So, the market has gone crazy. People ask me about the market and the impact of the COVID-19 and I keep saying it doesn’t matter. But with the market acting like this, it’s hard for people to agree with me. The markets make the news, the market creates the sentiment etc. and I can’t fight that. That’s OK, as it doesn’t really matter to me.

But I had a really interesting conversation recently, and I did some illustrative work and thought it was interesting so decided to make a post about it.

Every time people worry about these things, whether it’s a trade war, Brexit, 9/11, fiscal cliff, coming recession/depression, war or whatever, I say the same thing. If something is not going to have a long term impact on the intrinsic value of businesses, it doesn’t matter.

If you own a restaurant on a beach and the weather forecast shows a hurricane approaching, are you going to rush to sell the restaurant before the hurricane hits? Are you going to lower the selling price because you know the hurricane is going to hit and you are going to lose a few days or possibly weeks of business? Of course not! So why would you do the same with stocks?

I think most will agree that COVID-19 is temporary. We just don’t know how bad it’s going to get before we get it under control (I still think there is way more COVID-19 even here in NYC than anyone thinks, because frankly, people are just not being tested. Plus I don’t think the government is going to be truthful about this; I was living in Battery Park City during and after 9/11 and the EPA lied to us about the safety of the air. Christy Whitman admitted she lied to us about the safety of the air (she denies knowing the truth at the time, but I don’t believe that at all). Forgot who, but someone said that the government had to balance the risk of causing a panic and the abandonment of downtown NYC (to the detriment of real estate prices downtown) with the ‘minor’ risk of people getting sick from inhaling toxic fumes. This is especially true when the known risks were also known to be far off into the future, long after elected politicians are out of office (so won’t need to take any of the heat). So this was not really about public safety but more about social control. Not that different from China, are we?)

But in my recent discussion, I had trouble getting across that the intrinsic value of the restaurant is not going to be impacted by the coming hurricane. Yes, they will lose business, and will probably have to repair some damage (even though that should be insured). Of course, in the hurricane example, there is a possibility that it wipes out the whole beachside town and it takes years to rebuild. But most market exogenous events in the past ten or twenty years weren’t of the magnitude to destroy everything (in aggregate) for years.

Current P/E

So when I say it doesn’t matter about COVID-19, I don’t mean to say there will be no impact. I just mean that there is no impact on the intrinsic value of businesses in general 5, 10 or 20 years out.

If people value stocks on current P/E ratios, then yes, there will be an impact on stock prices. If you value a stock at 10x P/E and think it’s going to earn $1 this year, but COVID-19 will cause it to earn $0.50 instead, then you might think the stock is only worth $5.00 instead of $10.00. But if you think this dip in earnings is temporary, you would still think the stock is worth $10.00.

P/E ratios are just a short-cut to calculating future discounted cash flows, so it sort of makes no sense to price a stock on current year estimates if there is a one-time factor involved.

Intrinsic Value

So this is the part I had a hard time describing. I guess non-financial people (unfortunately including many in the financial press) have a hard time grasping the idea that intrinsic value of a business is the discounted present value of all future cash flows. This person argued that the market looks only at earnings over the next year or two, but not fifty years out. Yes, this is true. But intrinsic value has nothing to do with what the market is looking at. Intrinsic value is a mathematical truth as long as the inputs are correct (or reasonable enough). Intrinsic value is 100% independent of Mr. Market’s opinion. Well, Mr. Market does set the discount rate to some extent.

When people slap a P/E ratio on a stock, they are basically discounting all future cash flows back into the price of the stock; they may just not know it or understand it. The P/E ratio is just a shortcut valuation method.

If you value a stock at 10x earnings, you are basically pricing in a 10% earnings yield going out into perpetuity.

So first of all, we have to understand that regardless of what the ‘market’ is looking at, or what the pundits say on TV, a business is simply worth the present value of all future cash flows. We can argue whether that’s earnings, dividends, free cash flows or whatever. But the idea remains the same.

Here’s the thing I did to try to illustrate how non-eventful recessions and exogenous events are to the intrinsic value of businesses in general (but alas, this illustration failed to get the point across in this case even though the person is a highly trained engineer! No wonder why Mr. Market is so irrational!).

