Crazy!

It seems the market is going crazy, as usual. So I decided to do something I haven’t done in a while; look at the Dow 30 stocks and their P/E ratios one at a time. Averages often don’t always tell the whole story, but looking at a list of individual stocks can give you an idea of what’s going on.

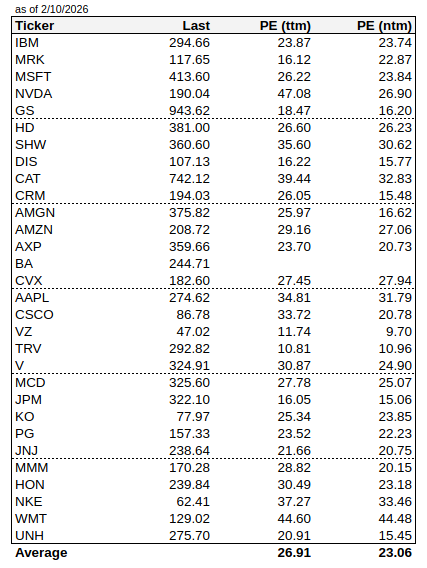

The DJIA P/E is 24.7x (ttm) and 21.1x (ntm), and for the S&P 500, they are 25.2x and 21.8x. With 10-year treasuries in the low 4%, it is totally normal and reasonable to me. I would bet Buffett would say the market is in a “zone of reasonableness”. The following is the list of the Dow 30 and their ttm and ntm P/E ratios. I excluded BA because it’s ntm P/E is like 6000+, and it makes the average P/E meaningless. Accuse me of manipulating data; that’s fine with me. Since I just did a simple average, the number differs from the index P/E that I grabbed out of the WSJ. To make it comparable, I would need to price-weight it, but I won’t bother.

Dow 30 P/E

Here’s an interesting thing to look at. We know that Buffett is price sensitive and will sell things when they get silly. I actually think the sale of AAPL and the current huge cash position is just a function of rebalancing the portfolio as AAPL just got way too big. I know he says he doesn’t do that sort of thing, but he does adapt to reality and will do things even if he says he wouldn’t (bought Apple after years of saying no tech!). The fact that he still left AAPL as the largest holding suggests that.

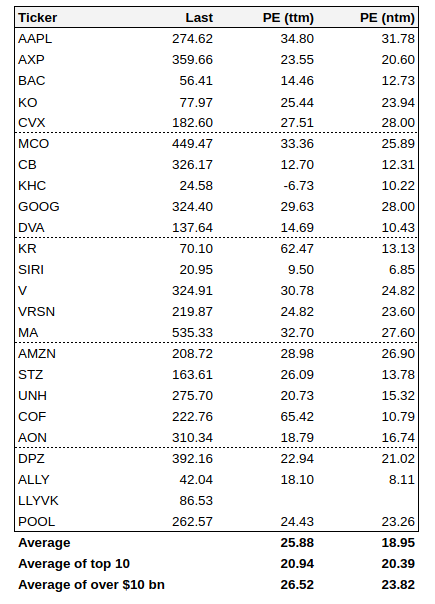

BRK Holdings P/E ($1 bn+ positions)

It is interesting because if you look at the P/Es of BRK holdings, they are not that far off from the market itself. For all positions exceeding $1 billion (based on September 2025 positions), the ttm and ntm P/E’s are 26x and 19x repectively. So, yeah, forward earnings is definitely cheaper than the market, but if you look at the top 10, forward P/E is 20.4x and for positions over $10 billion, it’s 23.8x, not so far off, if not higher than the market itself.

I know Buffett/Munger have said the hurdle is higher to want to sell stock because you have to pay taxes on it and the return on the alternative has to be good enough to make up for that. But if things are crazy and absolutely certain to go down or have very low returns over the long term, there is no doubt he would sell.

Given this, if something is good enough for Buffett to own / hold now, that is telling us something. It doesn’t mean Buffett would buy at these prices. At the very least, he is telling us that these stocks at these prices are certainly not overpriced tulips.

Looking through this list, there are some interesting ideas, like CB is cheap, isn’t it? This is not the old CB that we all used to know due to the 2016 ACE deal, but it may be worth a look. I know many of you have been following it, probably, because it’s an insurance company, and it is an often rumored BRK acquisition.

As an aside, one regret for me is MCO. MCO was a villain during the financial crisis and it was toxic. It is very interesting that Buffett never sold it. I noticed then that the damage to its reputation was mostly limited to the structured products area. Their core bond rating business didn’t slip down that slope of selling ratings for cash, or at least to the extent that it did in the structured area. All the bad ratings and loss of credibility was in MBS, CDOs, CLOs and things like that. So even then, I had a feeling that over time, they would recover based on that core business as it was obvious even back then that debt issuance around the world will just keep growing. I have not been following this closely, but I should have been, especially since the financial crisis as I did have that clear variant view. I’m not sure why I didn’t act on it. Well, it’s true that I did pile into JPM (at $20!) and things like that, so it’s not like I didn’t do anything back then.

But here’s another way to think about this. BRK owns MCO now at this valuation, and it’s not like it has supercharged growth. Is it a stretch to argue that if Buffett is fine owning things at these levels, that we can’t be looking at other companies at similar valuation levels? Is 25-30x P/E so bad? I personally am not averse to these valuations, as you know, since I have been saying 20-25x for the market is totally fine. But it’s just some food for thought.

