So, like many of you, I watched the BRK annual meeting (replay) as usual. It was nice to have Ajit and Greg join Buffett and Munger on the stage. Buffett and Munger both looked great, and it was good to see that duo in action again.

There were a few interesting things this time. This is by no means a summary of the meeting or anything close to it; I will just talk about things that stood out to me or things that I thought about. I know I’ve said that before and then sort of ran through the various topics that came up. But in this post, really, I don’t mention most topics that came up.

He pointed out that the top 5 out of 6 companies are U.S. companies. People who think the U.S. is on the decline should take note of this. The U.S. has a system that works etc. He said that in 1790, we had 3.9 million people in the U.S., 600K of whom were slaves. Ireland had a larger population, Russia had 5x more people, Ukraine had 2x more people etc… And yet, here we are in 2021 with 5 of the top 6 companies around the world U.S. based.

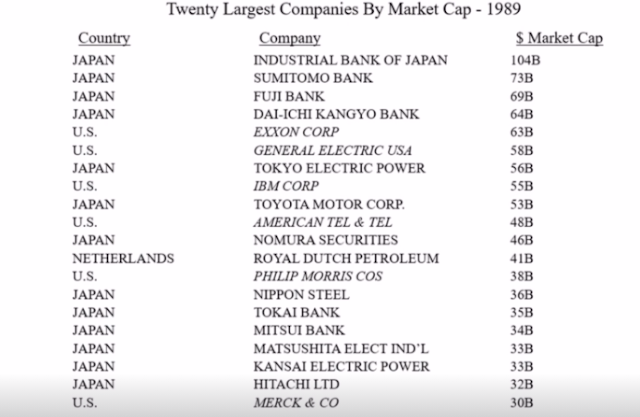

And then he talked about indexing and how pros are often wrong. He asked, of the top 20 largest companies on the 2021 list, how many will still be there 30 years from now. Then he showed us the list of top global companies in 1989 and pointed out that none of them are on the list today.

Here is the 1989 list:

This is kind of scary because at the time, there were all these books out there, like Japan as Number One and many others that basically said that Japan has the industrial / political structure, hard-working, obedient and highly educated work force and many other traits that make them an inevitable force that will take over the world. Well, that didn’t quite work out.

So it does scare me a little what might happen to the top 20 list today. Buffett meant to show the greatness of America by showing us the top 20 list of today, but I don’t know if he realizes that showing us the 1989 list may actually be telling us that we are peaking in our U.S. dominance. That would be a more consistent message from looking at these two tables.

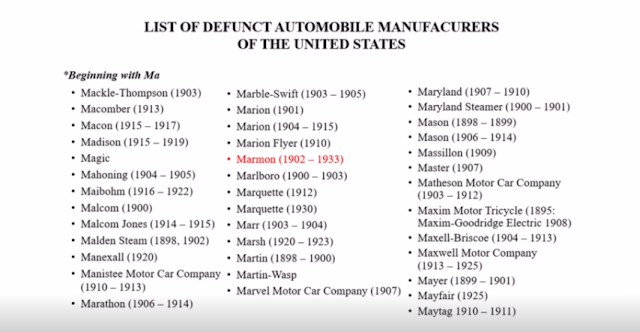

He showed a slide of some of the many companies in the auto business, but since there were so many companies, he only showed a single slide of companies whose names started with “Ma” (there were too many to list even just companies starting with the letter “M”).

The same argument was made in the 1999-2000 internet bubble. People (I think Buffett / Munger too) pointed out that there were many, many railroad companies that jumped on the railroad bandwagon in the 1800s, and only a few survived.

So being right about the future in terms of industries does not guarantee success, whether it be electric vehicles, cloud, AI, alternative energy or whatever…

- Is it a good business?

- Is it fairly valued?

We never evaluate businesses based on how the stock price performed in the past. Well, in this case, there is some need to evaluate that. But hold off on that for a second.

If you look at BRK, the answer to question 1 is probably, yes. It’s a good business. It is certainly a collection of above average businesses. And 2? Probably yes there too. Definitely not overvalued by any measure.

How about the S&P 500 index? Is it a good business? Well, it is average, at best. Right? And then how about question number 2. Is it fairly valued? Well, this can get tricky. I tend to believe we are not in bubble territory on the index overall, and a P/E in the low 20s in the current interest rate environment is not expensive at all.

But there are pockets, maybe even big pockets of egregious overvaluation in the index. Like, say, TSLA. I tend to think the large tech companies are not overvalued (not cheap either). But OK, many think the S&P 500 index is overvalued.

