I just listened to the fourth quarter earnings conference call for Pzena (PZN) and Richard Pzena said something interesting. He does a lot of work on deep value cycles and things like that so even if you don’t own the stock, it’s a good conference call to listen to. He is the only pure value investing asset manager out there so he has an interesting view of things both in terms of what is going on in the markets and what institutional investors are doing/thinking.

Midpoint of Value Cycle

He said that he thinks we are at the mid-point of the value cycle that average almost ten years peak-to-peak. He notes that we are five years past the 2008 low (actually, wouldn’t a midpoint then be five years after the previous peak which might be 2007? OK, let’s not split hairs). He says in these cycles, in the first half, the companies that had problems take time to resolve them. And after the problems are fixed, it takes another few years for the stock market to start to acknowledge that.

He mentions banks as having fixed their problems since the crisis over the past few years, and suggests that the market has not reflected that yet.

Record-High Profit Margin: Sustainable?

He also talked about the record high profit margin as being one of the hottest debates going on now. I also addressed it here before, but never thought about it the way he presents it.

He explains it in the fourth quarter newsletter which you can read here: Fourth Quarter Newsletter

Here’s some cut and paste from that:

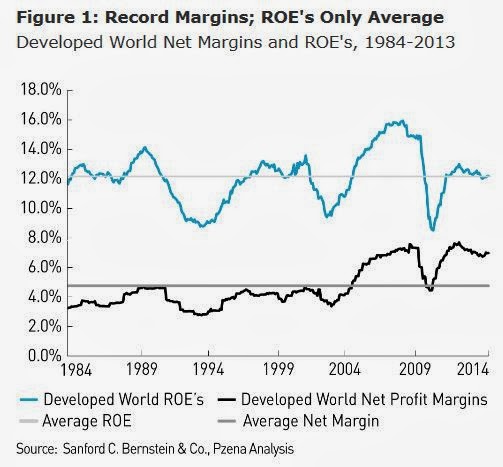

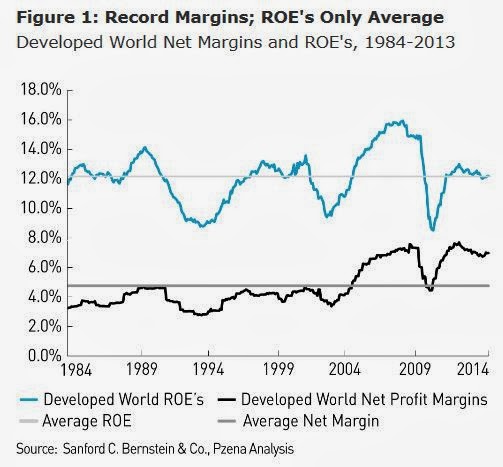

Pzena points out that although profit margins are at all time highs, ROEs are only average. In mature economies, capital replaces labor, so even as profit margins rise, ROE remains stable as more capital is required. So the margin expansion is showing that more profit is needed to earn an adequate return on capital.

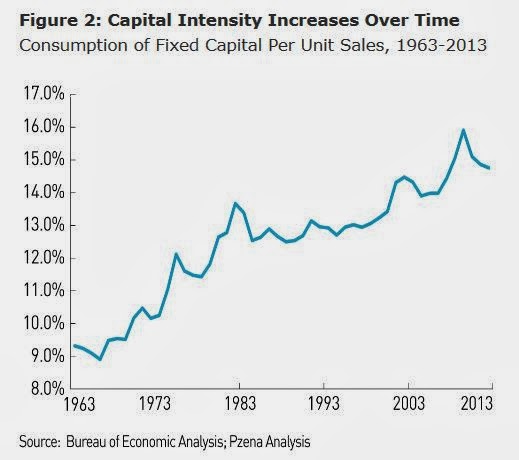

This chart shows that capital intensity increases over time. If this is the case and businesses continue to require returns on their capital, then the profit margins may be sustainable:

