JPM’s annual report is out, and maybe a good time for another post here. I know it’s been a few months. Honestly, I have been coasting recently on what’s been working and haven’t been digging around too much in the stock market. Most of my time recently has been spent on programming, having taken on a few freelance gigs for fun (and beer money).

Website

Anyway, I have updated my website. A lot of things there were broken, but everything broken there was just due to the Google and Yahoo Finance APIs being shut down completely. This is really annoying. There are a lot of books out there on AI, data science, quantitative finance and all that, and a lot of them depend on those APIs, so it’s like those books are worthless now. Well, not really… you just have to find an alternative source of data. But who wants to deal with that hassle?

Anyway, the website is here: brklninvestor.com

The Market Today

One of my favorite pages there is this one: Valuation Sanity Check

People are still talking about how overvalued the stock market is and how it has to go down, and how valuations do matter and that perma-bulls are saying valuations don’t matter.

Well, I have been telling people to ignore those people for the past few years, and I, for one, would not say that valuations don’t matter. Valuations do matter. The higher the valuation, the lower the future returns. Duh. This is not rocket science. This is no different than bonds. The higher the bond price, the lower the yield, the lower the future return.

Where I disagree with the bears is their conclusion: that if the market is overvalued, then the market must go down. (I am not arguing that markets won’t ever go down; they will with 100% certainty. But I doubt anyone can tell us with any consistent accuracy when it will!)

I also quantified this and put the data on the website.

Future returns in an overvalued market

I didn’t update it, but since the market has been up, the conclusion would be the same or better. Plus, the analysis uses decades of data, so a couple of years is not going to make a difference.

As for all the worries and concerns, Buffett’s 2018 letter has a great section called “American Tailwind”, and it basically says that the market has done well over the past 77 years and there were always things to worry about, but the market did pretty well. Maybe more on that in another post.

Anyway, the home page shows the trailing P/E ratio of the S&P 500 index at 21x, and forward P/E of 17x. This may seem high to some of us who started in the stock market business when interest rates were around 8%. They are now much lower than that. I’ve said in posts that with a “normalized” interest rate of 4% over the next decade, I would not be surprised if the market P/E averaged 25x P/E. So a 21x P/E is not at all alarming or shocking to me, and the 17x forward P/E actually looks pretty attractive, even assuming that forward estimates tend to be over-estimated.

Also, looking at the Valuation Sanity Check page, the Dow 30 stocks seem to be trading at 17.5x 2019 estimates and 15.4x 2020 estimates. The Berkshire stocks (just the stocks listed in the annual report) are trading at 15.4x and 13.4x 2019 and 2020 estimates.

Again, there are issues of the validity of ‘estimates’, but even still, these figures are nowhere near bubble levels.

My thoughts about the market hasn’t changed at all in the past year. Yes, it was a little scary in the fourth quarter of last year, but I was not that particularly worried as none of my work (as shown in previous blog posts) has shown any rubber band stretched to it’s limit that must snap back.

OK, anyway, maybe more on that another time. Going on to my next pet peeve…

Data

Google and Yahoo have no obligation to continue their finance data APIs, of course. But what is really annoying is how expensive simple financial data is. It has always been so, and Google/Yahoo made it affordable (or, well, free) for the little guys without big corporate budgets. But that is gone now.

As the world continues to move towards open source and open data (look at this great source of free data related to NYC: NYC Open Data), the financial industry continues to be closed and expensive.

There was an article in the FT today about people (even rich corporate users) complaining about stock exchanges gouging them on price for access to basic data.

As I see it, stock exchanges are basically public utilities. I don’t think they should be profit-making entities so long as they are given a legal monopoly (or oligopoly or whatever).

It’s just makes no sense that we stock market traders/investors must go through the exchanges to trade and the exchanges then accumulate and use that data and sell them for profit. It just makes no sense at all. This stuff should be public information and easily available to the public in various forms. It doesn’t cost that much money to provide an API where people can access this information. We can see they are already making tons of money on exchange fees etc.

So this is just nuts.

OK, so it’s not a huge issue for me as stock prices / data is not a big part of what I do. As you know, I am more about listening to conference calls and reading 10-K’s and stuff. The only time I use financial data was when I was putting stuff up on the website for fun; I don’t need that stuff to invest (and that’s why I haven’t paid for any data service, and don’t really plan to).

The idea of open-source is that if you make the information free and widely accessible, more people can play with it and more ideas can come out of it.

OK, enough of that…

JPM 2018 Letter

No offense to Mr. Buffett, but I sort of look forward to Dimon’s letter more than Buffett’s these days. Buffett still writes great letters and I read them as soon as they come out. But I feel like I am very familiar with what he has to say and there are usually no surprises, and I am not sure I really learn anything from reading them lately.

