So here’s another name that we like to follow around here. Loews Corp is a respected (not by all, I know… there are people who think L needs a big shakeup) value investor and has a good long term track record. Recently, things haven’t looked too good, but it’s still worth tracking what they are…

Tag: L

13F Fun

So, for fun, I wrote a script that grabs manager holdings and compares the portfolio since the last time a 13F was filed. This is available at places like dataroma.com but I wanted to be able to check out my own institutions that may not be superinvestors. When I wanted to diff the 13F files, I…

Loews 2014 Annual Report

The Loews 2014 annual report is out (OK, well, it’s been out a while). I was wondering how they would present their historical returns as they haven’t looked good recently. I’ve talked about how they have changed what they show in their annual reports for performance over time, and there was a discussion in the…

Loews 4Q 2014 Conference Call

I don’t normally make posts about conference calls as I tend to look at things over the long term and things don’t change much from quarter to quarter or even year to year. If I look at something and like it, it is probably because I looked at how someone has done over a long…

Loews 2012 Annual Report

So the 2012 annual report is up on the website. They revamped it and Loews even has a new logo. Here is the new logo: I’m not an art major or anything like that so I don’t know anything about it but my first impression was that this looks a little retro, even Art Deco-ish. …

More Adjustment to Loews Book Value

So I made a post about the adjusted book value per share of Loews (L) and someone kindly responded that there are publicly listed MLP general partnership (GP) interests that I can use to value L’s GP interest and IDR (incentive distribution rights) in Boardwalk Pipeline (BWP). The thing to do, of course, would be to calculate the…

Loews Adjusted Book Value Update

I may be jumping the gun here as Loews (L) annual report hasn’t come out yet, but since the 10-K is out I figured I would just update some numbers. Last year I made a post about adjusting L’s book value by adding or subtracting the difference between the market value of publicly listed holdings…

Loews Corp: Recent Returns, Adjusted Book Value etc.

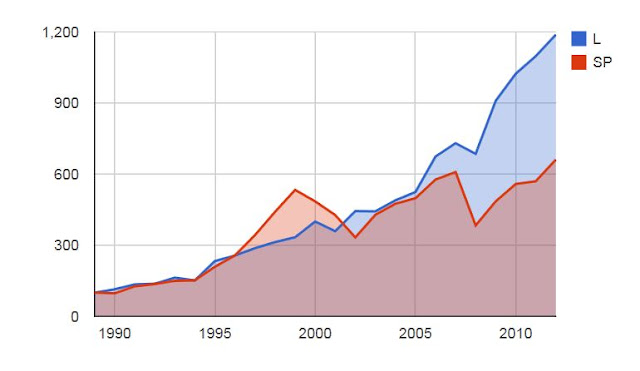

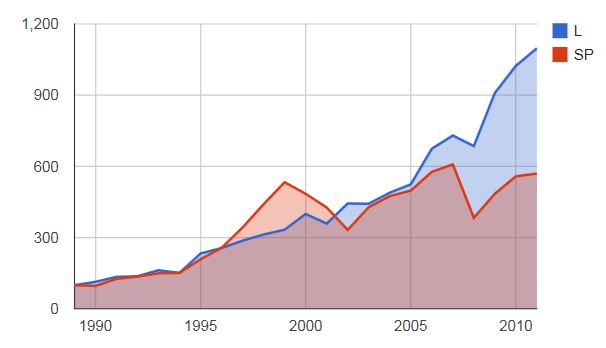

People always talk about L in terms of sum-of-the-parts and whatnot, and I just realized that I never really looked at their returns over time and in different time periods. This may not be necessary as you know the Tischs’ have created value over time as they usually illustrate in their annual reports, and if…

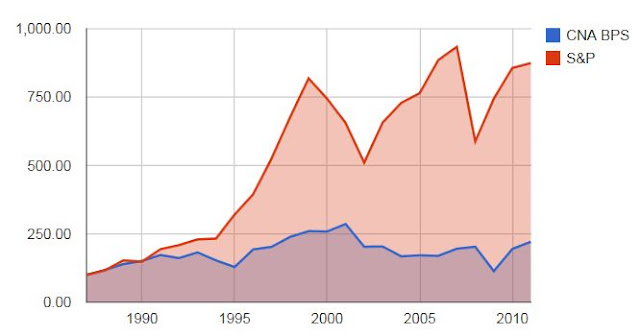

CNA: One-of-the-Parts (of Loews)

Loews (L) has been, for years, a popular sum-of-the-parts play by value investors and it seems that’s it’s always trading at a discount. I suppose that’s normal for a conglomerate. I am a big fan of L and have a lot of confidence in the Tisch family but one thing has always been nagging me about…

Natural Gas Prices

This comment by Tom Mara at the Leucadia annual meeting got me really curious about this guy, Arthur Berman, a petroleum geologist who has done extensive research on shale natural gas. I think the comment was that shale gas is uneconomical under $7.00/mcf over the longer term implying that when natural gas prices get back up there,…