Buffett was on CNBC the other day and it was very interesting as usual. Well, most of what he says is not new.

Not in Bubble Territory

Anyway, he was asked about the stock market and since so many people keep saying that the stock market is overvalued or that it’s in a bubble, I found it interesting that he says that, “we are not in a bubble territory or anything of the sort now.”

He said that:

- it’s a “terrible mistake if you stay out of a game because you think you can pick a better time to enter it…”, or something like that. He’s been saying the same thing for years.

- if interest rates were 7 or 8%, prices will look “exceptionally high”, but that measured against interest rates, stocks actually are on the cheap side.

- if interest rates stayed at 2.30% over the next ten years, “you would regret not owning stocks”.

- we have to measure against interest rates. Interest rates acts as gravity for valuations.

- compared the long bond to an entity trading at 40x earnings with no growth and said stocks are attractive compared to that.

This agrees with the charts/analysis I’ve been posting here relating P/E ratios with interest rates.

I know there are quants who say this is wrong, that P/E ratios can’t be compared to interest rates (we discussed this in the comments section of one of my posts about P/E’s). I understand that argument, but history shows that the market does in fact use interest rates to value the stock market however theoretically wrong it may be, and the greatest investor of all time does so too.

What if?

OK, many commentators and pundits are baffled at this huge rally in the stock market thinking it’s insane and taking the market to extreme valuations. I have been posting here for a while that the valuations aren’t all that extreme given the interest rate environment, even if you assume interest rates go up a lot from here.

Well, Buffett says if rates get up to 7-8%, then stocks are really expensive. But will rates get up that high? Even though I’m not an economist and have no idea what interest rates will do (actually there is no relationship between the two), I tend to believe that interests rates will get to 4-5% at most, on average.

So, let’s play a simple what if game. This is not a prediction or anything, just a scenario that sounds plausible and is not at all a stretch.

What if GDP growth is stuck, more or less, at the 2% level? Maybe Trump gets it up to 3%, but a lot of people don’t think that is possible (except Jamie Dimon who thinks we can go much higher in terms of growth). And let’s say that inflation does tend towards the 2% level. That gets us to a nominal GDP growth of 4% or so over time.

Let’s also assume that long term rates do revert to the level of nominal GDP growth. Then long term rates would get to 4%. Of course, there will be overshoots in both inflation, GDP growth and interest rates. But over time, it’s not hard to imagine interest rates averaging 4%. Total debt levels, demographics etc. make it hard to imagine higher nominal GDP growth.

So using the earnings yield-bond yield model, let’s assume that the earnings yield tracks closely to the long term interest rate of 4%. That means, over time, that the P/E ratio can average 25x in this environment.

Right now, 25x P/E ratio just seems super-expensive to many people because they look at the past 100 years and the stock market hasn’t stayed at the 25x level for very long and has more often signaled a major market top than anything else.

But given the above scenario, it’s not really inconceivable that the market P/E gets up to this level for an extended period of time. Some will argue that Japan has had lower interest rates and has been unable to sustain a high P/E ratio, but Japan has a lot of problems at the micro level too (companies not allowed to cut costs in their system of “corporate socialism” where large corporations are expected by the government to carry the burden of unproductive, unnecessary workers).

S&P 500 at 3250, DJIA at 29,000

The consensus EPS estimate for the S&P 500 index is $130. OK, I know that this will come down throughout the year, but that’s what we have now so let’s just use it. I’m not making a prediction or anything, just conducting a simple thought experiment.

Using the above, future average P/E of 25x, that would put the S&P 500 index at 3250!. Using the same percentage increase, that would take the DJIA to 29,000!

Believe me, that sounds just as stupid to me as it does to you. I’m just making simple assumptions and plugging in numbers. My own personal experience (anchoring?), however, makes these figures hard to swallow.

But you see, it doesn’t take much for the market to get up so high, and I am using a 4% interest rate, not 2.3%! So a large increase in interest rates is already built in.