But Dimon’s letters are much more granular and deal with a lot of specific, current issues etc.

Anyway, I don’t plan on going into detail here as you can just go read it yourself (and I know many of you won’t, but I don’t care… it’s your loss if you don’t!).

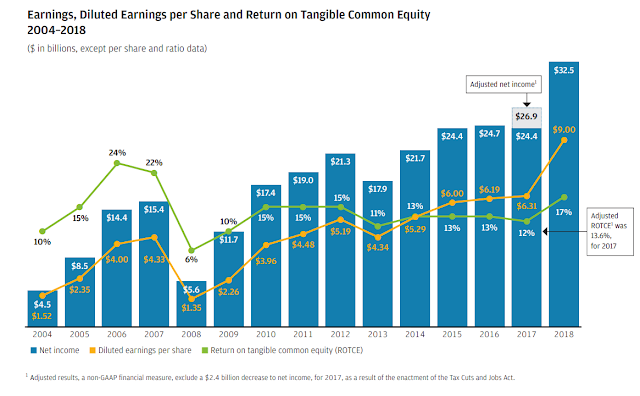

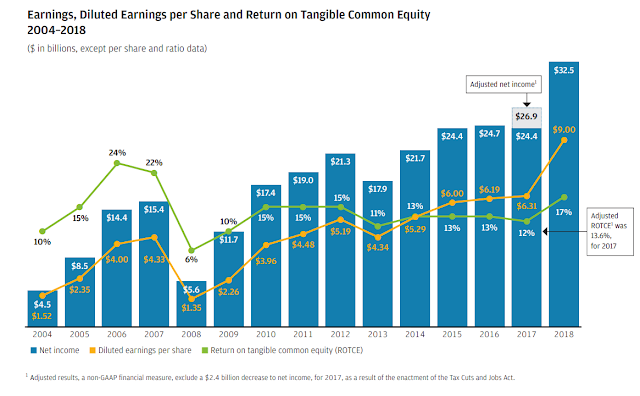

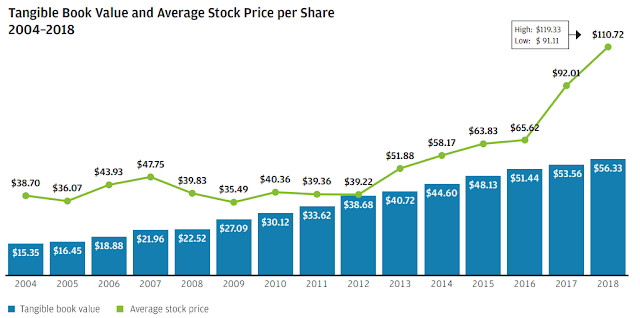

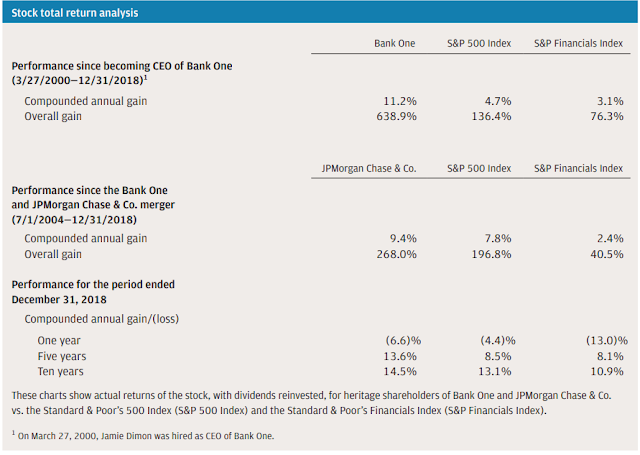

Here are my usual favorite charts.

Dimon Tenure Performance

These tables are really great; they show how Dimon has done as a CEO.

For reference, BRK BPS grew +9.5%/year from 1999-2018 and +10.0%/year from 2004-2018. So you can see that JPM has done better than BRK in both time periods, which is kind of shocking when you think about the fact that one period includes the popping of the internet bubble in 1999/2000, and both time periods include the financial crisis. (BRK time periods are based on year-ends, so don’t match up exactly, but whatever…)

Below is the same look but based on the stock price instead of TBPS. BRK’s stock price appreciated around +9.3%/year in both time periods (1999-2018, 2004-2018). This is kind of insane.

Social / Political Issues

I will not repeat them here, but Dimon goes on in great detail about how we can make things better here in the U.S. It’s too bad that our system does not allow for people like Dimon to become president. He would make an incredible one.

Anyway, he does caution us away from the creeping socialism and rising progressives from the far left. I am actually very sympathetic to this recent movement even though I am a hard-core capitalist. But I can see how it can be dangerous for us to veer too hard to the left and destroy things that have worked for us.