AI Insanity

I am reading the same articles you are, about all this capex going into AI. And yes, I am getting a little nervous too. I haven’t listened to the recent tech earnings calls yet, but for some of the big guys like GOOG and AMZN, the good thing is that as they invest in data centers, they can use this for their own business too. If you are OpenAI or other AI company that is investing massive amounts for a single purpose and it doesn’t work out, that is much riskier to me than a hyper-scaler investing as they can redirect capacity to various other lines of businesses or use it internally. But, I agree, some of these numbers are getting huge. I don’t know how this is all going to end. AI evangelists will tell you it won’t end for a very, very long time, as it is just incredible what it can do.

I’ve had people show me stuff that looks like professionally written software that they created using chatGPT (Claude is better for coding). The only problem is they didn’t know how to deploy it into the real world. So I just suggested prompts for one of them, and told him what to ask chatGPT to do; like how to register a domain name, how and where to get a virtual machine to host it cheaply. How to make the domain name point to the virtual machine, how to create a user login system with a database etc.

I use chatGPT, Perplexity and Gemini now all the time too for many things. It is really handy. For example, I have a few of these cheap Citizen and Casio watches, and I can never figure out how to go back and forth from DST to EST. And I used to spend a lot of time reading the manual trying to figure it out. Now, with chatGPT, I can say, “How do I set my Casio xxx model to DST?”, it gives me a step-by-step that actually works. I used to have to go through the manual, failing that, go to Youtube and watch video after video, nope, doesn’t work etc… Now, chatGPT, and boom. Done. Doesn’t take me more than 30 seconds. Yes, I know, that’s really trivial, but you do this for various tasks during the day, and you are talking about saving hours of time.

In the coding world, we all know how bad a lot of documentation is. Sometimes, we can spend hours just reading through documentation trying to figure something out. Now, with this AI, you can get an answer in seconds. No more poorly written documentation, outdated information or spending hours scrolling through years of Stack Overflow threads (and finally finding a solution that works for you at the bottom of a very, very long thread, the 23rd one you scrolled through). It is amazing. It’s like having an assistant working for you, but when you ask them to do something, they can respond in seconds. It’s kind of scary. I use it all the time for tax and legal issues too. Of course, I cross-check the various AI and make sure they agree, and I can ask for the source so I can actually read the relevant law. I wouldn’t want to represent myself in court with my laptop and chatGPT in front of me, of course, but for most minor things that we all need to ask, it is very useful, and oftentimes it is more than enough information to get comfortable.

Developers could probably relate, but recently I was stuck on some code and it kept throwing errors and although I consider myself pretty good at debugging, I just couldn’t figure it out, and out of frustration I cut and pasted the whole code segment into chatGPT and it found the bug right away. This is not ideal; I don’t want to be posting my code into some black box, but there was no personal information or credentials anywhere so figured it was fine. Some will read this and say, hey, use a good IDE and relevant plugins/extensions and you will never have that problem! But, OK, that’s another separate long topic.

Berkshire Hathaway

I know, there is a lot to talk about with BRK. Buffett is no longer the CEO. I wonder what the annual report is going to look like. I had totally forgotten about it, but I started another post on this topic and it’s in the queue. I may finish it up and post it later. But for now, I would just say that Buffett’s stock-picking skill hasn’t really been a factor in a long time, except AAPL (huge one!), and he was pretty hands-off with the operations. So it may not be a bad thing that a more hands-on operator takes over. It is possible that some things can actually improve at BRK. While Buffett’s greatest skill was limited by the sheer size of BRK (he was only able to realistically look at 100 or so names as potential investments to move the needle, private deals limited by competition from private equity etc.), Greg Abel is not restricted in that way. He can dig into operations and make them more efficient, for example. So while Buffett’s skill was getting less and less useful as BRK got bigger, maybe Abel’s skill gets more and more useful as they get bigger. I don’t know if the second part makes sense, but it sounds good so let’s leave it in there.

But my point is, BRK may not lose as much as we think in terms of Buffett stepping back, but may have a lot to gain by Abel, perhaps doing things that Buffett would never do. Who knows, maybe it is time to centralize and standardize operations across some of the subsidiaries to gain efficiencies. Maybe it is time to sell off or close businesses that are not returning the cost of capital. The BRK reputation of not doing such things to attract great private businesses may not be so important anymore as they are just far too big to depend on finding such businesses. It’s just a thought. I don’t mean Abel should become like Chainsaw Al, or, say, do zero-based budgeting for all subsidiaries. But there is a lot of space between that and totally hands off “almost to the point of abdication”.

Anyway, it will be an interesting year. I can’t wait to see what the BRK annual report is going to read like, and what the annual meeting is going to be like. Will it still be the Woodstock of Capitalism, or will it be dramatically reduced?

We’ll see.

Always look forward to your posts. You’ve replaced OID as my randomly, but appropriately timed voice of sanity.

Buffett did actually sell some MCO after the financial crisis go back and check the records. I believe he did it to demonstrate to Management that their behavior was not appropriate although I don’t think he sold a lot maybe 15 to 25% of his holdings something like that.

Thanks for the correction. He does buy and sell around his positions sometimes. But the gist of it is that he held onto most of his position. He did dump all of GS, even after saying at an annual meeting that he feels it in every bone in his body that GS will come back and make a lot of money. Maybe he should have sold BAC and held onto GS instead…

Thank you for sharing your insights, always a good read.