Sure, inflation can get out of control and rates can go higher. I am just trying to figure out a long term, stable-state, through-the-cycle sort of scenario, and 4% rates and 25x P/E ratio just seems normal in that sense. OK, so we can expand that to 5% rates and 20x PE; so let’s just say rates can get to 4-5% and P/E ratios to 20-25x without it being stretched in any way.

Again, this sounds crazy and sort of feels like ‘new era’ thinking and Irving Fisher’s “permanently high plateau”. I know. Every time I make a post like this, I feel like I am putting in the top. But this doesn’t feel like justifying anything new. In fact, I am insisting that things will go back to the way they always were; P/E ratios will be driven by interest rates, interest rates will be determined by nominal GDP growth rate etc.

I’m not making any outrageous assumptions like real GDP growing 4%/year or earnings growing 15%/year into perpetuity or anything like that.

And keep in mind that in this scenario, this is just the future ‘average’. The markets can get much higher than 25x P/E in a manic phase and much lower in times of panic.

In fact, this has already been happening. The stock market has been overvalued in the eyes of many since the 1990’s and hasn’t reverted back to ‘normal’ levels in a long time. I think the error is that many look at raw P/E’s and don’t account for interest rates.

Not to be Bullish

And by the way, I have been saying this sort of thing over the past few years not because I am bullish; I am actually an agnostic (but bullish over the long term). I say this stuff to counter a lot of the “market is overvalued so it must go down!” argument and to caution people (and myself) to stay the course and act rationally.

Some funds claim to use a lot of sophisticated models and they write great reports, but at the end of the day, they are just net short the market (and have been for years!). That’s just gambling; betting all their client’s money on a single trade. Crazy.

Trust me, I get the same queasy feeling you do when I type 25x P/E. I honestly don’t know what I would do with the S&P 500 index at 3000. I know I would be very uncomfortable (if it happened within the next year or two).

So I’m not really being a Pollyanna.

When considering this stuff, it becomes less of a mystery why Buffett would spend $20 billion buying stocks since the election (or including some buys just before). And it becomes a big mystery why anyone would want to be net short this market (unless you are a short term trader who will be in and out as markets rally, like some hedge funds do etc…).

Sanity Check

And by the way, when all this talk of high P/E’s make you nervous, just go check out my valuation sanity check page at the Brooklyn Investor website. This is updated after the close every day.

Sanity Check

I often look here to make sure I am not seeing the trees looking like the Nifty Fifty. When I see 20x or 30x P/E ratios on the S&P 500 index, I look at individual stocks to see if I see the same thing. If I do, maybe I worry. If I don’t, I don’t worry at all and assume the high market P/E is due to large cap, speculative names trading at high P/E’s and/or hard-hit industries dragging down the ‘E’, or some of both.

Speaking of the Nifty Fifty, in the Bogle book I mentioned here the other day (Bogle book), he mentions a Jeremy Siegel study that showed that 50 nifty stocks bought at the start of 1971, near the peak, marginally outperformed the market over the subsequent 25 years. Nifty Fifty returned 12.4%/year versus 11.7%/year for the stock market.

That’s kind of crazy. Even if you bought the Nifty Fifty at near the top, you would’ve beaten the market over the next 25 years, returning an above average 12.4%/year. By average, I mean the market returned 10%/year in the past 100 years or so.

