So, I was taking to a friend who has a million dollars in a large cap stock fund. The fund happens to be the Fidelity Magellan fund. The fund is very famous for being the ship that Peter Lynch navigated. But years later, it’s just another generic, closet-index/large cap fund. I don’t follow mutual funds too closely, but my initial thought was that there is basically no chance of Magellan outperforming the S&P 500 index over time.

And, of course, the expense was almost 1%. That is kind of shocking.

When you read gambling and trading books, they always tell you not to think of money as real money. When you are betting in poker and you see the $70,000 of cash in the pot as a BMW, you will make really bad decisions and will play poorly. If you see the loss on your portfolio as two years of your kid’s college education, you will freak out and make irrational moves. (Actually, if you really need that cash for your kid’s education in the near future, then maybe you should freak out, and maybe you shouldn’t have that cash in risk assets!)

But let’s do the opposite now. I said to the friend, gee, well, do you have a reason to believe that the Magellan fund will outperform the S&P 500 index over time? Not really. OK, then why are you basically writing a check for $10,000 per year? That’s almost $1,000/month. That’s a lot of money for a retired person. Why would you write a $1,000 check every single month for nothing?

In ten years, that’s $100,000 gone. Poof. For absolutely no reason at all. That’s more than most people have in their IRA’s.

It’s hard to notice these things as they are just deducted from the account so you don’t actually write a check every month. If you did, you would probably think about it a lot harder.

1% Too High?

Mutual fund fees are too high for most funds. There are some funds that may be worth the fee, especially some of the value funds with long term track records.

But with expected equity returns of around 5-6% going forward, we have to wonder about 1% fees. It’s one thing charging 1% fees in a 10% equity return world, but it’s a whole different world now. Maybe fees should be restructured so that the fee is minimized to cover overhead and bulk of fee comes from outperforming a benchmark index. I don’t know. I actually don’t own any funds so it’s not really an issue for me, but something interesting to think about.

Speaking of high fees and having watched the Berkshire Annual Meeting video, it reminded me of a fund with really high fees.

Wintergreen

Some people believe that there is no bad publicity, but in this case, maybe it was bad publicity. David Winters of the Wintergreen Fund criticized Coke for their egregious stock compensation plan and even criticized Warren Buffett for not speaking out against the plan and even went so far as to sell Berkshire Hathaway stock in a huff saying that Warren Buffett no longer looks out for his shareholders.

This was kind of shocking for a few reasons. First of all, when Winters talked about the massive wealth transfer, his number was totally off. I talked about it here, and Buffett said the numbers were also way off. So it means either that Winters is not a very good analyst, or is simply dishonest and threw out a huge number deliberately to get attention. I don’t know which is worse, but either way is not very encouraging for his shareholders (take your pick: incompetence or dishonesty). He also sold off Berkshire Hathaway because of this. This seemed to me he was taking all of this personally and getting too emotionally involved. I don’t know. But that’s what it seemed like.

This lead Buffett to mention at an annual meeting that Winters charges very high fees for bad performance. Ouch. A lot of people love to go on CNBC because it’s free advertising. But sometimes it backfires, particularly when you criticize a giant with no track record to back it up (and charge fees much higher than anyone else!).

First of all, this all happened in 2014. Winters sold his BRK in the 1Q of 2014. His fund is in red, BRK is blue and the S&P 500 index is the green line.

The Wintergreen Fund had assets of $1.6 billion in Dec 2007, but still had more than $1.2 billion as recently as the end of 2013. But as of the end of 2016, AUM was down to $300 million. There is some AUM in the institutional class too but that is down a lot too.

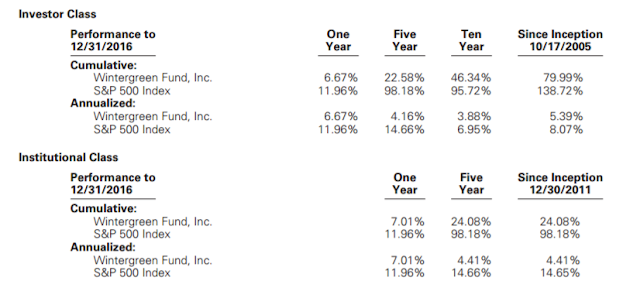

Here is the performance of the fund:

That’s a pretty huge underperformance no matter how you slice it.

