OK, so you guys can laugh at me. Having said what I said in the other post (you would have to sacrifice a lot to find a 10x P/E stock in a 20 P/E world), here are some really good companies for 10x P/E. I didn’t write the last post to set this one up or anything like that. As you guys know, I have followed these companies for years and have a high level of comfort, familiarity with them. Of all the industries I talk about, I am probably most comfortable with financials, since that’s where I come from.

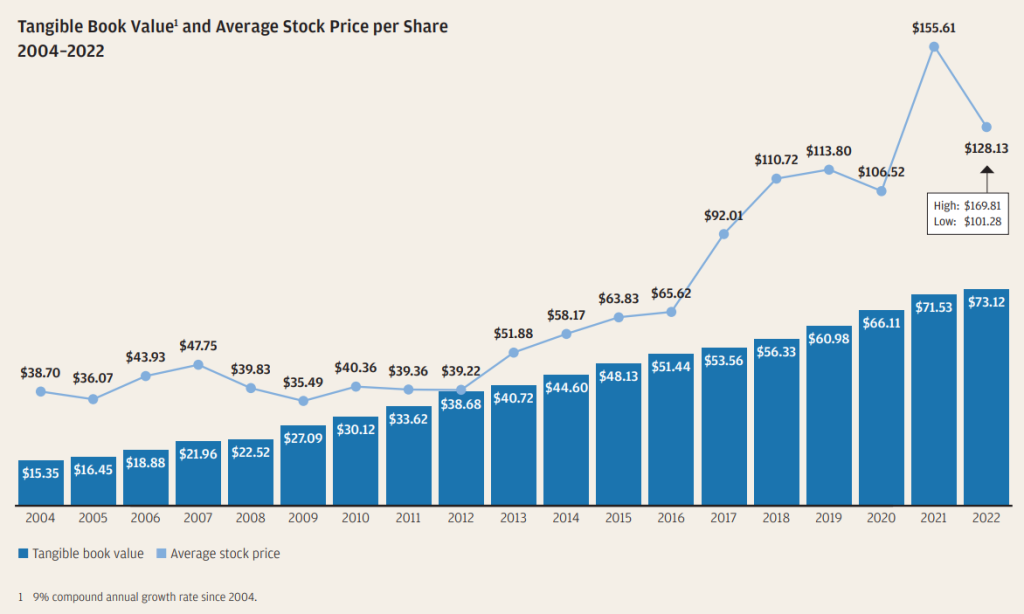

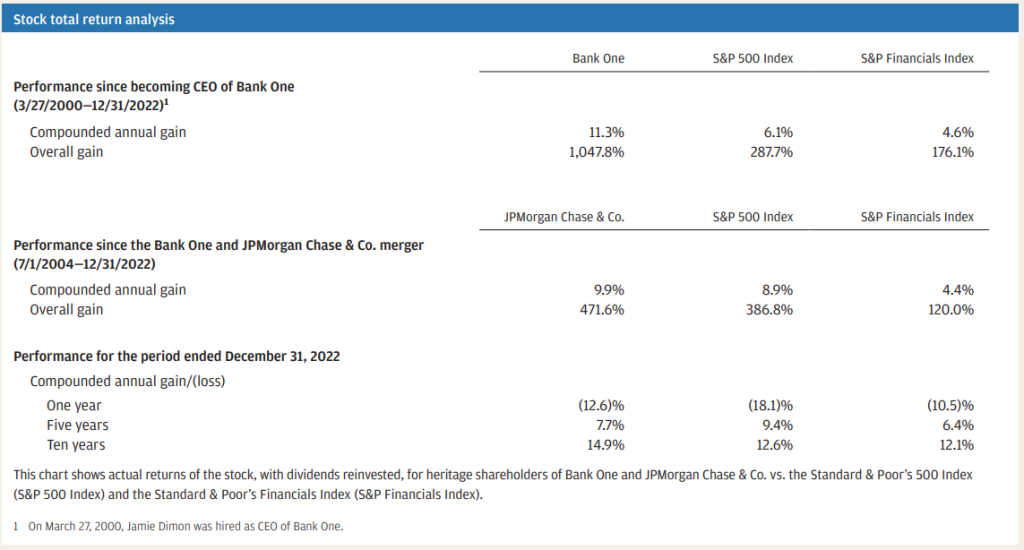

And for those who say value stocks have just been left behind because of the tech bubble, have a look at the 10-year performance of JPM. From JPM’s annual report, the stock has returned 14.9%/year in the past 10 years vs. 12.6%/year for the S&P 500 index. It has also outperformed nicely since 2000 and 2004.

And look at tangible book value per share growth since 2004 for JPM; 9%/year!

This amazing company can be had for 11x P/E. I know, it’s a bank / financial, and they don’t get great valuations, especially post financial crisis.

Also, I think people may worry about a post-Dimon JPM. I think it is well managed, and this is not a hedge fund or mutual fund, so you don’t need unique, one-in-a-billion talent to run it well. But it’s also true that Dimon is just really, really good. He has a really good shit-detector, and can smell risk from very far away. People who worked at Salomon Smith Barney way back when told me stories about how Dimon would just beeline right to someone on a trading desk and shut people down completely *before* things blew up. I heard about these things at the time, and everyone who came across Dimon thought he was really good. You can’t bullshit your way to holding onto bullshit positions or bullshit strategy. I worked in a department where we had some of those bullshit businesses, but management would typically not pull the plug until it blows up. Why? Because as long as it’s making money, people want to let it run, even if it really makes no sense. Their feeling is, let them do it, if it blows up, we just fire them. But take the money and shut up in the meantime. Dimon would never let that happen. This is why he has lasted so long, of course.