Pzena Q4 Commentary

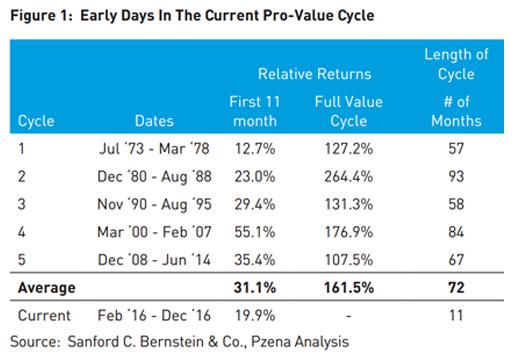

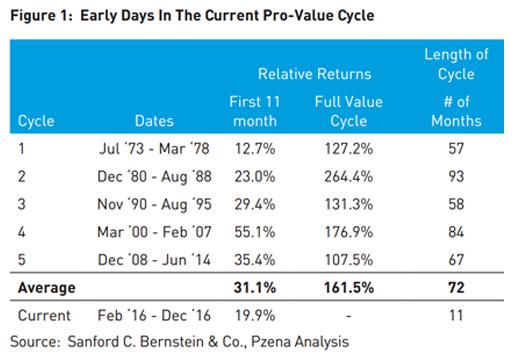

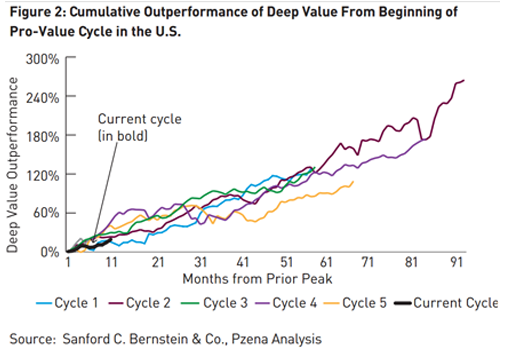

Pzena Investments posted their Q4 commentary and it follows up on their theme of the value cycle, and it is very interesting.

Check it out here.

Anyway, it shows that value has started to outperform again but that we are still early in the value cycle. Check out the tables and charts below.

I thought that was really interesting and I tend to agree with it. As much as I agree with Bogle and Buffett about indexing, there does seem to be a big, extended move in that direction which would have impact on valuations of individual securities, so it seems to make sense that maybe individual stock pickers can start beating indexes again (but don’t bet on many being able to do so).

I still have a lot to say (or at least think about) in terms of fund managers, but that will have to be in a future post.

Thanks! I enjoy the interview very much and am happy to see Buffett remains very sharp.

Wonder if you have looked at the latest annual report and roughly calculate the IV of the stock? Its net profit (ex-investment) was about $5.7 per B share in 2016 (2% YoY growth). Only grew like 7% CAGR for the past 3 years, even after big investment like PCP. Quite a lot of headwind on BNSF and insurance – no longer 15-20% earnings CAGR for operating business previously. That may be the reason why I couldn't see the 2 column table for investment / operating earnings per share in the report?

Buffett talks about no market timing and the market is not bubbly, but his cash level is all time high (even after spending $20bn or so on stocks) and he stops buying AAPL when share price shot up 10%. No doubt he can pay up for good businesses, but maybe he is a bit concerned.

So multiple expansion and increasing investment portfolio value are really what drove the stock upwards.

Have you heard of Herb Wolf that Buffett referred to in the interview?

No, I don't know much about Herb Wolf.

I haven't done any work recently on IV of BRK.

As for huge cash balance, I think he is just opportunity driven; he is not a market timer at all. Everyone keeps saying his huge cash balance is (and has been) a market call, but I don't think so. If he saw a great opportunity, he'd go for it regardless of what people say about the market.

The problem is his size. What do you do with all that cash? He doesn't have a lot of choice, so I think he is hoping for an elephant.

His purchases of Apple and airlines surprised people, but when you listen to Munger's DJCO meeting, he says that you have to marry the best girl that would have you and you can't do better than that.

So in a sense, at BRK's size, he couldn't find anything better than Apple and the airlines. If he was managing $100 million or $1 billion or even $10 billion, Buffett would probably invest in something else, but at this level he doesn't have a lot of options.

I still think, at some point, a run at something like KO would be very exciting with the 3G folks. KO is a joke and needs an outsider to fix things up. KO has talked up zero based budgeting the past few years and yet expenses haven't budged at all, lol… just lip service.

But yes, it's a little big. But so is BRK's cash balance and it's getting bigger so may be a possibility at some point. KO needs 3G very badly, lol…

"let's assume that the earnings yield tracks closely to the long term interest rate of 4%."

