Many people seem to be worried that the market is a little toppy. This is kind of strange because the market is basically flat and hasn’t done anything. But OK, the market was up 30% last year so if you include that (and the whole rally since the 2009 low) the market has come up quite a bit.

But still, smart folks like Howard Marks (who was just on CNBC yesterday) said that the market is not in bubble territory at all; maybe somewhat overvalued. The market is still in what Buffett called the “zone of reasonableness”.

Others say the market is in nosebleed territory and is due for a correction or at least subpar returns for a long time.

David Einhorn is short a basket of really expensive momentum stocks but he says that is only a small part of the market (mid-single-digit percentage of the market bubbled up compared to 30% of the stock market in a bubble back in 1999/2000).

I wrote about what to do in a market that has gone up a lot and you wonder what to do. You can see that post here:

What to do in this Market.

My thoughts haven’t really changed at all. I also wrote a series of posts on market timing (even including ‘pricing’ the market instead of ‘timing’ it). You can see my posts about Buffett the market timer

here.

In order for people to have earned 10%/year in the last 100 years, you had to own it through the depression, through war and peace, when p/e’s were 7x and when p/e’s were 30x. The point is that most people would not have been successful getting in and out of the market and doing better than 10%/year, even if you used market valuation levels (instead of economic forecasts). 10% returns were not earned by being fully invested at 7x p/e, 50% invested at 15x p/e and 0% invested at 25x p/e or anything like that.

Another way to illustrate this is if you look at something like Berkshire Hathaway. BRK has gone down 50% three times in the past (or maybe more). Once in the early 1970’s, once in 1999 and then again during the recent crisis. Of all the investors who owned BRK in 1970, how many have done better than the 20% or so return of the stock over the years by getting in and out of it in order to avoid the 50% drawdowns? There may be some who were able to improve on that buy and hold. But I doubt that there are too many people, even if they used very good valuation methods to time the sales and repurchases.

So that’s sort of the way to look at the market. As long as you have faith in the U.S. and the system at work here, you can look at the stock market in the same way. Most people who sound clever now telling us what the market is worth and getting in and out accordingly is probably not going to outperform the market over time. They will look good temporarily when the market goes down, though.

OK. So we all get that.

Having said all of that, it is still interesting to look at what’s out there in terms of alternatives for people who don’t like stock market exposure. I am really skeptical about those market-timing funds that change asset allocation according to market valuation, economic forecasts and things like that. A lot of that stuff is great for asset gatherers and marketing; everyone hates volatility and a lot of presentations by these tactical allocators just make a whole lot of sense. The problem is that I don’t think that they perform all that well over time.

So here’s the punch line:

Gotham Funds

As you know, I am a big fan of Joel Greenblatt, and this is the latest iteration of his fund operation. Initially, he had Formula Investing funds but shut those down and started these new funds. Why? Why is he running a long / short fund when he said about shorting that it is really difficult and that guys that do this are like the baseball outfielders that go, “I got it, I got it…” and then inevitably at some point go, “I don’t got it…”?

He also said that buying the Magic Formula stocks and shorting the most expensive stocks on the list would have led to much more volatility on the overall portfolio than just being long because you can get really killed on the short positions.

But here we are with Greenblatt running long/short funds.

I’ll get to that in a second, but first let’s take a look at the cool website and his returns so far.

Here’s the website:

There are some nice links there of Greenblatt’s interviews on Bloomberg and CNBC. Also, his interview in

Value Investor Insight is posted there too and it’s a great read. Read that

here.

The Funds

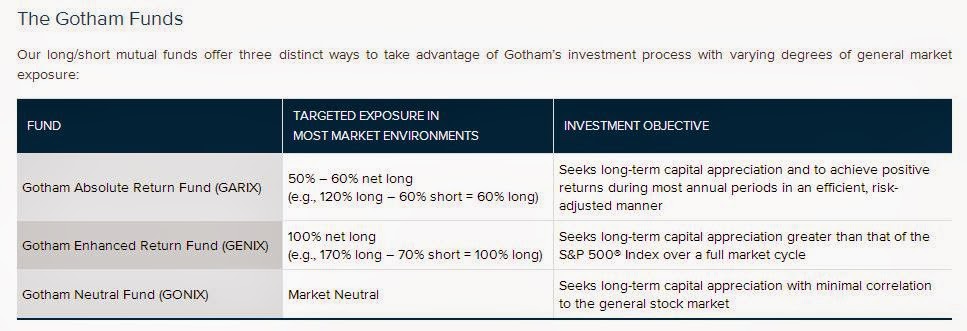

And these are the funds that they offer:

I know, I know. This looks suspiciously like the long/short funds that was popular with the big mutual fund companies not too long ago. I think most of those haven’t done too well over the years. The problem, I think, with the long/short funds that the mutual fund giants put out was that they were usually run by long only managers who suddenly had to start shorting stocks and they had no idea how to do that.

They would buy a nice value stock and then short an expensive mo-mo stock. It makes sense on paper, but then the value stock goes up 15% for a nice return and then the mo-mo stock goes up 50%. Oops.

So running a long/short portfolio requires different skills than running a long only equity portfolio. I’ve actually seen this happen (a long only manager transitioned to a long/short manager) with predictable results (even though this manager turned it around eventually; it helped to have been part of a legendary hedge fund firm).

Plus, if you are working for one of the big mutual fund firms and can actually do long/short well, you would either get hired at a hedge fund or start your own. Why would you not go out and earn your own 2 and 20?

Performance

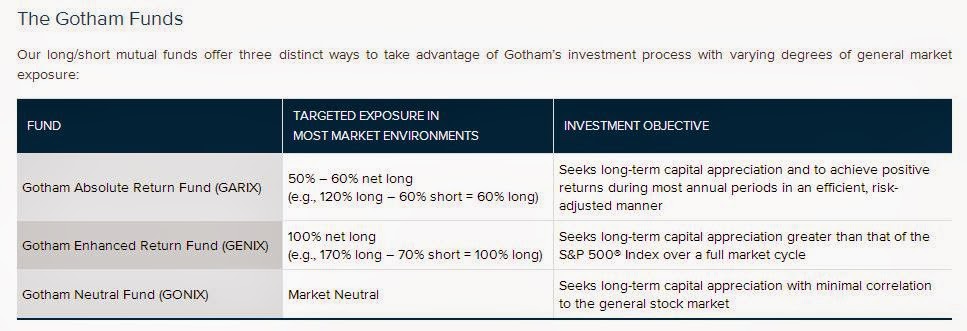

The funds are too new to really evaluate them, but here are the figures anyway:

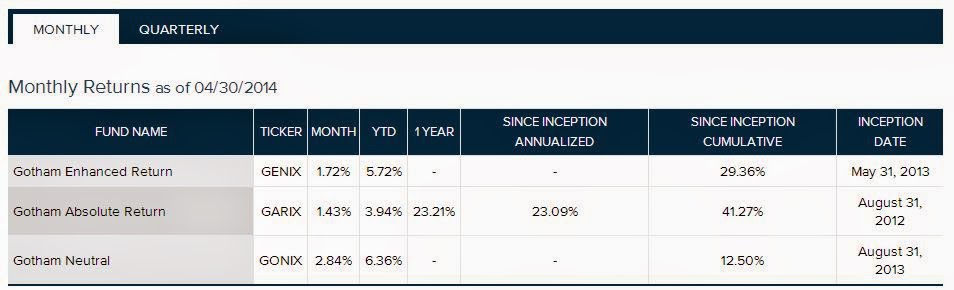

The S&P 500 total return isn’t listed with these figures, so here are the year-to-date and one year returns of these funds versus the S&P 500 index (the figures below are as of June 10, 2014):

YTD 1 Year

Gotham Enhanced Return +10.5% +34.4%

Gotham Absolute Return +6.4% +21.5%

Gotham Neutral +7.4% n.a.

