As a long time Wall Street apologist, how can I not comment on this Knightmare (KCG)? Here are some of my quick thoughts on this.

HFT, Trading Bots Killing Markets

First of all, there is a lot of commentary about how the HFTs and algorithms are killing the markets and scaring investors away from the market. Andrew Ross Sorkin had a thoughtful article in the New York Times today. His point was that these computer generated blowups aren’t what is causing people to move away from stocks; it’s other factors such as poor performance of stocks in the past decade or so and other external factors (fiscal cliff, Europe etc.). I completely agree. If the stock market has been going up 15%/year over the past ten years, I bet people would be jumping into stocks regardless of insider trading busts, flash crashes and any of that other stuff.

Sorkin has become a much more well-balanced reporter, I think, after he wrote the book “Too Big to Fail”. It’s almost as if all that time spent interviewing people for the book has enhanced his understanding of how things actually work.

Anyway, this Knight trading error is pretty scary but I don’t think it’s a reason to move away from computer trading. I’m sure when people crashed their cars early this century, some called for going back to the horse and buggy. Or what about automated traffic lights? I have no information but I wouldn’t be surprised if some of them malfunctioned early on causing car accidents. This may have prompted someone to call for going back to people directing traffic, or outright just banning cars.

I don’t know if it happened, but it’s easy to imagine many situations where technology caused problems. This is no reason to back away from it. We just have to make it better. As someone said, you can’t put the genie back in the bottle.

As far as market-making is concerned, I am convinced that computers are far better than humans.

For most individual investors, none of this stuff should be relevant. If you like a stock and you buy it and hold it, what difference does it make if an errant computer sells a $70 stock at $40, or if some ‘dumb’ firm blows up because of faulty software? As for bots trading too much, that is also irrelevant to people who don’t trade stocks often. The more someone trades, the more ‘taxes’ they pay to the street. But it’s always been that way; it’s just different people that walk away with the money.

I think these bots are the most frustrating to the day traders. (Does Buffett care if HFT’s trade a billion KO or IBM shares a day? Probably not as it doesn’t impact the intrinsic value of the business).

Institutions Will Get Biggered

Another thought I had reading about this incident is that contrary to public sentiment, political pressure etc., this may actually accelerate the biggering of financial institutions. If a small firm like KCG can blow up on a normal market day without any triggering event, who can you trust?

This would be a non-issue, normally, but this comes after Lehman (which proved that even prime brokerage clients are exposed to the credit of their brokers), MF Global (which proved that even clients with segregated accounts and with no theoretical credit exposure can lose money).

The 2Q 2012 Morgan Stanley (MS) conference call was interesting in that they said that volumes were down due to clients holding back business from MS to see how much they would be downgraded. People were worried about even the prestigious MS.

Goldman Sachs (GS) learned during the crisis that even if you have no problem positions and are in good shape, clients can run (Druckenmiller even famously took money out of GS accounts and transferred them despite a close relationship with GS’ Cohn).

If you are an institutional investor or hedge fund, why would you take the risk of something happening? Is it worth the risk? Why not just keep your assets at a large, supersafe bank like JPM?

Almost everyone is calling for big banks to be broken up, but it seems to me that people are actually wanting to run to the big banks for their own money; they want big, diversified and safe. When times are turbulent, it’s nice to be on a huge cruise ship rather than some ferry or yacht, however high tech and cool they are. Of course, there is the Titanic to worry about, but those are rare.

I think this JEF incident will reinforce this trend. (I do suspect that MER and JPM’s investment bank are doing way better than GS and MS partly for this reason. I don’t think GS has ever said that is a factor, though).

Joyce

It does seem a little odd that a CEO that oversaw such a large blowup is allowed to stay on board. Under any other circumstance, the CEO would have been blown out immediately. But Joyce is a street veteran and it seems like he was bailed out by his friends so maybe the new owners will allow him to stay. There are all sorts of motives for bailing out KCG. Some see a decent business and an opportunity. Others wanted to keep KCG alive for game theory-like reasons.