Financials Still Cheap

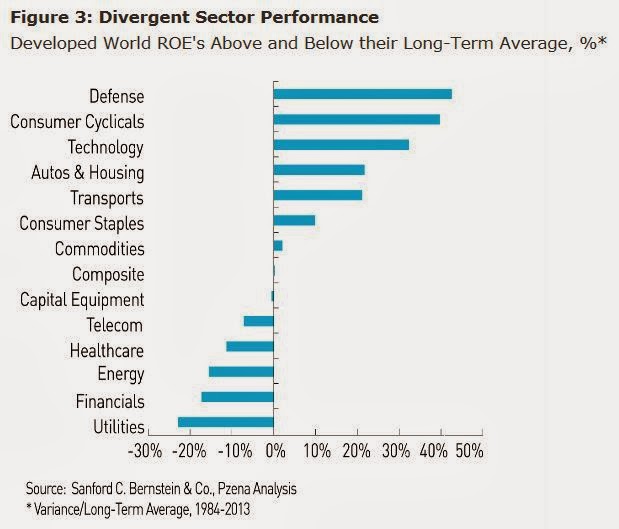

He also points out that it’s more important to look at the components rather than the whole. Where are the ROE’s too high and unsustainable? Where are returns below normal with potential to come back up?

Pzena says:

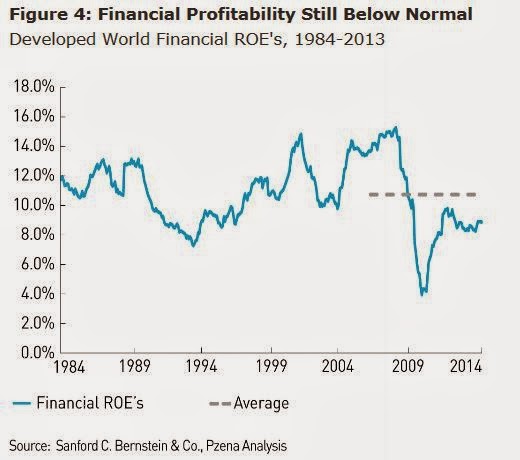

In general we would seek to avoid areas where conditions have been too rosy, favoring those where a return to long-term norms and low valuations provides opportunity. Figure 3 indicates that healthcare, energy, financials and utilities are sectors where today’s profitability is lower than what history would suggest. Financials are an obvious example. Figure 4 shows the 30 year history of developed market financial ROE’s.

ROE’s for developed market financials are 8.9% today, below their 30-year average of 10.7%. In the U.S., the picture is quite similar with ROE’s at 8.8%, versus their long-term history of 11.6%. Some of this gap is attributable to cyclical conditions (e.g., low interest rates), but much is due to greatly increased capital, driven by changes in regulatory requirements following the events of 2008. The large bank sector, in particular, is in the midst of a substantial adjustment of its business model to fit the new regulatory regime. We believe the path to normalization of returns in the sector will likely include widening of net interest margins, recovery of global fixed income trading volumes, greater fee income, additional cost rationalization, and more optimal capital deployment. Though institutions are also feeling the effects of elevated operating costs and legacy legal settlements in an evolving regulatory environment, history indicates that as regulations become more certain and past issues resolved, the industry adapts and adjusts its business model to restore profitability. Coupled with low valuations, financials represent opportunity.

In other sectors, utility ROE’s have followed interest rates lower, and health care returns have fallen off the unsustainably high levels experienced during the 1990’s and early 2000’s, yet valuations are generally elevated in both sectors.

I agree with that; I still do like financials even though I have lightened up a lot since they are much more popular now than they used to be. When I first started blogging about financials (and blogging in general), it was the fall of 2011, in the middle of the “Occupy Wall Street” movement. Everyone hated financials. Traders hated them, investors hated them. The public hated them. Bank employees were ashamed to confess that they worked for a bank in social situations. That is certainly not the case now with almost every CNBC guru loving financials.