S&P 500 Index +5.5% +18.7%

So it looks like even the Neutral fund is outperforming the S&P 500 index year-to-date. Of course, the time period is way too short for this to be relevant.

But, you know, I have been a big fan of this approach (Magic Formula) and I have a lot of confidence in Greenblatt so I would have no problem recommending any of these funds to anyone interested in this sort of thing. I don’t own any mutual funds but if I had to pick funds to invest in, I would definitely consider one of these.

I usually don’t like these long/short type funds unless they are run by people with a proven track record of doing well with the strategy.

And I am also very skeptical of quantitative/mechanical investment methods. Yes, value has been proven over and over to work in study after study. But when things get mechanical, I start to worry and have never been a big fan of investing mechanically (I actually don’t know how purely mechanical these funds are because there does seem to be some room for input from the managers).

But Greenblatt is different. He came up with something after years of experience in the markets. Usually, it’s the other way around: Some folks in academia or research departments at wire houses come up with some sort of screening method to try to create baskets that outperform. I’ve seen tons of these things over the years but never saw anything that was as simple and consistent as Greenblatt’s Magic Formula.

And whatever they do here in these newer funds is an improvement on that (partly going long/short, and then an added layer of weighting the portfolio according to how cheap or expensive something is instead of equal-weighting it).

The Evolution of Joel Greenblatt

So, let’s get back to the question: After dismissing shorting as too difficult and saying people eventually get killed doing it, why is he now running a long/short fund!?

In order to understand this, we must go back and look at how Greenblatt has evolved over the past decade or so.

Stock Market Genius

After a nice long run as a hedge fund manager and putting up some impressive figures, Greenblatt wrote

You Can Be a Stock Market Genius. He said that he initially wrote this for individual investors. After it was published, he realized that much of the material was over the head of most individual investors. It turns out that this book was used successfully by many young hedge fund managers. So he said, hmmm… How can I reach the less experienced, more typical individual investor?

Magic Formula

Then a few years later he wrote

The Little Book That Beats the Market. This was meant to explain how value investing works, and he even gave readers a formula to calculate return on capital and earnings yield. He even set up a website to list the cheapest stocks according to this methodology.

Formula Funds

And then he realized that even with all of that stuff provided to the public, people still didn’t act correctly and ended up not doing too well. I think he had a record of people using the formula but human intervention prevented some from actually doing well (I forget the details, but it was something like not wanting to buy the crappy (cheap) stocks on the list, or getting scared out of the market during declines).

So he set something up where someone will do all the work for them.

I don’t really know what went on between the Formula Funds and Gotham Funds, but my guess is that it went something like this:

Greenblatt realized that even if Formula Funds did all the work, people will still get scared out of the market at the worst time. I’m sure he had some experience with that and studies show that individuals tend to do way worse than the funds they own as they put money in at the highs and run away at the lows. Some research even showed that investors collectively actually

lost money in a fund that performed well.

This reminds me of the person (I mentioned this on the blog before) who told me that he has never made money, ever, in the stock market and he has been investing in the stock market during the period the Dow went from 4,000 to 12,000 (or something like that). How can you be an “investor”, have the stock market triple, and not make money?! I think this is very typical.

Big Secret

And at some point he wrote

The Big Secret for the Small Investor. This book was about value-weighting the indices. Market capitalization-weighted indices didn’t make sense for value investors because you were forced to own the larger cap names regardless of their valuation level. Someone improved on this by removing the big-cap bias by equal-weighting the index. The Big Secret is to take it a step further; the value-weighted index would give a higher weighting to the cheaper stocks and less to the more expensive ones. This makes a whole lot of sense and I was sort of looking forward to some development in this area.

I wrote about that

here, but it seems to have gone nowhere (the website data only goes through 2010).

But hold this thought for a second, the idea of putting more into cheaper names (instead of equal-weighting it like the Magic Formula).

Gotham Funds

So now we get to Gotham Funds. He once said that shorting is very difficult and that trying to long/short the Magic Formula would create more volatility, not less. But I guess he revisited the idea after realizing that even if a method worked well, most people won’t benefit from it because they can’t sit tight long enough to make any money.

So he must have been working on figuring out a way to get the long/short to work. Plus the Magic Formula was so incredibly consistent that it must work, somehow. By consistent, I mean that the 1st decile stocks through the 10th decile stocks performed exactly as expected over time according to their relative cheapness. This sort of vertical consistency was strongly indicative that some sort of long/short strategy must work.

By using a larger number of stocks and weighting the components by how cheap/expensive they are, he figured the volatility of the portfolio will be more stable (than say, buying a basket of 20 cheapest stocks and shorting the 20 most expensive ones).

With the various options above, an investor can choose how much market exposure he wants. Someone who is comfortable with the stock market can just buy the Enhanced Return fund, and others who don’t like stock market volatility can go with the Neutral Fund.

He did say in an interview that he wouldn’t use these funds as market timing devices because most people won’t be able to do that well.

I can see the temptation to roll into the Neutral or Absolute Return funds when things look expensive and then get into the Enhanced Return when the market goes into a bear market (and gets cheap). I imagine the fund flows would actually be the opposite of that, though.

There is a fee for redeeming early so there will be a cost to doing that.

And I wouldn’t really advocate that at all.

But this would still be far better than switching in and out of the stock market versus cash and bonds. If you have to time and switch, it would be far better to do so between funds that would probably do well either way.

Plus I would guess that that would be far better than owning a fund that tries to outperform over time by switching between stocks, bonds, cash, commodity proxies and whatever else based on economic forecasts, market valuations and things like that. Again, good luck with that.

Why Kill Formula Funds?

So why did he have to get rid of the Formula Funds? I don’t know. My guess is that he thinks he found a better way so why bother keeping the old funds if these new ones are better? He doesn’t want to build a mutual fund giant by offering many variations of funds. Most mutual fund companies love putting out new funds and using every new fad to increase AUM. That works great for them; more funds, more work for their employees (young apprentices can gain experience by trying to run a new fund etc…).

