Sometimes, the next Chipotle is, well, Chipotle. Or the next Microsoft is, Microsoft. I know we’ve spent a lot of time here looking at future BRKs, but sometimes, the next X is just X.

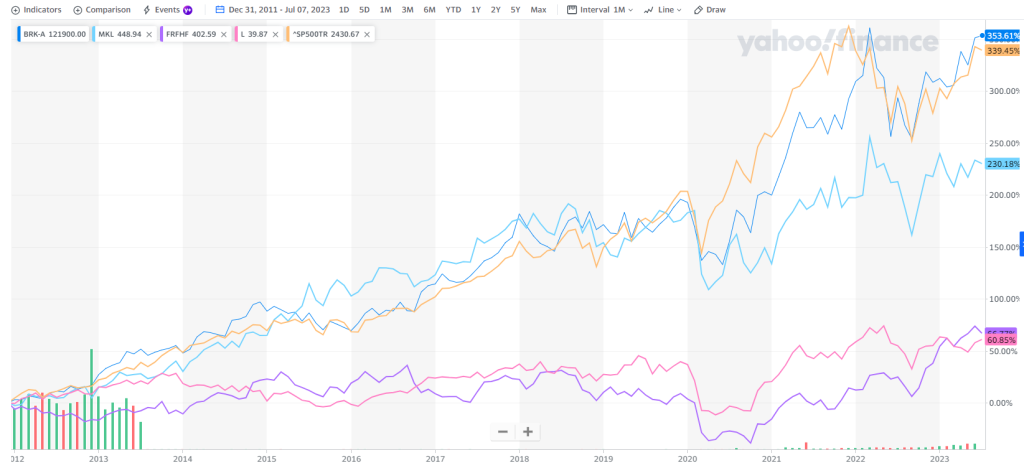

This blog started in the fall of 2011, I think, so let’s just look at some of the Berkalikes and how they’ve done since then. I used December 31, 2011 as the start point; this is the first date I chose so didn’t cherry-pick. And check it out, the only one who has been outperforming the S&P 500 total return index since then is BRK! It turns out you would have been better off just owning BRK instead of switching over to something smaller and presumably much more nimble. (FRFHF and L had some dividends, but probably won’t affect this chart all that much).

The Next Chipotle

Anyway, I am not a restaurant specialist or anything, but I do love following restaurants, and I have done well with CMG. I have owned it for a long time, and I am also a sucker for anything fast casual. I love checking out new restaurants in that category, and of course, if there is a stock listing of a fast casual shop, of course I will look at it. My kid used to bug me about Sweetgreen (SG) all the time as he used to have it for lunch just about every day. But as much as I try to justify high prices here, I usually don’t do money losing businesses, unless there is a clear path to profitability (I only bought AMZN after AWS).

I remember a while back, people were talking about Noodles and Co. (NDLS) as the next CMG, and there was a little bit of a connection there; I think some former CMG employees went over to run it. Of course, first chance I got, I went to one and tried it out. But in this case, it was obvious this was not going to work. I liked it, and it was OK. But the menu was sort of scattershot and didn’t really strike me as interesting. But the worst of it was the model.

As much as they wanted to make it feel like the next CMG, here was the problem. You go to the counter and you order your food. Then, you have to go sit down and wait for your food. I was stunned when I looked behind the counter that they only put the pasta into the pot after you made your order, which means that you are going to have to wait at least 5-8 minutes until the pasta is done, and then you get your food. OK, so with some types of ‘fresh’ pasta, I suppose you can cut that down to 1-3 minutes. But still, I knew right away they are not going to get anywhere near the unit economics of CMG doing that. Remember, the key to CMG’s unit economics is throughput. They can get so many people through the line so fast that it was amazing to watch during their peak years (I assume they are back to peak performance again lately). Well, Five Guys and Shake Shack are similar in that regard, you have to wait for your food, but it seems to work for them (even though I have no idea about the economics of Five Guys, other than that it’s mostly franchised).

CMG never made the best burritos. I know some local places that make way better burritos, but the problem is, you go to the counter and order your food, only then does the guy behind the counter put your meat on the grill. Well, that’s why it’s going to be better, but it’s going to be slow. And they are not going to go through a line as fast as CMG can.

