This is one of those things that I looked at before and never posted, so here it is. Actually, I didn’t write much about it, it was just sitting in my queue.

I know Munger likes China more than India, but I think India is very interesting. I don’t think I have to say much about it as it is not a new idea. And yes, India has problems that China doesn’t have (democracy that can actually hold back progress unlike in the authoritarian China where the government can just basically do what it wants). But India is still fascinating, especially with all the things going on over there now (pro-business government for the first time etc).

Anyway, as usual, before that, check this out from the Fairfax 2016 Letter to Shareholders.

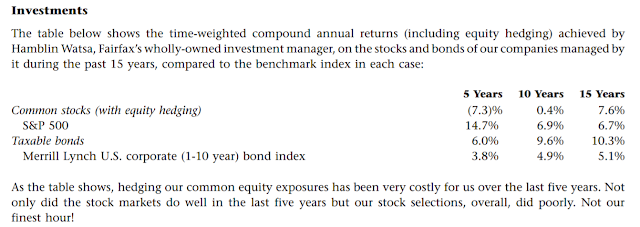

Here’s the long term investment performance of Fairfax (not the India entity):

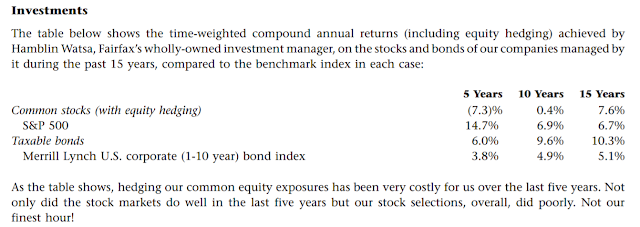

And what happened in 2016:

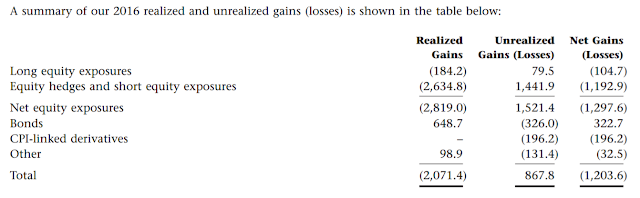

Their equity hedge has been very costly, basically a total disaster. Their hedges cost them $4.4 billion since 2010. Since it was a hedge, you have to look at it on a net basis with the longs; that’s a $1.7 billion loss. Still pretty awful. This is during a period the S&P 500 index went up 12.5%/year. In 2010, they had $4.5 billion in stocks. If this was unhedged and their stocks kept up with the market, it would have added $4.5 billion to their net value instead of losing $1.7 billion; that’s a swing of $6.2 billion! That’s huge given their common equity in 2010 of around $8 billion ($8.5 billion at end of 2016).

It’s fair to say, though, that if the portfolio wasn’t hedged, it might have been smaller than $4.5 billion; the portfolio might have been sold down for risk management purposes.

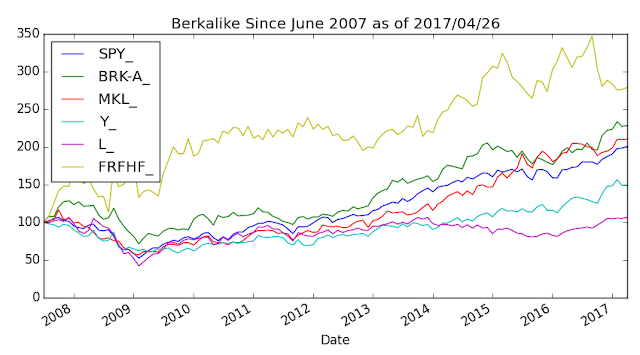

Since 2007, Fairfax has still outperformed (price basis) the S&P 500 index and all of the so-called Berk-a-likes:

This chart (and other charts), by the way, are updated every day at the Brooklyn Investor website.

Anyway, over the long term, they have done well, so it’s not fair to focus just on this one mistake (even though it’s a huge one). Many CEO errors cause their companies to go bust, and that hasn’t happened here, or anything even close to that.

Here is the other ‘bet’ Fairfax has on:

This bet doesn’t look so interesting these days, but the important point is that the downside in these bets are known and small. It’s one of those “if you’re wrong you don’t lose too much but if you’re right you can make a ton” deals. Needless to say, the equity portfolio hedge was not that kind of bet!

Expensive Market

Anyway, I still have conversations about this sort of thing and hear all the time about the markets being expensive, people being confused as to what’s going on.

