This is just some housekeeping stuff for LUK. National Beef is a major purchase and it may be at the center of LUK’s plan to turn it into a fortress entity; a cash flow producing going concern that will generate cash even in bad times and less emphasis on deal-making to create wealth. This is sort of like what Buffett is doing at BRK too; making BRK less of an investment portfolio and more of an operating business. I guess this is sort of like endowment-izing these entities for easier succession and longevity/durability.

Minor Trivia

It looks like National Beef actually tried to do an IPO; they filed an S-1 in October 2009 and an amendment as recently as August 2010 (OK, so maybe that’s not so recent). I suppose market conditions derailed that plan. You can get this stuff at the SEC website. Also, they have been filing 10-k’s and q’s since the early 2000s.

It’s interesting that one of them said when asked what they are looking for (for the future of LUK), he said something about generating $200 million in profits (in normal or good times; don’t know which) and make $50 million even in bad times. And National Beef seems to fit that bill; it’s making more than $200 million in the last two years and made $20-40 million in not so good years (but they were not-so-good years for National Beef, not for the economy. They did fine during the financial collapse).

Financial Summary

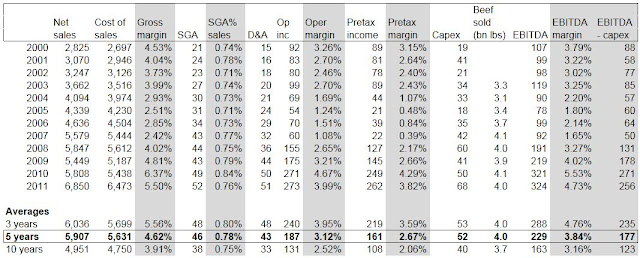

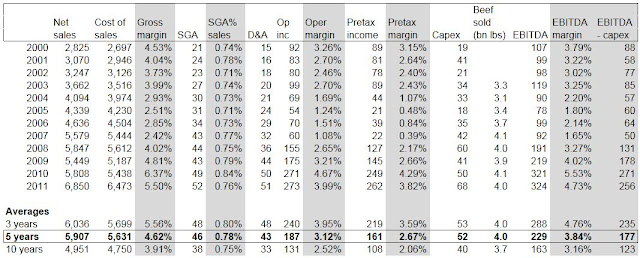

So I quickly jotted down some figures from their 10-k’s since 2000 just to get a feel for the sort of business this is. I took some liberties like free bloggers tend to do sometimes, like using operating income + depreciation and amortization as EBITDA instead of using EBITDA listed in the 10k (but that’s because they stopped putting that in the summary table so I figured it’s faster just to do the simple math I did even though it won’t be exactly the same).

It’s clearly a low margin business, but it does seem a lot more stable than I would have imagined. They’ve been profitable every single year since 2000, and we all know it hasn’t been the best decade in terms of the economy and even commodity price inflation. It’s good to see that they are a pass-through business where they can just pass higher prices on to customers.

The big jump in earnings in the last few years seem to be from higher beef prices; it’s not volume driven.

(The pretax return is close to or same as net income in many cases because National Beef is a partnership).

Valuation

Cumming said that they are just looking for 15% in pretax returns (at the annual meeting), so we can use this as a sample to see how that fits with the valuation here.

LUK paid $867.9 million for 78.95%, so the equity was valued at $1.1 billion. Long term debt outstanding was $360 million so the total enterprise value was $1.46 billion (ignore cash as it’s small relative to EV).

Here are the valuations against various metrics; I will use the 2011 full year figures and the five year average figures to ‘normalize’ them. Three years might be a bit short and they have posted some good numbers in the past three years, and maybe ten years is too long as they may be a much better company now than ten years ago.

Anyway, here are the metrics:

FY 2011 Five year average

EV/EBITDA 4.5x 6.4x

Pretax income 4.2x 6.8x

EBIT/EV 18.8% 12.9%

EBITDA – Capex 5.7x 8.2x

(free cash yield) 17.5% 12.2%

Owner earnings 22.3% 13.7%

(for EBIT/EV, I actually used operating income)

So from a pretax income point of view, they paid a price that yields 24% on last year’s earnings and close to 15% on the last five years’ average earnings.

This means if they do just as well as they have done in the past five years (with a near depression and rising commodity prices), they can make 15% pretax returns and any upside is a free option; if they expand exports, increase margins on more added value products etc… this will all come on top of the 15% pretax they already earn.

Based on free cash (using EBITDA – capex) and on an EV basis, they will earn 17.5% if National Beef keeps doing as well as it has done last year and 12.2% if they do just as well as they have done in the past five years.

The owner earnings yield (owner earnings here is pretax income plus D&A less capex) is 22.3% based on 2011 and 13.7% for the last five years. Sorry, the owner earnings didn’t make it into the table.

So that’s not a bad deal at all.

I haven’t really dug into National Beef (haven’t really dug into the K’s much) so this is just a quick look as sort of a sanity check so I get a tear-sheet-like familiarity with the business. And what I see is encouraging as I thought this business would have been much more volatile in terms of earnings (loss years etc…).

Only $1.2 Billion in Equity in 2001

By the way, it’s really amazing when you think about the fact that LUK had only $1.2 billion in shareholders’ equity as recently as 2001. And now they have an 80% stake in a durable business that will generate $200 million or more on an ongoing basis *plus* all that other stuff. Compare that to holding the S&P 500 index since 2001.

Very interesting! You are linking some "dots" together.

I was looking at this the other day and was wondering the same thing. There is a company in the UK, Hilton Food, that is in a similar type of business (broadly) they make crazy returns, they listed in '06 and have made 40%+ on net operating assets every year since then, very slim margins (about half of National Beef) but they turn at about 25x. Thought it may interest you, suprisingly interesting industry.

Thanks for the idea.