But shouldn't you get a risk premium for holding stocks? With a long term interest rate of 4%, you'd expect a higher yield from stocks, on average.

Interest rates can still act as gravity for valuations, but E/P "should" be > 4%.

That was true with dividend yields almost a century ago. Stocks were viewed as risky so dividend yields were higher than bond yields. Since then, retained earnings and earnings growth has become the norm so dividend yields has been below bond yields in recent years, except some periods of extremely low interest rates. A similar argument can be made for the earnings yield; as Buffett points out, earnings grow over time but bond coupons do not. On that alone, EY should be less than BY, and this has been true over decades.

Hmm… I came into these comments to say something like "what do you think the equity premium should be?", but I see that you've already sort of answered that.

It's a good point that earnings grow but bond coupons don't. But of course, a lot of the earnings growth is due to retained earnings — companies that retain all their earnings will grow faster, and companies that pay out most of it will grow slower.

Another way to put this is that if you were to 'retain' your bond payments by reinvesting them all into buying more bonds, then your payouts would indeed increase. Maybe the way to compare stocks vs bonds would be to assume reinvestment of all cash payouts back into the asset…

I've seen a lot of academic research putting the long term equity risk premium at a % somewhere between 5-6% (Aswath Damodoran).

So let's take 9-10% cost of equity (4% lt rate + 5-6%) and our perpetuity formula. (C(1+g))/(r-g) = C(1 + 4%)/((9 to 10%) – 4%) = C*(17x to 21x) Normalize C to 1 = earnings multiple.

FYI this was written like an "I'm telling you something" but i'm more just sharing my thoughts which are possibly flawed

KK,

Have you seem this article,

http://intrinsicinvesting.com/2017/03/01/the-market-rally-inflation-expectations/

The brief discussion on relationship between inflation expectations and market PE was kind of interesting.

How do you justify using the same multiple for equities and risk free bonds? I would roughly calculate that the market has an average WACC of 9%. Using a terminal growth calculator :

1+2%/(9%-2%) with the standard assumption of long term growth of 2% gets me to a multiple of 14.5x.

About that sanity check. Any special reason you've decided the Dow 30 should be the Dow 29? Or did you just decide it was better for your sanity to leave off the highest P/E component?

lol, no… that's just sloppy coding, actually. I have a Python program that runs automatically after the close, and that program uses Selenium that opens up the Yahoo finance page (can't get some fundamentals from their API, and the page needs to actually be loaded on a browser for stats to show up, unlike how it used to be).

Never mind the details, but long story short, for various reasons, sometimes some pages won't load. In that case, the program just skips to the next name.

I will rewrite it so it will keep trying at least 2 or 3 times before moving on to the next name.

I didn't really worry about that too much because it's just meant for looking at briefly; I'm not using it to calculate any real data from it etc…

So that's basically it; if the web page for a name fails to load, it moves to the next name… (actually, I think I have it try twice, but I'll look at it again…)

It may also be a bad ticker.

I was just kidding, of course, but it was an odd coincidence.

Surely plenty of mistakes/errors here, but no fake news!

Don't mean to harp on this, but where are you getting those P/E's? I don't see anything that agrees with your numbers. The numbers I'm seeing are not going to help out your pursuit of sanity if it depends on average Dow 30 P/E at 19ish. You'd better check that script. Or its data source. Seriously.

I should add that I may well be wrong. After all, I'm only a Bronx Investor.

Leon Cooperman is from the Bronx. Anyway, I looked at the data and it's fine. I get it from Yahoo Finance, so if their wrong, I can't do anything about that.

The confusion may be that the P/E's in my table are for current year estimate and forward estimate whereas on the Yahoo Stats page, it shows trailing and forward, but not current year. You have to go to the analyst estimates page to pull the current year estimate.

I looked at a couple of names and the numbers match.

Thanks for pointing it out, though, as I would obviously like to know about errors.

I think the P/Es are wrong as well – in the sense that they seem to be based on "adjusted" EPS that companies report, rather than a true GAAP or IFRS basis. Sanofi earned 3.66 euros in 2016, so by my calculation they trade at 23x trailing. But they also reported a much higher EPS figure as well.

