After such a huge rally since the great recession, and now after a huge runup this year people are wondering what to do with their money. Many are afraid that the markets will tank as they are getting bubbly and there will eventually be tapering that will most certainly be devastating to the markets.

But then people like Buffett just keep buying stocks and telling people stocks are the place to be, even recently. When people ask him about stock prices, he always says that if stock prices go down it would make him happy as he will find more things to buy. Munger also says that bad times and low stock prices are good; that’s how businesses grow. That’s how the rich get richer; they just take advantage of dislocations to expand.

Someone asked Buffett about IBM; he owns a bunch and the stock price is down. He says that IBM is buying back a lot of stock so a low stock price is actually good for him as IBM can buy back more stock. This is something that people have a hard time understanding. If he owns a bunch of Berkshire Hathaway stock, how could he be happy to see the stock market go down? If he owns a bunch of IBM, how can he be happy to see the IBM stock price go down after he has already bought a bunch?

I was thinking about all of this stuff and it occured to me that this ties back into the outsider CEO / owner-operated business theme.

Outsider CEOs and owner-operated businesses tend to be good businesses and remember, those outsider CEOs had tremendous track records even through the bad times. If the best hedge against inflation or bad times is a good business, then outsider CEO businesses must be great hedges.

First, let’s just look at the obvious one.

Berkshire Hathaway in the 1970s

I think what many fear is a 1970s like situation; interest rates and inflation flying out of control, stocks going down a lot or staying flat for a long time, stagflation etc.

So let’s see how Buffett did during that horrible period. When I mention Buffett to people, even people on Wall Street, many say that Buffett is just a product of a bull market (if it’s that simple, then how come there aren’t more Buffetts?).

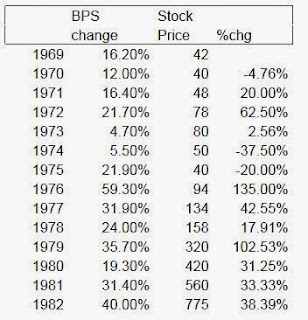

Here is the book value per share change of Berkshire Hathaway, stock price and change in stock price from 1969 – 1982. Now remember that 1969 was sort of a peakish year. You can use 1968, 1970, 1972 or whenever you want, but I think they make a similar point.

So from 1969 through 1982, BPS grew +26%/year and the stock price appreciated +25%/year. And this is between 1969-1982. There was no bull market here. There was no boom. From 1972 – 1982, both BPS and stock price rose +26%/year. Buffett (as far as I know) didn’t own gold, gold stocks, crude oil futures, oil stocks, commodity funds, real estate, timber, alternative investments or anything like that. A lot of this value was created because of the flat period and low prices. He was able to pick up stocks and businesses on the cheap and he didn’t need a bull market for those values to be realized.

I posted here many times how well the superinvestors of Graham and Doddsville did during this time period too despite a flat market.

OK. So we can’t identify a Warren Buffett or superinvestor ahead of time you say. Of course if we invested with Buffett early on, it wouldn’t have mattered what the market did.

So now let’s look at one of the outsider CEOs.

Teledyne in the 1970s

So check this out. We know that Henry Singleton was a great capital allocator. But he was not a stock market ‘superinvestor’. He bought and sold businesses, for the most part (they did get into insurance at one point too).

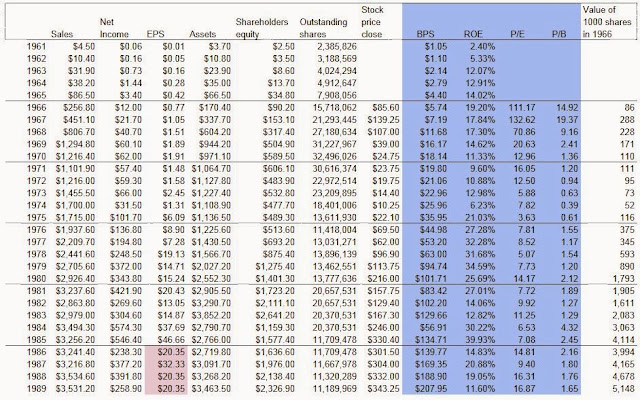

Look at this table closely. I input some of the data at the back of the book, Distant Force.