But that’s not what Greenblatt is trying to do. He is trying to help the average individual investor make money in the market, and as long as he finds better ways to do that, he will replace the old strategies with the better ones. If you invent and start selling refrigerators, maybe you can just stop selling ice.

But this is just my guess. Plus, the cost of running multiple funds is probably a big factor too. He probably wants to keep this a small, simple operation and invest resources into research and improving the product and not wasting money increasing administrative overhead by running a bunch of different funds.

Has Greenblatt Really Evolved?

One question is, has Greenblatt changed his views on investing after all these years? He said in the Value Investor Insight interview that he hasn’t changed. In fact, if he started all over again he would do exactly what he did the first time; run a highly focused fund of special situations. He said that this approach is highly volatile and he was OK with that. In the early years when he made high returns (40-50%/year), every two or three years he would have a 20%-30% drawdown that happened pretty quickly. But he didn’t mind that.

These recent ideas are his ideas that he thinks will work better for most people.

So this evolution is more of Greenblatt’s evolution in trying to help the average investor make money in the stock market. He wrote a book. That didn’t work. He wrote another book. That didn’t work. He did the research for them. That didn’t work. He set up a fund for them. That may or may not have worked, but he found a better way to make the average individual investor stick to the strategy and not get scared away.

Bifurcated Market

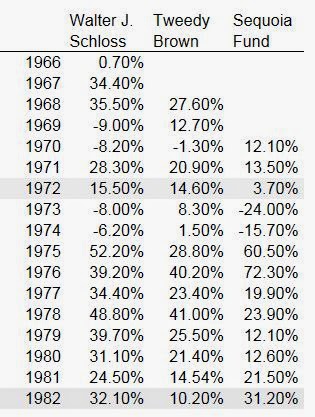

By the way, here again is the performance figures for the Superinvestors of Graham and Doddsville from 1966 through 1982, a period when the stock market went nowhere. The market was overvalued back in the late 1960’s and the Nifty Fifty peak was in 1972.

But these Superinvestors did well overall through the period. I use this table to remind myself (and others) that the overall stock market level is not always the most important thing in long term performance.

The other point, looking at this table now, that I realize is that during this time the market was probably highly bifurcated. The mo-mo stocks were expensive back in the late 1960’s, and then having been fooled by the conglomerates boom and tech stocks (-onics was the .com of the time; end your company name with these and the stock price went to the moon), investors rushed into the nifty-fifty one decision stocks (they were high quality blue chips, not fad stocks. What can go wrong, right?). My guess is that these Superinvestors did well during this period because they stayed away from the bubbled up areas.

I think we may be in a similar period now. I don’t really see the overvaluation that people keep talking about; I don’t see excessive margins in the companies I am interested in and I don’t see high p/e ratios there either.

But there are pockets of silliness here and there. If you look at TSLA, AMZN, NFLX not to mention FB, TWTR, things look a little bubbly. As Einhorn said, this area is not as big a part of the market as internet/tech bubble back in 1999/2000. The collapse of some of these names may or may not take down the whole market, but either way, it’s not such a big part of the stock market.

This is one reason why I am not a big fan of looking at the stock market valuation as a whole in making investment decisions. The Superinvestors wouldn’t have done so well if they sat out the market in 1966, 1972 etc… And there was plenty do to even in 1999/2000 despite the market trading at 30x p/e (or whatever it was).

So why is this relevant to this post?

A highly bifurcated market is a great time to be long the market (if you own the right stocks) but can also be really interesting for a long/short strategy. But of course, only if the person running it is competent. I don’t think just any long/short fund will do well; I think most will do horribly; they will get killed on both sides (the shorts will go up and the longs will underperform!). But if I’m right, Gotham Funds may do well on both sides; at least relatively.

Conclusion

So although nothing has changed as far as I’m concerned (with respect to what to do in the markets) I like to follow Greenblatt and I think he is the real deal.

I am usually not a fan of long/short mutual funds (or even hedge funds unless run by someone with a good track record; never buy these things offered by the large mutual fund companies!), and I am not really a big fan of mechanical investing either.

But again, Greenblatt is a veteran that has a proven track record in the markets so he is not just some academic coming up with a nice theory trying to sell you something. So I wouldn’t have much reservation about these funds based on it being a long/short strategy and quant-based.

Also, I know that the Magic Formula has been controversial in the past; that people have not been able to duplicate Greenblatt’s results. I haven’t done any work on that myself but I suspect a lot of that is going to be because of the data.

When I worked at big firms, a lot of resources went into cleaning up the database (that were presumably already cleaned up by the vendor). So it would be really difficult in any case to duplicate results without a good staff actually going over the raw data first. You’d be surprised how much silliness gets into these backtests if you don’t actually check the data yourself (or have someone do it for you). This would include things like dropping stocks where the financial data is suspect or meaningless (data vendors won’t do that).

So,

- In this bifurcated market we know that there are decent stocks to buy and the Magic Formula type things will outperform over time. No need to get out of the market even if the whole market is expensive (and some great investors say it’s not) if there are reasonably priced stocks to own. And the Magic Formula is not a bad way to be long (assuming the Gotham Funds use a similar methodology).

- On top of that, the returns in these funds will be enhanced by the weighting strategy of buying more of things that are cheaper instead of equal weighting them (read the The Big Secret for the Small Investor and go to the website (valueweightedindex.com) to see how that works).

- And then you have a short portfolio overlay on top of this using the same strategy in reverse; shorting more of the more expensive things. The short book is risk managed by having smaller positions per name so as not to get killed by the occasional NFLX / AMZNs.

- People will always be afraid of some stocks due to recent bad news (and therefore underprice them) and will always adore others (and therefore overprice them). As long as this continues to be the case, the strategy should work.

It’s such a simple idea and it sounds too good to be true. And yes, the mutual fund industry is littered with funds that tried similar things in the past.

I will tell you, though, that this is different than those past attempts by a wide margin; mostly due to the experience of Joel Greenblatt, the research that he has done and disclosed to demonstrate that the ideas actually work etc…

The $250,000 minimum investment might be a high hurdle for some younger individual investors, but if I wasn’t actively managing my own account, I would certainly consider putting a decent chunk of my risk capital into these funds.

Anyway, I don’t recommend mutual funds here all that often, but take a look!

Side point that is related to how returns are earned and human nature – The concept of volatility and its implications to investing befuddle me. Why would any investor care about anything other than total return? If my investment of $100K goes down to $25K, but back up to $200K for a net gain of $100K in one year, that is still a much better than the investment that steadily goes from $100K to $175K for a net gain of $75K in the same time period.

Volatility is not risk. I suppose it's human nature to see the investment that swings up and down in market price as "risky", but if you believe that the market does not always reflect the true value of an investment, then the day-to-day market price shouldn't really matter all that much to an investor.

Exactly. We all know that, but in practice, it's pretty hard for most people. I had lunch with an old friend who was a quant (derivatives etc.) and did some prop trading and then retired. He said that derivatives and all that prop trading is garbage, and Buffett-like value investing is what really makes sense. We talked about stocks every now and then. He knew all that stuff that we value investors talk about and it sounded like he was totally converted.