Now, with NDLS, you had a scattershot, unfocused menu where you didn’t know what to make of it, and then you had this really slow process. I guess when you try to please everyone with a menu, you end up pleasing nobody. I also remember the really complicated menu at Qdoba a while back.

Needless to say, in this case, you were better off just buying CMG instead of the “next CMG”. Anyway, I don’t mean to suggest I can go into one restaurant in a chain and be able to tell you if it’s going to work or not, but this was not that hard a call.

CMG vs. NDLS since NDLS IPO

CAVA

OK, so where is this going? I happened to come across CAVA only recently, and the food was really good. The service was not so great as it was really slow and people had to keep going back into the kitchen to get things. I think that might be because they just opened and it was not during a busy time. But the food was good, and I had no idea that an IPO was imminent for the company. When I saw that they did an IPO the other day, I was very excited. This is certainly a name that if you were a big institutional investor, you would have definitely asked for a piece of it (so you can at least flip it on the first day… which, actually, you may not be allowed to do; if you did, you won’t get the next hot IPO).

Of course, IPOs are not usually places anyone would go to look for value, and I don’t usually read a lot of S1s, unless it’s in a sector / industry that interests me. Then I would read it as there is often a lot of useful information in them even if you are not interested in the offering.

Anyway, the normal way to value these things is to just look at how many stores you think they will be able to grow into, figure out their margins, eps, slap a P/E ratio on it and then discount it back to now. I will leave that to analysts to do, but here, I will just make one simple observation.

First, since people keep saying this or that is the next CMG, let’s just look at the whole history (or most of it) of CMG and see how it has grown and evolved over time.

Chipotle Historical Data

| Revs | G&A | Op inc | net | EPS | # rest | Stock price | market cap | op mgn | p/s | p/e | fwd p/e | |

| 2001 | $131,598 | $20,687 | -$24,722 | -$24,000 | -$1.49 | -18.79% | ||||||

| 2002 | $204,645 | $25,803 | -$17,632 | -$17,289 | -$0.87 | -8.62% | ||||||

| 2003 | $315,520 | $34,189 | -$7,935 | -$7,714 | -$0.34 | -2.51% | ||||||

| 2004 | $470,721 | $44,837 | $6,106 | $6,126 | $0.24 | 401 | 1.30% | |||||

| 2005 | $627,695 | $51,964 | $30,994 | $30,240 | $1.43 | 481 | $22 | $580,228 | 4.94% | 0.92 | 15.38 | 17.2 |

| 2006 | $822,930 | $65,284 | $61,952 | $41,423 | $1.28 | 573 | $57 | $1,850,505 | 7.53% | 2.25 | 44.53 | 26.8 |

| 2007 | $1,085,782 | $75,038 | $108,183 | $70,563 | $2.13 | 704 | $147 | $4,872,462 | 9.96% | 4.49 | 69.01 | 62.3 |

| 2008 | $1,331,968 | $89,155 | $124,039 | $78,202 | $2.36 | 837 | $62 | $2,055,052 | 9.31% | 1.54 | 26.27 | 15.7 |

| 2009 | $1,518,417 | $99,149 | $203,705 | $126,845 | $3.95 | 956 | $88 | $2,824,976 | 13.42% | 1.86 | 22.28 | 15.6 |

| 2010 | $1,835,922 | $118,590 | $287,831 | $178,981 | $5.64 | 1,084 | $213 | $6,759,555 | 15.68% | 3.68 | 37.77 | 31.5 |

| 2011 | $2,269,548 | $149,426 | $350,562 | $214,945 | $6.76 | 1,230 | $338 | $10,739,950 | 15.45% | 4.73 | 50.00 | 38.6 |

| 2012 | $2,731,224 | $183,409 | $455,865 | $278,000 | $8.75 | 1,410 | $297 | $9,439,551 | 16.69% | 3.46 | 33.94 | 28.4 |

| 2013 | $3,214,591 | $203,733 | $532,720 | $327,438 | $10.47 | 1,595 | $533 | $16,672,773 | 16.57% | 5.19 | 50.91 | 37.7 |