BUT, the story is still good, I think. Valuations are still reasonable. And as Dimon said, all this talk about regulation lowering ROE’s is true, but all the analysis is based on static analysis. If all else equal, capital requirements are raised, then yes, ROE will go down. And Dimon keeps trying to tell people, all else won’t be equal. Banks will reprice loans to reflect higher capital requirements. Fees will be adjusted so various businesses will earn a decent return on investment. Banks will exit some businesses and enter new ones that make more sense in the new regulatory environment. But he complains that all of the analysis he sees doesn’t take any of that into account; it’s all straight math, a direct lowering of ROE in proportion to raised capital standards.

And my favorite analogy (my analogy, not Dimon’s) is the big bang in the 1970s. People thought investment banks/broker dealers were finished when they deregulated commissions. If you just did the straight math and ignored the fact that broker-dealers were active, organic entities that can change and adjust, then yes, it would have been the end of broker-dealers. But we all know that’s not what happened! Banks too have come through many regulatory changes over the years (interest rate regulation has changed over the years (look up Reg Q)).

Well, having said that, I’m not calling for a 1980s-like super-great times for banks going forward. I just mention it to say that it won’t be so horrible as most people seem to think.

Housing

Speaking of banks, one area that has not recovered much is housing. I just read the most recent annual report of Toll Brothers (TOL) and found page 18 to be very interesting. It is not new at all; I’ve seen this argument made by Jamie Dimon, Warren Buffett and many others about housing. But it’s the most recent, updated iteration of the “housing will recover” argument and thought it was very interesting.

I don’t own housing stocks and never owned TOL, but I’ve always thought of them as a high quality organization, and their annual reports are really great. I’ve been reading their annual reports for years.

They explain things in detail and provide historical financial figures going all the way back to the 1980s. I think that’s really good and honest. Some companies just want to show historical financials when it looks really good, and then stop showing it when things don’t look so good. But TOL (like BRK and the old LUK and some others) always shows the same historical figures going all the way back. I love that.

Why don’t I own any? Well, for most of the time I’ve been reading their reports, we’ve been in a housing bubble and after the collapse, I didn’t think they were super-cheap. And when they were cheap, I felt more comfortable owning the banks and other stocks. So the stars never quite lined up for me to want to buy.

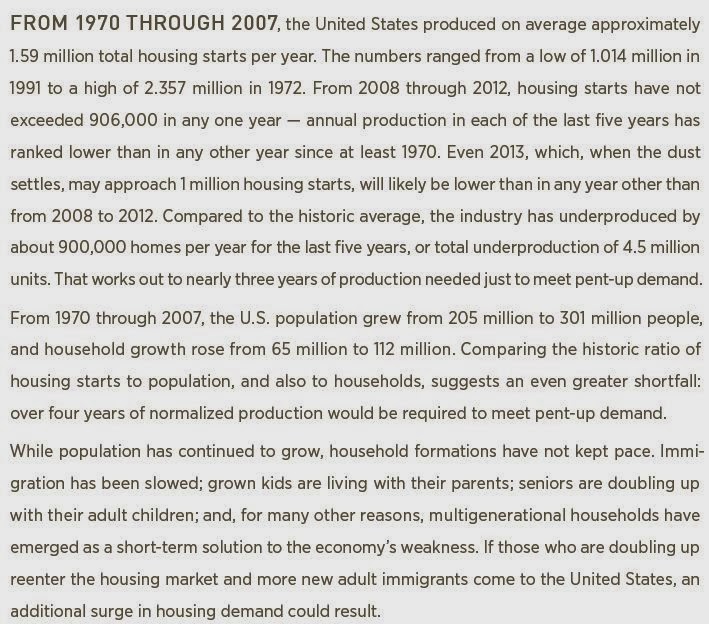

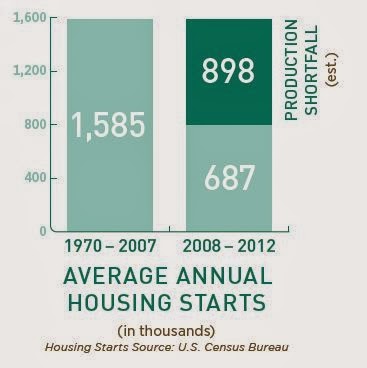

Anyway, this is the same story that has been told about housing over the past couple of years, but it’s worth refreshing:

So maybe times have changed and we won’t ever completely fill in this underproduction; maybe multigenerational households is the wave of the future.

But I wouldn’t be surprised if there was at least some catch up at some point in the future.

Housing figures can go up and down in the short term due to mortgage rates and things like that, but I think some of these large trends (of underdevelopment) are so big that they will at some point correct.

And what’s the point? I think this would be really good for the banks (and many other areas in the economy/markets).

Great blog! Are you still looking at 'Outsiders' companies? I loved that series. Have you looked at Roper Industries (ROP)? Thank you.

Hi,

Thanks. Yeah, I am still looking at them. Someone did mention ROP. I look at everything people suggest here… there are a lot of great companies, but I only make posts about something when something strikes me… Just because I don't post about it doesn't mean it's not a good company. Sometimes it can be a valuation issue too; I would prefer to post about cheap stocks.

But ROP is definitely on my list…

Thanks for your typical great post. Are there any big national banks in particular that would benefit from a rebound in housing? WFC maybe? (Kind of just a guess).

Charlie Munger's Daily Journal disclosed their equity portfolio and WFC and BAC were big positions, and they are big players in mortgages. I like JPM too; Buffett owned JPM personally, but dont know if that's still the case.

You can't go too wrong following those guys although it's no guarantee, of course…

Soros is with JPM as well.

About Pzena, I've been reading his writings for awhile and he is obviously an extremely smart person, brilliant, yet it doesn't show in his yearly returns. I think he over analyze and even if he writes about bottom up he in fact relies a lot about macro or macro concepts which he manage to rationalize about. No matter how smart you are the variables are just too many. He'd probably be able to achieve at least double if he stopped doing that. Than again, I'm not half as smart as he is and what do I know.

I'm not saying by this that what you wrote about financials is not correct, it's just about Pzena.

Oh, and Soros also bought C as did David Tepper where C is his largest position. Any thoughts?

Hi,

Pzena got crushed during the financial crisis owning some of the hardest hit financials then. And yes, he does spend a lot of time talking about big picture stuff, but they are mostly valuation discussions, not economic forecasting or anything like that. So in that sense, I think it's totally fine. Why not seek sectors that are cheap / undervalued? It makes sense for what they do.

And I think a lot of their work on the big picture (which again is not economic forecasting too much, but more valuation and stock market cycles) is for marketing purposes; when Pzena sits in front of potential clients, he has to explain to them why they should invest with him. And he is a hard core deep value investor which by definition owns very unpopular things.

So I actually don't know if he would do any better if he didn't do that work; he has analysts working on company analysis, I think. And they don't shift around the portfolio based on economic forecasts or anything like that.

As for JPM and C, yeah, they are both really good. Of course, I like JPM because of Dimon, but I think Tepper/Soros and others see a lot of potential at C. They do have really good assets hidden behind all of their problems. And their exposure to emerging markets makes them look bad now, but when the cycle turns and emerging markets are not so hated, it can be a plus.

So yes, C is very interesting too.

Interesting. Jim Chanos seems (or seemed) to have the opposite opinion, at least in the short term. C was his second biggest position back on Dec 31 according to the latest 13F-HR filing.

Chanos has been around a long time, but I wouldn' worry too much about him being short something unless it's really driven by some specific issue with a company (balance sheet/income statement problems like Enron, Worldcom). If it's a macro call, then I wouldn't worry at all (China will collapse and take down all the emerging economies and C has exposure etc…).