Yeah, Dimon had his tempest in a teapot moment, but that was a minor event given JPM’s size.

Also, these days, Dimon’s letter to shareholders are probably more important than even Buffett’s. Also, check out their investor day. It’s really a great company.

Oh yeah, and I’m not too into these macro analysis, but if you don’t know, JPM publishes a really good Guide to the Markets. Check it out. I browse through it now and then.

GS

Here’s another quality business trading at 10x (forward) earnings. I’ve written positively about this in the past, and Buffett owned a chunk for a while after getting a piece during the financial crisis. Back then, he said every bone in his body tells him that GS will make tons of money going forward. He has since dumped it. My guess is that he feels GS can’t make money like it used to post-crisis due to the new regulations. The quality of the people, I don’t think, hasn’t changed all that much.

OK, so the current CEO is getting a lot of heat, and their consumer banking business is not looking too good. But isn’t that sort of the time we value investors have to be looking at things? Sometimes stocks are most expensive when they are doing really well. But when you have temporary, fixable problems that may impact earnings, it can be a time to take a close look.

I don’t know how AI and fintech is going to impact this business, except to say that GS uses a lot of AI and tech. But investment banking doesn’t really seem to be an area that is being taken over by AI or iPhone apps. Same with Asset and Wealth management. Indexing and ETF’s already sort of did to active fund management what AI will do to other professional skills. And I don’t know that AI will ever outperform indexes and low cost ETFs.