But the fact is that what has worked for “us” hasn’t really been working for a very large number of people.

Conclusion

It’s been a while, but I haven’t really changed my mind on anything at all. Nothing new to report, really. The market looks fine. No bubble at all as far as I’m concerned. Maybe not cheap, but not really that expensive either.

The way stock exchanges use data as profit centers is deeply disturbing and is not consistent with what I think of as their mandate as virtual public utilities. The whole system of exchanges charging money for data, and a whole industry of data vendors runs contrary to the worldwide trend everywhere else of open-source and open-data.

OK, way back in the old days when you needed expensive mainframes to manage this stuff, it may have been understandable. But with technology where it is today, this whole data industry setup and cost makes no sense at all. The industry must be laughing their way to the bank as costs keep going down and the prices they charge keep going up.

JPM continues to do well and it looks like in may ways they are disrupting themselves, which is really great. It assures (or increases the odds) of their continued success.

They have come a long way since I opened my first bank account at Chase many years ago.

I probably told this story here before, but I’ll tell it again. When I had my first job in the city, I needed to open a bank account somewhere so my employer can deposit my paycheck.

I figured all big banks are the same, so I went to the World Trade Center (near where I worked and lived) and walked into Citibank. There was a reception desk at the front and I said I wanted to open a bank account.

A big-haired girl, loudly chewing gum and filing her nails barked at me, “I’m on break. Come back later…”. She was sitting at the reception desk/booth. I was shocked at how rude she was, so I just walked across the hall to Chase and said the same thing, and someone immediately came and helped me out. Chase was not that much better; it was pure chance that the Citi employee was on break and Chase’s wasn’t.

This is the only reason why I started at Chase. Unbelievable. But that’s how big banks were back in the 90’s. Just terrible. Like the post office.

Anyway, JPM is no longer no-brainer cheap like it was when this blog first started (2011), but it still seems pretty cheap.

I'm not sure what kind of data you were pulling through the APIs but if it's just historical prices try https://www.alphavantage.co/. You can make 500 free queries per day. That's what I use.

Thanks, yeah, I know alphavantage but haven't tried it yet.

Love the content and appreciate the work you put in creating these pieces.

Cheers!

Hi kk,

Can you do some update posts on stocks like wfc or even citi and what you think about them now.

Hi, thanks for dropping by. Good question. I may have to take a closer look at some point. WFC has issues and the fact that they are having or had so much trouble finding a CEO is not a good indication to me; maybe there are a lot more problems we don't know about. Usually, if it's a simple problem, CEOs should love to go in there to turn it around. As for Citi, also not so sure.

Banks to me aren't as interesting now as they once were, even though they are still very cheap. I still like JPM and it is very cheap. Same with GS and others. So I am not sure buying the secondary ones at a discount are better than just buying the best ones.

I have not ventured into WFC or C, but still own JPM.

If I have any further thoughts, I will consider posting.

Thanks again for dropping by…

So if banks are not as interesting to you right now, then what sector is? To me it seems the financial sectors are still one of the lower priced stocks compared to everything else.

Also one note on "buying the best banks"… WFC was supposed to be one of the best a few years ago so that is why they had that premium in price. Now, it turns out they were not better than other banks. So now with JPM/GS, what makes you believe they are actually the best?

Good question. You are right, valuation-wise, they are still very attractive especially relative to the market. But it just doesn't feel like 2011 when almost everyone hated banks. What sectors are interesting? Not sure…

Good point about WFC, and maybe dumb luck that I was in JPM instead of WFC. For me, my understanding of JPM and GS is a lot deeper than, say, WFC, as I did work in the industry in NY, have known and know people that work at each, have heard many first-hand accounts of what Dimon is like, what it's like to work at GS/JPM etc… So there is a level of comfort for me with those companies that go beyond the financial statements, earnings calls and things like that.

I never had that level of intimate knowledge with WFC that lead me to a high comfort level.

I admit this sort of comfort level is hard to achieve in most of the time…

If the banks doesnt look as interesting and there are no interesting sectors.. then what are you invested in?? Correct me if im wrong, but it seems to me that you may actually have a significance portion of your portfolio in some sort of cash form/or heavily invested in a few stocks, and that seems weird to me for someone so knowledgeable.

Hi, I don't have a lot of cash; mostly invested. I do still own JPM and BAC, but own many other things I've talked about here over the years. MKL, BRK and Y, for example. I've owned GOOG For a long time, and CMG etc…

Hello just wanted to give you a quick heads up. The words in your content seem to be running off the screen in Firefox. I'm not sure if this is a format issue or something to do with web browser compatibility but I thought I'd post to let you know. The layout look great though! Hope you get the problem solved soon. Many thanks

Best Mortgage Rates