Of course it's interesting to listen to that sort of thing and I suppose we should all be aware of potential problems.

Though I don't dispute there has to be a recovery in housing at some point, I think the level of expected recovery may be exaggerated by TOL. While housing is no doubt depressed in the 2008-2012 period, there was a lot of over-building around the 2005 period, so when they talk about pent-up demand without accounting for overbuilding, I think it's a bit disingenuous.

To account for this, in the "Average Annual Housing Starts" chart above, it would probably make more sense for the left column not to stop at 2007 but rather at 2012.

That's a good point about the overbuilding. I think Buffett accounted for that when he talked about the housing recovery a couple of years ago; but he said that that has been absorbed, pretty much.

Anyway, I think story overall is still valid.

kk, I know you have written quite favorably in the past about Loews (L) and the Tisch family. What do you make of the recent under-performance of Diamond Offshore (DO) and the recent Boardwalk Pipeline Partners (BWP) sell-off? Have these, coupled with Highmount, caused you to question your opinion of this generation of Tisch's? Just curious, sorry to hijack your thread.

Not really. I still think highly of the Tisch's. I was never a big fan of the energy investments. But even DO and BWP, Loews has gotten their money back so it's house money they are playing with in those investments. So BWP looks bad on the big drop in stock price, but they are already way ahead.

One thing I didn't like was that DO was created by buying rigs when they were unloved for dirt cheap, and then when they were hot in 2006-2007, they didn't get out. I know that's not their style, and they did pay out special dividends and get a lot of cash back. But still, if you owned L, a lot of the value was still tied up in DO.

Also, like Y, I do tend to think they are very conservative; probably overly so. But they have a view that is not so optimistic so they would rather play it safe.

So short term is not so great, yes. But I feel like I understand it well enough not to change my views on them too much. Plus, these things are cyclical; value investors outperform over time but sometimes underperform for a while.

I think they will do well over time.

Maybe I will update my thoughts on them after the annual report comes out.

Oh, and I should add that even though I am not a big fan of energy in general (especially after that big boom in the mid 2000s), I do believe that oil will probably trade much higher eventually, and do believe that the L viewpoint will prove correct over time. So DO might not look good today and some natgas investments, but that may just be a cyclical issue. Natgas has other issues (fracking) going on, but in crude, slowing China and tanking emerging markets are holding it down; basically the unwinding of the big commodity boom (driven by China). But as that stablizes and things normalize over time (there may be more downside from China/emerging markets in the near term), oil is probably getting harder to drill for, so prices will eventually reflect that.

And that will make the current lower return looking drilling projects look better.

That static analysis of crude, it seems like to me, is that crude will stay at this price and finding and developing costs will continue to go up and therefore oil company returns and margins will go down. But that makes no sense to me. If crude is getting harder to find and more expensive to drill for, commodity prices will eventually reflect that (or else there will be no more commodity, of course!).

But that's a long term view. And that's what the folks at L do; they look out for the long term. That's why they may look out of sync in certain periods.

Thank you for your response – I appreciate it. Love your blog!

This one has me scratching my head a bit. Assuming L had to know that the payout was unsustainable more than a couple of quarters ago, I can’t figure out why they would have continued extracting an unsustainable dividend, given that L hasn’t really used that cash. (Unless they needed this cash to overhaul the DO rigs, but that seems unlikely, and possibly a tax inefficient way to accomplish that). Maybe they figured they’d keep taking the dividend, run it dry and then return cash to BWP via debt? Dunno.

KK, have you looked at MUSA at all? I had a look to see if it is a Greenblatt-esque spin-off situation. It was spun from Murphy Oil last fall. Seems cheap on both an intrinsic and relative basis, but doesn’t seem to get much interest. Maybe because it’s not an exciting growth story, but the planned growth seems fairly friction-less. Anyway, could be a boring, yet interesting situation. Or one that just ends up being cheap forever. Marty Whitman’s shop bought some other stuff in that industry recently, so that piqued my interest, too.