And then the crisis happened and he has now sworn off all stocks, lol… After the crisis he shifted his attention to real estate, which wasn't a bad call as I think he picked up some foreclosure properties.

But at the end of the day, he understood value investing and was into it, but in reality didn't have the stomach to actually execute it.

I have seen this over and over again both in casual situations and even when I was on the street. Saying that you will do this or ignore that if something happens before the fact is very different than actually confronting the issue and having the emotional fortitude to follow through.

I think Greenblatt tried and saw that his followers actually couldn't deal with the volatility; that's why he came up with this latest attempt to get investors to stick with the plan.

Trading is the same too, by the way. I've seen professional traders criticize others for freaking out or losing it, but when they themselves went through a drawdown, they freaked out too and made bad decisions. You just never know what kind of stomach you have until you actually do it.

Which reminds me of the recently rescued army deserter. He loved the idea of going to Afghanistan to kick some Taliban ass, but when the bullets started to fly, he freaked out, apparently. This happens in markets all the time.

theres really no point saying that this makes more sense than that and vice versa, there are a lot of really successful prop traders, that have literally extracted billions from the market under 20-30 yrs with a lot less risk than value investing – on the other hand we all know about immensely successful value investors. Two big differences, great trading strategies dont scale like value investing, and all great trading strategies work until to many are doing it, or the market changes for some other cyclical, structural reason. Of course value investing evolves as well, with the individual hopefully, but it is still more about patience and the feedback loop is much longer. Whereas with a trading strategy the feedback loop is often much shorter, and a big part of it is trying to structure the combination of trades and time frame so can control the outcome. You have to find a style that fits your personality and interests.

Yes, I agree. There are many ways to make money for sure so it makes no sense to say what my friend said. But the point is that he thought he can do value investing but ended up realizing it is not for him.

No matter what people decide to do, it's really about emotional temperament and self control than intelligence (well, you can't be dumb either).

I think being dumb and knowing it is better than than being smart and believing it will save you. Or you can call that smart, its just not smartness in the traditional school sense. The market is a mental game, as you say.

Original poster here. Thanks for the response. I know I'm preaching to the choir, but the other term that kills me is "risk-adjusted return". "Risk-adjusted"? That's risk based on someone else's definition of risk! So if I get amazing returns, but I didn't get them the way you think I should have, then it's not as good on a "risk-adjusted" basis? Laughable.

IMO running an uncorrelated multi-strat helps with smoothing out the returns so that you aren't as susceptible to making the bad decision of giving up at the bottom. So perhaps you have a 'magic formula' type value strategy along with a momentum stock strategy and then a tactical asset allocation/trend following strategy. The TAA strategy outperforms in bear markets, and the value/momentum strats work great in bull markets. Weight/rebalance them correctly and you 'shouldn't' have the 50% drawdowns that stock-only strats have experienced.

You say that you do not own any mutual funds. Do you focus more on special situations or on the large owner operator companies with long term track records? If you look at most of the owner operator companies, TDY, TDG, Colfax, DHR, ect…, the are not priced as value stocks. So, can we get a sense of how you think and build your portfolio of stocks? Thanks.

I'm just cutting and pasting the answer to this here (it appeared under the next comment for some reason):

Well, I don't want to go into too much detail on what I do, but for example, I would probably just rather own BRK than own most mutual funds out there. Right? And then maybe mix in some other long term performers like MKL or whatever else. I tend to like TPRE and GLRE now.

And then I do have a lot of other special situation type things that change over time. And I don't mind higher priced stocks like DHR and CFX if the pricing makes sense. Not everything I own has to be 10x p/e. I do sort of subscribe to the Tiger/Robertson school of investing too, so I don't need dirt cheap all the time.

But my allocation to higher p/e stocks would be limited, though.

I had invested in Formula Investing and was baffled when it was closed down (and a bit annoyed). I believe the return in 2013 was 52%! One could be cynical and guess that the management fee on the Gotham Funds is twice as large as Formula Investing was which may explain why Greenblatt decided to change course. I'm highly skeptical that he can maintain the performance of these long/short funds which as you point out has been amazing. Time will tell.

Hi, thanks for commenting. It's good to have someone who actually owned a Formula fund. I don't know about Greenblatt's motivation, but from what I understand about him I really doubt it is about fees. I've followed Greenblatt for years, reading about him, his writings, watching him on interviews and also sometimes hearing about him from others, he is not really one of those guys that will do things to maximize his own profits.

I really do think it's as simple as he thinks he found a good way to execute his idea with less volatility so he won't have to worry about mass redemptions on the next market decline.

He doesn't worry about redemptions for the sake of his own income, but I do really think that he wants people to do well and not bail out on every dip.

For example, when he first wrote the Little Book, people said he should start a fund and do it for them, and he really sounded like he didn't want to do that. He had to be talked into it, I think.

Anyway, I don't know for sure, of course. But I would certainly give him the benefit of the doubt given his past and his reputation.

P.S. Let me add some more thoughts on the closing of the formula funds. I believe they teamed up with an outside firm (former creator of DLJ direct, I recall) to create the mutual funds. Maybe something happened and they decided to bring it in house, but they needed a much higher minimum for it to work with their infrastructure at gotham. Another relevant fact is that the international versions of the funds were exceeding their expense caps it seemed by a considerable margin and were also stinking up the joint. So maybe the other party wanted out or they couldn't come to an agreement on subsidizing continued losses/fee waivers in the international versions. I note there are no international focused funds among the current offering. Thanks again for sharing your interesting thoughts on this question. — CorpRaider

Thanks for adding some real facts to the matter. That's too bad… maybe they could have let the older funds lived if it was able to support itself.

In any case, it doesn't sound like it's about Greenblatt pushing people into higher fee funds for more profit or anything like that (which I didn't think was the case).

Oh, and I may have accidently deleted your other comment when I was cleaning up some spam.

Thanks again.

No problem. I agree, the 2-ish% ratios are a huge bargain for a L/S fund with this level of management quality. Your blog is awesome, if there is anyway to support it besides buying books through the amazon links, please let us know! Best, CorpRaider

Great post! Thanks.

The comments re: the market being bifurcated made me recall this post which I read not too long ago:

http://greenbackd.com/2014/02/11/a-market-of-stocks-distribution-of-sp-500-pe-multiples-tightest-in-25-years/

[Basically, this says that P/Es in the S&P 500 are more tightly clustered than they have been since 1990. Or at least that was true as of February.]

If you get a chance to respond, I'd be curious to hear whether something like this changes your description of the market as bifurcated or if it would make you change your investment approach in any way? I think the larger implication of something like this is that the magic formula might experience a period of underperformance in the intermediate future because the spread between cheaper stocks and more expensive stocks isn't as dramatic as it has been historically.

Also, are you able to recommend any resources for someone interested in learning more about the Tiger/Robertson approach to investing?