What is KCG Worth?

This is not a deep dive into KCG at all, but just a quick look. Most seem to agree that KCG is worth tangible book value at this point.

Before the $440 million loss, KCG had $1.5 billion in equity capital as of the end of March 2012. They had 98.2 million shares outstanding.

The deal was for $400 million for 2% preferred shares that are convertible into common stock at $1.50/share. There is a mandatory conversion if the KCG stock price trades at 200% of the conversion price for 60 consecutive days (that’s $3.00/share at this point). This $400 million preferred is convertible into 267 million shares.

So you have $1.5 billion that went down to $1.2 billion due to the loss ($440 million pretax loss, or $264 million after tax) and then replenished with this deal to $1.6 billion. Now you would have diluted shares of 365.2 million shares.

Post-deal, the book value per share comes to $4.38/share.

They had $338 million in goodwill and $89 million in intangibles as of March-end 2012, so tangible book was $1.17 billion post-deal. That’s $3.21/share. This figure will vary according to how people round figures, whether they use pretax or after tax loss figure and which number of shares is used (I don’t know why the shares outstanding implied in the KCG presentation is much lower than the 98.2 million shares shown in the latest Q. It seems there is a large gap between diluted shares used in EPS and shares outstanding at period-end; this may be due to a lot of stock option/stock repurchase activity and the timing. I think BPS usually uses period end and not average SOS used in EPS calculations.)

KCG Historical Performance

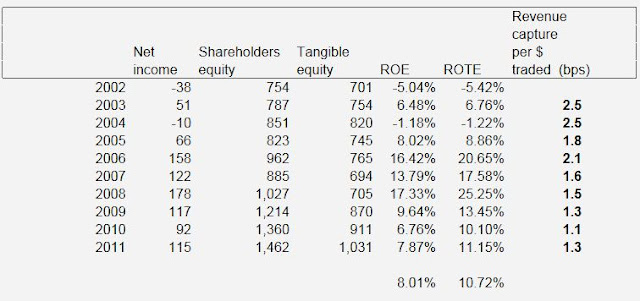

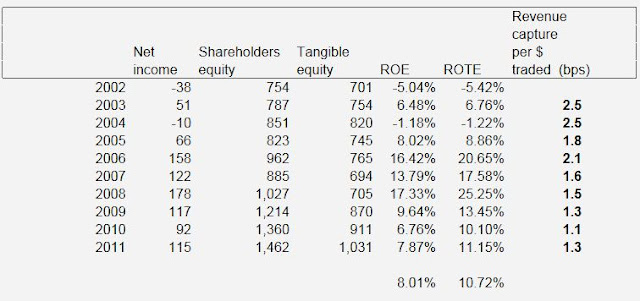

Here’s a table that shows how KCG has done in the recent past.

Over time, KCG has earned an ROE of 8% and a ROTE (return on tangible equity) of around 11%. This includes the boom times of 2006/2007 and some bad years like 2002 and the financial crisis.

From this we see that if KCG can continue as before with no negative effects from the recent debacle, KCG may well be worth tangible book.

However, I don’t know how strong the moat of this business is. As you can see, this business has been under considerable pressure. The market-making business used to be very lucrative because the bid-ask spread was 1/8 even in the highly liquid stocks. So if you just sat there and bought at the bid and sold the offer, you made 12.5 cents on every share.

Of course not every trade is going to be a buy at the bid and sell at the offer. It’s not that easy. By the way, this is why firms like KCG want your “dumb” money flow. The more market orders they get, the more money they will make. Filling a limit order is like clerical work and not as profitable, even though I suppose you can take advantage of limit orders of inactive traders (option value).

In 2001, the market went decimal, and this sort of ‘decimated’ the industry.

The right hand column in the above table (Revenue capture per dollar traded) is how much money KCG made on every trade (this is in basis points). You can see how the trend has been down over the years. They used to capture 2.5 basis points on every trade but now only makes a little over a single basis point.