| 2014 | $4,108,269 | $273,897 | $710,800 | $445,374 | $14.13 | 1,783 | $685 | $21,585,720 | 17.30% | 5.25 | 48.48 | 45.4 |

| 2015 | $4,501,223 | $250,214 | $763,589 | $475,602 | $15.10 | 2,010 | $480 | $15,117,120 | 16.96% | 3.36 | 31.79 | 623.4 |

| 2016 | $3,904,384 | $276,240 | $34,567 | $22,938 | $0.77 | 2,250 | $377 | $11,223,290 | 0.89% | 2.87 | 489.61 | 61.1 |

| 2017 | $4,476,412 | $296,388 | $270,794 | $176,253 | $6.17 | 2,408 | $289 | $8,254,129 | 6.05% | 1.84 | 46.84 | 45.8 |

| 2018 | $4,864,985 | $375,460 | $258,368 | $176,553 | $6.31 | 2,491 | $432 | $12,079,584 | 5.31% | 2.48 | 68.46 | 34.9 |

| 2019 | $5,586,369 | $451,552 | $443,958 | $350,158 | $12.38 | 2,622 | $837 | $23,682,915 | 7.95% | 4.24 | 67.61 | 66.9 |

| 2020 | $5,984,634 | $466,291 | $290,164 | $355,766 | $12.52 | 2,768 | $1,387 | $39,412,992 | 4.85% | 6.59 | 110.78 | 60.6 |

| 2021 | $7,547,061 | $606,854 | $804,943 | $652,984 | $22.90 | 2,966 | $1,748 | $49,837,228 | 10.67% | 6.60 | 76.33 | 54.6 |

| 2022 | $8,634,652 | $564,191 | $1,160,403 | $899,101 | $32.04 | 3,187 | $1,387 | $38,921,994 | 13.44% | 4.51 | 43.29 |

The important thing to note here is that CMG didn’t get solidly profitable until they had over 400 restaurants. CAVA only has 263 at the end of the 1Q, and SG has 186. So expecting them to be profitable soon might be asking a lot. All restaurants are different, so maybe this is not correct, but looking at this, that’s what I would conclude. A company as well-managed as CMG was able to turn a profit only at around 400 restaurants. And then look at the trend in the market cap. SG has a market cap of $1.7 billion and CAVA is at $4.6 billion after doubling their IPO price on the first day. This is very rough as I am only looking at year-end prices, but CMG didn’t get to a $2 billion market cap until it had 700 restaurants. You can look at the table to see where CMG was at these various market caps.

Show Me the Money!

But one thing that strikes me from looking at this CMG table is that it is OK to wait for profitability before investing. CMG didn’t turn profitable until 2004, and they had their IPO in January 2006. Even if you didn’t get the IPO price and you bought in at the end of 2006, you would have bought in at $57 and would be sitting on a nice return. At the end of 2006, CMG was profitable for a full 3 years. Maybe this just means SG and CAVA IPO’ed too early, I don’t know. But this is what I would look at. How will they perform getting up to and past 400 stores etc. CAVA seems like they are doing well as their restaurant level margins are up to 25% while SG is not doing so well on that metric. Of course, like many others, I look at SG and think, well, it’s just salad. But people said CMG was just a burrito and SBUX is just coffee, so I am careful about making statements like that, of course.

But I’ll let them prove to me that there is something there, and there is absolutely no rush. It is OK to wait for these things to turn profitable, and even wait for them to get on a solid track before touching the stock.

One other thing about CAVA is that I don’t know why Zoe’s didn’t succeed (OK, I just Googled a little bit and it seems like they made a lot of mistakes, debt-funded too-fast growth etc). It was listed so the SEC filings should still be there, so maybe I will have to browse through those filings to figure out why that didn’t work. I remember when that came out, the concept was exciting to me, but there were no restaurants near me for me to check out, so I couldn’t touch it or do anything with it.

Also, we have to keep in mind that during these early years at CMG, they were pioneers in this concept, so they had it all to themselves. Now, if you walk down the street, there are so many decent-looking fast casual concepts opening (and closing) all the time, and fancy, upscale food courts everywhere. So the space between cheap fast food and sit-down restaurants is filling up pretty quickly, which will make it harder for the likes of SG and CAVA for sure, compared to CMG.

