Value Funds

Holy cow, I haven’t been reading or keeping up with much in the value investing world. As part of my catch up, I plan on reading letters from the various value funds and things like that. One of the first ones, of course, was Sequoia Fund, and I was shocked at how poorly they are doing. I know that in the zero interest rate world, everyone suffered. But this is worse than I thought. I know Sequoia had that Valeant fiasco, but even without that (that happened in 2016?), the dramatic underperformance seems to continue.

I remember once saying that if I was going to go on a mission to Mars and I had to keep my money in some fund, I did say I would put money in Tweedy Browne Value. Over time, I admit I became less and less interested in any funds because as expected returns came down to, say, 4-6%/year, the 1% management fee starts to look like a hedge fund incentive fee, but they get it no matter what (1% of 4% is 25%!!). So I don’t own any funds (except an old 401K where I don’t have much choice), and wouldn’t own any. I tell people to just get out of active funds and roll them into the S&P 500, and the reasons are what Bogle has always said: people won’t outperform, and even if they do, the fees are hard to justify. I probably made a Bogle-head post here a while back. I wrote an investment plan for a non-profit not too long ago, and the main point was to avoid fees at all costs.

Take a look at some of these figures. They are kind of terrible. I don’t mean to pick on anyone; I’m just looking around and making honest comments about what I observe. These are just the first two funds that came to mind when I wanted to read what they were up to.

And, by the way, for the younger readers who may not know who these guys are, they are some of the so-called Superinvestors (from Buffett’s Superinvestors of Graham and Doddsville essay), and the two that are still active now. I put their performance numbers up so check it out, how Super they once were: Superinvestor returns

