Buffett was on CNBC this morning. Who has time to sit in front of the TV from 7:00 – 9:00 am? And only the hardcore Buffett-heads would click through and watch all the videos or read the full transcript. (Also, I tell people to listen to Buffett but I know most don’t have the time to…

Tag: investing

Crash!!?

This is not a market-timing blog or anything like that, but every now and then I get the itch to make a post about it even when I have no real information or analysis to offer. So most can skip reading this post. Anyway, last October and November, I made a bunch of bullish posts…

The Deep Value Cycle (and the Case for Value Investing)

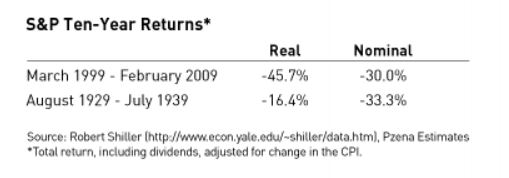

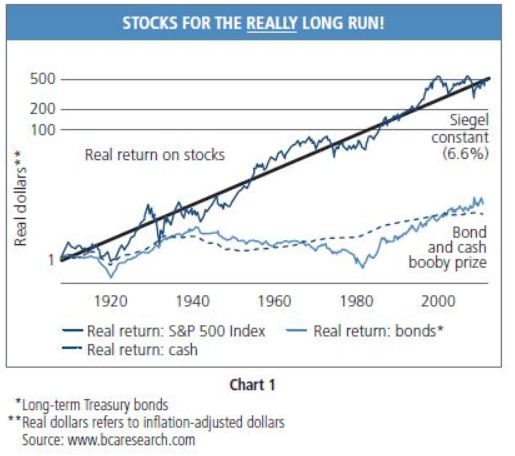

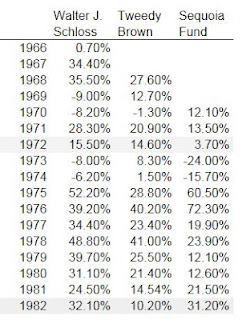

OK, so this is sort of a continuation of my PZN post. Listening to conference calls, you can tell that Pzena spends a lot of time thinking about value and deep value investing. I guess that’s because he spends a lot of time talking to potential clients and he has to sell them on the…

The Big Secret, Magic Formula, WisdomTree etc.

I just finished reading The Big Secret for the Small Investor, and thought it was really good. I know, I know. This is old news. It’s been blogged and discussed to death, I think. But I haven’t kept up with my reading and I just happened to come across this at the local library so I checked…

Quick Comment on Fundamental Analysis

So the conversation I overheard this weekend that I mentioned in the previous post reminded me of something. Back when I used to talk a lot more to ‘trader’ types many of them used technical analysis, macro-forecasting, astrology and all sorts of other things because they claimed that fundamental analysis of stocks just doesn’t work. Part of…

DF Spinoff, Mr. Market, When to Sell etc.

So it’s been a while since I posted. Some late summer, beginning of the school-year business, some laziness and some dead-ends is my excuse. Dean Foods / WhiteWave Foods Spinoff I spent some time digging into the Dean Foods (DF) WhiteWave spinoff but couldn’t get over the fact that it just looks like a really crappy…

World War III and the Stock Market (and other random thoughts)

I’ve read the 1934, 1940 and 1988 editions of Securities Analysis but haven’t read the 1951 and 1962 editions. For whatever reason, they slipped through the cracks. I really love the 1934 edition because it is the first edition and really digs into what went wrong in the 1920s and early 1930s (sounds exactly like the…

Howard Marks on Macro etc.

Howard Marks was on Bloomberg TV yesterday and it was a great interview. I think Bloomberg TV is way better than CNBC these days as they seem to ask better questions and give the guests more time to answer questions (rather than trying to make them say things that the interviewer wants to hear, or…

Market Volatility

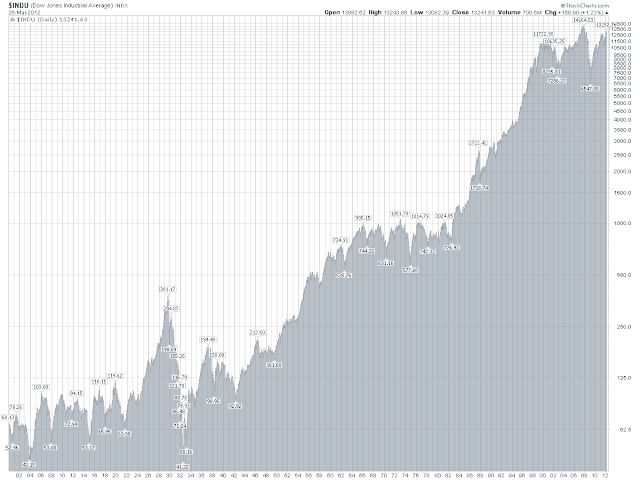

So I hear this a lot: “With HFT (High Frequency Trading), hedge funds, ETFs and instant trading via iPad apps (and mobile smart and dumb phones), the volatility in the stock market is intolerable. I can’t take it anymore. I’m out!” Or, “with so many darn MBA’s, PHD’s and rocket scientists trying to outsmart the…

What’s Important

Goldman Sachs published a lengthy report recently saying that the stock market is a buying opportunity of a lifetime. Of course, the bears are out tearing apart the argument piece by piece. I’ve read the report and some of the very well articulated counter-arguments. First of all, some are laughing at Goldman Sachs’ report saying that it’s…