This is going to be a short post. It’s just another one of those things that hit me in the head, like, duh!

I read all the time that even Buffett is bearish the stock market as he is stockpiling a ton of cash. He has close to $100 billion in cash (and equivalents) on the balance sheet now. The idea is that the market is so expensive he is not finding things to buy (even though he is still buying Apple).

I took it for granted and sort of agreed, thinking that maybe he is just saving up for a really huge deal.

Still, something about this bothered me and didn’t sit well. I was catching up my 10-Q’s and just read BRK’s 3Q and saw these giant numbers on the balance sheet, and something else struck me too, right away. Loss and LAE is up to $100 billion!

And that immediately reminded me of one of my old posts where I contended that Buffett never allows cash, cash equivalents and fixed income investments to fall very far below float (old-timers will remember this). In other words, the idea that the low cost “float” is invested in stocks and operating businesses, to me, is baloney. Well, cash/capital is fungible so you can’t say float isn’t invested in stocks. But still, I noticed this and made a big deal out of it. Well, sort of.

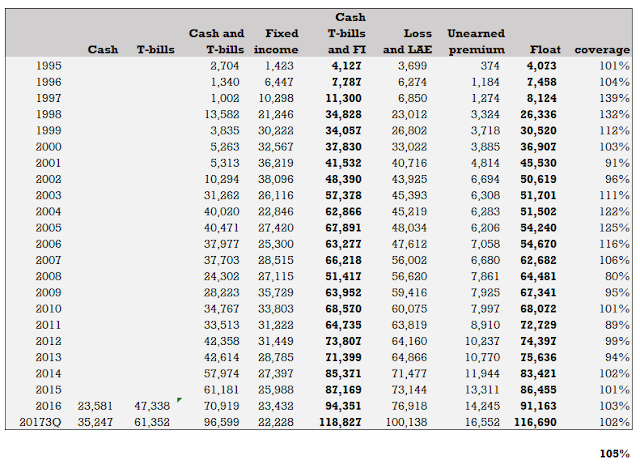

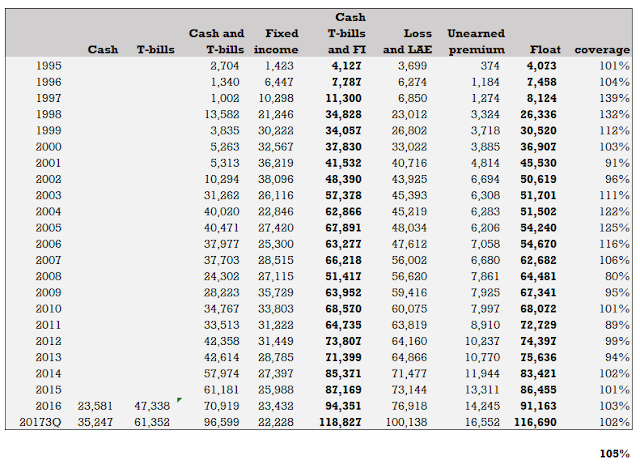

Anyway, I just created a new spreadsheet going back to 1995 to see if what I said is still true (well, there is no reason the historical data would change, of course).

And here it is:

I shouldn’t be surprised at this as I noticed this myself a few years ago. But check it out. I think people think Buffett is bearish because he used to say that he wants $20 billion of cash on the balance sheet at all times for emergency liquidity. And when cash gets over that amount, it is assumed that this is ‘firepower’ for the next mega-deal.

By the way, my float is not the same float as Buffett’s. For simplicity, I only include Loss/LAE and unearned premiums.

Anyway, check it out. All of that cash and cash equivalent increase is basically just matching the growth in float! And to the extent that cash and cash equivalents have grown quicker than float reflects the reduction in fixed income holdings (from $36 billion in 2009 to $22 billion now), which is more of an indication of Buffett’s bearishness on bonds.

The column all the way to the right is just the cash, cash equivalents and fixed income investments as a percentage of my lazily calculated float. You will see that it has been close to 100% since 1995, and I think it was true going further back. The average over this period is the 105% you see at the bottom of the table.

Conclusion

Anyway, the next time someone tells you that Buffett is bearish; just look at his cash stockpile, you can say that is more reflective of his bearishness on bonds (bond balance down, cash up), and the rest is backing up the float, as he has been doing since at least 1995.

Hi, great post again! If fixed income is the only meaningful investment of float with declining % contribution over time (T-bills are just cash really), why do you think Buffett talked about float as a perpetual debt similar to equity for investments with much lower cost (even negative cost)? If it isn't to be deployed for investments why would Buffett want float to grow? And also Berkshire is minimising its insurance exposure to disasters or those with sudden outflow, and focusing more on those with more predictable claims. Wouldn't that intend to better prepare Berkshire to deploy the float money in equity investments or M&A?

I recall Thomas Gayner once said that Markel only uses equity to invest, not float, unlike Berkshire, because Markel isn't as solid as Berkshire yet.

Cheers.

I'm not sure why both Buffett and Munger have talked about float as if it can be used for equity investments and acquisitions. As long as interest rates are positive, it makes sense to grow float. Back when interest rates were 8%, for example, if you were running a 20% ROE business, and had additional float with zero cost, any earnings would directly increase ROE (increase in R with no increase in E).

one quick observation on this ratio that kk has compiled up. The ratio for periods during major recession/immediate post-recession years are particularly low, which can be interpreted as buffett deploying more dry powder to invest.?