This is kind of tricky to look at due to all the transactions, splits, stock dividends and things like that. The important figure is the far right column which shows the value of 1,000 shares of Teledyne owned in 1966 (in thousands of dollars).

All of the raw data is from the back of the book, and the blue area are figures I calculated using the raw data. I just put it there for perspective so it’s not perfectly accurate. For example, book value per share is simply shareholders equity divided by shares outstanding, ROE is net income divided by average shareholders equity (average of beginning and ending equity). There isn’t enough information to make necessary adjustments, so the blue area is for reference only.

The purple/pink figures for the 1986-1989 EPS is calculated using the net income and shares outstanding as the EPS figures in the book look wrong. In the book, it shows EPS of $4.07, $6.45, $6.81 and $4.66 for that period which doesn’t make sense if the net income and shares outstanding are correct (and those look more in line with the rest of the data).

From the end of 1966 to the end of 1989, a Teledyne shareholder would have gained +19.5%/year. And look at the valuation as of 1966; 111x p/e and 14.9x book. But you had to endure a lot of pain to achieve this long term return. From a peak of $288,000 value in 1966, the value of 1,000 initial shares held would have gone down to $52,000 in 1974. That’s a stunning 82% decline! That’s sort of what you get for paying more than 100x earnings. Between 1966 and 1974, book value per share of Teledyne actually increased from $5.74/share to $25.96/share; it grew +21%/year during that time. Net income was positive too all throughout the period indicating that Singleton was creating value throughout this period.

Between 1972 and 1982, Teledyne stock returned +33%/year. Again, this was sort of a peak-to-low in the stock market; no bull market or strong economy to help.

Much of Teledyne’s return has come from share repurchases. There’s a nice table at the back of the book that shows the many tender offers Teledyne did between 1972 and 1984 at significant premiums to the then trading price of the stock. The eight tenders in the table show that it repurchased as a percent of the then outstanding number of shares, 27.9%, 6.9%, 17.6%, 10.4%, 19.6%, 18.4%, 21.6% and 42.9% (in 1984). From 1972 through May 1980, Teledyne repurchased a cumulative 74.5% of their outstanding stock. In May 1984, they bought back 42.9% of their outstanding stock so the cumulative shares repurchased between 1972 and through May 1984 was an astounding 85.4%!

Buffett often mentions Washington Post as an example of how share repurchases can create value. His ownership stake has increased over the years simply from share repurchases (he owns the same number of shares but share count decreases with repurchases).

Low Prices Are Good

From these examples, you can see why Buffett is not concered at all with lower prices. If you have good, honest, competent management, then lower prices is fine as they will focus on value adding acquisitions or share repurchases. The above shows that you don’t need a roaring bull market and booming economy to get good returns. In fact, the above two examples show people who did better in a flat, horrible economy than most did in the bull market starting in 1982.

This is why I think it’s so important to focus on what management is doing rather than on what’s going on in the world. A good manager will do what makes sense in whatever environment. The question of management is so much more important than what asset class might or might not do better in the future, how much cash to set aside or anything like that.

The natural instinct, though, from looking at the above tables is to try to find a way to avoid sitting through a 50% decline in the stock price (even Berkshire Hathaway went down 50% in the 1970s and in the recent financial crisis too (and in the late 1990s)). It seems like most people tend to focus on how to avoid the 50% drop rather than the long term value creation of good businesses (which makes a temporary 50% drop in the stock price entirely moot).

Depressed Valuations for an Extended Period

The other thing people worry about is that purchases of businesses made at reasonable prices may trade at depressed levels for a very long time. What if you pay 20x P/E for a business and it trades at 7x P/E for an extended period of time? If it trades cheap for a long time and the business is sound and throwing off tons of free cash (again, this is why free cash flow is so important!), then it’s not going to matter; value will be increased.