OK, that’s not so uncommon these days with active managers underperforming.

But here’s the shocker. Look at the fees charged on this fund:

That’s 2%! First of all, the fund underperforms in all long term time periods. In a 5-6% return equity world, the fund is basically charging 33%-40% of expected return! But that’s assuming the fund keeps up with the index, which historically hasn’t been the case. If the fund lagged 1%/year on a gross basis that comes to more like 40-50% of expected returns going to the manager. That’s truly insane.

And looking at this on a real cash basis, if you had $1 million in this fund, you would be writing a check for almost $20,000 per year! That’s some real money. Over 10 years, that’s $200,000!? You had better be sure someone will outperform the index if you are going to be writing checks that big every year.

One may argue that the benchmark is wrong; Wintergreen owns non-U.S. stocks. Actually, as an investor, that shouldn’t matter. The fund doesn’t have an explicit mandate that they must invest internationally or anything like that. If they invest in non-U.S. stocks, it has to be because they think non-U.S. stocks are more attractive; that they will outperform U.S. stocks. Or else why bother, right? So in that sense, benchmarking against a completely neutral S&P 500 is fine.

It’s kind of crazy what people get away with.

I know people will immediately respond by saying, yeah, but you like all those alternative managers with even higher fees! Well, most alternative guys charge too much too, but the ones I tend to like do have really good long term records.

Mutual Funds Sticky

Here’s the thing about mutual funds versus alternative funds. I think a lot of mutual fund assets are really sticky due to the indifference of many investors. They just leave it and don’t think about it, which is the correct approach to investing, generally. But the downside is that many don’t realize how much is being sucked out of their net worth from these fees for no return.

Hedge funds, private equity funds, on the other hand, have investors who are more active in tracking performance etc. If you perform poorly, you will lose assets more quickly and go out of business as many hedge funds have seen in the last few years. Mutual funds can last forever on dreadful performance.

KO

And speaking of KO, it was also in 2014, I think, that Kent (KO CEO back then) started talking about zero-based budgeting. I was skeptical about this at the time; a lot of CEO’s would just grab the latest buzzword and throw it in their presentations just to show how hip they are to the current state of the world (Now it seems to be AI, machine learning, big data etc… Well, that’s all over Dimon’s letter too, but financials have been big into these areas for a while…).

Anyway, KO is too big for most to make a run at it so there is no real sense of urgency there so you know nothing is going to happen, not to mention the arrogance there from a century of dominance. I have made the case that for anything to change at KO, it’s going to have to come from the outside. Internal people will not be able to make big changes; they can’t pull off the band-aid as it would hurt too many ‘friends’.

Look at margin trends since they claimed they started using zero-based budgeting:

|

|

|

|

Percent Change

|

||||||||||||||

|

Year Ended December 31,

|

2016

|

|

2015

|

|

2014

|

|

2016 vs. 2015

|

2015 vs. 2014

|

|||||||||

|

(In millions except percentages and per share data)

|

|||||||||||||||||

|

NET OPERATING REVENUES

|

$

|

41,863

|

|

$

|

44,294

|

|

$

|

45,998

|

|

(5

|

)%

|

(4

|

)%

|

||||

|

Cost of goods sold

|

16,465

|

|

17,482

|

|

17,889

|

|

(6

|

)

|

(2

|

)

|

|||||||

|

GROSS PROFIT

|

25,398

|

|

26,812

|

|

28,109

|

|

(5

|

)

|

(5

|

)

|

|||||||

|

GROSS PROFIT MARGIN

|

60.7

|

%

|

60.5

|

%

|

61.1

|

%

|

|

|

|||||||||

|

Selling, general and administrative expenses

|

15,262

|

|

16,427

|

|

17,218

|

|

(7

|

)