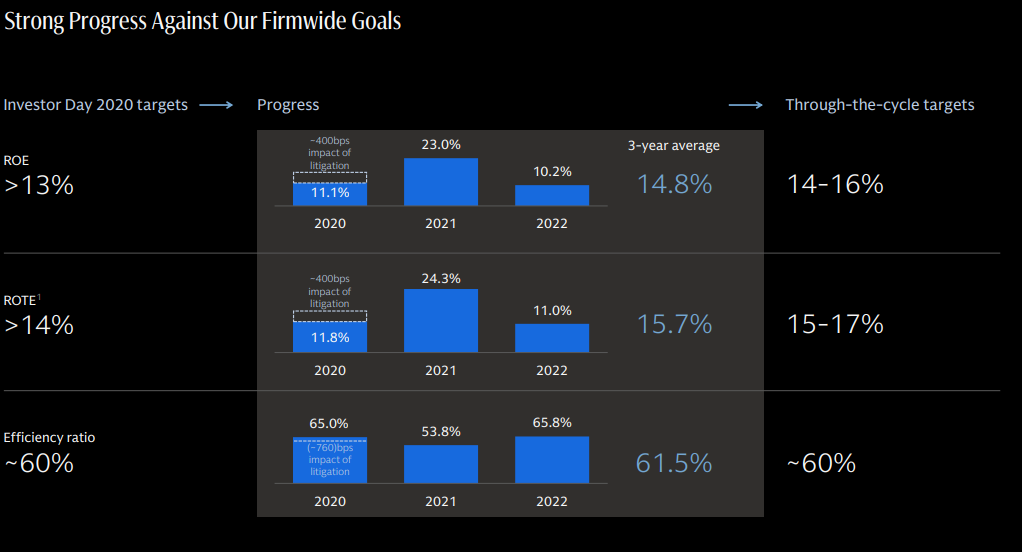

Anyway, David Solomon doesn’t seem to be on the level of, say, Lloyd Blankfein, but GS hasn’t been doing that terribly. From their investor day / annual report, check out some of these figures.

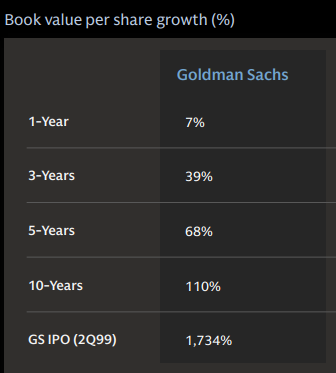

The above book value per share growth annualizes to 11.6%/year for the past 3 years, 10.9%/year for the past 5 years, 7.7%/year for the past 10 years and 13.5%/year since 1999.

And keep in mind that 2022 was a bad year; the market was down, with war, inflation up, bonds tanking, so it was sort of a stress test for the markets and financial industry and GS was able to make money and even earn double-digit ROE in that environment. There is no reason why they won’t be able to achieve their goals over time.

Similar to JPM, I’ve had interactions with GS people in the past, and even recently. I was out with a GS employee recently and I asked about the culture and whatnot, and he said it’s still exactly as I described it. I told him that in the old days, GS walked away with a deal very often because when GS did client visits, they did it as one team. They are still compensated for their contributions to the ‘partnership’, not for maximizing profits for their own department or desk. Whereas, at other firms, different departments did client visits separately and actually competed against each other, even dissing each other, explaining why, say, a client shouldn’t work with the equity financing division etc. I’ve also been sucked into bitter turf wars between departments, and it is really a stupid waste of time.

And whenever GS people quit and went to other firms, they were often shocked at how casual people were… During lunch, traders would gather around a TV set to watch sports or play games. At GS, there is no such ‘relaxing’; the vibe is to always be working. No putting up March Madness pools on the white board in the meeting room, no liars poker playing. No horsing around. Just work. Lunch time? Phones aren’t ringing as the market is slow? GS people still sit and work.

So they probably still have the smartest people around, and they probably all still work very hard (or at least when they are not DJ’ing). As I said in the past comparing, say, gold or bitcoin to a GS, if you own GS, it’s nice to know that the smartest people on the planet get up every morning and go to work (or work from home) and spend all their time trying to figure out how to make you richer. That’s not a bad feeling.

And the great thing here is that not only is this stock trading at 10x P/E, it’s trading at around book. OK, so that just means their ROE is not all that high right now. GS traded at over 2x book as recently as 2006-2007, but their ROE was 20-30% back then.

So this is not a story about buying something at book hoping it will trade up to 2x book. It’s more of a story about being able to buy something at book value when they have achieved, even in the ‘bad’ years, double-digit ROE, and management goal is a credible 14-16%.

With bond yields at under 4% and the stock market at over 20x P/E, being able to buy into something like GS, with the quality of their employees, management and culture, for book value, where they aim to earn 14-16% on that book, is pretty exciting, no?