The Teledyne example is a perfect one. Teledyne would not have done so many tenders if the stock wasn’t so cheap.

Let’s take a look at the period 1969 through 1979. According to the table above, Teledyne was trading at 20.6x P/E back in 1969, but was trading at only 7.7x P/E in 1979. The value of an initial 1,000 shares owned in 1966 grew from $171,000 in 1969 to $890,000 in 1979. That’s an +18%/year return! And that’s with the valuation going from 21x P/E down to less than 8x P/E.

So for the Teledyne shareholder to have done well, it didn’t even have to get back up to 10, 15 or 20x P/E. Going from a reasonable (or high) valuation to a cheap valuation still allowed the shareholder to do well. And again, that’s due to the tenders done throughout the ‘cheap’ period.

And importantly, a Teledyne investor didn’t have to wait until the stock price got cheap in order to do well in the stock. Of course they would have done better buying at the low, but how many people actually do that? In many cases people wait for a good opportunity to buy and it never comes, or it comes at a far higher price.

Conclusion

With the market having done so well recently a lot of people seem to be looking for other places to put their money. They wonder how much in stocks they should own, whether they should get into real estate, gold or other hard assets. Institutional money is running to alternative assets.

I think the more interesting question is not so much whether or not to own stocks (versus other assets), but which stocks to own. I think history shows that choosing which stocks to own is more important for returns than choosing which asset class to own, which sort of goes in and out of fashion. If you own commodities, gold or real estate, they will go up and down with the trends/fashion of the moment (actually, real estate can be managed actively and intelligently).

I know there are academic reports contradicting this, but my guess is that those studies focus on large institutions and their equity portfolios tend to mimic the major indices so there is probably very little difference in returns based on stock selection.

But if you own a good business such as those run by an outsider-type CEO, the stock price may go up and down in bull and bear markets according to the mood of Mr. Market, but the intrinsic value of the business will keep going up. And the markets will eventually reflect that increasing value over time. Even if Mr. Market refuses to acknowledge the value, a good CEO can use that irrationality to enhance value (through aggressive buybacks).

Anyway, this is what Buffett keeps saying and value investors understand this. But I just wanted to use a specific example to illustrate exactly what he means; to see the mechanics of how this actually happens. Of course, Teledyne is an extremely successful example so we can’t expect to find something that will do as good as the old Teledyne, but I think many companies operating under similar principles can do much better than the market (and certainly better than ‘hard’ assets and most other investment ‘alternatives’).

So what do you do in this market? I guess the conclusion is to keep doing what we should always be doing. Looking for businesses like the above, and then just hanging on. Don’t do anything different. Ignore books and people who give advice on what to do in flat markets, inflationary markets, depressions, how to prepare for this or that and things like that.

hi, thanks again for an interesting read. However you didn't mention the fact that buffett and munger have worked almost free for 30 years and took no equity from partners via option grants etc. HUGE factor long term, no ? Thank you, hc.

Hi, yes, there are a lot of things I didn't mention. Many of these cases, even between the outsider companies in the book are very different. BRK, for example, has just about never bought back any shares either.

Thanks for reading.

remind us, did the tdy board take 1-2 % a year in stockholders equity a year forever as part of their compensation back then ? how many shs of ibm does that board take a year ? for some reason this doesn't bother buffett ? thanks.

Buffett has always said that he is all for pay for performance. He doesn't like pay for non-performance. I would imagine that he thinks Teledyne folks got what they earned. As for IBM, time will tell but if they pull off their targets, I'm sure Buffett is fine with their compensation.

i think this report is highly suspect. You took two of the most successful capital compounding machines over the last 50 years as example. This ex-ante analysis is very selective. For each of these two examples, there are hundreds, if not thousands of companies that would render a complete opposite outcome.

Hi,

This is true; this is all after the fact. But just like the Superinvestors of Graham and Doddsville, the successful ones had something in common. Buffett wrote that essay in the early 1980s and the superinvestors continued to outperform after that too.