Thanks for effort you put into your posts. They are very educational and I appreciate them.

Just curious, what Whitman holdings are you seeing that are similar to MUSA?

Hi,

No, haven't looked at MUSA; of course I should.

As for L and BWP, that's a good question. It seems a little sloppy how the dividend was cut crashing the stock like that. I don't have a good answer to that other than what they said on the conference call, which I suppose we have to accept. I this is something the private eye, Ms. Lotta Value is going to have to investigate (see L 2012 annual report) since there was a lotta value lost.

Their argument is simply that this was the right decision for BWP thinking about things over the long term (they can keep the dividend up, but may have to borrow or raise equity capital in the future to fund their growth).

Anon: Susser and CST – discussed in their 3Q letter. Perhaps in the small cap fund discussion.

Interesting post– a few questions:

Any idea whether the current ROEs reflect companies having more or less excess cash (i.e. cash that isn't strictly part of the minimum cash balance) than average over the sample period?

Also, shouldn't nominal returns on assets or on book equity vary with nominal interest rates? Put differently, wouldn't we expect a higher nominal return on book equity in environments where there are higher nominal interest rates, and a lower return on book equity when there is a lower nominal interest rate? Simplifying a bit further, in a world with historically low costs of capital, shouldn't we expect returns on capital to be historically low? (There is an underlying inflation argument here too but I'll waive that away so long as we're thinking about mildly positive or negative real interest rates.) If this is the case, aren't current Returns on Book equity extraordinarily high right now given the low interest rate environment?

That's a good question. I don't spend too much time on this sort of thing so I don't know. As for interest rates and profits, I have seen studies that seem to suggest that profits are actually higher now as interest expense is lower (and not that profits are lower because interest rates are lower).

As for nominal interest rates and ROE's, I don't really see a correlation over time. Even in the above chart, the ROE fluctuates within a normal-looking range since 1984, but we know that interest rates have gone straight down pretty consistently over this entire time period and ROE is still the same as it was in 1984. I think this is true going further back too.

Thanks for reading.

The Outsiders: The Book the Activists Are Reading

http://blogs.wsj.com/moneybeat/2014/02/20/the-outsiders-the-book-the-activists-are-reading/?mod=WSJBlog

Thought you might be interested in this presentation.

http://www.dream.ca/documents/6357_DREAM_MDA.PDF

Do you have any thoughts on FNMA/FMCC? Ackman stated 10-15x bagger potenial at Columbia B school conference

Hi,

Yes, FNMA can be worth much more if the senior preferreds didn't exist. The way it is structured, the preferreds (owned by the government) pretty much gets all profits. I know hedge funds have been buying common and other preferreds (series not owned by government) and have been lobbying in DC to get it changed arguing that the government has gotten their cash back with decent return.

But I have no idea how that is going, and why the government would change the terms. I don't understand the legal argument that the hedge funds are using. I understand the rationale, but I don't understand the legal and political situation.

Ackman has said that he will present something in the future. Just looking at the financial results and ignoring the preferreds, it's easy to see the value there. But the hard part is, what will the government do? And when will it do it?

When it comes to that question, I am completely in the dark. So as a speculative punt, I guess it can be fun to hold some. But I don't really know how to handicap it.

I have to admit, though, that I didn't do too much work on this so maybe there is a clear argument why, when and how the value will be realized.

In light of recent earnings report, do have any new thoughts on TPRE (re: you post Aug 12, 2013)? Definitely, "outsider" (very little talk/news in blog/messageboard world) but stock price has been disappointing.

thx

No new thoughts. I think they are doing well, as you notice. The stock has been trading pretty much above book value. Over time, if they keep doing well the stock will reflect that. It's not like TPRE is ignored at a deep discount to book or anything like that.

thx very much

your's is the first read of my day