Thanks for the link. That's an interesting chart for sure. I remember 2007 being frustrating as everything seemed way too expensive and it doesn't feel like that too much now.

But it's a good point. If there is less p/e dispersion in the market, long/short returns might be lower than otherwise. But then again, when the market p/e is 7x, long returns would be better too, but that doesn't mean we shouldn't be in the market when the p/e is 15x or even 17x. So similarly, even if the dispersion is lower, it doesn't mean long/short won't work.

So first of all, would this idea have been a good idea back in the mid to early 1990's when dispersion was also really low? For the long term, probably yes. That's the more relevant question, not so much how the strategy would perform in the immediate future.

Also, there is an interesting comment on that page below the chart that says that since the p/e dispersion is lower, there is opportunity now that different quality stocks are trading at similar p/e's.

Now, remember that the MF is not a strictly p/e or valuation rank. It's a valuation versus return on capital rank. So if ALL of the stocks were trading at exactly the same p/e for a p/e dispersion of exactly ZERO, unless every company earned the exact same return on capital, there would be plenty of opportunity to buy and sell stocks at the same exact p/e (buy a 15x p/e stock with 40% return on capital and short one that destroys capital at the same 15x p/e).

So yes, that chart is probably indicative in some way on the opportunities in the long/short world, but I don't know how definitive it is for the above reason.

But yes, I may have to temper my statement that the market is bifurcated a little bit. That chart shows that Einhorn is probably right; that the bubbled up area of the market is a very small area.

As for Robertson, there is a book out on him. I don't remember it being a great book or anything, but there is a lot of information in there about Robertson's approach to investing, about running his firm, how he trains his employees, what they look for in investments etc.

He was also interviewed in Money Masters of Our Time by John Train. He may have been featured in other Market Wizard-type interview books, but I can't recall which others he may have been in off the top of my head. I don't think he was in any of the Market Wizards.

There was also a really great, long interview in Outstanding Investor Digest years ago where he talked about investments in the usual detail that OID usually had.

Otherwise, he has been on CNBC numerous times with some interesting interviews, and I think there are some other interviews on some web channel he did where he actually talks about the investment process and stuff like that, but I forgot where I saw that.

Thanks for commenting.

There's one fairly long interview with Robertson on opalesque TV. — CorpRaider

tagging on to what Mike Leraris said, do you have any thoughts on correlations in today's market vs the market that the super investors were investing in?

so much money is in ETFs these days that even if the market is bifurcated into cheap stocks and expensive stocks, just about all stocks go down together when something happens.

My response to this is to adjust cash levels higher. Years ago i think it made plenty of sense to just hide out in the cheap stocks regardless of what "the market" was doing because the cheap stocks would be just fine in a sell off. you can see this very well through the popping of the tech bubble where cheap stocks did fine. With the ETFization of the market, cheap stocks sell off just like expensive stocks when bad news hits. higher cash levels positions you to avoid the sell off and maximize the opportunity.

off course the problem is that this approaches market timing…

so anyway, i'm just curious how you think about increased correlation in conjunction with staying more fully invested through cycles etc etc.

this would be a great post topic in my opinion.

thanks!

(btw, i was in high school/college through the tech bubble, so that comment is based on secondary research, not primary experience)

Hi,

Yeah, the ETF thing may increase correlations between stocks, but remember, we don't really care about stock price movements, right? As long as you buy something at a good price and the intrinsic value grows over time, who cares?

If something you buy cheap gets cheaper due to ETF selling, who cares? You can just buy more if you want.

Not too long ago, a lot of people were worried that BRK is too correlated to financial stocks as it is a component of financial sector ETF or something like that.

My thinking is, who cares? That just brings more opportunity for smart investors. If financials tank for the usual reasons that some financial companies did stupid things, and BRK goes down along with them without having done anything stupid, you just back up the truck. Simple. Right?

So I wouldn't care so much about stock price correlation with each other.

What does matter, though, is valuation dispersion. You want better companies to be priced higher than lower quality companies. So WFC trades at a higher P/B ratio than BAC or C, and that makes sense given how well WFC is doing and has done through the crisis.

In that sense, the market is working perfectly fine.

But the stock prices of all of these banks are highly correlated with each other. But it doesn't matter as long as the quality is differentiated through the valuation. Right?

So if AIG is trading at 0.7x and BRK is trading at 1.4x book, again, that's wonderful. That means the market is making judgements on these companies.

I don't know what the correlation between the two stocks are, though. But if they are very high, who cares? Doesn't matter.

So it's one thing to worry about stock price movement, or potential stock price movement on the one hand and what you think something is worth and how that might grow over time.

If you worry too much about what might happen in between, then it's going to be hard to invest successfully.

I'm a past owner of Formula Funds, and current owner of Gotham funds. Wanted to point out that Formula did not have a short component; Greenblatt alluded to some conceptual struggles with this in "The Little Book." Apparently he (believes that he) figured it out. One poster noted the higher fees in Gotham… but again, look to the short component for at least part of this. There are very, very few investors to whom I would entrust a large % of my net worth…. Greenblatt is one of them. Not a core investment issue, of course, but it says a lot about a person when he spends his free time teaching at Columbia and in efforts toward major educational reform…

Thanks for dropping by. Yes, I view Greenblatt as sort of a modern day Benjamin Graham. Greenblatt returned all outside investor capital to investors in his hedge fund relatively soon so you know he is not motivated by trying to become Wall Street's top income earner, or trying to become the biggest hedge fund conglomerate or anything like that. He had enough money, he returned capital to investors and just invested his and his friends/family money.

After doing that a few more years, I think he really wanted to start going out and helping people, and that's what all the books and these funds are about; not making money (he surely has enough, and if it was about money, he would probably make more money just doing what he used to do; focused special situations investing).

And yes, his teaching at Columbia is also indicative of that (as I don't think that work pays at all), as is his work with trying to improve schools in NYC (via charter schools).

any thoughts on the Bauposts and Abrams of the world and their current position of 40-50% cash?

do you think it is as simple as they have the stomach to run into burning buildings and thus should keep cash on hand?

of do you think that they are playing a dangerous market timing game?

I don't know much about Abrams, but I think Klarman has always had a large cash position and yet earned 20% or close to that since inception. I think he has always had pretty low exposure to equities, especially U.S. equities.

So he is a special case, I think. Not many can get those kinds of returns in any asset class. He only invests in very special situations and often outside of equities.

Finally, another post here! I enjoyed it.

One thread that I am going to pull on, though, is the absence of Munger’s performance right around where you said "My guess is that these Superinvestors did well during this period because they stayed away from the bubbled up areas."

My recollection is that Munger's fund had terrible performance for 2 or 3 years in the early 70s — not because of he bought overvalued companies per se — the phenomenon was near disaster though. After a few more years Munger's fund fully recovered and he wound up the partnership with an overall extremely impressive CAGR (presumably both when measured by simple beginning to end and on an average dollar weighted basis, which Munger states all funds should be measured on). Munger has described those few bad years as being extremely unpleasant. So, (a) I would say that this would add a richness to the data set, if you can get those figures.