With the outsider CEOs, they too all had something in common (read the book), and they have tended to outperform consistently. I just tried to show how they did in the 1970s; we already knew they did well over the long term.

As for why I chose Teledyne, it's just that I happened to have the data that was in the book. When I put all of that into the spreadsheet I didn't realize how well they did during the 1970s.

But yes, you can argue this is all after the fact. But I think others will see that there is a common element to the people who do well over time, and that is the important point.

to be honest, both the Outsider and Buffet's Superinvestor article are inadequate and suffer from selection biase. you have to consider the total universe of companies and analyse them in aggregate.

When Buffett wrote the article on the superinvestors, he said that these were his picks from long before 1984 and he chose them due to the process, not historical results. The superinvestors have tended to outperform since then. I found this article:

http://www.insidermonkey.com/blog/warren-buffett-knew-these-9-fund-managers-would-outperform-the-market-1064/

As for the Outsiders, I thought about that too. It's sort of hindsight. But again, there is a common process that these CEOs have in common, and they tend to do the things that are opposite of value destruction.

Thanks for reading.

Look at Greenspan and how they talked about how he was the best Fed Chairman ever when retiring. Fast forward a few years and very few (if any) come to the same conclusion. I think the same can be said for Bernanke now. In a few years, I suspect we will think differently. Yet I (highly) agree with kk. Instead of being afraid or paralyzed to do anything today because of this reason (or a multitude of other reasons, China/Europe/Japan collapsing among a few others), still search for stocks today that will do well in any environment.

Another way to think about it is that regardless of the environment of the next 10 years, there will be stocks that do extremely poor. If that is true, then the opposite must also be true, there will be stocks that do well regardless of the environment.

selection bias, survivorship bias, data mining, whatever you want to call it–it's critical to this kind of an analysis. Additionally when a company like BRK increases market cap by 4,000-fold over the time period, you are actually talking about two entirely different beasts. In 1974/75 what was BRKs cap? Maybe $50 million? That would be a microcap today, wouldn't it? Today's investor can't invest in BRK as a microcap (obv.). So, even accounting for the selection bias issues, the "universe" of possible investable stocks which might mirror or emulate this kind of look-back would have to be microcaps only. BRK doesn't even qualify.

Yes, it's going to be hard t find the next Berkshire Hathaway for sure. The point of the post is not really so much that we can find one, but to illustrate how good managements with capital allocation skills can do well in whatever market. The stock price will go up and down, of course. Noone can control that. Even BRK went down 50% in the 70s.

We can find companies now that do allocate capital well and will probably continue to increase intrisnsic value over time. Of course, not many will do so at 20-30% rate but just because a company can't grow at 20-30% doesn't make it bad.

Selection bias is a problem for sure in these sorts of arguments (including the Superinvestors article), but I think time has shown that excellence tends to persist. We all knew how brilliant Buffett was in the 1980s, and he has done well since. The mini-Berks have been known to be mini-BRKs and have done well too. In private equity, it's always been known that the big ones like Blackstone and KKR are the really good ones; this was known since the 1980s too and they have continued to do well. The Market Wizards have in general tended to continue to do well too even though there might have been a blowup somewhere…

So as Buffett said, if you can find a group of outperformers, it may be random. But if you can find common traits that explain the outperformance, then maybe it's not so random. Buffett explains it better (google Superinvestors of Graham and Doddsville and you can download the essay).

Anyway, you make good and valid points. I would ask the same questions in this sort of discussion.

hey nice post KK. I love your style of blogging here. The way you writes reminds me of an equally interesting post that I read some time ago on Daniel Uyi's blog: Simple Tips To Stop Procrastinating About What You Want To Accomplish In Life .

keep up the good work.

Regards

I think DirecTV is a good example of a company that is currently trading cheap, has a management team that allocates capital well, and really has been a compounding machine. Berkshire of course is a large shareholder. Other one that stands out to me is Softbank in Japan. They are right in the middle of all of the trends in mobile/Internet and have a CEO who has a great capital allocation track record. Anyways, good post.

