Yes, it’s a tsunami. Tsunami of liquidity. A fiscal tsunami. Both at the same time. People seem baffled at the strength of the stock market; they keep saying the market is ‘divorced from economic reality’ and things like that. Others say this is a big bubble waiting to implode. I don’t mean to argue that…

Tag: Greenblatt

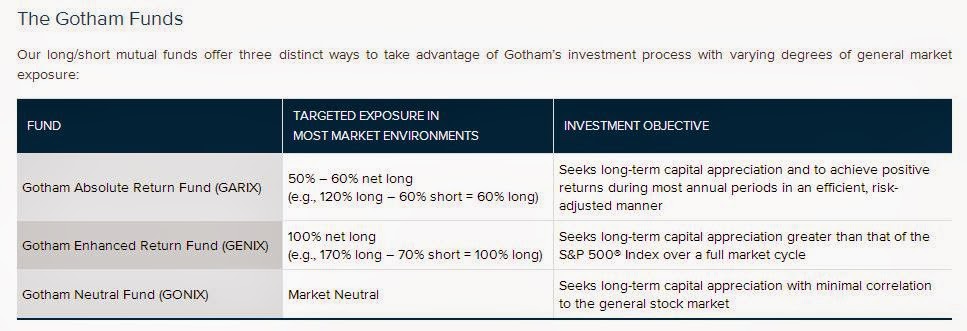

Gotham’s New Fund

Joel Greenblatt was in Barron’s recently. He is one of my favorite investors so maybe it’s a good time for another post. Anyway, this new fund is kind of interesting as I am sort of a tinkerer; this is like the product of some financial tinkering. I don’t know if it’s the right product for…

What to Do in this Market: Gotham Funds Update

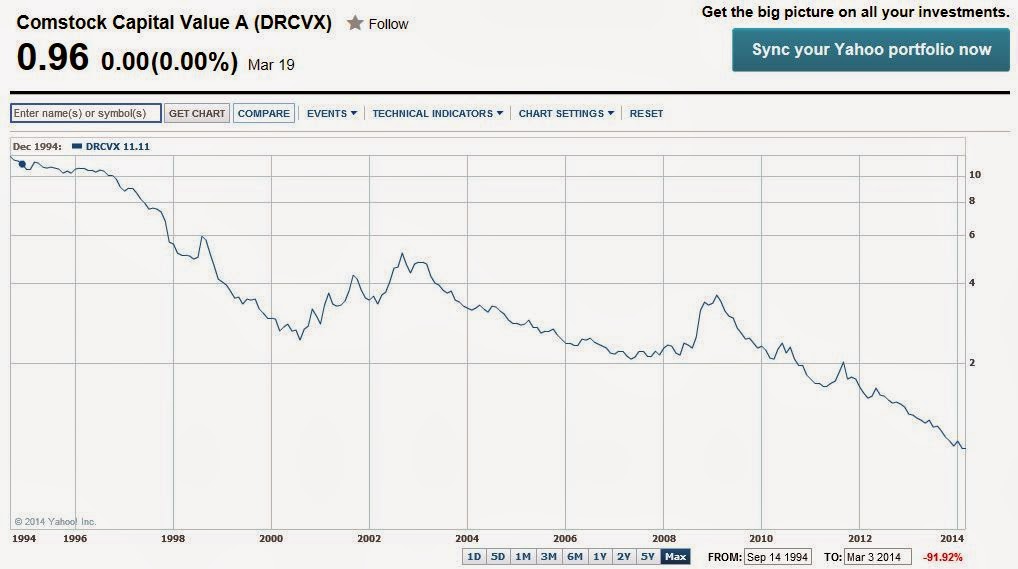

So my posts about the perils of market timing and market valuation have led to some interesting discussions in the comments section. Anyway, I wrote about the Gotham funds last year and since a little more time has passed, I thought I’d look at their performance to see what’s going on. But first, let me…

What To Do in this Market II: Gotham Funds

Many people seem to be worried that the market is a little toppy. This is kind of strange because the market is basically flat and hasn’t done anything. But OK, the market was up 30% last year so if you include that (and the whole rally since the 2009 low) the market has come up…

Greenblatt on CNBC: Market Reasonably Valued

So Joel Greenblatt was just on CNBC and said some interesting things. I don’t intend to post every time someone I respect shows up on TV, but this appearance was especially interesting to me for a couple of reasons. One major reason is, of course, market valuation. I don’t really care about the many folks…

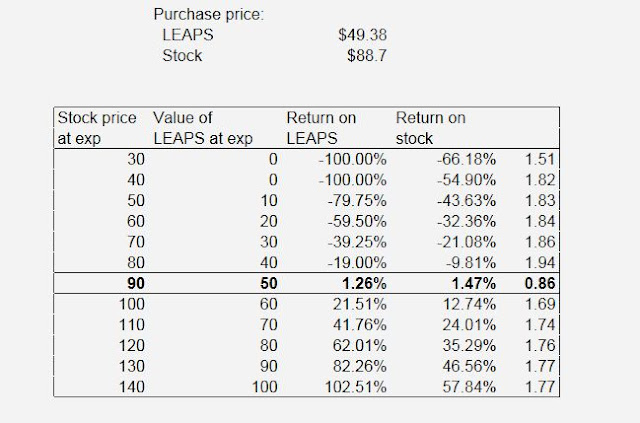

Recapitalizing Berkshire Hathaway

So I had a conversation recently and I mentioned LEAPS and leveraged recapitalizations (or synthetic recapitalizations) as one idea mentioned in Greenblatt’s You Can Be a Stock Market Genius (see the book here). Actually, Greenblatt calls this “creating your own stub stock”. A stub stock is the post recapitalized shares of a company that borrowed a…

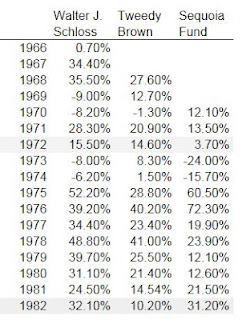

The Big Secret, Magic Formula, WisdomTree etc.

I just finished reading The Big Secret for the Small Investor, and thought it was really good. I know, I know. This is old news. It’s been blogged and discussed to death, I think. But I haven’t kept up with my reading and I just happened to come across this at the local library so I checked…

What’s Important

Goldman Sachs published a lengthy report recently saying that the stock market is a buying opportunity of a lifetime. Of course, the bears are out tearing apart the argument piece by piece. I’ve read the report and some of the very well articulated counter-arguments. First of all, some are laughing at Goldman Sachs’ report saying that it’s…

Joel Greenblatt on CNBC

Joel Greenblatt was on CNBC yesterday and said that the stock market is now, as measured by a ratio to free cash flow, in the 95th percentile of cheapness in the past twenty years. The market is typically up 15-20% a year after this kind of cheapness, and a value portfolio can be up mid-30s…