Sequoia Fund Performance

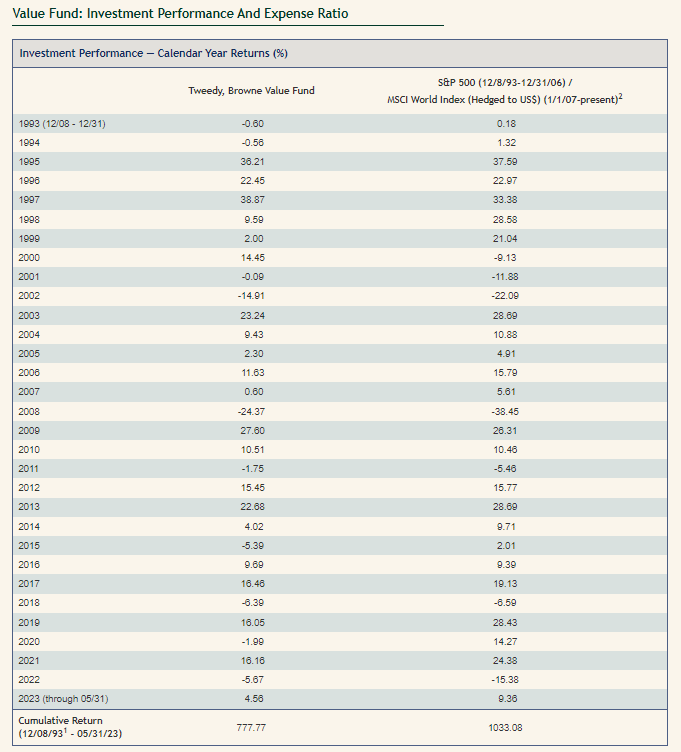

Tweedy Browne Value Fund Performance

Berkshire Hathaway

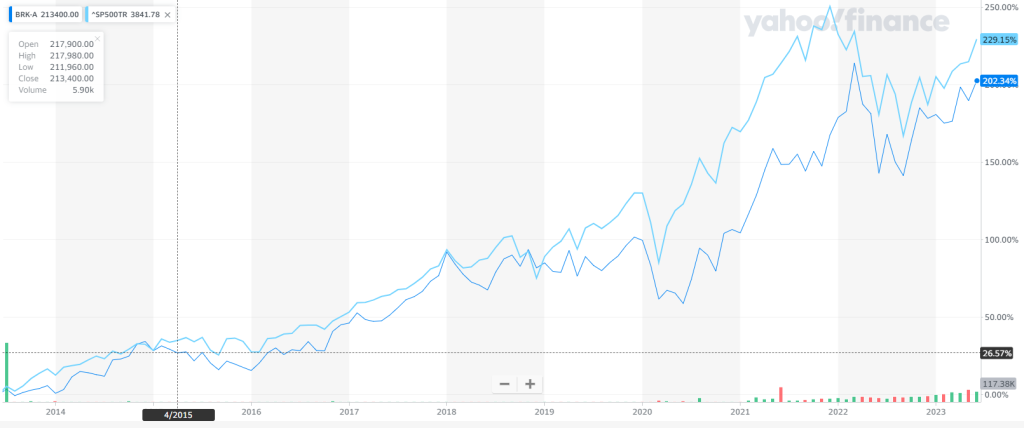

Value investing sort of looks broken when you see those Superinvestors, but let’s take a look at BRK. Remember, many said that BRK won’t outperform anymore, or even if it does, not by much.