DTV is gobbling up a lot of their own shares and it seems to be really well run. I don't own any, but maybe it will be a future post. The question for me is what they do when they get saturated. Many of the outsider CEOs were able to deploy capital outside of their main business into related areas.

Thanks for reading.

Thanks for the great Outsider series, KK. I hope you'll keep going, as that's a rich vein, a fruitful soil.

I was wondering if you had a chance to look at Valeant (VRX) and Endo Health (ENDP)? They are kind of like Danaher and Colfax to each other, both in size and models, and I think they share similarities with the outsiders.

Thanks!

Hi, those are great companies; I haven't taken a close look at them but maybe they will be subjects of future posts. Thanks for the ideas.

ENDP is interesting in the way that its new CEO was the CEO of VRX, and Blue Ridge initiated a new position (about 3% of equity portfolio) in 2Q of this year.

Thanks for ENDP. I will take a look at that; that looks timely. VRX is well-known to value investors thanks to Sequoia so if the VRX CEO is moving over to do a similar thing, it can be interesting.

The new CEO of ENDP was president of VRX, not CEO, so probably not the primary dealmaker… but it's still worth a look…

Absolutely fantastic post. Thanks for dissecting a bit of Teledyne. The problem with humans is the inability to delay gratification. I want the marshmallow now, not 2 after a month. 🙂

Dividends and capital gains are instant gratifications, share buybacks take a long time to show their gorgeous effects. If only the earth took 1800 days to go around the sun 🙂

Thanks. Yes, it's instant gratification, or loss aversion. People are obsessed with avoiding 'temporary' losses and have no interest in long term growth in intrinsic value. It's all about non-correlation, low beta and high alpha. If the intrinsic value of a business grows, who the hell cares about correlation?! I would love to own a bunch of outsider CEO type companies and I don't care if they are all correlated with each other. Peole accept low returns for the sake of lower volatility and low correlation.

This is understandable for institutions as managers will get fired for drawdowns in their portfolio. Hedge funds will get redeemed out of business etc.

But individuals and small investors have no problem like that. That's why I am often so confused when small investors worry about things like that and want to invest in non-correlated assets. Why? It makes no sense. The only reason people should invest in timber or real estate is if it's a good asset and is undervalued; not because it's not correlated with the stock market.

Thanks for reading.

I agree with most everything you have written here and think you do excellent work in most everything I read!

Just to clarify the point on correlation: Trying to have individual stocks/companies in a concentrated portfolio that are NOT correlated is probably a very good idea and Buffett and Munger work very hard at this….but that is not the same as investing by asset class.

I have spent a good deal of time worrying about inflation. You can smell it coming as easily as any astute observer of the housing market could tell that was an unsustainable bubble in 06-07. I… (perhaps like you)…. have had no luck finding what I believe are good and rational alternatives from a valuation standpoint to underpriced equities and/or debt (not the market as a whole per se). I spent my career financing real estate and have found no bargains I really wanted to own in the Northeast throughout the crisis. I went to school for Forestry for a while in the late 70's and after boning up and looking around for a bit have found no undervalued timber. I tried to get access to the interest rate caps that Klarman was using a few years back and they had shut the desk down at MS ( and probably would not have gotten good access to it anyway). I don’t believe I can value gold or silver rationally even though I realize it can be an alternative currency. To do the REAL WORK on any of these alternative asset classes takes great slugs of time and effort and if it’s outside my wheel house, why should I really devote time to it? I would rather be more sensitive to things getting over valued and have cash available to opportunistically deploy when I get the opportunity.

I also think stocks are a better game because of the “liquidity trap” that so many investors fall victim to. You don’t get that in the hard asset classes quite as much

Thanks, PB

Yes, even concentrated equity portfolios should be diversified; owning 10 banks is not such a great idea.

The problem with the way the financial industry looks at diversification is that they only really care about short term price movements. They want/advocate diversification because they can't afford to have a bad quarter or year. This is a real concern for institutional money managers as they pull money from underperforming funds and they respond to short term returns.

The diversification in an equity portfolio should be about business exposure, not price movements.

