OK, so since I am a big Dimon and JPM fan, how can I not post something on this? So JPM held an emergency conference call to announce that they have $2 billion in losses and people seem to be going crazy. The Volcker rule crowd, of course, love this. “Told ya so!”. People keep…

Tag: JPM

JPM Annual Report 2011

JPM posted their 2011 annual report last night and as usual it’s a great read. It’s probably the best annual report written out there (other than Warren Buffett’s). I know a lot of people are skeptical of what corporate executives say. They say, “you actually believe what these CEOs tell you?!”. Good point. But what…

Financials Still Cheap

The financials have really exploded this year as unemployment and other economic figures continue to show some decent recovery. Europe doesn’t seem like it’s going to blow up tommorow. China seems to be going into a hard landing but China might be a laggard to what has happened in the U.S. and Europe in the…

JPM Investor Day

So J.P. Morgan had their investor day yesterday and Dimon was pretty optimistic about J.P. Morgan and even the economy (I wasn’t there). He does see a lot of businesses so has a good feel for what’s actually going on in the economy than economists that just sit around inputting data they get from the…

Dimon on CNBC

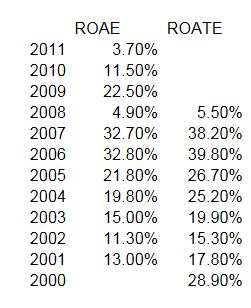

Jamie Dimon, CEO of J.P. Morgan Chase (JPM) was on CNBC yesterday and reiterated that the current stress test banks are undergoing in the U.S. will be a non-issue for JPM. This is not new news, but it is interesting that he said that JPM will have a Tier 1 common equity ratio of 7-8%…

Cheap and Cheaper

I know, this is a broken record blog. We all know financials are cheap and we all know there are plenty of reasons why they are cheap and why they might be right to be priced cheap. However, I tend to still like the well-managed financials. This is laughable and I don’t mean to suggest…

BPS Growth at Banks versus the S&P 500 Index

OK, I keep saying I won’t do something and then go ahead and do it a post or two later. One thing interesting to notice about these bank earnings announcements is how solid they are despite the horrible environment (or so it seems when you read the newspaper). For example, the S&P 500 index has…

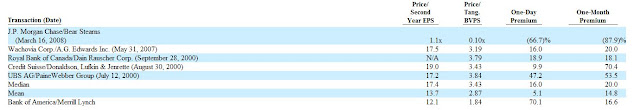

Bank TARP Warrants

One legacy of the financial collapse is the series of long term warrants on the banks that received TARP money. When large U.S. banks received TARP money from the Treasury in 2008, they also issued warrants on the shares of stock to the treasury department. The Treasury then sold the warrants to the public when…

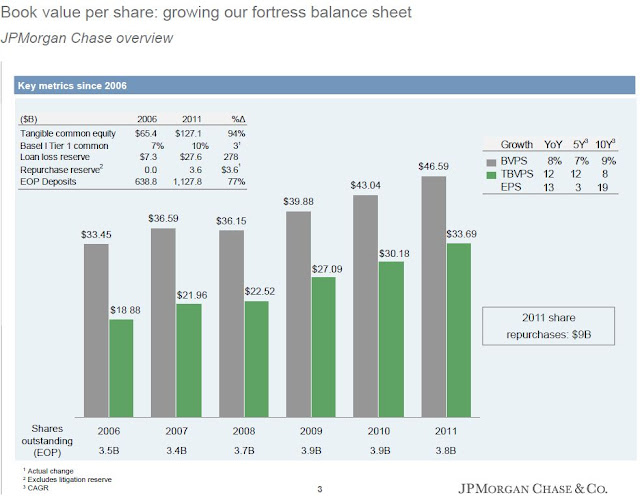

J.P. Morgan at Tangible Book

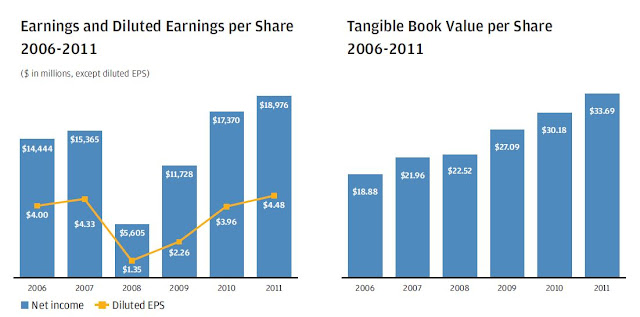

I was reading a recent issue of Grant’s (August 12, 2011) and he reminds us that J.P. Morgan Chase (JPM) is trading at close to tangible book value per share. He also quotes Jamie Dimon, one of my favorite CEOs as saying in April, “Your company earned a record $17 billion in 2010, up 48%…