One hedge fund executive (wasn’t clear what position was; not sure if he had investment experience/responsibilities) was on CNBC the other day and it was stunning because the comments were based on such extraordinarily static analysis, talking about the uncertainties in the market, how things were expensive etc.

Reflexivity

And it reminds me of a book that I plan to reread (if I can find it!). When I read it years ago, it was incredibly eye-opening, and it feels like a lot of people have forgotten about this sort of thinking. The book is by George Soros, one of the greatest of all time:

He talks about reflexivity, and it sort of differentiates the traditional economists viewpoint based on static analysis versus his more dynamic view of the world based on reflexivity. (This book is more of interest to traders than long term investors).

For example, if the market goes up, most people assume it must go down because it is overvalued. Economists base their views on supply/demand balance so they think things must trend towards equilibrium. Most comments I hear these days tend to be in this camp.

Soros’ view is that in fact, an expensive market can make a market even more expensive. Why? Because if markets go up and gets overvalued, then financing costs go down and can encourage more profit-making and increased earnings, which can drive prices even higher. Economists wouldn’t consider this factor. This is in fact what happened in Japan too in the late 1980’s.

I think Soros talks about the REIT boom/bust of the 1970’s in this book; maybe it was somewhere else. But the above is exactly what happened.

Anyway, I am going to dig up a copy of this; it must be somewhere around here in one of these boxes or piles of books.

Mean Reversion

Sort of related to the above, here’s another thing I hear all the time: mean reversion. I too believe in mean reversion. But there are tradable/investable mean reversions and untradable/uninvestable mean reversions.

Values mean revert, usually. As a value investor, we can buy undervalued stocks and assume mean reversion will enhance our returns. This is investable mean reversion. As long as you are not leveraged, you can just wait for the market to prove you right.

Shorting overvalued stocks is also a mean-reversion trade, but it is untradable. Ask anyone who was or is short Tesla, Amazon, Netflix. Oh, remember L.A. Gear? Or U.S. Surgical? Anything in 1997-2000? Those are untradable because you will get killed trying to short that stuff even if mean-reversion will eventually kick in. Nobody has that kind of staying power.

So what kind of mean reversion do you want? You want mean reversion that happens OFTEN. You want mean-reversion that is tradable.

Not exactly a mean reversion trade, but take index arbitrage. You go long stocks and short future against it (or vice versa). You know from history that the premium/discount fluctuates over time. But you also know that this spread will not diverge too far apart, and you know that at expiration, your long and short will offset and you can realize the spread perfectly with very little risk. That’s a spread you can trade safely. (In fact, one of Soros’ early strategies was to arb gold prices between New York and London. I think a long distance phone connection was that era’s version of a direct optical fiber connection to exchanges today)

How about options volatility? For shorter dated options, trading volatility works too. You may or may not make money, but volatility cycles are often not that long so you can capture volatility by trading options. You may need some staying power, though, because sometimes you sell volatility at 30% and it goes to 40% or 50%. But you know that eventually, these panic levels will subside at some point for much lower volatility.

What about stat arbs? These guys too, especially the high-frequency guys, are trading mean-reversion. The one mentioned in the Thorp book, I think, was based on 2-week returns in stocks. Stat arbs these days turn over their portfolios multiple times in a day (I am guessing, but we had high turnover a long time ago; I am assuming it’s much faster now), which implies a high level of mean-reversion; each trade is not expected to last very long. Things diverge and revert very quickly.

This has two big advantages (well, probably more but let’s keep it simple); first, with so much frequency you have that many more data points. With that many trades, you are that much more likely to make money. With time span so short, the risk of divergence, or spreads widening out even more, is minimal.

Imagine trying to trade inefficiencies in the stock market based on tick data where trades last for minutes. What is the risk? Hint: tiny on each trade, and since you do so many trades, you are well-diversified and if your data is correct, you are more likely to realize the ‘edge’.

Now imagine trying to trade inefficiencies in the stock market where people misprice P/E ratios on individual stocks. The expected duration of a trade can be years (the P/E ratio inefficiency probably will not correct within the next week or even month. Unlikely even in the next year; how many years have TSLA, NFLX and AMZN been overvalued?). Now think of the range of stock prices that a mispriced stock can trade at over that time span. Now you see how huge the risk is.

Of course, sometimes you can see some sort of deterioration in a company, some manic blowoff or some other ‘timing’ device that might help you nail a short of an overvalued company. But you see how trading just on valuation on the short side is going to be tough game.