Anyway, this isn’t really much of a post for a value investing blog, but we all have some stuff in our portfolio that really don’t fit the conventional value mould so I will write about them sometimes (I don’t, but I bet some of you own bitcoin but would never admit it!).

i think it’s a great post for a value investing blog. if they build out a lot of units successfully, it will probably work very well (assuming you pay a price that doesn’t make it a poor return even assuming a lot of success, which imo the current valuation does). low multiple of current earnings power does not mean value and high multiple does not necessarily mean bad value. need to visit a cava, i’m intrigued. but as you point out, CMG was valued at $2bn when it had 700 stores. well more than double that at an earlier stage seems like a tough putt to me.

https://sabercapitalmgt.com/calculating-the-return-on-incremental-capital-investments/

Saber talks about CMG

Regarding mini berkshires, I’ve come to the same conclusion over time. I invested in L for several years in the early 2010s and it always seemed cheap, management was always buying back stock, and the sum of the parts story always seemed compelling but there was no growth and the quality of the assets were far inferior to Berkshire. I owned Markel for well over a decade starting in early 2011 and still really like management but no longer can justify owning the stock. Berkshire is just unique in the quality of the businesses and Buffett and Munger just keep going, and I think Abel will have a good run ahead of him. What happens 10-15 years after Buffett dies is more of a concern when all his shares are converted to B and given to foundations. I am more concerned about ceo succession from Abel to the next ceo, maybe in the late 2030s or early 2040s. Anyway, always good to read your thoughts and glad you’re posting again.

Just as a coincidence I bought BRk, Markel and Fairfax big in October 2011 and hold them until today. In fact those three made up 50 per cent of my portfolio back than, with MKL and Fairfax just as big as the other and BRK double that amount. In fact I bought more MKL over the first years, step by step, and over the last year I switched a lot from BRK to Fairfax, but I still hold MKL, as I have some reasoning why BRK outperformt MKL and why I Thibk they will iutperform going forward:

– MKLs ROE was and is way more tied to interest rates than BRK. In relation to equity the float is way bigger than at BRK. So of course in a 0 per cent world MKLs ROE got hit harder than BRK ( see my other post here)

– Look at the chart above: Until Corona popped in, MKL and BRK went more or less parallel. With Corona popping in my best guess is, that more people were looking for a safe harbour. My dads bank told him two years ago that they now recommend BRK too their clients.

– Growing interest rates have two effects on bonds: First you loose ewutiy, as all your long running bonds go down in price. But than earnings grow over time, as year after year you get higher interest rolling over your bond portfolio. Of course MKL is hit harder zhan BRK at the beginning (in fact MKL euqity went down last year!) – but at the same time MKL will profit way more than BRK. They have 3 times (or so) more bonds per equity.

– Look at Markel ventures: From 2008 to 2012 the revenue of wholly owned businesses summed up to 1,136 dollar, from 2018 to 2022 to 15,168 dollar. And earnings popped up from 133 to 1,710 dollar in the same timeframe.

– Gross written premiums were 13,200 mn dollar in 2022 and it‘s growing really strong even in q1 2023 (16 per cent or so). CR was 92 in 2022 and 90 in 2021. They earned 1.3bn dollar in those 2 years with underwriting profit alone. And float is growing… Isn’t that amazing for a company wither 18bn market cap?

Have you been reading the shareholder letters of the last years? It‘s really eye opening.

All good points. Yes, I have been keeping up with MKL letters, and it is always a good read. I may write some about these names in the future.

Markel has made some serious mistakes. They spent a lot of money on ILS businesses, overexposed to equities, and eventually had to issue preferred stock to backstop their capital. Do you believe Buffett would ever be compelled to issue preferred stock?

Yes, they were wrong sometime, but who wasn‘t? Buffett bought Berkshire. An old textile mill. Recently IBM and Precision Castparts weren‘t so good. And don’t forget: He‘s an Airoholic.