So where does that leave us? The BRK is an above average business trading at a reasonable value whereas the S&P 500 index is an average business possibly trading at above reasonable value, or even at best, reasonable value.

Here, you have to be with Munger. It’s BRK; no-brainer.

What about the past underperformance? Well, Munger calls it an accident of history. He believes that a collection of superior businesses will do better than a collection of average businesses over time. That makes total sense.

So when you put it like that, and you sort of break it down like the above, it makes sense to own, or keep owning BRK despite it’s long term underperformance. Too much Kool-Aid for me?

Now, I am sure there are others here that would actually prefer the S&P 500 index; especially the tech lovers who think BRK is a dinosaur. That is not a totally unreasonable view either. It’s a matter of taste, to some extent. And it’s true that over time, an index will evolve (S&P survived past century) and it is not at all guaranteed that an individual company will (GE?).

I have been a great actor for so long that I no longer know what I truly think on any subject.

This may not be exactly what Buffett is talking about with corporate myths, but these things popped up in my head when he talked about myths.

Anyway, as usual, if you have time, check out the replay. It is pretty good. Mostly t he usual stuff, but it’s free to watch (and fun).

Great post! Thank you! Got inspired and had to review my strategy once again. Probably not doing any changes but just thinking for different outcomes.

kk,

Thank you.

I believe Buffett has another message when posting those top 20 companies tables; before Japan, it was the Soviet Union, it was certain at the time that they will take over; today it's someone else. He is saying it will repeat itself.

KK,

Any comments on the covid still lingering in EMs ? Would also love to hear some thoughts on the inflationary effects that we see now

No, no insight on covid in the Ems. Surprising to see India really mess it up. Sad.

As for inflation, I haven't looked closely, but it sort of feels like it's just a side effect of all this shutting down and reopening; things are just way out of sync. So in that sense, it feels temporary to me. But can't know for sure, of course. Inflation probably will be higher over the short to medium term, but I am not really all that worried about it at the moment.

What about inflation

First, just want to say I love you blog. But I think suggesting that Buffett didn’t realize the obvious implication between the 1989 to today comparison seems to insult the mans intelligence a little. If we saw the pretty glaring connection (ie US may be peaking), then you can bet tbone did as well. None of the material he prepares is accidental.

Good point. Buffett knows what he is doing, of course. But it is kind of jarring when he shows us the top 20 companies now, never bet against America, we have top 5 of 6 big companies, etc… and then puts up the 1989 top 20 list, lol…

Of course, I have long argued here that no matter what others say, we are not, in the U.S., in a Tokyo 1989 situation at all, so I don't worry about that.

But still. And then he is very long the top company too, and said he and Munger both agree that selling some last year was a mistake. And in the Q&A both of them said big tech is not necessarily overvalued etc…

In any case, it was an interesting moment for sure.

WEB and CM are masters! Brooklyn, thanks for the post. In comparing the 1989 bank heavy list with the 2021 tech and info tech heavy list, I wonder if the comparison will be valid.

I wonder if they are:

apples to apples comparisons,

apples to pears, or

apples to fishing poles.

Any thoughts?

Well, it is what it is. It's always dangerous to say this time it's different. But if you must, you can say the Tokyo bubble was a serious one, with P/E's of 60-80x for the whole market. Banks were (and still are) run by totally inept, incompetent people. Valuations rose for bubble reasons, not for management or 'great business' reasons (asset inflation, cross-shareholdings increase balance sheet value of banks etc…).

The current tech list, is at least, is there due to truly great businesses with decent returns on capital with a lot of growth, very competently managed etc… Almost the opposite of the 1989 banks…

If you look at the 1999 list, it's interesting because MSFT is there, and it's still there in 2021. Amazing.

This is not to say the current tech companies in the top 20 will stay there, of course. Who really knows. But just because it makes the list doesn't automatically make it a sell either.

It is kind of telling that China appears 3 or 4 times on this 2021 list, depending if you count Taiwan as part of China or not. It is also interesting that Market Cap is the criteria, as investor psychology is the determinant on how high the market cap is. Just my observation….

Thank you for the post, I always look forward to your comments on the mkt and brk specifically. They are very measured and reasoned. A couple things stood out at me. I try not to read as much into his comments as I did in the past but still worth noting:

1) Said was a mistake selling apple but never really gave his logic or reason for selling to begin with so was it just a mistake because went up? Sounds a bit like davey day trader.