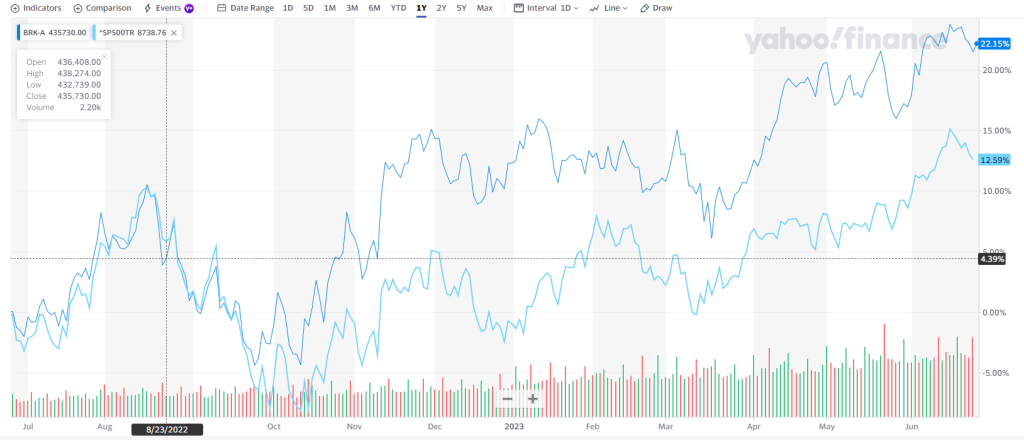

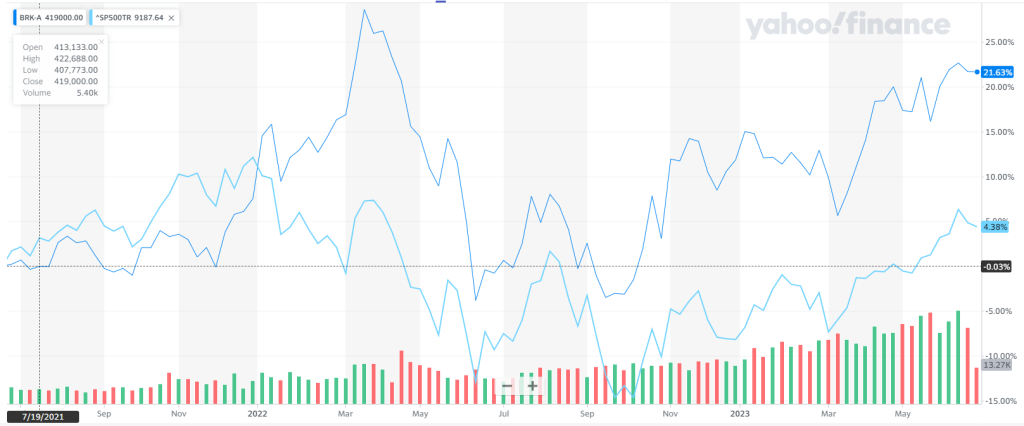

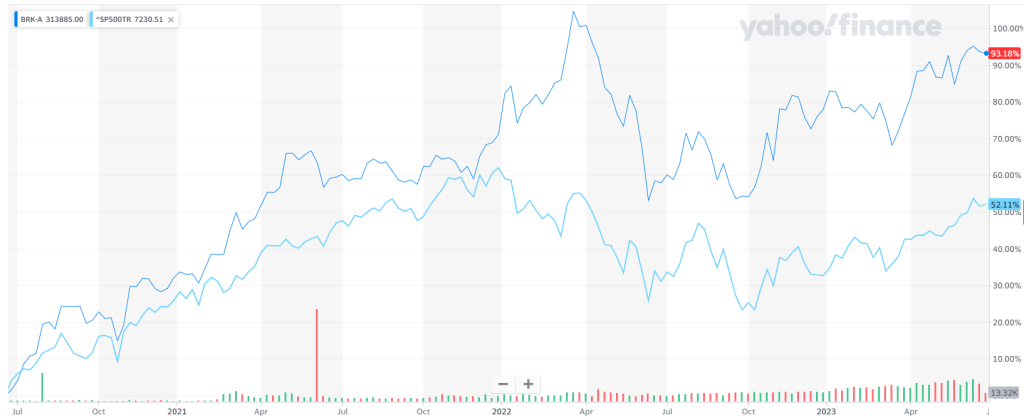

Check out the 1, 2, 3, 5, 10, 20-year and since 1993 charts. I haven’t updated any of my BRK BPS tables or anything, so this is just a lazy way to check. I just compare BRK-A’s stock price to the SP 500 total return index over these various time periods.

BRK 1 year

BRK 2 year

BRK 3 year

BRK 5 year

BRK 10 year

BRK 20 year

BRK since 1993

So you see, BRK outperforms in 1,2 3, 5, 20, and since 1993. The only period it doesn’t outperform is 10 years. You may get different results due to different start / end points. I just did these against today.

Is Value Investing Dead?

So this begs the question, is value investing really dead? If so, how is BRK doing so well? First of all, we have to remember that Buffett ditched the old, conventional concept of value investing years ago, at least in the 1980’s, if not the 70’s. He said Munger taught him that, to pay up for quality. Over the years, whenever asked about value investing, he always said something about value and growth joined at the hip, so you can’t discuss one or the other independently. He basically dismisses the whole idea of separating out value investing vs. growth investing.

I don’t think value investing is dead, nor do I think value investing has changed all that much in concept. The idea that things have intrinsic values and that you should buy things below that level will never go away. The concept of what constitutes value, though, may evolve.

Alternative Hypothesis

Instead of saying that value investing is dead, or that it no longer works, how about thinking about it this way? First of all, I have to admit to being baffled over the years at various value funds just getting out of the market or raising a lot of cash, even when they say the don’t want to try to time the market. What is raising a lot of cash if not timing the market? OK, so they say this is not timing the market, but pricing it. What if their pricing concept is wrong?

I got into the markets back in the 80s, and interest rates were 7-8%, and the idea of a fair value of the stock market was around 14x. This was the historical P/E ratio, and Black Monday taught us all that a P/E over 20x is bubble territory and dangerous (this was confirmed by looking at the P/E ratio in 1929). I think I mentioned on this blog years ago that when our house economist in the early 90’s told us that the Fed funds rate (then around 8%) would go down to as low as 4%, we all laughed at him. Some said we should fire him as he has completely lost his mind. Let that sink in for a second.

So with interest rates at 7-8%, we thought 14x P/E was sort of the norm for the market. By the way, the Fed funds rate should not determine the fair value of the stock market at all. So I don’t get why pundits are saying “if FF rate hikes stop here, then xxx, if they go up 50 more bps, then yyy”. What difference does it make? I look at the 10-year treasuries yields. That is sort of the global benchmark for pricing assets. Again, this just goes back to keeping your eye on the North star or lighthouse ahead, and ignoring the waves (FF rates) nearby.

OK, so where is this going? What if the fair value of the market went up as rates came down? I think most people agree that asset prices are dependent on interest rates. Buffett has said so too, even in recent years. So if interest rates are far lower now than they were when I first started in the business, then it makes sense to assume that the fair market value of the stock market is far higher than it was back then.

I already argued that I think the market is fine even at 25x P/E, as long as interest rates (long end) is around 4% (it is still below that).

And interest rates have been far lower for decades since I started, and the stock market has been much more expensive in all that time. I don’t find that to be a coincidence.

Now, here is where I dig into the value funds. I haven’t looked at their holdings and analyzed why some of these funds have performed poorly. But hear me out.

