It’s been quite a few weeks since my last post. I haven’t really changed my thoughts since then, but maybe the economic impact of this will have more than a blip on the long term charts after all. So far, the economy seems to be doing much worse (or will soon) than the stock market….

Tag: MKL

Markel Ventures

So the question was raised about MKL management’s use of EBITDA to evaluate Markel Ventures (MV). I wondered about that too, but had totally forgotten that this issue was addressed back in 2010 in the letter to shareholders (thanks to someone pointing it out in the comments section of my previous post). I figured clarifying…

Markel 2014 Annual Report

The Markel (MKL) annual report is up on the website and as usual it’s a really good read. Markel seems to be on fire, doing really well. They grew BPS +14% in 2014 versus +13.7% for the S&P 500 index (total return) and +8.3% for BRK (BPS). The equity portfolio also did really well,…

Loews 4Q 2014 Conference Call

I don’t normally make posts about conference calls as I tend to look at things over the long term and things don’t change much from quarter to quarter or even year to year. If I look at something and like it, it is probably because I looked at how someone has done over a long…

Markel 2013 Annual Report

So Markel’s (MKL) 2013 annual report is out. MKL grew book value per share by +18.2%, the same as Berkshire Hathaway (BRK). BPS is now $477.16 versus the recent price of $591, so it is trading at 1.24x BPS. 18% growth in BPS is pretty good, but they also grew BPS at a +16.5%/year…

Markel 2012 Annual Report

The Markel (MKL) results have been out, but I just noticed that the annual report is out too (I don’t check so it may have been out for a while). The MKL annual report is a very good read of you have the time to check it out. We know this from the earnings release, but…

Markel – Alterra Merger

So, Markel (MKL) is buying Alterra (ALTE). We know Markel is acquisitive and is looking for opportunities. So here it is. Of course Markel shareholders might have gotten sticker shock from the stock being down so much. If the deal is accretive to book value, then why the heck does the stock price have to…

Financials Still Cheap

The financials have really exploded this year as unemployment and other economic figures continue to show some decent recovery. Europe doesn’t seem like it’s going to blow up tommorow. China seems to be going into a hard landing but China might be a laggard to what has happened in the U.S. and Europe in the…

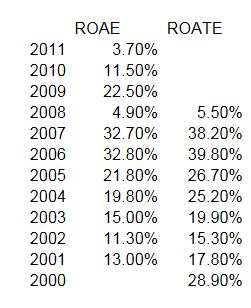

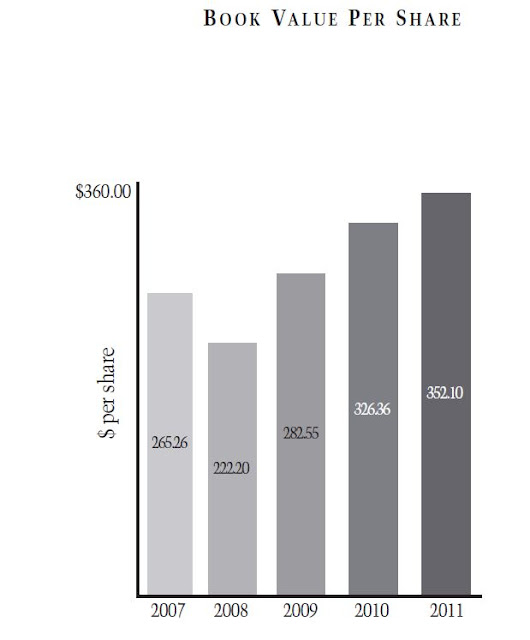

Markel 2011 Annual Report

Markel’s annual report was released and it’s a pretty good read. For fans of Berkshire Hathaway, this is a company that is following a similar model; insurance company with emphasis on underwriting profits instead of premium growth, investing float unconventionally (more equities than most insurance companies) and is even starting to invest in operating businesses…

Markel at Book?

This blog is getting boring, I know. All these financial companies with great historic track records at book value (JPM, GS, BRK). An incredible hedge fund manager available to the public (GLRE). Yawn. Nobody seems to care. But good investing isn’t supposed to be exciting. Sometimes, it’s boring. There’s nothing to get excited about. The…