It is getting harder and harder to know what your companies are really earning these days, I fear this will come to bite us in the end.

I spit out my coffee laughing at the Microsoft p/e of 20. They struggled to ever earn more than $2, which puts the current p/e at about 30. You get your own opinions but not your own facts as the man says.

MSFT did make more than $2.0 in 2013 and 2014, I think it was. The P/E ratios are from Yahoo finance and are based on current year estimates and next year's estimates.

So i have been following your blog for a few years now and have learned many things.

Since you do not believe the market is not terribly expensive, what do you think about houses? I'm wondering specifically for houses in Los Angeles/Orange County area. I have seen many foreigners buy up property and driving up the prices a lot. So much that i don't think local residents can afford these houses anymore. It would take two highly paid engineers to barely afford a house in some of these cities like Irvine.

Houses to me has always sort of been overvalued. Cap rates in real estate are far lower than earnings yield in the stock market. I don't like real estate/houses as investments, unless it's a primary residence or maybe secondary residence. But as a pure investment, it doesn't appeal to me at all, especially these days.

So would you buy a place right now if you used it as a primary residence with such high prices? I know people suggest to buy a place if you plan to live in it for at least 7 years. However, i do see some houses that were the same price as they were in 2008 making them horrible to buy even as a primary resident.

Hmm.. that's a good question. The math on rent versus buy is pretty straightforward. The problem with rising prices is that rents often go up too, so even if you avoid buying, then you end up paying a high rent that will probably be pushed up every year. People who didn't want to pay high NYC prices rented, and then rent went up every year and had to move out; can't afford the city anymore.. whereas the people who bought high locked in a fixed mortgage (and kept refinancing down), and the mortgage won't go up for 20 or 30 years. So that's a benefit; you are inflation-proofing yourself.

As for what to do, I dunno. You can try being adventurous and buy something on the edge a little for lower prices. It's pretty easy to see which way gentrification moves so it's not that hard to see where things will move soon. That's what we did. We avoided prime, best block in the best neighborhood, but took some risk on the edge, and now we are surrounded by millionaire bankers and lawyers, lol…

Anyway, I'm not involved in real estate so sorry I can't help you more…

kk,

We are in a similar situation. Can you elaborate on how to figure out where the edge is? Doesn't seem so trivial for us. As for hedging against rising rent, would it better than just straight out buying primary residence, do find a better investment RE wherever that would be and used that rent to pay for the primary rent? Obviously tricky… thanks again

I don't know, that's specific to each region. In NYC, just buy a place with no Starbucks and no Trader Joe's nearby, and then sell when you have 3 starbucks and a trader joe's within walking distance. Well, half joke, but sort of serious.

In NY/Brooklyn, I think it probably makes sense to look at properties adjacent to decent neighborhoods as those neighborhoods tend to grow/expand if it can. Areas that look terrible between two great neighborhoods can improve over time too as both sides grow etc. It seems to be just a matter of watching where people are moving.

Buying a rental property as a hedge might make sense, but it's complicated; costs, taxes, etc. I am not a real estate person so I can't tell you what to do about that.

Prices are set by active investors, regardless of how many there are (to a point of course).

Passive investors purchases equities at prices set by active investors.

Therefore, active investors will not generate any advantage by the freeriding of passive investors. Before passive investing, they competed with each other over pricing and value, and they do the same now with passive investing. In the future, as passive investing grows more popular, they will continue to simply compete with themselves at setting prices through actively buying and selling.

Active managers are not playing a game against passive investors; they are playing a game against other active managers.

I do not understand why people think that money flowing in at prices set by active investors will somehow provide an advantage to the active investors to find securities that are mispriced… as only active investors could have 'mispriced' them.

When you look at CAPE, this market looks rich. Hard to take the other side of Warren though.

Thank you for sharing such great information.

It is informative, can you help me in finding out more detail on

house loan interest rates.

great blog.