This thread leads me to (b), which is that whenever people say volatility doesn't matter, I generally think they are over simplifying things or haven't thought the issue through. I mean that in several ways.

i. If you are running a long-short fund, volatility can kill your fund– e.g. as commonly happens, some of your trades are crowded and during a crisis those trades end up being unwound at the same time, resulting in longs going down, shorts going up and you having margin call or effective insolvency of the fund. Volatility can be extremely dangerous to leveraged investors—which certainly includes long-short funds, even those that aspire to be ‘market-neutral.’

ii. There is the Cliff Asness sense of volatility which is, basically, it's fine for you to the valuation work and figure out expected returns on assets, but what if you are wrong?

iii. Then there is the Munger sense, where if your fund gets clobbered for 2 or 3 years, it can be extremely traumatic.

iv. Finally, if we are using Beta and volatility somewhat interchangeably as Buffett himself does sometimes, at least part of the idea behind Beta makes sense. When underlying businesses and their securities perform poorly during bad times, people should demand a higher rate of return. Bad times are exactly when people are more likely to lose their jobs, have negative (or at least below expected) real wage growth and hence may need to consume their savings. Also bad times are exactly when we should be trying to buy bargain securities, so if you have an interest in a company that throws off extra cash in bad times and / or its market price doesn’t go down much and stays liquid during bad times, that is a very beneficial thing.

Hi,

Yeah, Munger's performance is actually in that essay, and you are right. But frankly, I've never actually considered Munger one of the superinvestors. What really interests me about the Superinvestors (and why I consider them superinvestors) is because of how they performed *after* the essay came out. So it's an in-sample, out-of-sample sort of thing. Buffett highlighted them in 1984, and they continued to do well after that.

And yes, if you are running a long/short fund, then volatility matters. You can't short a stock and say it's worth zero and just sit there. Look at Ackman/HLF. So there is a trading /risk management issue with shorts that are not that important with long only portfolios.

And also yes, in bad times you will get clobbered in stocks. That's why Greenblatt said that the amount of stocks you should own is the amount that it won't upset you if it goes down 50% because it will. Buffett said that if it will upset you if a stock you own drops 50%, then you shouldn't own stocks.

And yes again, you can be wrong. This is why you don't go 100% into one position. Focused investors usually think 8-10 names is enough diversification in case you are wrong on some of your picks.

Also, during bad times, stocks will go down for sure. That's why you have to go back to the Greenblatt/Buffett comments and see if you should be in stocks in the first place, or how much you should be in stocks. Bad times will come for sure and bear markets will come for sure. Make sure you have an amount invested that you can cope with it.

Greenblatt said that the mistake people made in 2007 was not that they didn't sell out before the sh*t hit the fan, but that they owned too much stock and freaked out and sold when the market tanked. I totally agree with that.

So the amount of stock you should own is not based on your age, years to retirement or target invest return to make retirement by a certain age or anything like that; it should be based on what you can deal with and not freak out.

I do talk about being fully invested all the time, but I don't mean fully invested in having 100% of your net worth in stocks at all times. This percentage will differ according to who you are, what you need, and what your stomach strength is (temperament).

When I say don't get in and out according to forecasts and pundit advice, I just mean don't buy and sell based on those forecast/projections.

If market declines are too upsetting, then of course someone should scale back their equity exposure. But they shouldn't do it because they are scared now and then get back in when they are not scared. That won't work either.

Anyway, thanks for the comments, and I hope Munger doesn't see this, lol…

Oops, sorry, forgot to add:

In bad times, you might want to own stocks that won't go down much, but for me it doesn't matter. If you don't want downside, you might end up owning a bunch of utilities and MLPs, which might do well.

But for me, I'd rather go with the guys that may go down a lot in bad times but will pick up a lot of good stuff and come back really strong when the market stabilizes.

This is the sort of business that I talked about last year; outsider-type companies, for example, that manage for cash flow and allocate it well. They can either gobble up a ton of their own stock on the cheap, or they can go buy other companies on the cheap.

Either way, you may take a mark-to-market hit on these stocks, but you know they are growing their intrinsic value precisely because of the weakness.

Munger talked about that at an annual meeting; how Rockefeller, Carnegie, all those guys got big this way. In bad times, they just bought up the weaker guys that fell on hard times.

So if you own a business like that, you don't sell it in bad times. You hold on and watch them grow. And the mark-to-market will correct itself when things settle down…

I agree exactly with your gist of Rockefeller, Carnegie, etc. I would approach the bad times concept from 2 ways though. One is the mark to market of your publicly traded business, but the other is the underlying businesses profitability / cash flow generation profile.

Thinking about this as a private owner, if you own 10% or 50% or 100% of a business— for any given discount rate (and cash flow PV), you want a business that generates extra cash flow during bad times, or at least isn’t hurt much during bad times. This allows you to be opportunistic and buy when ‘there is blood on the streets’ – e.g. forced asset sales from overleveraged companies, buy traded bonds of other companies trading at steep discounts, etc.

If your business’s cash flow generation capabilities dry up during bad times, even if you have no debt, you lose a major tool that you could use to be opportunistic in buying up other companies (or even buying back your own stock if publicly traded). There are other tools you can use to try to remain opportunistic (e.g. issue extremely favorable debt during good times and sit on the dry powder while eating the negative carry). But as someone who does not want to be a man with only a hammer, I have grown enamored of having many different tools in my toolkit – in this case to be opportunistic with acquisitions.

In principal I agree on certain subset of pipeline MLPs, but there are many other businesses like Coca-Cola, See’s, an awful lot of the pharma royalty companies, and really most companies with customer captivity and consumable (as opposed to durable) goods.

I don’t think there is anything wrong per se with buying shares in a company—whether 1% or 100%– that will perform poorly during down times, but as an intelligent buyer you should demand a bit of a higher return (either via a higher discount rate, or a steeper discount to calculated intrinsic value).

Yes, I agree. That's the part of analyzing the business before you buy it. You want it to be a strong company that won't suffer too much in a recession or bad recession. That's why I keep saying that the value investors that got killed in 2009 didn't make a macro error. Some said in their letters that "things got worse than we thought" as if they made a mistake on their economic forecast. They owned things like LEH, BSC, FNM and AIG. I don't consider losing money on those an error in their economic forecast, and their error wasn't that things got worse than they thought (because things will *always* get worse than anyone thinks… that's just the nature of the markets and the real world).

Things got worse than Buffett thought too, and he too owned financial stocks (WFC , AXP, USB etc…), and he didn't get killed.

So it was an error in stock selection. Some value investors owned highly leveraged, not very well managed businesses that were bound to blow up on any bump in the credit markets and that's precisely what happened.

In fact, things got much worse than even the ever-practical Jamie Dimon thought. And he got JPM through the crisis without even a single quarterly loss (which happened years later due to legal costs).