Simple Model

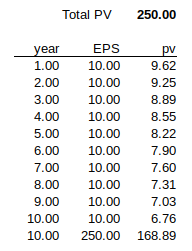

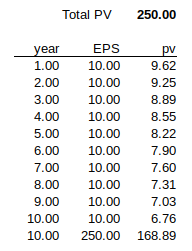

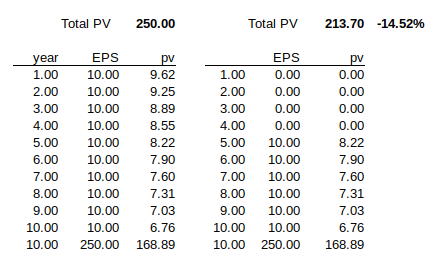

So, here’s the illustrative model. Let’s say the market has an EPS of $10/year, and the discount rate is 4%. In this table, I just took the earnings for the next 10 years and discounted it back to the present at 4%, and then added a residual value at year 10 based on a 25x P/E ratio (or 4% discount rate), and discounted that back to the present and added them together. Of course, this would give the market a present value of 250.

I think most of you have no problem with any of this. For illustrative purposes, the details don’t really matter, and I have no earnings growth built in here either.

Now, let’s say COVID-19 causes the global economy to stop for 3 months, and companies earn no money at all for three months. Of course, many businesses will lose money (retailers, hotels, airlines), but others will continue at a lower rate but may not lose money in aggregate. Remember, the S&P 500 (and predecessors) has shown a profit every single year since the 1800s, and that includes the great depression, world wars, great recession etc. So this is not a stretch.

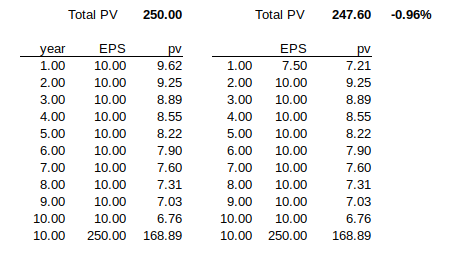

Plugging in $7.50 for year one earnings instead of $10.00 would negatively impact intrinsic value of the market for sure. There is no doubt about it.

Let’s quantify that. I copied the above table into another one so we can look at it side-by-side.

If the above scenario holds, the intrinsic value of the market would go down less than 1%.

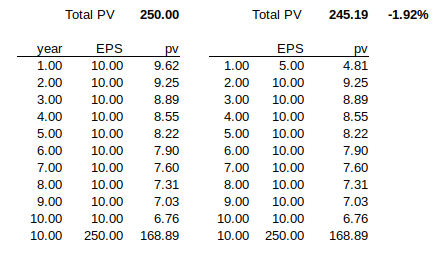

Way too optimistic you say? OK, so let’s say the S&P companies make no money for six whole months. What does that do to intrinsic value?

Let’s take a look!

This scenario would dent intrinsic value by less than 2%.

OK, screw that. Too optimistic. Let’s say that the economy is wiped out for a whole year, and the S&P companies make no money for a whole year. Remember, this didn’t happen even during the great depression or great recession (or during the 1918 flu etc.).

Still too optimistic? OK. Zero earnings for two years, then.

Ah, now we are starting to hurt the market. With zero earnings for the first two years, intrinsic value is knocked down by 7.5%. Ouch. That hurts.

Here are some more:

So, with the market down more than 12%, it is like the market is discounting no earnings for the next four years! Nuts!

When the pundits say that the market is or isn’t done discounting the risk of COVID-19 or a coming recession, you can see how that sort of comment is total nonsense. It is based on Keynes’ beauty contest. They are just saying that people didn’t expect a recession or negative event earlier this year, and now these things are here so the market therefore must go lower as the market lowers their expectations.

But this has nothing, really, to do with intrinsic value or expectations thereof. It is just based on pundits guessing what Mr. Market would do based on the headlines.

Of course, I would be the first to admit that if an event did occur that would cause the S&P500 companies to not earn any money for a whole year, two years or three years, it would cause a drop in the market far in excess of the decline in intrinsic value. That would have to be quite a scary event!

Again, this is just a simple illustrative model. There are other reasons why the market can be down. The market may simply have been overly optimistic / overvalued, and this has triggered a ‘normalization’ of valuations. Maybe the market needs to increase the discount rate to account for the increasing risks that were not considered in the past. Maybe this will actually cause some sort of permanent reduction in the profitability of corporations in general going forward.

