So, here is my new year’s resolution: turn over more rocks this year. A LOT more. The process of investing is pretty much just looking for interesting things to do. The more situations you look at, the more chance you have of running into an interesting idea. I have to admit that in the past…

Tag: investing

Investing as a Skill

I am now reading a book by Jerry Yang called “All In”. Jerry Yang is an Hmong immigrant from Laos who came to the U.S. and in a very short period of time won the World Series of Poker in Las Vegas. It is a very interesting book for many reasons, one of which is that…

Market Volatility

The market seems to go up and down these days depending on who said what, or what the latest development in Europe is. No confidence vote? Referendum? It is really silly. Someone said to me the other day that it must be hard to deal with markets like this. I said, “What are you talking…

Some More Bullish Stuff

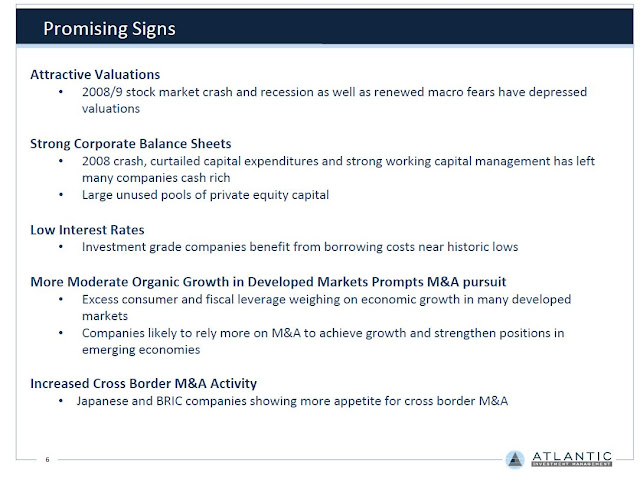

The Value Investors Congress was held in Mid-October. This is a conference run by Whitney Tilson of Value Investor Insight and it features some of the best value investors as speakers. After the conference, notes and presentations float around the internet and they make very interesting reading. Anyway, I was browsing through some of these…

Bullish For Next Ten Years?

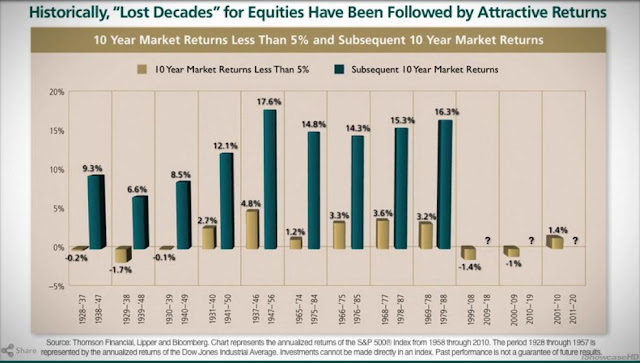

I just found this chart in a promotional video from Davis Funds and I thought it was interesting in that it illustrates what I tell people about dumping stocks because they say stocks are no good. The chart below shows every ten-year period since 1928 that the market rose less than 5%. The gold bars…

Stocks No Good? (Superinvestors)

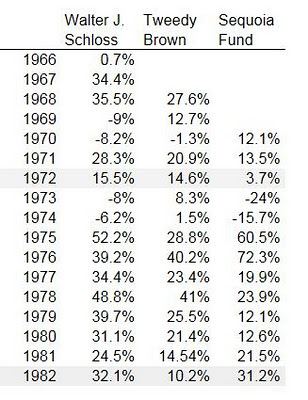

Continuing on the “stocks are no good” theme, it is interesting to look at what the Superinvestors did during the long flat market period between 1965 and 1982. I think the Dow hit 1,000 back then and didn’t go above it for good until late 1982. The talk now is that the U.S. may go…

Are Stocks Expensive Now?

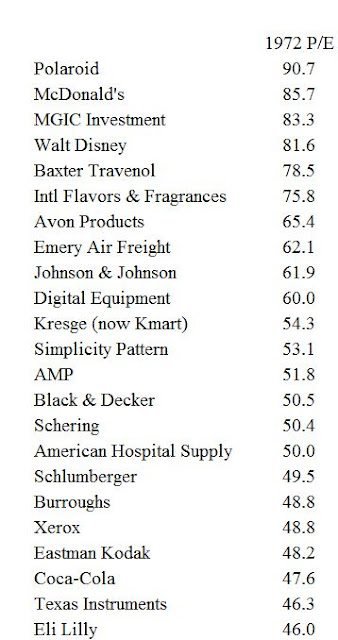

I couldn’t find a list of the nifty fifty stocks of the early 70’s and their p/e ratios to illustrate the difference between then and now, but I did find some lists with p/e ratios of some popular stocks back in 1972. I found this on the internet and just cut and pasted it (sorry…

Crash?!

The Dow is down another 170 points this morning after being down 260 points yesterday. The market is apparently now in bear market territory (-20% from a high). Are we headed for a crash? Who knows. It may happen. Mr. Market is emotionally unstable so trying to guess what will happen is like trying to…

Second-Level Thinking

Howard Marks is a well-known fund manager with very good returns over the long term in the corporate bond market (distressed etc…) and has been writing great memos to investors for a long time. They do float around on the internet so when I do find one I spend time reading it and there is…

Where Will the Market Go?

The S&P 500 index closed at 1136.43 and gold closed at $1642.50 per ounce today. I said before that this is not a market forecasting or predicting blog, and I actually really have no idea where the market will go from here. It certainly doesn’t look good. But I thought I would just highlight a…