So it wasn't so much about "paying attention to" or "ignoring" the macro. It was about "being ready for anything because nobody knows when and what will happen and how bad it will get…".

Analyzing businesses has to include how well it will hold up in a recession or bad recession. It doens't have to be recession proof completely, though, becuase those things tend to get overvalued due to their seeming recession resistance (defensive, high-moat, strong brand companies like Coke tend to get expensive… Gillette / PG used to be in the 30-40x p/e range etc…).

But yes, you can have some diversity in the sort of stocks you own.

At the end of the day, the most important thing is that you know what a business can earn on a through-cycle basis, or on a reasonable normalized basis, say, five years out, and then try to pay a lot less for the business.

How lumpy the earnings will be going forward may be a factor in your decision, of course, but the most important will be that it will be able to get through hard times without too much trouble. I wouldn't try too hard to find something that won't even have down earnings or something like that, because then again, you end up with utilities and things like that (which may not be bad, necessarily, depending on price).

This comment has been removed by the author.

I am also an admirer of Greenblatt's investing success (can't argue with a 40%+ CAGR over a >10-yr period) and his moral rigor (favoring performance over asset accumulation, teaching at Columbia, charter schools, his efforts to create good investment vehicles for the general public, etc..), But a few questions arise in regard to Gotham Funds.

1) Why didn't he explain the closure of Formula Funds? I'm willing (eager even) to cut him slack based on his great record. But doesn't he owe his investors an explanation for closing those funds? Was it due to a disagreement with his CEO? Due to unmanageable expenses? Due to poor returns? Should an investor in Gotham Funds be concerned about them being closed as well? What if that investor incurred capital gains tax liquidating assets to move them to Gotham Funds?

2) Long/Short—As you mentioned Greenblatt has stated on many occasions his dislike for the long/short investing strategy. What he said, roughly, is that it works until it doesn't work, and every 5 to 7-years the market will go crazy and both your shorts and longs will go against you and you'll blow up. Given his long-held public view on long/short, I want to hear him explain what has changed. Why is he now comfortable with long/short as a viable long-term strategy? Your supposition that he's doing it to reduce volatility and thereby reduce the risk of investors bailing at the wrong time makes intuitive sense, but if that is the case I'd like to see evidence that these strategies do indeed reduce volatility. I am sympathetic with your willingness to cut him slack based on his excellent record and character, but don't you think his investors deserve an explanation for his about-face on long/short?

3) Back-testing—Given all his analytical and research resources and his history of thorough back-testing of other strategies, the absence of published back-tests of the three strategies in Gotham Funds is notable. Why didn't he publish back-tests? It is very likely that he did them. Given his previously-held view on the drawbacks of long/short, I can't be the only one who'd like to see how the strategy held up under past market dislocations. How about '98-'99 when the mo-mo stocks were soaring and the value stocks languishing? When a guy who has publicly stated that long/short strategies tend to blow up launches a set of long/short funds don't you want to see his back-tests? I do.

I like Greenblatt. And I like the thinking behind the Gotham Funds strategies. But these questions give me pause before making an investment. Why would a guy as thoughtful and thorough as he is leave them unanswered?

Those are very good points. I don't know. I didn't own any of the Formula Funds so I don't know what kind of letter investors received when they were notified they would be shut down. It's reasonable to expect more of an explanation.

For long/short, you also have a good point. I think he did say on TV the other day something about having a more diversified, or smaller short positions than longs; for example the biggest long is 1% and biggest short is 0.5% (or 0.8% vs. 0.4% ) or something like that.

I think he has 300 names in the long and short, so there is much less of a risk of getting squeezed. Guys like Julian Robertson, when he got squeezed in 1999/2000 had a lot fewer names as shorts, I think.

So that's part of it.

About back-testing, that's a good point. He has all that data for the Magic Formula and even the value-weighted indices, so why can't he show us some research on the long/short? I would love to see that too. There must be some results, even if not the exact same approach as the portfolios, but something similar as a 'proxy' on what we can expect going forward.

On the other hand, the explanations in the Gotham Funds seem to be less purely mechanical than the Formula funds. I don't know if that's true, but it seemed like there was much more active involvement in these funds (which I would not object to at all given Greenblatt's experience/ track record).

So maybe that's one reason why a backtest would not be representative or indicative of future returns (well, even if you did an exact mechanical backtest, it would still not be indicative of future results, but you know what I mean).

Those are valid questions, and maybe he will answer those some time.

If you are a former Formula investor, you can try writing to him and see if he (or someone) responds.

Anyway, you raise very good, fair questions. I wouldn't minds seeing some answers.

Great post!

I have backtested the magic formula on the swedish stock market between 2002-2012. Totally crushed the market. The market had an yearly return of 7,9%. The Magic Formula slightly over 24%.

Wow, impressive! Build a real-time, real-money track record and you have yourself a business!

Thanks for the update.

Hi kk,

Great post as usual. An off topic question: do you like LMCA as a buy at current prices or it´s more of a hold now?

Thanks in advance.

Regards.

Since LMCA was brought up, am I right to assume that you'd recommend holding onto both entities after this upcoming stock split? Seems like if history is any indication, Malones transactions work out for all entities involved.

Hi,

To the question above, buy or hold? Hmm.. that's a tough question. I still like it but this is a dynamic situation so you can't look at this things as dynamic entity and say it's worth this much, and it will be worth x in five years. The whole point is you want to take the ride as these guys do things to create value in a dynamic industry. There will no doubt be plenty more deals and LMCA will look very different in five years than now.

And yes, I do think it's interesting to own both after the split up; that's just another way of creating value and it has been a winning strategy for these guys before.

So going back to whether this is a buy or hold, I suppose this split is yet another catalyst that may make it a buy. But as far as timing is concerned, I don't think any of the entities here are trading at distressed levels or super cheap or anything like that… so in that sense maybe not an urgent buy.

Oops, I meant to say that you can't look at LMCA as a "static entity and say it's worth this much…".

What do to in this market? Have you noticed that Ian Cumming has concentrated 93% of its portfolio in Harbinger?

Hi,

For whatever reason, I think that reflects LUK's position. The 93% allocation matches the allocation to HRG on LUK's 13-F, so I guess things are still filed under his name.

Cumming still owns a bunch of LUK, Homefed, Crimson etc… so it wouldn't make sense for him to be 93% HRG. Of course, if he really was 93% HRG on a personal basis, that would be big news. But I don't think that is the case.

Thanks for mentioning it, though.

I am a large investor in Garix, Gonix, and Genix having to satisfy different tolerance levels for family members I have used different funds for each. By the way if you cannot meet the min. $250k that all brokerages I have called(now 7) require, try Schwab since I satisfied one member of my family by Schwab's min. of $50k.

This issue of Joel closing the previous "Magic" funds that were doing so well for a few short yrs. was handled ethically in my research. He allowed those investors to get into the funds I mentioned prev. w/o having to meet the min.