|

(5

|

)

|

|||||||

|

Other operating charges

|

1,510

|

|

1,657

|

|

1,183

|

|

(9

|

)

|

40

|

|

|||||||

|

OPERATING INCOME

|

8,626

|

|

8,728

|

|

9,708

|

|

(1

|

)

|

(10

|

)

|

|||||||

|

OPERATING MARGIN

|

20.6

|

%

|

19.7

|

%

|

21.1

|

%

|

|

|

|||||||||

Operating margins are actually down from 2014. So much for zero-based budgeting!

Munger indicated that a $150 billion deal would be huge for Berkshire Hathaway, so it is unlikely that BRK could make a run for KO on it’s own. But in some sort of combination with BUD, KHC or some other 3G entity, who knows what will happen.

Berkshire Hathaway Annual Meeting Last Question

By the way, the last question on the Yahoo video was about CEO’s social responsibility; should companies move jobs overseas to increase profits at the expense of local communities, domestic jobs etc.?

This was really a good question and I think about that sort of thing all the time. Do we always have to be the most efficient and lowest cost at all times? Do we really need to be increasing productivity all the time? Why can’t we come to some stable status quo and not keep trying to grow or increase profits all the time?

And I always seem to go back to Japan. Japan is a country where companies usually do act responsibly and really doesn’t want to fire people. And Japan is in terrible shape, I think, large due to that. Long time Canon CEO, Fujio Mitarai, explained that Japan can’t compete well in many industries because they operate under the system of corporate socialism. The Japanese government won’t provide unemployment and other social safety nets; Japanese corporations are expected to take care of redundant workers (by not firing them) etc.

You can protect people for a while like that, but at some point, the burden gets too big and the corporation will collapse.

Panasonic was one of those intensely socially responsible companies; Konnosuke Matsushita, the founder, strongly believed that it was the responsibility of the company to take care of their employees. He never wanted to fire anyone. It’s a great concept and noble, but I don’t believe it works.

McIlhenny Company (Tabasco sauce) was like that early on; they had an island they wanted to be self-sustaining. They wanted their employees to live there, they built schools, stores etc. But over time it just doesn’t work. I think Henry Ford, Hershey and others tried similar things too when it was believed that if they created a company town with everything necessary for employees to raise a family and live comfortably, they can create a sort of self-sustaining utopia.

It just doesn’t work. It also reminds me of the pre-Thatcher Britain; it didn’t work at the national level either.

And besides, more of a threat to the domestic work force than globalization is technology. I haven’t done much research in the area, but technology is probably more responsible for job losses than globalization (moving production to low wage countries).

And do we really want to limit or stop technology? Japan will make large advances in that area due to their shrinking population. They need nurses and other workers to take care of the increasingly aging (and dwindling) population.

If the U.S. slows technological progress for the sake of maintaining low unemployment, then the Japanese will ultimately rule the future and we will have a large, unemployed (and unemployable) population.

Related to all this, just by chance, I happen to be reading the new Kasparov book. I’m not done with it yet, but it is really fascinating. True, he’s a former chess world champion so what does he really know? He is a voracious reader and runs around meeting and talking to interesting people all over the world so he has interesting insights into many things.

He points out that every time we have technological advancement, people fear this or that. For example, the elevator operators union had 17,000+ members in 1920. The technology existed in 1900 but wasn’t widely used (automatic elevators) until 1930 due to people’s fear of riding operator-less elevators (similar to fear of driverless cars today; but people’s fear is not what is holding back driverless cars today…).

Anyway, I am not a believer in holding anything back for the sake of maintaining employment; it will only delay the day of reckoning, and at that point the negative impact might be much worse.

Since technology is advancing so quickly, retraining won’t be able to keep up, so something like a universal basic income is probably the only way to go at some point. I know I sound like a communist when I say that, but I can’t think of any other way.

Anyway, this veers far away from the topic of this blog, so let’s get back on topic.