Watsa bought deflation hedges as an insurance against a black swan event (and hadn’t needed it as we know today). Buying big into Blackberry wasn‘t really brilliant.

But still Watsa managed to grow book value with an cagr of 18 per cent per year, better than MKL and both got higher growth than Buffett since their inception in 1986 (and they are ahead over this 37 year timeframe. Think about that for a moment. 37 years. In five years MKL and Fairfax will be at the stock market for two thirds of the time since Buffett overtook Berkshire in 1965).

Yes, „don‘t loose money“ is important. But if you want to bring this risk (nominal) to zero: Buy bonds and never equities! But there‘s a reason why Buffett took that risk and bought businesses as a whole or in parts and not only bonds (as so many insurance companies).

Don’t get me wrong: I am a fan of Buffett. BRK and MKL are head to head my 2nd and 3rd biggest positions. Both are around 15 per cent or so.

But do we really get the big picture when comparing, what one made wrong here and the other there? Of course it’s interesting and helpful to see, how one reacts, when doing a mistake. Does he learn? But so we get the big picture doing this? And isn’t it even a mistake to look back to the low and zero interest rate times and think, that that‘s a good timeframe for an analysis who of the three has been best in class – extrapolating that into the future? Brooklyn Investor made a nice table comapring MKL, BRK and S&P500 in 2015: http://brooklyninvestor.blogspot.com/2015/03/markel-2014-annual-report.html?m=1

I mean in the first 21 years (and more; but that’s from inception to 2008), both MKL and Fairfax have handily beaten BRK. Now they are behind BRK over a 10 years timeframe. Does that mean Gayner and Watsa lost their touch, when getting into their sixties?

Here‘s another way to think about it:

MKL has two or three times more float per equity than BRK, and Fairfax has something like 10 times more float per equity than Berkshire has (I might be wrong with the exact numbers, but still think, that’s roughly the big picture). In fact Fairfax has nearly double the amount of float than equity, MKL around 50 per cent (might be 60 or 40, but still) and BRK around 20 per cent.

The time since 2008 regarding those three was like watching a car race with three handicapped cars. One called BRK with one broken turbocharger, one called MKL with two broken turbochargers and Fairfax with four broken turbochargers. And before the turbochargers broke, BRK was way behind most of the time. Now, with Buffett, Gayner and Watsa all driving with broken turbochargers, Warren won. To me that shows the excellence of Buffett, winning that race; no question. He’s a perfect driver. He’s THE driver. BRK is way bigger etc. And he won. Applause!

Still I think the worth of such an analysis is limited when you want to know who‘ll win the next decade. All three will drive faster when (or: if) the turbochargers are repaired; but with different outcomes as the extra push will be different.

Of course interest can go back to zero (turbochargers can get broken again). Still MKL and Fairfax might have won the races of year 1, 2 and 3 out of 10. And don‘t forget: The drivers MKL and Fairfax might have learned something in the races of the last decade, when driving with the broken turbochargers.

In the end all three entered 2008 with a cagr of over 20 per cent per year since 1986. All of them were beating the market big over full cycles until interest disappeared, but none of them managed to beat the markets cagr within the last decade with say 4 or 6 or 10 per cent. And look at Brooklyns article from 2015; MKL was ahead 10 per cent/ year against the S&P500 and over 5 per cent against BRK over the 16 years since 1999 – and against the S&P500 even 10 per cent per year over the 29 years since inception. And the reason is obvious: for the first time since 1986 (and since 1965) float was nearly worthless, no „cost-free“ leverage. Insurers with combined ratios a bit below 100 and organic growth under 4 per cent or so loose a lot of steam with interest at or near zero.

Will interest stay high or at least be above zero? Who knows. But if, insurers might be the winners; and the higher the rates, the harder for BRK to beat MKL and Fairfax.

Coming back to your points regarding MKLs mistakes: Anyway Buffett himself seems to have gotten a fan of Gayner as MKL is within Buffetts portfolio since some quarters. And by the way Fairfax was over a lot of years (within the 2010s or so – might be wrong) a big stock within MKLs portfolio. Of course BRK is one of MKLs biggest position since at least 2011; sometimes behind Fairfax if I remember correct. So there are connections between those three.