I have spoken to inside mgmt. of Gotham Funds about this issue also in this chat line about past research that Joel and his group did over almost 7 yrs. trying to addr. this volatility issue and the "back testing" done to validate the strategy of long/short in various forms and ratios. The fund is not allowed to release this back test data after the first fund went public (Garix) from inception date(this is a SEC requirement). Previous to that I do not believe Joel's group ever showed anything publically and their staff has confirmed that to me so there remains big questions about how well this strategy will work in the future during tough times. The comfort I get in addressing this issue is Joel's outstanding investment record: nearly 40%/yr. avg. for 18 yrs. he ran his hedge fund with the worst yr. being -10%. He stopped it because of all the new regulatory changes on hedge funds required after Obama and Congress had to rectify the excessive speculations that drove our economy into the mud in 2008 ( side note: not to mention the Bush administration's disregard to uphold any controls that were in place in moderating excessive speculation by disabling many agencies with figure heads that allowed the laissez faire philosophy of governing businesses.) Also getting back to DD, that he is using the same hedging concepts now in his funds as he has done in the past with his hedge fund and does for private clients now with excellent results. With the Gotham Funds he manages the hedging is organized, researched and computerized. I was assured that his research staff also looks over extensively each company they invest in so it is not just by computer algorithm. The other point is that if you look at the drawdowns of each of these three new funds (now historic for validation of this DD issue) you will see that compared to the S&P500 index they are basically correlated most of the time but with different DD figures. Gonix being of course the most conservative but Garix holding up better in both performance and DD. Genix is very exciting to me but it would be a much bigger risk in a bear mkt. especially like we saw in 2008. My feeling is to switch over to Gonix when the s&p 500 wkly ema 43/17 crosses downward. This is too new to play the game of trust and "pray", I prefer prudence since at my age (now 70) my pockets are not as deep as people like Buffett who doesn't care if he losses on "paper" 50% since he knows it will come back but in the meantime he can still pay his bills with his large nest egg. Most of us that are older cannot play the game of it will come back, we will probably will be dead when it does so you may wind up short in the meantime when you want to enjoy the "golden yrs." as they say.

Thank you for the detailed comment! It is very informative.

The above comment on Aug. 23, 1025pm I want to add one thing, I mentioned wkly EMA 43/17 as the point to switch and I want to make clear it is the S&P 500 index with all dividends reinvested that is charted. The only place I know of that does this is StockCharts.com which limits you to 3 yrs.(for the free service) but you can do 3 yr. incremental look backs as far as 1990 so that will show you how effective this timing tool is in keeping you out of bad mkts. Occasionally you get whipsawed but not too often, it improves the return on the S&P 500 overall and eliminates all the bad DDs in that 23+ yr. span. The Black or was it Blue Monday of 1987 hopefully won't be repeated because of the circuit breakers they now use on Wall St. to shut it down in panic mkts. This was to enable wealthy savvy investors to be able to get out who might be "surprised" who use tools like this one in their tool boxes. I might add the symbol on StockCharts.com is $SPX for the s&p 500. Good luck to you all. May we all be enabled with knowledge that allows an equal playing field

First off not be political.. but the Anonymous poster is incorrect about the closing of Greenblatt's hedge fund

>> He stopped it because of all the new regulatory changes on hedge funds

>>required after Obama and Congress had to rectify the excessive speculations

>>that drove our economy into the mud in 2008

Greenblatt closed the fund in 2006.

Next. I was an investor with Formula Investing — not the mutual funds but the privately managed funds. After FI stopped/closed they offered investors the opportunity to invest in the Gotham Funds (G*N*X). I seriously look at investing, but then I saw the expense ratio of ~ 3.5% and passed. You have to be a supremo investor to be ~3% then the S&P, granted Greenblatt has a wonderful but consistenly beating the index by 3%… na. Also, I had the impression (from You can be a stock market genius) that what really set Greenblatt apart and the real source of his alpha mojo was his prowess at recognizing and exploiting special situation — risk arb, spinoff,etc. He probably can't do that kinda of stuff in the mutual funds he runs. So that begs the question at least for me where's the alpha mo-jo going to the come from — picking stocks. Yikes.

Alpha Architect recently published a long short backtest a la Gotham and found it's an excellent strategy but had a massive 70% DD at one point! I suspect Gotham fund buyers will eventually be faced with a much larger DD than they think is possible.

The Alpha Architect backtest (with the drawdown reflecting the 1999 tech bubble period) is inaccurate because, among other reasons, they didn't use sector caps that Gotham Funds uses. The Gotham Funds strategy (value/quality diversified long/short with sector caps, and 25% net long in the case of GONIX) is broad-brush similar to Boston Partners/Robeco long-short fund (BPLSX) which has been in operation since 1998 with an excellent long-term record. BPLSX, while only 25% net long, had a 1999 return of -12.9%, followed by returns of +60% in 2000 and +25% in 2001. Unpleasant in 1999, but hardly the wipe-out Alpha Architect suggests. Note that BPLSX week-to-week performance has also closely tracked GONIX over the past year or so.

question… in "stock market genius" greenblatt says that statistically you are well diversified with like 8 stocks…. do you know the math he used there?

is he saying that if you have 5 stocks and one goes to zero you're down 20%, 6 stocks and one goes to zero you're down 16.6%, 10 stocks you're down 10%, 11 stocks you're down 9.1% so when you go from 5 to 6 you're adding 3.4% of protection, but when you go from 10 to 11 you're only adding 90 bps of extra protection so what is the point?

any thoughts on the math or theory here is appreciated…

thanks

Hi,

Sorry for the late response; I was on the road and had no access here. What you say is an interesting way to think about it, but for each time you add a name, you also increase the possiblity of another stock going to zero…

The simple way to look at it is that if you have a bunch of assets that are uncorrelated, they can reduce volatility of the total portfolio. The math is port_vol = asset_vol / Sqrt(number of assets). Port_vol is the volatility of the total portfolio, asset_vol is the volatility of each individual uncorrelated asset.

So the more uncorrelated assets you have, the lower the volatility of the portfolio. You will notice that the reduction in volatility goes down by the square root of the number of assets added, so you can see that the benefit of adding assets decines as you keep adding them.

For stocks, this would be a little different as you would have beta etc…

But Greenblatt's point is the same. Diversifying can reduce single stock volatility in a similar way to the above, but after adding a bunch of stocks, you may succeed in eliminating single stock risk but will still have market risk (beta), so there is no point in further diversification.

At 8 stocks, there is enough diversification. I think the book had a table illustrating how portfolio vol goes down with number of stocks added, and I think it shows a sort of a SQRT() function.

You can google portfolio diversification math or whatever and read more about it. It's all related to CAPM etc…

Oops, that didn't quite come out right. I don't mean that Greenblatt suggests diversifying away all single stock risk until only market risk remains. That is obviously pointless; you might as well own an index. He would advocate stopping diversifying long before that, of coourse, but at a point where each additional stock doesn't reduce the portfolio risk that much anymore…