Conclusion

If you are one of those people who have a bunch of mutual funds in your IRA/401K or whatever, I would actually go in and do the work to calculate how much you are actually paying in real dollars. Is it really worth it? Same with financial advisors. When fees are just deducted from your account, you may not realize how much you are paying. Calculate what your are paying. Is it really worth it?

Let’s say you have $5 million and most of it is in tax-free money market funds and the S&P 500 index funds. With a 2% fee, that’s $100,000 per year! Why would anyone pay that? Is it really worth it? Can your advisor really pick stocks and funds better than some simple passive portfolio?

I don’t know. When you look at it in real dollars like that, it is really insane.

If you had 1 million dollars to put into the market, what would you put it in. SPY ETF? a low fee mutual fund of S&P?

Good question. I would own a bunch of BRK and some of the other Berkalikes before S&P, actually. And then I would keep a portion to invest in fun stuff that I really like but may not fit value, like CMG and things like that. You gotta live a little, right? So having a small portfolio to pick your own stocks, I think, is a good idea to help you get over any 'itch' or urge to do anything stupid in a large way. Play money, basically.

Having said that, it really depends on your financial situation too. Some people just don't have the temperament to own stocks. If you own $1 million in stocks, you are going to see marks of $200,000 and even $500,000 against you every now and then. Most people will panic and sell at that point. So you should only invest an amount that if it went down 50%, you are OK. THis is really important.

All these financial advisors keep talking about these silly things like 100 minus your age should be in equities or whatever… That's all total nonsense to me.

I think it depends, case by case. Can you see your portfolio go down $200,000 and be OK? Do you have an income stream so that the portfolio value is not that relevant to you for the next 10 or 20 years? Or will you have to start tapping into that principal in the near future?

So you see, it really, really depends on your situation. If someone has an income stream that covers expenses and they have a big portfolio and a strong stomach, why not 100% equities? etc…

I can go on and on about this. I know this is not your question, but I just mention that just in case someone comes into $1 million cash by inheritance or lottery or whatever… I wouldn't want someone to just jump in right away in that situation without thinking about how much they can afford to invest in stocks, both financially and temperamentally…

Great article as usual… This is very important.

A Motley Fool book maybe 20 years ago clued me into the fact that most funds don't beat the S&P 500. Since then anything stuck in a company 401k where I have limited investment choices has been in VINIX or something similar. Looking back on things two decades later, that one light bulb going off early in my earning career has made a huge difference over time.

401ks are great for paying yourself first and building up a nestegg without ever really missing the money. But as you point out, the double-edged sword is that not thinking about it also makes you susceptible to others sucking money off you. This really adds up over time.

One other point. While I was on top of this for my own funds, I wasn't on top of it for my parent's investments. What I found in managing the estate after they were gone is that way too much money which could now be happily compounding away for my kids went to some undeserving fund managers. If I could do it all over again, I would have worked with my parents to get their retirement into better performing, lower fee options. Sounds complicated, but it's surprisingly easy to do. Hopefully that helps someone out there….

Hi KK, great article again! I keep wondering why Winters still had $300mn. What were the investors thinking?

Having followed the Berkalikes for quite some time it seems only MKL can sort of match/beat BRK in terms of performance, track record and even peace of mind for investors. Not sure about LUK or Fairfax. What do you think?

Thanks to Bloomberg's function, I actually tried to map all the historical portfolio performance for anyone who files 13-F (4,000+) – I know there's delay, and only snapshot at quarter-end, etc, but they are good proxies for low-turnover funds (the portfolios that reward stock-picking rather than trading). Only very few can beat SPY in the long run historically, but no guarantee they can continue to do in the future. Surprised to learn that even many from dataroma.com do not beat SPY on that test.

Have you read this research on why SPY cannot be beaten on a statistical prespective?

https://www.bloomberg.com/news/articles/2017-04-09/lopsided-stocks-and-the-math-explaining-active-manager-futility

Cheers.