But remember, we all had the same thoughts every time something happens. We all see some permanent negative change that explains a lower stock market. For example, after 9/11, the thought was that the world would never be the same, and that increased security measures will permanently reduce global growth potential and profitability.

Again, the market makes the news, and the market creates the explanations, not the other way around. We all try to model the facts to explain what is going on in the market to maintain the two illusions that 1. the market is always right, and 2. that we know what’s going on. We wrap the market volatility tightly into these rational-sounding wrappers, pleased at having figured it out, secure in the knowledge that we know what’s going on.

Conclusion

OK, so I lied. The above tables clearly show that there is a negative impact on intrinsic value by even temporary business interruptions. But the magnitude is not nearly as much as the market usually moves.

Index arbitrage traders make money because the futures contract fluctuates much more widely than the fair value of the contract. Debt / credit traders make money because credit spreads fluctuate (or at least used to) much more widely than the credit quality of companies. And value investors make money because stock prices fluctuate much more widely than intrinsic value of the underlying businesses.

Of course, I am not calling a bottom in the market, or trying to say that markets won’t or shouldn’t fluctuate based on the headlines. We can be pretty sure there will be more wild days to come. Markets can be up or down 1000, 2000 points on news. I still expect photos of empty streets in NYC at some point before this is over with the market down a lot on those images. NYC is only starting to test this week, so when more cases are found, subways will be empty too, and of course the market will be down on that.

But I have no idea, actually. It’s sort of what I expect (and have been expecting since early February).

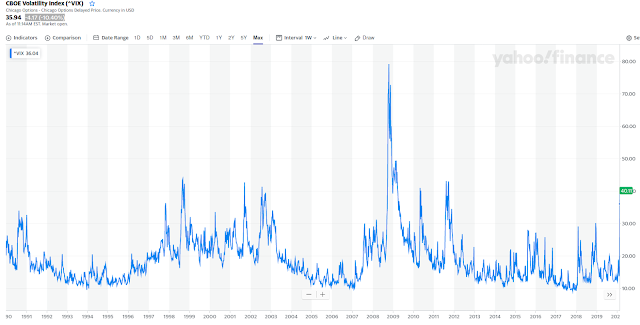

On the other hand, check out the VIX index. In my trader days, this was my favorite indicator. As Munger says, always invert. You don’t usually make money being short in a market with the VIX at a high level, and it’s as high as it’s been in the past few decades. This is no guarantee that the market can’t go lower, of course.

But anyway, who cares what Mr. Market thinks!

Who knew that all numbers add up to 168.89!

Sorry, the sum is at the top. 168.89 is 250 discounted back to present value, not the sum of that column. Not well designed table, I know…

Great post. I agree COVID-19 is a temporary event and therefore we should look through the noise. But one qualification to your argument. Temporary events can do permanent damage to leveraged entities, if the shock is deep and persistent enough. Think of a leveraged airline or cruise ship business. Most should be fine if this thing clears up in a few months. But what if it doesn't? Same thing economy wide. If cash flows are impacted deeply enough and for a long enough period, suddenly we have something that looks more like a 2008 style financial crisis with its related liquidity issues. Not saying this is the main scenario at this point, but I think it is a risk many are underappreciating.

Yes, but that's already built into the above scenarios. During the financial crisis, a lot of financial institutions did indeed go bust, but that didn't have any longer term negative impact on the market overall or on any of the businesses that were 'sound'. I would never invest in 'weak' businesses that would fail on recessions or panics, like those that failed in 2008. So that's all there, built into my scenario already, so no need to qualify.

The only qualification you would have to make on my above is a world-ending event, or something that would permanently alter the environment in aggregate. And of course, this is possible too. But probably not by this.

To add something else to this, we must always remember that companies have underlying customers, so while individual companies might go out of business if they are over-leveraged, the underlying demand for the service/produce usually doesn't go away. So the remaining companies within their respective industries will eventually pick up those customers who still seek what they seek. This translates to earnings going into different hands, but ultimately still into the profit line of companies.

Nice post. I tried to explain much the same thing yesterday with respect to intrinsic value impact on actual businesses but your examples are better, I think.

https://www.rationalwalk.com/thoughts-on-the-coronavirus-correction/

Ah, cool! Great minds think alike, lol…

Great post. Would you think a 4% discount rate a bit too low with respect to the equity risk premium and a long-term normalized risk free rate? I think many people use 10%, which would mean 10x P/E for companies with no earnings growth (Gorden Growth Model). Would be interested to know what you think. Thanks!