But that’s not even the biggest decline. They didn’t provide this figure in basis points prior to 2003; they reported dollars per share traded. This metric was $0.0092/share back in 2000 and that declined to $0.0015/share in 2002. That’s a stunning decline of more than 80%.

Here’s a table to show the ‘crash’ in revenues per shares traded (and in bps next to it):

Revenue captured Revenue captured

per share per $ traded

traded ($/share) (bps)

1999 $0.0095

2000 $0.0092

2001 $0.0032 3.62 bps

2002 $0.0015 2.41 bps

This discontinuity is just because KCG switched from reporting revenue captures from a per share basis to a per dollar basis. These figures are net of clearing and other direct costs.

I am not so sure if their institutional business will ever make money, and how long the market-making business will continue to make money. As the markets evolve, I do think that the moat gets lower and lower. There is plenty of capital available too for this sort of operation.

So KCG may very well be fairly valued here at around tangible book. I am not particularly interested in this sort of business model but I don’t really have a strong opinion on KCG either way. I have looked at it off and on over the years and was never particularly interested (for the reason I stated; declining moat, increasing irrelevance).

So Who Benefits?

If KCG is not interesting to me, of course the other side we have to look at are the guys that bought into this deal. If the reporting is correct, Jeffries took $125 million of these preferreds. Blackstone and Getco each took $87.5 million and TD Ameritrade took $40 million. This doesn’t add up to $400 million as there are others; I haven’t seen the full list (I don’t think it was in any of the related SEC filings, but maybe it’s somewhere).

If KCG is worth $3.00/share (around tangible book), then these preferreds are worth twice as much as what they paid. Jeffries bought $125 million, so these are now worth $250 million; not a bad trade for one day.

JEF has shareholders equity of $3.3 billion so this deal puts almost 8% of that into KCG. The investment, though was only 4% of equity. Of course this means that JEF has earned an immediate 4% on book just by doing this deal. Not a bad day at the office.

Given the low returns on equity these days at investment banks, this will be a nice bump to earnings this year and to book value.

Of course, this is assuming that KCG can continue as before. This is not a certainty but it’s also not completely unreasonable to assume. If this loss was a one-off event however unfortunate, and people are convinced that it was caused by a single software malfunction and is assured that it won’t happen again, KCG may continue more or less as before but perhaps with more focus now on costs and earnings as there will be vested board members that will have an interest in enhancing value there.

Conclusion

- KCG is not a particularly interesting business to me, but may be a so-so business; its seems like an OK business at best, and may be a declining, bad business (notice how ROE didn’t pick up after the crisis in a strong market). Tangible book is not a bad starting point for valuation, though.

- Bots and computer trading is getting another black eye from this incident, but I really don’t think this tells us necessarily that computers are out of control. It is unbelievable that KCG was unable to stop the trading even when they realized what was happening (and it apparently took the NYSE to shut them down). But again, this to me indicates really bad management and doesn’t mean all computer based trading is equally dangerous. These things will keep happening, and we will just keep improving our systems, especially checks and safety mechanisms (just like we improved cars and airplanes over time).

- Financial institutions, I think, will get bigger. With all of this uncertainty and fear in the markets, money will flow to the large banks. Why worry about what will happen to independents in another crisis or near crisis? Why not just move money to the large, safer banks?

- JEF made a great deal. It’s nice to know that these opportunities do pop up and JEF is there to take advantage of it. Leucadia (LUK) owns a bunch of JEF, so I’m sure Cummings/Steinberg are having a good week.

Sorry for the off-topic (I won't mind if you delete the comment), but I follow your blog and it appears you know financials. Do you have an opinion on Standard Chartered? I'd be glad to hear if you do.

Hi, no problem. I don't know Standard Chartered; haven't really followed it.

Heard there is a book coming about knight trading’s blunder last year, something like knightmare on wall street