Hi, thanks. Yes, a lot of terrible funds still have AUM, but that is probably from totally passive (in the sense of inattentive) investors that have a ton of funds and they never really keep track of it. Or else they would be out by now. As you know, there are funds that have been LOSING money every single year in a BULL market that still has AUM, lol… Totally irrational. Makes no sense. But psychology is that it's hard to dump losers… people tend to dump winners waiting for losers to get back to even etc…

As for LUK, it's a totally different beast than the original entity; it's now 1/2 investment bank, and investment style is very, very different. It can still be interesting, but nothing like the old days. Fairfax too has a great track record, but recent blunders make me wonder. Some of the mistakes totally go against my philosophy of not trying to time the market. So his $7 billion mistake is a huge turnoff for sure (I still own some). The inflation bet is a macro play, but it's fine because you know what your loss is going to be if you're wrong. So that didn't bother me at all. It was an interesting idea.

And thanks for posting that article. I read something similar somewhere else. It probably true to some extent, but you have to be careful of these studies because if you go through a list of 5,000 or 10,000 stocks or whatever one by one, you will realize that MOST of those are uninvestable anyway, so a large percentage of those stocks are easy to avoid.

I went through a huge list from OTCmarkets a number of times, and they have a ton of those Nevada-based, former gold-miner turned venture capitalist/tech company, lol… there are literally hundreds or thousands of those easily disposable as garbage stocks.

So given that, the numbers from these studies are a bit exaggerated, I think.

But still, I get the point. Anyone who doesn't own the FANG stocks now, for example, are probably lagging the index. But this will not go on forever…

Anyway, thanks for the interesting discussion!

Hi Anonymous

"Only very few can beat SPY in the long run historically, but no guarantee they can continue to do in the future. Surprised to learn that even many from dataroma.com do not beat SPY on that test.

"

That is very interesting.

Can you perhaps share your data or your observations of which of the dataroma superinvestor have good historical performance compared to S&P500?

Or does anyone know where I can find the performance of each of the superinvestors historically?

" I would own a bunch of BRK and some of the other Berkalikes before S&P, actually…"

That's been my approach. I'm with you and Munger. Over 60% of my portfolio is in BRK. The other 40% in only two other stocks. Call me crazy. BRK has a number of attributes that are almost certain to ensure it will perform better than the S&P 500 over time. These include, cost free float, best capital allocators in the world, the ability to allocate capital across industries (companies and public markets, depending on where the best returns are), extremely low overhead (headquarters staff essentially zero). And last but not least, it has a huge ($95B) and growing pile of cash. That pile of cash will be prudently deployed when, and if, the time is right.

A market or economic downdraft would be the right the time. While others would be fearful, Warren and his fellow capital allocators would be greedy.

P.S. Thanks for posting your ideas and other useful data here. Particularly liked your comments challenging the "market is expensive" mantra. Buffett echoed your thoughts after you posted your ideas. Keep up the great work.

Thanks for your post, very informative as usual. It took me a while to figure out that 95% of what you hear in the financial media from ïnvestors¨is really a carefully crafted marketing strategy. Look at Baupost or Elliot or any number of well known huge funds preaching doom forever yet they have billions more of assets now and have NOT been short the market in general. Keep investors scared and nervous so they give it to someone else who is ¨smarter¨.

Or look at people like Tilson who is intelligent, well read and connected to many famous investors yet seems to practice every joe blogs investor mistake. Intelligence is not the main ingredient in the mkt, emotion is much more important. I have lost track of how many shorts Tilson has said should be zeros and none are! Some continue to do very well. Again selling Ï am a smart contrarian investor¨pitch vs what is best for overall returns. Even Sequoia blatantly trying to pt out that without VRX their stock picking would be beating the market! But hey they are very smart. Same goes for BIll Miller etc.

Keep trucking.

Buy BAM. Why not be one of the guys getting the fees instead of one of the guys paying the fees? They own "real assets" and there is no good way to own these kinds of assets without paying someone else to manage them.

"Why can't we come to some stable status quo and not keep trying to grow or increase profits all the time?"