The Market

Let’s take all of the above thoughts and apply it to the overall market. People always talk about mean reversion of the market P/E ratio, profit margins and things like that.

Are these factors tradable? If the stock market went to 20-30x P/E and then went down to 8-10x and then went up to 20-30x and kept doing that many times over the years (averaging out at 14-15x), then it turns into a tradable idea. You can set ranges too and calculate probable outcomes and manage risk accordingly.

But looking at long term data, that’s not really the case. It’s more like these things happen very rarely and over long periods of time. Most people talk about what happened in 1929, 1968, 1987, 2000 or whatever. I think it was Buffett (but may have been Munger) who said that to bet on something that happened just a few times over the last 100 years does not sound like a good idea.

Again, the same questions apply: when is the expected reversion? What is the risk? If the reversion is not expected in the short term (next week, next month, within the year etc…), then what is adverse move against you going to cost?

Interest rates mean revert too, but look at the rates in the past 100, 200 years. If you want to realize any ‘edge’ in the long term mean-reversion of interest rates, you have to play for decades, and the reversion may not even occur within a single generation.

Back to Fairfax India

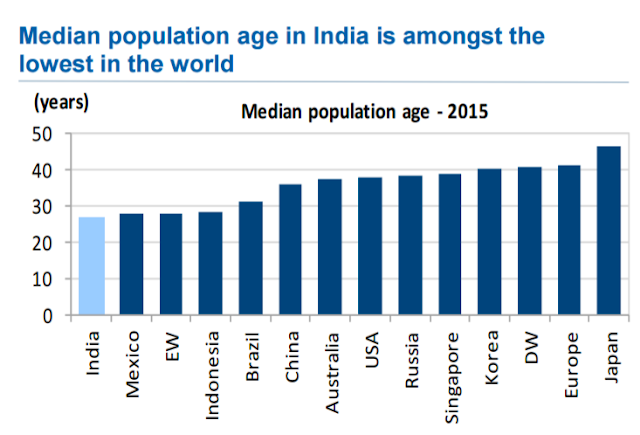

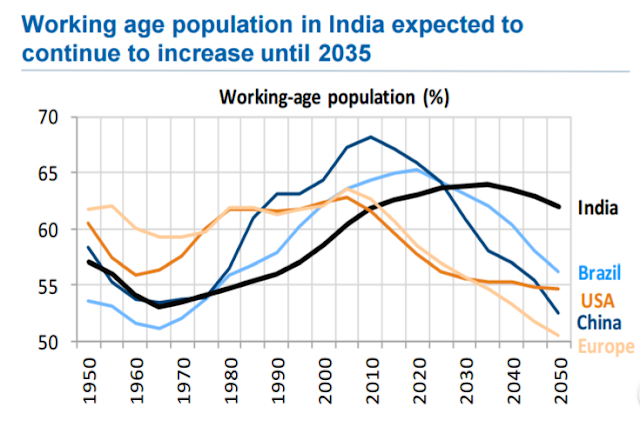

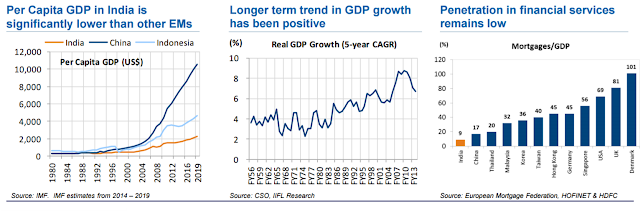

Emerging markets haven’t been so hot in recent years, but I don’t think there is any doubt that that is where a lot of growth is going to come from over the next few years. Much of that growth will be captured by global firms to be sure, so owning global companies will give you exposure without having to invest in emerging markets.

But it’s fun to have some direct investment overseas when there is an interesting opportunity. I don’t think FFDXF is a unique opportunity right now in terms of value/pricing, but it is an interesting opportunity in that you can co-invest with a successful manager in an investment vehicle focused on India that combines listed stocks and private investments. There are not too many of those ideas.

The option to invest in private deals expands the universe of potential investments so increases the odds of finding winners. The closed nature of this vehicle (not an ETF, mutual fund or hedge fund/partnership) allows them to focus on the long term and not worry about liquidity and short term performance.

With these advantages and with a management that we understand that agrees with out own views on investing makes this an interesting opportunity.

Of course, the value approach to investing is not universally accepted, and Fairfax has its own fair share of long-time critics. So this is only interesting to those who appreciate the Fairfax track record and what they are trying to do in India.