A long time ago, I may have mentioned this here too before, but a quant friend of mine was doing all sorts of studies, and he also looked at price-to-book value ratios in Japan (he was based in Japan). And what he found was that the P/B ratio was highly and inversely correlated with credit quality. In other words, low P/B companies just had bad credit and vice versa. So if you created a low P/B ratio portfolio, you just had a lot of credit risk, so from that point of view, you weren’t really getting any ‘value’.

It’s like buying a junk bond yielding 9%. Looks great! But is that really value? Could be, but you can’t be sure.

Bond Fund Example

OK, so hear me out. Stay with me. This is not a great analogy, but it sort of illustrates what I am trying to say. Let’s say you are a high yield portfolio manager, and you started investing in the 80’s and 90’s. Well, you are trained to demand double-digit yields on any junk bond. Right? That makes sense. I often heard those guy say that you get an ‘equity-like’ yield. Yes, 10%, 12%, that’s like equity-like returns. OK, so that’s in a 7-8% treasury yield world. So your credit spread is like 300 bps, 400bps, 500bps. Right?

Now, for the next few decades, interest rates keep going down. At 5%, you still insist on equity-like returns because you are taking so much risk. But if you are demanding 10% yield, that’s a credit spread of 500-700 bps. Now, if you don’t adjust for lower long term rates, and are anchored to expecting 10% yield, what happens to your portfolio?

Exactly. The credit quality of your portfolio is going to start to deteriorate. Now long term rates go down to 4%. You still want 10%. Now your portfolio is filled with crap that has a 600-800 bps credit spread. So you are sort of holding a portfolio that is a lot crappier than it was when long rates were 8%. You are talking about a credit spread going from 200-300 bps to 600-800 bps. That’s kind of nuts.

And imagine, the portfolio starts to see a lot more defaults, and doesn’t perform well. And the managers complain, they don’t make junk bonds like they used to! Get Milken back in the business, godammit! Well, did the market really change? Or did the portfolio quality just deteriorate over time due to the actions of the manager?

Now, in reality, this probably hasn’t happened. I think in credit markets, people do trade off of spreads and not really nominal rates.

Do Stock Investors Unknowingly Do This?

I think they do. When rates are 8% and the market P/E is 14x, and you find a great stock at 10x P/E, that’s great. But when rates are 4% and the market is at 20x, can you really find anything decent for 10x P/E? Or do you have to sacrifice a lot of growth and/or quality to do that?

I have a nagging sense, from watching value investors over the years (again, not so closely in recent years), that this has always been the case. They couldn’t accept such high valuations, even though the rate structure was very different than it used to be. They refused to evolve. They were anchored to their old view that the market should be fairly valued at around 14x, or maybe it’s 16x nowadays.

I don’t own any AAPL (except indirectly via BRK), but that’s trading at 30x P/E, which seems nuts if you are still anchored to the 80’s and 90’s. But if you accept a 25x P/E for the market overall, then a 30x P/E is only a slight premium to that. Right? But I bet you won’t find any value investors that would agree with this.

And I am only proposing that, maybe, just maybe, it’s not that value investing is dead. It’s just that many of us are still anchored to old benchmarks that haven’t been relevant in decades.

Now, I know defending high prices is always risky, lol… You are always at the risk of making the Irving Fisher “permanent plateau” comment.

And I also agree, there is a limit to this argument. I would never say (and didn’t say) the market is fairly valued at 100x P/E with long term rates at 1%. Globally, stock and real estate prices tend to stop chasing yields down when it gets below 3-4%, as people will just not accept risk at yields below that for ‘risk’ assets.

But anyway, this is sort of the feeling I get having watched investors over the years.

Also, by the way, this also begs the question of how much culture is going to matter in the investing world. I think nothing has probably changed at Tweedy Browne, as some of the older partners are still there. But the Sequoia Fund hand-off is not looking too good. I know we are all long-term investors, so it may be too soon to make judgements about any of this, as recent years have been extraordinary (but some will argue it’s always extraordinary).

I remember watching the Michael Jordan documentary and someone said something about building the team and the culture at the Chicago Bulls that goes beyond just one player. Well, I think it’s obvious now that this one player was a huge part of it.