I was just thinking of the exact same thing about 6 months ago. I asked my wife: why is our society obsessed with growth – revenue, profits, etc… What is wrong with no growth, just stable status quo? Growth actually drives our economic system, but what is growth? What are we giving up for that growth. In US, I see growth widening the gap between the rich and the poor. although there are social programs to help the poor, but the decay in human morality or character is increasing. If you look at japan, I believe their GDP has been pretty stagnant for the past two decades. But when I was there in Jan of 2017, everything seems peaceful and harmonious. People worked hard. There is very little crime, and I did not see any homeless people pushing carts are setting up tent cities. I was in Taiwan on the same trip ( I think their economic system is "stagnant" vs China), but if I had a choice, I would live in Taiwan instead of China. China has the worst pollution of any country, India is probably worst. I believe China and India are growing like crazy in terms of GDP. This is probably a very complex issue, but I was just very surprised that you also had the same thought. anyways, I really enjoy your articles. Especially love the article about the 10 time pretax earnings in buying companies or their stocks.

Here in Germany it's common sense to be very sceptical with technology and leaders of the economy. Thus it's a common saying "yesterday everything was better!". Putting this well-known cite upside down, some German journalists published a book with the title "Yesterday everything was worse", opposing the view of Germans with well researched data about the world as a whole. I was impressed about the divergence of what I felt was true and what is true. Just highlighting a few points: E. g. do you know, that there have been more victims of terror in Europe in the years between 1970 and 2000 than from 2011 until today? Per year it's been nearly 200 per year in the first, but "only" 40 victims per year since than. Or have known, that in the 1970ies way more people per 100.000 living on this planet were starving (from memory 40 out of 100.000 people were starving in the 1970ies and today I think it's 3). Poverty has been reduced by a lot since the 1970ies. We live longer, there is less violence in families and even on the schoolyard. More people than ever are living in a democracy as of today. In the arabic world aphabetization is above 95% in nearly every country, up from 25% to 60% a generation ago (so maybe the rising of the last years was grounded on that and the rebellion for democracy was just the start of something new – and not the end?). And so on.

I found a lot of this stuff astonishing, as watching tv and clicking videos of today – e. g. yesterday in Manchester 22 young people died after a terrorist attack at a concert. So it doesn't feel like "getting better". But that's only our emotions, upsetted from all the pictures and movies of bad things happening getting to our smartphones. It's not more bad things happening – but we see them live on our little devices. Remember 2001 – you could watch everything on television.

So this book kind of resonates to me. And let me add: The writers credo is not to just lean back as everything is fine. On the contrary they are encouraging the reader to be self sufficient: We, the people, are overcoming problems. As Buffett said, wealth in the US has been sixfolding in Buffetts live.

Why am I writing all this? Because I ask myself the same question as you: Do we need growth? Is the economy good or bad? And looking at the world as it is and as it develops – not looking at months or years, but over decades – and looking at all the problems mankind has overcome, the longer I think about, the more sure I get on one thing: It takes time and sometimes it's hard to wait decades long, but in the end the economy is our friend and the motivating force for doing something at all. Maybe we need to adjust capitalism a bit (e. g. commiting the strong for helping the vulnearble within a society by law or installing a minor income for everybody).

Sorry for getting that long and so political. Your writing was just resonating to me and I just wanted share thoughts. Hope my writings doesn't sound too esoteric here. 😉

I don't own any mutual funds I have 95% of my portfolio in individual stocks and the other 5% in index funds because it is in HSAs etc. Other than the fees, I believe the main problem with D. Winters is that he focuses too much on "quality" disregarding price. I have done very well investing in some of the companies he has in the portfolio only buying at much lower places than what he paid for and selling them when they become very dear, but I still pay attention to his portfolio only I would never pay the prices he pays for some of the "quality" stocks.

An awesome post..it reminded me of some incidents that I personally experienced regarding high fees.

This content contains valuable information.one tip one day is a market research company which facilitates live stock market call