India Macro

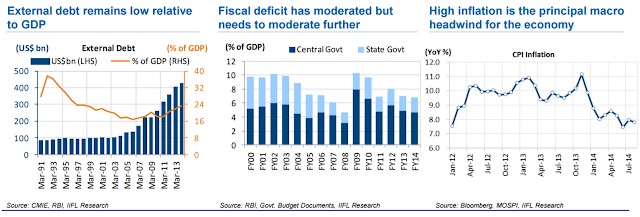

A lot of potential for growth in India, and recently trending well:

Singapore II?

Watsa compares what can happen in India going forward to Lee Kuan Yew’s Singapore starting in the 1960’s. Singapore is a great example of a successful nation, and Munger brings it up all the time too. But we have to remember that Singapore was a tiny island city-state with a population of less than 2 million (in the early 1960’s), and a current population of less than 6 million. The area of Singapore is smaller than New York City.

It’s one thing to rebuild and lead a nation of 2 million, but it’s an entirely different matter to try to do the same with a country with a population that exceeds a billion. Try banning chewing gum in a huge country like India with a 1 billion+ population!

But OK, we get the analogy. Maybe India can’t repeat Singapore’s performance, but with the right policies, they can still do really well.

Past Performance

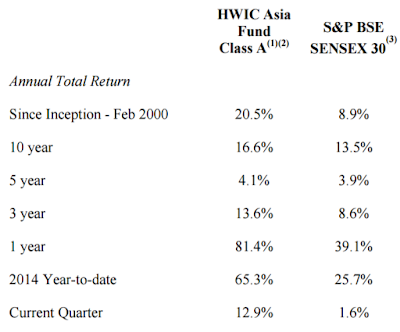

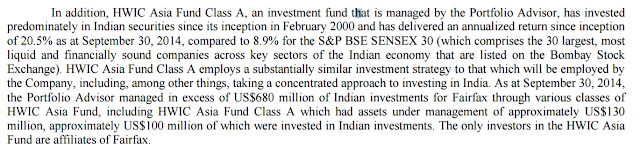

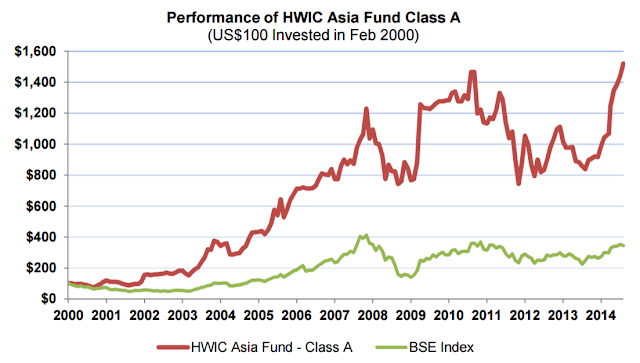

These things may not be as indicative of future performance as we’d like to think, but here is the track record of Watsa’s India investment management team. They have done really well, but we have to keep in mind that the results are very volatile. We are talking about an emerging market, and a highly concentrated portfolio. Plus not much has happened since 2007 (a lot of volatility!).

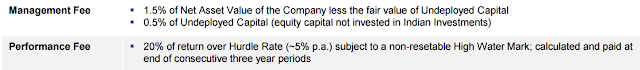

One thing that Fairfax fans may not like is the management fee structure. This seems kind of normal in the investment world; 1.5% management fee and 20% incentive fee (but only after 5% hurdle). In this day and age, it might sound a little steep. Maybe it’s not so bad when you consider that it is partially a private equity fund.

Why not ETF?

Well, if India is so interesting (and I don’t mean in the timing sense, by the way. I don’t follow India closely enough to tell you even what the sentiment is like, but I think emerging markets overall here has been out of favor), and the fees are too high, why not go with and indexed ETF?

That may be a good idea. I haven’t looked in detail at any of the India ETF’s, but emerging market ETF’s tend to be packed with large, inefficient, formerly state-run enterprises. Plus who knows when the government dumps (IPO’s) a large, stodgy, bureaucratic, inefficient state-run organization onto the market for non-differentiating index funds to blindly buy into (this could be one of your funds!).

I think the inefficiencies in these markets tends to favor the active investor.

Plus, here, you are betting on the continued success of the Fairfax/Watsa investment approach. You don’t get that in an index.