This does not bode well for the post-Buffett, post-Munger world. Is it Buffett? Or is it BRK’s culture. I would tend to argue, like the Chicago Bulls and Jordan, it’s Buffett / Munger. But the good thing about BRK is that it’s not just about investing in stocks. It’s a bunch of operating businesses too so there may be talent on the operating side that can continue to do well and add value to BRK, so I would not be as worried about BRK as I would be about a mutual fund.

Anyway…

This was just a quick post I thought I’d make as some of these above points have been nagging at me for years, and seeing how poorly some funds have been doing lately prompted me to make it. Value investing is not dead (I am not talking about value vs. growth). Some investors with outdated assumptions due to ‘anchoring’ might have ruined the performance of their funds, but it’s not that value investing doesn’t work anymore, I don’t think. IT guys call this “user error”; there is nothing wrong with the machine!

But still, this is just an idea. What if we are all wrong? When something goes wrong, as many IT guys know, we are quick to blame the machine but sometimes won’t consider that we are doing something wrong.

This is not meant to be a definitive, this is what’s happening, this is why funds aren’t performing answer. It’s just a possibility that we might want to consider.

A very good and needed perspective on value investing. It is a struggle to manage both anchoring and recency biases. Which bias dominates seems to depend on length and kind of of history one has gone through in markets.

Great discussion of past fund results. But what about the future?

Below is a link to a thought provoking paper recently published by Michael Smolyansky at the Federal Reserve.

Smolyansky argues that with interest rates rising back to “normal” levels the future is going to be tough for companies and stocks.

June 2023

End of an Era: The Coming Long-Run Slowdown in Corporate Profit Growth and Stock Returns

“I show that the decline in interest rates and corporate tax rates over the past three decades accounts for the majority of the period’s exceptional stock market performance. Lower interest expenses and corporate tax rates mechanically explain over 40 percent of the real growth in corporate profits from 1989 to 2019. In addition, the decline in risk-free rates alone accounts for all of the expansion in price-to-earnings multiples. I argue, however, that the boost to profits and valuations from ever-declining interest and corporate tax rates is unlikely to continue, indicating significantly lower profit growth and stock returns in the future.”

https://www.federalreserve.gov/econres/feds/end-of-an-era-the-coming-long-run-slowdown-in-corporate-profit-growth-and-stock-returns.htm

Yeah, nobody knows. This argument is not new, and I agree that returns will probably not be as great as in the past. But if you ask Buffett, he will probably tell you to look at what the market has done over the past 100 years, not just once slice of recent history.

Anyway, I remember reading many of these sorts of ‘papers’, and unfortunately, even if they have some truth in them, they are not all that useful.

There have been many times in the past, even going back to the 1990s where similar arguments were made, that the mega-bull market in bonds is about to end, and that this will be the end of the mega-bull market in all financial assets etc… I am not saying this will or will not happen (or might have already happened)…

So, as Munger always says, we have to invert. Don’t miss the trees for the forest!

Great write up. Thanks for sharing. I agree with your thoughts. So how are you electing to invest to navigate this thesis? No funds and no Apple but owning BRK. But what else. Thanks again.

I haven’t changed anything, really. I own stocks that I like. I will probably write more about individual stocks over the coming months…

Market may be fair value at 25X but it’s important to understand that such a high fair value means much lower returns going forward for equities in the same way that lower interest rates means much lower future returns forbonds.

For sure. There is no doubt about that.

Hello kk, I have been following along these years and I am really happy to know that you are back.

I would like to ask you for 4-5 blogs, webs or whatever you consider that feel that are mandatory to read foe every investor. Out of Buffett, Marks, Ackman…I meant blogs like yours and easy to read.

Thank you and keep doing it so well.

Ah, good question. Actually, I have no idea at all. In the past few years, I have not read or followed any blog, website or anything at all. I’m sure there are great bloggers out there, but I haven’t really looked around recently. If I have time to read, I just want to read annual reports, 10q’s, corporate presentations and things like that. This is not to say you can’t learn from others, but I haven’t gotten around to looking for anything yet.

I’m not kk but this is an investor board relating to all things Berkshire Hathaway. Generally has a high signal to noise ratio. Free and easy to sign up. Warning, don’t post garbage. The board doesn’t suffer fools lightly ( speaking from experience).

https://shrewdm.com/MB?command=recommend&pid=164392964

Hey, I agree with you about there being that anchor effect.