I know some people still may have a negative image of GS from the financial crisis, but I personally never really had any issues with GS. Sure, the entire industry got carried away in various areas, but I don’t think GS was ever as evil as the press has made out (vampire squid).

Thanks and great to see you back! I think JPM is a good bet. some has talked about US banking system eventually look more like Canada with a few large banks which I think is fairly possible. So JPM should deserve at least the same if not more valuation as RY in Canada (1.7 price/book).

With GS, why do you think management is credible that they can achieve ROE of 14-16%? Maybe they have smart people but no-longer seem like the premiere place to work compare to PE or boutique IB. Love to hear your input.

Again, thanks for sharing your thoughts.

That’s a good question. A 14-16% ROE is certainly not a no-brainer for them, but they did achieve 10.2% ROE in a tough year, last year (2022), and their 5 year ROE averages 13.5%, so even on that basis, they are not far off. Looking further back, of course, post-crisis, there was a decade of really low ROE, but that kind of feels like a period when GS didn’t think the world changed and they were sort of waiting to go back to what they used to do… but now they seem like they are finally evolving.

But you are right that private equity (and hedge funds) is grabbing a lot of talent too, not to mention, of course, the tech world. There is a lot of competition for talent.

GS should be much more nimble than many other large banks / institutions, as their assets are primarily financial (and people), so not like banks that have to deal with many physical branches, lower level employees etc…

Oh yeah, and as someone just posted below, if GS does ever earn 15% ROE on a regular basis again, then the P/E is less than 7x at this price. But the more important point is that at this price, even if they don’t, and they only earn 10-11% ROE over the next few years, it’s not a bad investment at all.

Great post. GS does seem particularly cheap: if you pay 1x book and they can earn 15% ROE, that’s another way of saying you’re only paying 6.7 P/E. They might not earn that this year, but if that is an ROE that they can achieve, this is very cheap relative to that earning power.

Regarding moats: Chris Davis said it best: the great thing about banks is that “money never goes out of style”. Jamie Dimon talks about how in 10-20 years, there will be more money supply, more deposits, greater global market cap, revenues, earning power, deal volume, etc… and all of that will mean more raw material for banks like JPM to earn fees on. I think these businesses will be earning more money a decade from now.

Great to see you writing again!

JPM and GS are really good! Here are some other Financial Quality stocks with a „real“ PE under 10

– Assuming Fairfax Financial longterm ROE will be north of 9 per cent (Watsa aims for 15+per cent; in fact he has delivered 18 per cent over the full 35+ years), you can buy it at a PB Ratio of 0.9, so the PE is below 10. My best guess is a PE of 5.

– Markel shares can be bought at a 1.4 PB Ratio. Assuming a ROE of 14 per cent, Mr. Market gives it to you at a PE of 10

– Berkshires PB Ratio is 1.5, so assuming an ROE between 10 and 14, you‘ll get it at a PE of 11 to 15 (ok, that‘s above 10, you got me… But hey, it‘s BRK and it‘s not really expensive compared to the market plus Buffett is able to invest the free cash with a ROE above 10 . So just like MKL. And Fairfax pays just a low dividend under 2 per cent and invests the rest again at high ROE)

– Smurfit Kappa has an average ROE above 17 per cent and you can buy it at a PB Ratio of 1.7 (PE of 10)

– Fairfax India is a collection of companies with ROE far (far!) above 15 per cent and can be bought at a PB Ratio of 0.7. OK, you‘ll pay some fees to Fairfax Financial, but still, that‘s a PE of below 5.

Yeah, so pretty much what we’ve always been looking at; back to where we started. What do you guys need me for?! lol… But don’t worry, I have a lot to say about all sorts of stuff, so I will be around.

Commenting to subscribe to blog posts.

Hey kk- welcome back! Big fan.

Reading your thoughts, curious to see if you’ve looked into any of the ECIP banks. They’ve been a popular theme among micro/small cap folks on Twitter. Essentially government-funded overcapitalization of several community banks, some of which are better managed than others.