Speaking of emerging market funds, it seems like emerging markets have grown at a higher pace than mature economies for decades, and yet how come there aren’t really any good emerging market funds with good long term track records? Mark Mobius was a big star back in the 1990’s. Last time I looked, his funds’ performance was not very good. I wonder about that. Maybe it’s something I should look at in another post. I am always intrigued by the idea of emerging markets, but am almost never sure what to do about it! (uh oh… reading too many Watsa reports… the exclamation point is contagious!).

There was a time in the late 1980’s and early 1990’s when all you had to do was to own the telephone companies in each of the emerging markets and you could earn hedge fund-like returns (any ADR with a ‘com’ (not ‘.com’) in the name would have worked).

Conclusion

Anyway, this may not be for everybody, and it will probably be pretty volatile but it’s an interesting thing to keep an eye on, or tuck into your portfolio somewhere and just forget about it and check back in a few years.

Why not just own FRFHF? Doesn't it have some exposure to India? Thanks.

FRFHF is good too. This is interesting in that it's a pure India play. Hopefully, Watsa doesn't get any ideas about trying to hedge that portfolio!

I enjoy reading your blog. How did you realize those charts? With google finance? Would be very interested into how this works.

Hi, I use Pandas and Matplotlib in Python. Data itself is either google or yahoo api, forget which one. I use Python itself to write the html page and that is ftp'ed up to the web server (all automated, of course). There are many ways to do this, but this is happens to be the way I do it…

Thanks. That sounds like some programming skills in Python are necessary. Would be nice to have, but really difficult to learn as an autodidact. If you somehow used the google visualization API with google finance, the data can refreh automatically with 20 minutes delay (if you ever need it).

Here is an article about expectations, with some thoughts an valuation of the Indian market:

http://www.safalniveshak.com/reasonable-expectations/

The average IQ is reported to be a nice 108 in Singapore. As for India, it comes a bit short on that score…

Groan… not a sign of a high IQ to believe things like this

Oh, so by merely mentioning an inconvenient fact, I transgressed a taboo I guess. Those damn facts are racist.

nothing about being racist. IQ is just not the perfect encapsulator of intelligence that you believe it to be

Huh? Where did I mention that IQ is "the perfect encapsulator of intelligence"?

I own Fairfax India.

In terms of funds, have a look at VinaCapital Vietnam Opportunity Fund

http://vof-fund.com,

written up a little by Wexboy: https://wexboy.wordpress.com/tag/vinacapital-vietnam-opportunity-fund/

Under NAV, good performance, good allocation it seems.

I also like the manager of Fundsmith Emerging Equities Trust https://www.feetplc.co.uk

His methods etc are to be found here:

http://www.iii.co.uk/articles/409842/star-fund-manager-terry-smiths-secret-successful-investing

He's underperforming right now, but will probably kill it in the long run.

Isn't Fairfax India Holdings a PFIC, so a big tax headache for US-based investors?

I have chosen HDB ADR to use as a proxy to Indian economy. It has excellent ROA, conservative leverage, big enough that govt will come bail it out. Entry PBV will likely be high but so will exit PBV if I can unload within next 30-40 years.

Thoughts?

I haven't looked closely at the name. As long as it is doing well and creates value and you don't overpay, it should be a decent proxy. Some banks don't really create value, they keep giving it all back in bad times etc…

Also owned HDB for about 2 1/2 years, for the same reasons. Expect to hold that one for a long time to come.

I've been traveling to India for work annually over the last 6 years. Anecdotally, the amount of visible change each year, and over the whole 6 years, is stunning. Everything from small processes at hotels, to shopping habits of my co-workers, to brand awareness and mall traffic (they still actually go to malls!), to traffic in the cities and local infrastructure evolution is very noticeably different each year and clearly moving forward. My takeaway is that the Indian economy is a freight train moving forward with some serious momentum.

Thanks for the insight from the ground. That sounds really great.

I'm invested in FRFHF, but i've also invested in Fairfax India Holdings and Fairfax Africa Holdings.

How often do you get the chance to invest alongside Watsa in upcoming economies. Both are pretty new holdings and I'm looking forward to a long long ride!

@kk: did you take a look at Fairfax Africa Holdings? Any thoughts?

No I haven't looked at it. It is an interesting idea, but I don't know the extent of Watsa's familiarity with Africa. India makes sense; he has been involved there for a long time, has insurance operations etc… Africa is a relatively new thing and I don't have a comfort level with it myself or what gives Fairfax and edge there etc…

This is not to say it's a bad idea. It is interesting for sure, but just not something I have developed a comfort level for…