But can you really compare Berkshire to Tweedy Brown, Sequoia, …? I would say there is more to it. Sequoia and Berkshire is – I think – a bit like comparing apples and oranges; not least because of float at Berkshire and none at Sequoia. And Funds are marked to market with the parts they own (not really sure; as I said, I don’t know them really, just know, that they are part of the Graham and Doddsville analogy…)

Sure, as you say, Buffett has left the concept of cigarette butts behind. To stay in the picture: the last puff of the cigarette butts would then simply have become smaller and smaller over the years with Treasuries of zero per cent. So small that it was no longer really worth saving them. And I therefore also believe that you are right at that point (but I can’t judge how it is with Tweedy as I have never analyzed it; but it’s more like a fund, isn’t it…?)

But my analysis for Berkshire Hathaway shows that compared to the “good” 2002s, it is much more cheaply valued relative to the market today than it was 15 and 20 years ago. Mister Market valued the S&P500 at a P/E of 15 to 20 between 2004 and 2006. Today, the P/E of the S&P500 is around 25. Berkshire was valued at a PB Value of 1.5 to 1.9 in the same 200s; today, it is valued at 1.45. Yet Berkshire’s equity is more valuable today than it was then because more complete companies are now part of Berkshire whose value is poorly represented in book value (and it makes more sense nowadays anyway to do a sum of the parts analysis like Whitney tilson and Book value is not really representative anymore and Buffet himself is not a fan of using it… But still: Book value is quite roughly usable as a rule of thumb.).

So it seems to me that Mr. Market is much more optimistic about the overall market these days, and at the same time a little more pessimistic about Berkshire. So I would think that the current slight outperformance of Berkshire is more likely to extend over the years; and at the same time Sequoia & Co are “Marked to Market”.

I think this disbalance is even more true for the little berkshires like Markel and Fairfax. Fairfax Financials Equity has increased six-fold since 2004; S&P500 earnings have tripled in the same time (in my view, this comparison works as a rule of thumb, though not perfect; but for me it’s ok, especially since the risk-free rate was about the same in 2004). And yet Fairfax’s stock market value is only slightly better (+400% vs +350%).So ROE of Fairfax has been way higher than the market average; and this is true in a time, where Fairfax has lost a lot of growth for the deflation “bet” (I would say “deflation insurance”). So looking forward ROE Delta between Fairfax and the market should increase; the more, if we assum the risk free rate being higher within the nect 10 years than in the last 10 years. (for both without taking into account dividends; but that should hardly change the overall picture).

yes, all good points. You can’t really compare BRK vs. mutual funds. But as investors, we can either invest in the S&P 500 index, BRK, individual stocks, mutual funds, ETFs etc. I just wanted to demonstrate that BRK is sort of a value investor, not a tech fund or anything, but managed to keep up and even beat the S&P, and not being able to mark operating businesses to market would be a disadvantage in a roaring market, but we are looking at stock price, not BPS, so maybe not an issue.

I was about too fast. The last sentence refers to the comparison between the S&P500 and Fairfax.

Best

Hamburg Investor

I haven’t visited your site for a while , don’t know why, perhaps because I started a twitter account 3 years ago and sort of forgot about all the great blogs I regularly read before. Anyway, strangely, you mention the only two funds I own, $SEQUX, and well, almost $TWEBX, which I did own, years ago, but still own $TBGVX. (To many years of subscribing to OID, when it still existed, I guess). Neither are particularly large holdings $TBGVX is about an 8% holding, $SEQUX about 3% of my equity portfolio, but I’m about 32% in 3-6 mo. T-bills, so less than my total portfolio