ECIP overview by Treasury here: https://home.treasury.gov/policy-issues/coronavirus/assistance-for-small-businesses/emergency-capital-investment-program

Some thoughts on CZBS, an ECIP favorite, from dirtcheapstocks here: https://twitter.com/dirtcheapstocks/status/1628501306158551040?s=20

A good public list of the ECIP banks and various measures here: https://twitter.com/eriksen_tim/status/1645875110749048845?s=20

Thanks! ECIP looks interesting. Is it really ‘free’? I haven’t looked into it. It seems like every few years, this area gives opportunities. A while back, there was the mutual bank conversion trades etc…

Close to free. This other writeup by dirtcheapstocks summarizes:

-https://drive.google.com/file/d/12pcz5FR4chXArz28rGYkqmqeV8Ra9T8S/view

-Infusion is non-cumulative perpetual preferred

-Dividend rate between 0-2% depending on how funds are deployed (in today’s rate environment, this is… very attractive)

-Treasury can elect up to two board members if # of div pmts are missed

-Treasury will transfer preferreds even in case of merger as long as acquirer is CDFI (community development financial institution) or MFI (minority depository institution)

-Preferred stock is considered Tier 1 capital from a regulatory standpoint (!)

-Treasury states that shares may be transferred at a price no less than 10% of the liquidation preference (implying that FMV is much lower than face value)

Worked at GS almost 15 years ago. Every single person I used to know at GS have left , that include many partners and MDs.. it’s not a pleasant place to work. It’s true people work much harder there , but that’s because the partners are Slave drivers and also keep bonus to themselves.

The positives things are they still have a culture of hard working and they got rid of many old guards.

Thanks for dropping by. I do remember back in the old days, GS was well-known for underpaying, but back then, the carrot was the eventual making partner; people will accept lower wage for an eventual partnership which will make them ‘made’, lol…

What you are saying sounds like AMZN too. Great company, does great things, employees work their asses off, but maybe not for everyone; not sure I would want to work in that kind of pressure-cooker environment… Same with a lot of other tech…

I will add WRB (though it’s trading at 15 PE) which is a long term compounder. And CASH (Pathward Fianancial) which is trading at forward PE of 7.x

Nice post, any thoughts on European banks?

No, I don’t usually follow European banks… sorry…

Great Post. I share your optimism on JPM and have the same concerns about the Key person risk i.e. Jamie Dimon. One of the things is all that is required for Dimon’s successor is to run the bank conservatively and the profits will continue to roll in.

Apropos to GS the only gripe I have about them is their direction on Consumer Banking is unclear and their core IB Business is volatile and JPM might have already over taken them here.

Instead of this WFC sounds like a better bet? Esp their earnings are quite understated and the asset cap might not remain at $2T for long.

Yeah, I was actually just looking at WFC. It is interesting for sure. And GS, I don’t worry about it as if consumer doesn’t perform, they will dump it etc… which might even make the stock pop.

Great post. My only issue with GS is how much pressure those at the top, particularly, DJ has on “meeting their targets.” I feel like this could bleed to their marks on their books, risk appetite, provisioning, etc. in order to “make their numbers.” I think that’s a red flag.

Their blow-up in consumer with markdowns in Greensky, Apple, etc., was another red flag.

The partner level departures have also been very unsettling as well. I do think those are very real risks to the place—much moreso under DJ than the old guard.

So nice to see you are back.

Why is the most important metric for a bank is the growth in book value?

Isn’t book value less relevant in the data age?

What other metrics you might look at?

Bank of America and Schwab looked cheap a few months ago.

Thank you again for great writing always,

Ran

Good question. Book value matters far less in the digital age, like when looking at, say, GOOG. But for banks, their assets are pretty straight forward and have clear value (cash, loans, treasuries securities etc…), so it is still a good measure, I think. At least compared to non-financial companies, tech companies etc.

Other metrics are the same as usual, ROE, free cash generation, growth etc…