You can play with the discount rate and do what you want to see what happens. Using 10% flat out for the market with no earnings growth is a little steep, I think. People may use 10% as a discount rate, but would put in growth factors, like 5-6% earnings growth. 4%, even. Then you would get similar results. If the P/E of 25x seems high, you can use 15x or 20x as the discount rate and see what happens.

It's just an illustrative model.

Why do you use a 4% discount rate.? A 25 PE seems high.

See above.

Really outstanding post, thank you. Nothing about COVID-19 changes the long term trajectory of the companies I'm invested in as far as I can tell. Haven't sold anything, and am looking at where I ought to add to my positions before the yard sale is over.

Thanks for being level-headed, as usual. We need more of this right now.

I'm sure you gonna disagree, but

I ran your DCF on SP500 and the issue is not Covid, the issue is valuation.

Starting with 133.53 SP500 earnings ( from here https://www.multpl.com/s-p-500-earnings/table/by-year , I did not double check ), 0% growth this year, 3% growth rate from here to year 10, 5% discount rate, terminal PE 15, SP500 value would be ~2700.

Using 5% growth rate, SP500 value would be 3179.

Now, this assumes 5% discount rate, which is basically expected return. If investor wanted more than 5% return, the numbers are way worse.

(No, I don't think 25x terminal PE or 4% discount rate make sense. I don't think growth rates above 5% make sense either. Yes, I know that risk free rates are close to zero. I'm not gonna use risk free rates for DCF. But, yeah, that's likely why SP500 is where it is.)

Thanks, have fun

No, no disagreement here. I was not clear, my example wasn't so much about the absolute level of the market, but what impact short term events can have on it.

As for these discount models, I don't use them and wouldn't know what to put in them.

Having said that, I do think much of the world is still anchored to a 14x P/E and 7-8% long term interest rate world. But then again, 1% is also too low; I would not use that as a discount rate either.

That's why growth rate is so important. Higher growth rates also make the adjustment to a few months to 2 years of no earnings even less important.

This comment has been removed by the author.

Very well written and makes the point of intrinsic value not always inline with Market pricing.

%99 agreed with the post. %1 is: If I think that a company will have no earnings in next 4 years because of the financial crisis virus caused, I do not invest on it by looking the intrinsic value made by 10-year valuation. The price of stock will probably be under pressure because of the bad sentiment. (Also there is no dividend return) So, why do i put my money in here and wait for the change of sentiment while there are probably better options (maybe gold, just an example)

Thanks for the post.

Any chance for an update on these models, considering how much has unraveled since?

Hi, no, there is no need to update the models themselves… The model includes situations where there would be no income or a year or more etc.

The model doesn't address at all what can happen to the markets in between. It is volatile, and will probably remain volatile for a while. I think there is a lot of forced selling; people who sell the market down 1000 pts or 2000 pts are people who *have* to sell, not people who *want* to sell. I think there are a few blowups we haven't heard about and liquidations that are impacting his market. You don't want to sell into things like that, but should be buying if you see something you like that is cheap (but then, after you buy, don't look at it because it probably won't be the bottom! Nobody is going to buy the low tick (well, most people).

I wish there was a website that showed what the EV/E of the market was. That would give us a more accurate earnings yield.

Also, the money printing / inflation going on behind the scenes has be a net positive for the market right? Costs go up but revenue goes up proportionately. The P/E remains the same and the MC will be higher. Correct?

On a side note, the minimum wage has not budged since 2009, failing to keep up with inflation, let alone the stock market. Meanwhile the middle and upper class are being asked to shoulder the burden to resolve the difference with higher taxes and higher healthcare premiums and deductibles. Some hardworking Californians have to pay 50%! There is justifiable anger on both sides. But the real problem is the tax loopholes for the top 1% who own half the country's wealth. It's not a wonder why Mr. Malone cringes at the thought of a party leader who would find more creative ways to tax him.

Nice blog you've got here. I will be sticking around. Hope to see more updates!

I totally agree that COVID-19 is temporary. We just don’t know how bad it is before we get control. How the market reacts to the news, I can not control. However, I can control how and when I invest, so I tend to focus on it.

Thanks

you

so

much