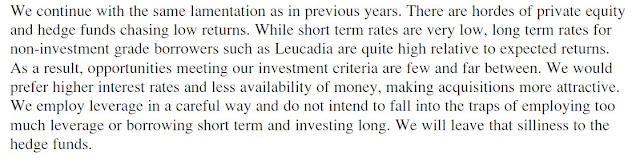

LUK: Leucadia National, Some Quick Notes

2011 Annual Report As usual, the Leucadia National annual report is a great read. This is one of those annual reports that is never a waste of time. They made an exception in this year’s annual report to talk about the sorry state of this country’s politics. It says, “Usually we begin our Letter…

Berkshire Hathaway Annual Meeting Notes (of Notes) 2012

OK, so I was not there but since the information is all over the place on live blogs and things like that, I thought I’d just sum up some of the things I’ve read including things I’ve heard on interview clips on places like CNBC, Fox Business News and others. Most of the actual meeting…

HRG: Harbinger Group, Negative Stub Value

I looked at HRG last year to see if there is an opportunity. Someone called this the next Berkshire Hathaway. I wrote about it here. With Falcone in the news a lot again, I thought it’s a good time to take another look at this thing. I will take a completely fresh look at this and…

Biglari’s Compensation Plan

So I understand that Biglari has pissed off a lot of people with renaming Steak N’ Shake to Biglari Holdings and his hedge fund-like compensation package, which is of course unheard of for publicy listed restaurant companies. To be sure, Warren Buffett doesn’t have anything like that, nor does the Tisch family or the folks…