2) Said he sold the rest of his banks during the pandemic because he didn't like the weighting in the portfolio. This was nothing new the weighting didn't change much since most things went down. Seems like the time to get the weighting right is before a crisis not during. Is he gonna sell some reinsurance biz during the next hurricane?

3) Not buying anything meaningful during the pandemic or even T&T buying anything was truly bizarre. Did not need to be a hero but beyond some bac they bought nothing, not even brk, not they seem to be buying brk consistently. Seems counter to his general thesis of buying when the news is bad not when good.

4) Whoever bought the goldminer should probably not be working there or trusted, made no sense and was counter to everything brk stands for.

5) Selling the banks and airlines during the pandemic was very costly. Back of the envelope, cost at least $50bn and probably more and did not replace it with anything meaningful even brk.

6) He seemed to be trying to make reasoned arguments against some of these proposals against BHE. He didn't seem to acknowledge that reason and logic is not centerpiece to the green movement. They are all or nothing crowd. To ignore that seems strange.

7) Again Buffett gives cryptic answers with very little background so we have very little color to go by. Munger while more honest and open gives even less.

Good points. I think the mistake in selling AAPL, he just meant don't sell a good business. Maybe he was trimming to cut exposure or whatever. Who knows.

As for banks, he said he didn't like the weighting given what was coming. I think he sort of panicked selling the banks and the airlines so quickly like that. It was very unlike Buffett to react to things like that, even though he may be right about the long term about airlines; but they can adjust too. So still seems to me like panic selling.

Not buying the dip was discussed in the 2020 annual meeting. He said it was too fast. The market tanked, the government came in quickly, the market bounced immediately, the phones stopped (or never even started to ring like in 2008) ringing as nobody needed his money with the govt writing big checks for those in need. etc…

As for proxy issues, he just means that people who actually own their own shares with their own money should be making these proposals etc. He is probably with the left on green issues, and Munger is on the right, but that's really not the issue with these shareholder proposals, so…

And yes, Buffett / Munger, as usual, will only say what they are willing to.

It is sad that he doesn't talk about stocks / businesses anymore. He used to talk a lot about KO and other stocks, and even with IBM, he talked about it. But that didn't work out, and since then, it seems like he doesn't want to talk about stocks anymore. Well, he never really did give 'tips', but at least he talked about businesses he liked, but doesn't even do that anymore… oh well…

I know how to value Berkshire and buy on huge drops, and beat the S&P 500 with BRK.

Investing, doesn't have to be static, where you buy a stock and then wait 10 years later to see how it did versus the S&P 500.

Warren Buffett said if you know how to value 5 stocks, you can become very wealthy.

Are you thinking the cost mgt myth at KHC is the 3G slash and burn methodology?

Agree with you on examining the buy and hold forever thinking. I have compromised and allowed myself to sell some absolutely wonderful companies (TXN being one… ugh) that by my best judgement has high probability of modest returns over mid term due to current high valuation. But am only allowed to sell if have another investment to put it into with similar characteristics but more favourable valuation. Also, part of the compromise is have a core group of holdings not allowed to touch unless their business changes in some fundamental way. It's a balance between holding and trading and still feel the only real edge I have is time so am proceeding accordingly. But with compromises.

Yes, that whole thing about cutting costs etc. Even though it seems like all the branded goods makers were suffering similar fates; it was sort of a shift in the balance of power from the big brands to retailers, I think, and other cultural shifts that had a big impact too…

Just one minor point, the equal weight S&P may be an average business but the cap weighted S&P should be well above average with the heavy weighting of some truly great businesses like Amazon, Apple, Facebook, Google, Mastercard, Visa etc.

Good point. But TSLA is in there too, lol… not saying TSLA is a bad business, but…

The Kraft-Heinz thing is caused by Anheuser-Bush. Buffett decided at the time of the merger to not trust the Brazilians and to take the money instead of the new BUD shares. That turned out a big mistake. When the Brazilians brought up the next deal, he couldn't miss out again.

Today I would rather own BRK than the S&P 500 any day, the S&P 500 is too heavily weighted in those Top 20 Companies.

Hey Brooklyn. Can we please get an update? Its been way to long and I miss your analysis. Thanks.

Hi Brooklyn. It looks like Warren Buffet did it again with the 10x pretax rule. The purchase immediately reminded me of your article.

Are you fin, Brooklyn Investor? I just wonder, if everything is ok, as you haven‘t written for such a long time. Would be happy, knowing you‘re fine. Best – from Hamburg/Germany

Hey Brooklyn, just stopped by to say that I'missing your posts. They were a voice of rationality in difficult times. I hope you're doing ok.