Thanks for reading (and commenting).

In 2008/2009, much of what WEB was actually investing in, wasn't common stock. He was investing in "special situations" i.e. debt at very favorable (for him) terms + warrants/equity kickers. If you read what Seth Karlman was doing it was similar–he wrote that the question for him was finding things to invest in that were "depression proof" and I don't think the answer was "common/public traded equities," for the most part. It's not that they aren't super investors, it's that the historical outcomes are so "path dependent" that you can't just say "invest like buffet or klarman." You have to be able to formulate specific criteria that are applicable now–how do you choose the "modern day" equivalent of what buffet was 30/40 years ago? Maybe it's Sergei Brin.

In this post, my point isn't really to "invest like Buffett or Klarman". My point is that if you invest in a good business with good management, they will figure out how to exploit the environment and whatever comes. That's the biggest point.

So if you invest with good management (like BRK, for example, which is not a bad investment at all even it's not a microcap), if the market falls apart or we go into a long, horrible bear market like in the 1970s, they will find a way to increase intrinsic value of the business. The stock price will fall in a bear market, but the other point is that one shouldn't worry about that as long as management finds a way to increase intrinsic value.

So those are the main points of this post. It's not so much that we should be like Buffett, or that we should find the next Buffett (even though it would be great if we could!).

I tend to think that most of the companies I talk about here fit the bill for being value creators whatever the environment. (Of course, if we go into a depression for the next 10 or 20 years, then maybe no management can create value. But that's a different argument).

Thanks for reading.

From all these "market" posts I'm starting to think you have a massive short position to allow "resting calmly" with the long positions 🙂

Thanks for another great post.

http://www.nytimes.com/2013/11/10/business/treasure-hunters-of-the-financial-crisis.html

The NYT has an article about Oak and what caught my eye was this:

"Before they started Apollo, Mr. Harris and his co-founders were Drexel bankers. So were Mr. Sokoloff and his fellow managing partners. And as a young high-yield bond manager at Citibank, Mr. Marks became a Milken disciple and a client of Drexel. "

Greenblatt was also connected to Milken.

Is this a coincidence?

Milken was a pioneer in high yield so a lot of people in this area come from the old Drexel. Apollo's Leon Black was an investment banker there so knows a lot about who these things work. Richard Handler of Leucadia/Jefferies is also a former Drexel trader.

So it's not surprising that there is a Milken connection in this sector…

Thanks, could you recommend an objective book about Milken or Drexel?

Hmm… That's a good question. The only books directly about Milken / Drexel are the two classics, "Den of Thieves" and "Predators Ball". I enjoyed both of them at the time I read them, but the "Den of Thieves" book has been discredited since then. "Predators Ball" too was a gossipy book and I don't know how useful that is.

So the answer is, no I can't recommend a good book on the subject.

I think Milken had some problems, but he was brilliant too. It's just another one of those situations where you have a genius with a flawed character, even though a lot of the flaws seem to be made up by the press.

I don't have a problem with ex-Drexel people because I have come across them over the years and my impression has been that they are very good. The ones we read about and know from reputation seem to be very good too (Handler etc…).

So how to you reconcile that with their 'evil' image from the late 80s? I don't know. Maybe a lot of the evil was exaggerated. Maybe there was a lot of brilliance and genius there that got buried in the scandals and bankruptcy. Who knows.

There are several books on Milken/Drexel – here are the ones I am aware. License to Steal by Benjamin Stein, Highly Confident by Jesse Kornbluth, Payback by Daniel Fischel, and Fall From Grace by Fenton Bailey. All are long out of print, but I believe cheap used copies of all can be ordered on Amazon. What I found was that to get a full picture of Milken and Drexel all of the books, including Den of Thieves and Predator's Ball, needed to be read. It was such a charged issue that the authors generally could not hide their biases, both positive and negative. I would say I enjoyed Highly Confident the most out of these books, but it's been many years since I read them.

Thanks for filling in the gap. I haven't read those other books, but I guess that's the way to go; read all of them, if someone wants to get a feel for it.