Just as an update: Fairfax is up above 15 per cent within the last 1 or 2 month or so and 35 per cent this year. What fascinated me: They delivered just what one would have to expect in q2 with so much leverage as they have. It was all there since the annual report came out. Nothing new. But still Mr. Market seemed totally excited and overwhelmed that day when q2 came out.

Thanks. Yeah, I may have more to say about various related issues in the future…

Thank you for this great piece again. Regarding Fairfax the CAGR since 1986 is 16.1 per cent (shareprice) and 17.8 per cent (book value). The difference between those CAGRs alone in my eyes is a signal, that Fairfax is cheap at present, as long as they compound book value at similar rates. I just checked the CAGR of Berkshire since 1986: It‘s 13.8 per cent (stock price).

I totally see the point, that more often than not the original often is the better choice and we only thought we found the same company idea, but smaller with the same ingredients… But they don’t turn out to be like this. I had that with L too.

Nonetheless there are exceptions of course. And Fairfax (and I am pretty sure Markel too) have beaten Berkshire over neay 40 years now; if Berkshire wouldn‘t exist THEY would be the originals and we would try to find the smaller versions of them.

To me there‘s an inner logic, that it‘s more easy for BRK to beat the Berkalikes in a time, where interest was so low. MKL and Fairfax have way more float in comparison to their equity than Berkshire. Mkl about 50 per cent float and Fairfax 200 per cent of equity; and at Berkshire it‘s about 20 per cent or so, so Fairfaxs „bond hedge“ is 10 times that of Berkshire.

Hi kk,

As a long term part owner of Chipotle how did you deal mentally and actually with what happened with the company in the years 2016-2017? What made you decide to stay invested with the company?

Oh, that was rough, but I actually bought some back then too. I think I lightened up some before that. I think that was an easy case of seeing that it was temporary. It was rough going, though, but not hard to see. One of the hints I got was that a lot of the ‘cases’ that kept getting reported were old ones that made the news as if it just happened. They did complain about that during conference calls. So the public thought it just kept happening, whereas it was actually old cases being reported; an article would appear about something that happened months ago, and the stock would plunge as if it were a new case that just happened etc.

A broader point (secular change) about fast casual:

Fast casual, done well, has food quality almost as good as a sit down restaurant (much better than fast food). But the cost ratio, to the consumer, between fast food/fast casual/inexpensive sit down is perhaps 1.0/1.4/2.0. However, you then have to jack up the sit-down for the expected tip of around 18+%, so, post-tip, you’re at something like 1.0/1.4/2.4.

But since:

1) ~Everybody pays by credit card now

2) Fast casual is ~all order in (for takeout or dine-in)

3) ~All fast casuals try to guilt you in to 18%+ tips for counter service

Whereas

4) Fast-food is mostly drive-thru

5) ~No tipping pressure on drive-thru, and minimal if any on counter service at fast food

So now, the price ratio is 1.0/1.8/2.4

i.e. Tip pressure (new since ~2020) at fast casual narrows its price advantage against sit-down, and widens the gap vs. fast food.

I wonder if this will diminish the appeal/growth of fast casual?

Will fast food try to move up market a little to take advantage of this?

Taco Bell tried to go up market ~5 years ago to compete with CMG, but since seem to have abandoned this, and if anything gone back in the opposite direction – lots of over-cheezy, low-end stuff. Maybe there’s a hole in the market there for a better version of Taco Bell? Just as Culver’s is a ~better McDonalds in the burger space…

All interesting points! I have no idea, actually, as I tend to really focus on what I find interesting and like, but don’t really comprehensively try to cover the whole industry etc… Well, if I can use it as an excuse to eat junk food (fast food), I do it when I can, lol…

I don’t remember, actually, being nudged into tipping at CMG. Maybe others do it. I have tried some really great fast casual concepts, but I think the trick is for any of these to be able to scale it like CMG was able to do. Most won’t be able to do so… Even CMG couldn’t get their Asian Shophouse to work. I loved it (well, not great, but for me, ‘good enough’), but they said they couldn’t get the economics to work, so that’s often the hard part.