First $TBGVX, which I’ve owned since 1995, I think the stock picking hasn’t been terrible from a value perspective and if you want to protect against the downside first and foremost. But, it’s basically an EAFE fund with a good percent of capital in large Swiss, UK, German, and French companies, and those have been horrible places to be for like forever it seems. In it’s Morningstar category (“Large Foreign Value”), it’s ranked 2 out 124 funds they track in that category over the last 15 years. So they haven’t been bad stewards of ones money, it’s mainly they haven’t participated in the mania in U.S. equities that’s gone on since 2010, or I guess really, since 2003 with a short-lived blip in late 2008,early 2009 and half of 2020. $TWEBX, which keeps about 30% in U.S. equities, the remaining 70% or so is essentially a clone of the international fund, and when you consider the U.S. holdings are $JNJ, $CSCO, $BNY, etc., not surprising it’s performance is so mediocre. I’m sure there will be a day when I’m happy to own $TBGVX again, but I’ve been believing that for the past 15 years. Remember, these guys won Morningstar’s fund of the year in that category twice, last time in 2013. They’re record in the private funds, before the two mutual funds American Value and Global Value were available in the mid 1990’s was even more incredible. Unfortunately it’s 2023 and that was the 70’s, 80’s, 90’s. I still like International Value and it’s all in a ROTH now, so if worst comes to worse, my heirs have until 10 years after I croak to hope it returns to it’s formal glory – it they can hold on.

As far as $SEQUX, that’s another issue. I jumped in the fund when it re-opened in 2008 after 26 years, expecting Goldfarb to at least give me something close to Ruane-like returns. But something happened when Cunniff was no longer director and passed away in 2014. Goldfarb and Co. just couldn’t seem to find the $FAST’s, $TJX’s and $ORLY’s of the world early on (they still hold the latter), and then the Valeant debacle (these guys should have had a subscription to Grant’s). Looking back at some old annuals I have from 96-2004, they never of course held any dotcom or even tech stocks in general. Currently , it seems that’s a good part of the of the portfolio, and Berkshire is pretty much insignificant. Would Ruane have ever held $NFLX, $GOOG, amd $META at all, much less at the same time. I kind of think not.

Simple but not easy

Correction, $ORLY is no longer in the fund

Way to challenge the value orthodoxy that is too often fixated on earnings multiples. Long-term interest rates are the key – and more so, I should say, expectations of long-term rates. The market seems to believe that inflation is under control. I have my doubts. If it turns out that inflation expectations rise, and LT rates need to rise in order to give bond investors a positive real yield, then we very likely go back to a world where 30x earnings is too much for any company, including Apple. That’s the risk these investors are trying to protect their investors from.

I tend to look at the components of the S&P500 index instead of looking at the index as an unchanging entity.

https://awealthofcommonsense.com/2017/07/the-biggest-stocks/

In the mid 2000s, the top components were industrials, energy, financials, etc. (GE, XOM, MSFT, C, PG, WMT, etc.).

Now the top 10 components are almost all tech (AAPL, MSFT, GOOGL, NVDA, TSLA, META, etc.).

The RoEs and incremental margins are quite different for 2023 companies vs. 2005 companies, and hence we should expect a valuation difference.

For some reason many value funds have not bought tech companies which has contributed to their underperformance.

I will also say that BRK’s outperformance is not just due to stock picking — it uses insurance float as leverage, so it could just be “levered beta” instead of alpha contributing to the outperformance.

I will also note that some deep value investors have done well due to stocks like DDS, GME, etc.These were very cheap on an optical basis and did get re-rated after covid (some due to short squeeze).

Interesting study!

From a pedestrian perspective, 13% (sequoia) unlevered returns since inception is certainly great achievement! BRK after all is operating at 2 to 1 leverage ratio since almost forever (effect of float is well documented in discussion).

I suppose IF just looking at returns of last 10 years vs S&P500 then the difference is shocking. If that’s the case, even BRK struggled on an ROE perspective during that time. And if the leverage is factored in, then even more so. Not to mention BRK’s returns are largely operating in nature, whereas funds are solely capital.

It’s quite hard to conclusively say whether results of the two example funds are due to quality deterioration per se, (sequoia has meta and google in portfolio and tweedy has goog) but your point is well taken.

I do observe that size of those position are small relative to the rest, whereas the market weighted S&P500 would mean those positions are large relatively. Which means perhaps it’s more of a sizing matter rather than lack of quality matter.

Another interesting way to compare performance would be to strip out Fangs’ performance from S&P500’s. Following article has some data points: https://www.nasdaq.com/articles/whats-the-sp-500-without-its-faangs

Rereading this almost two years later, I realized I reached a similar conclusion. For decades, Tweedy Brown managed most of my money. As their fees didn’t come down and, as the information asymmetry on which old school value investing was based, disappeared, I switched to more qualitative value investing. For this, I didn’t need mutual funds or ETFs. Find companies run by great capital allocators and buy reasonable price.