I am not sure if fast food can move up market to take share from fast casual, as people who refuse to go to MCD is not going to start to go even after they started using fresh meat (instead of frozen). It’s just a totally different feel and vibe.

The bigger risk to fast casual is just other fast casuals popping up all the time, probably. Someone on CNBC said the other day that fast casual is already overcrowded, and that CAVA, for example, basically has no chance to succeed… I thought that was a bit harsh, but he is an industry analyst that spends his days researching this stuff (while I do not), so he may be right.

Anyway, it’s a fun industry to play around in as we get to eat and call it “work”, lol… that’s what I tell my wife, anyway… I have to kick the tires and do research…

My post-tip ratio math was a little off – probably closer to 1.0/1.7/2.4

McDonald’s may not move upscale, but potentially others (new entrants and/or regional chains moving up the ladder can). Culvers has a pretty strong offering in the Burgers ‘n Fries segment. (Though, per usual, their fries are inferior to McDonald’s, but Culvers has quite good, and presumably unhealthy, cheese curds).

I mentioned that I think there is room for fast-food that’s above Taco Bell, but below CMG/Qdoba. Probably catering more to the drive-thru crowd than the light dine-in/take-out of CMG. But, I’m not aware of an ACTUAL chain in this space. Then again, I’m not in the Southwest – maybe the contender is developing there now and will roll out more broadly in years ahead.

Upscale sandwiches, via a drive-thru, seems possible, but most sandwich places seem to cater to at-the-counter service, so you can see your sandwich being made, specify changes, etc.

(Above post was me – didn’t notice could post anon)

It will be interesting, from both a business/investment perspective, and a social/personal one, where the new craze for tipping on many counter-service transactions ends up.

My teen-age daughter is working this summer at a sandwich shop (small local chain), which tip-splits the CC tip-nudge $$$. She was making something like $18 hour with the tips, which seems a lot for a sandwich shop in a MCOL area.

Even conventional sit-down restaurants have this issue – ate at a good, but upscale BBQ sit-down, and the waiter spent maybe ~7-8 minutes total, servicing our table (over the course of the meal). Presented a CC device for me to pay on which nudged me with the usual high-end tip %s. I think I manually lowered it to 15% which was still a ~$30 tip. A good waiter might juggle ~6 tables at a time – even adjusting for slower times, smaller tickets, the per-hour rates seem grossly excessive – this wasn’t a Michelin 4-star place.

More broadly, when tip expectations/pressures get excessive, there seems to be a case for business arbitrage in providing a similar level of service in a context where tipping is not expected. This was probably at least part of the reason for fast-casual’s initial success, and the shift in tipping expectations may shift the marketplace again.

And, FWIW, my one time eating at Noodles & Co – I shared your impression that it didn’t really have an interesting theme. Didn’t notice the wait time, just the unimaginative, unevocative menu.

I think Panera went downhill when it started offering pasta. Good bread (originally) set up good sandwiches. And good salads doesn’t seem much of a stretch for a sandwich shop. But pasta is a whole different thing. Unwise brand extension, IMO.

I agree that CMG’s limited menu is more appealing than Qdoba’s overreach. That said, my young adult daughter loves Qdoba, preferring it to CMG for the nachos with queso. Expanded menus give you more chances to hit niche consumers, but tend to lower the quality and focus, overall.

Hardee’s (fast food) at one point tried to sell fried chicken (bad). Also tries to sell Mexican lately (Red burrito co-brand). Also bad. Just sell the best burgers you can, a bit of chicken sandwich/strips, and, if you’re feeling frisky, maybe a large beef hotdog or the like.

Oh yeah, I used to love Au Bon Pain… soup and sandwich was great, as there was one nearby. And then that founder went on to build Panera, and at first I really liked it, but it was sort of on the expensive side, and also, the service was kind of terrible… at least the one around here, it took forever to get your food, and sometimes they just lost your order. But that was years ago… So they had all sorts of issues like that. You may be right, maybe pasta threw them off.

Love Cava. Used to go to the original in Rockville all the time.

You should check out The Science of Hitting’s recent post on Cava

https://thescienceofhitting.com/p/cava-the-next-chipotle