And the particular years when these numbers are high (97~98, 04~06) can also be interpreted as him finding the markets rather expensive and scale down on the cash deployment?

Pls note that the above remark are made without ANY investigation into BRK's Loss and LAE numbers growth (there could be some particular events that cause the ratio to become particularly large or small).

The Gen Re deal happened in 98, or around then. 04-06 might be lack of investments for sure as he mentions that in the 2004 annual report, that he couldn't deploy the cash…

I find the speculation about buffett being bearish vs bullish to be, on average, irrelevant. For insurers who lack confidence in deploying float aggressively or insurers who pursue questionable pricing policies to grow volume (which is like most insurers), i'd expect cash to outstrip float by a lot. But it appears standard to me that float should roughly approximate cash for berkshire, a standing that indicates they're almost always fully invested (buffett rarely goes years without good ideas and he's always learning new ways to deploy). That said, a cash buildup doesn't have to mean he's bearish (he could simply be looking for — and not finding — larger safety cushions), nor does the opposite necessarily mean he's bullish (although given Berkshire's size, it's hard for them to dabble in secondary or little-known issues which can be undervalued even when market leaders are fully priced). There's little reason to think that if buffett was bearish, he wouldn't just say it. He has been outspoken at market extremes. His relative quiet, instead suggests to me he's just as puzzled as most top investors with the low interest rate environment.

Hi KK , a bit unrelated but have you calculated how much Berkshire will gain if the corporate rate is reduced to 20%. Berkshire now is paying about 30% after various deductions vs a Hypothetical 35%. Also on the balance sheet net it has a deferred tax liability of 76 bio. Some of it is due to the unrealized appreciation of stock and some of it due to PPE and Goodwill. the PPE part I assume comes from different schedules of depreciation ? I am not sure if the benefit will be on all 76 bio. Thank you !

Hi,

No, I haven't thought about that much, actually… We'll see what happens. This would have no impact on what I do with BRK in any case, so it doesn't really matter to me…

I think that its tough to look at (cash + FI) and float in isolation as if they are the only two variables. The CAGR for the operating companies has far out stripped the CAGR on the investment portfolio in recent years, so it only follows that cash from operations would swell in a corresponding fashion. Almost 17% growth rate for last 5 years and mid to high teens for rolling 5 year periods going back to 2009. Even higher before the recession. Cash from Ops for TTM thru Q3 was $45 Bil alone. ( All #'s from Cap IQ). Munger said they could do a $150B acquisition at the meeting in May. Warren dialed it back a bit….but that'd be a good use of cash.

Funny that you cut it off at 1995. I'm sure coincidence, but float was not nearly covered by cash + FI as of year end 1994. Only about 75%. That was rare though.

I just went back as far as sec.gov has 10-k's. But that's already more than 20 years of data! so good nuf for me… I don't cherry-pick or massage data to fit my needs as I don't really have an agenda. Like most readers here, I just want to know the facts, even if we don't often know what the 'facts' even mean even if it's right in front of us, lol…

i am appreciated to your blog articles very good news

nifty Tips

Great post.

I completely agree that equity and operating businesses are not float. Insurance regulators would not let insurance reserves be put into operating businesses and public equities. This is codified in insurance regulations.

BRK enjoys a position unique among *any* insurance provider in the world…they don't really need bonds. Taking the entirety of invested capital available at Berkshire, there will always be a cash allocation. As the operating companies grow, cash builds and some is reinvested, but a constant floor on cash allocation does and should exist. Cash is perfectly acceptable to most (though not all) insurance regulators in lieu of bonds.

So…if the entire BRK investment portfolio (including wholly own equity positions i.e. operating companies) generally has a cash allocation, and equity as a whole grows faster than FI as a whole over time (as it should absent major insurance reserve acquisitions)…then BRK doesn't need as many bonds and can allocate a portion of capital to reserves as cash.

This doesn't really happen at other insurance operations since they typically pay a dividend and don't reinvest. But if they did and they'd been around for long enough, you'd see the same thing with them as with Berkshire.

That is my thinking, at least. Always enjoy your view points.

what a information thnks…visit too.. Forex trading tips

Trade in securities exchanges implies the exchange for cash of a stock or security from a vender to a purchaser. This requires these two gatherings to concur on a cost. Values (stocks or offers) present a possession enthusiasm for a specific organization.

Best Stocks to Buy

your thoughtful process is so appreciable.

Expert Share Market Tips

Someone asked this question at the Berkshire annual meeting (at about the 5hr 38 min mark in the link below). Buffett seems to claim it is a divine coincidence. Not a very satisfying answer to me, but I'm not sure what would've been if it really is just a coincidence.

Does anyone here have a good understanding of the regulatory requirements for insurance businesses? Would regulators really stand by were Buffett to decide to commit Berkshire's cash and cash equivalents (save the $20B that Buffett repeated he will keep as cash) to a share buyback? What do you think would happen to Berkshire's credit rating?

Link:

https://finance.yahoo.com/video/2018-berkshire-hathaway-annual-shareholders-153210513.html

Yes, I saw that. It was a really good question and I was sort of surprised, but not surprised at the answer. I would have guessed they would say what he said; deny any connection. I don't know what to make of that, really, as it does seem to correlate very well as I have demonstrated here for it to be a coincidence. On the other hand, Buffett has no reason to lie about this either. So, I stand by my analysis and assumption that they will continue to track each other, but on the other hand, understand Buffett denies any connection.

A few other thoughts:

In one of the earlier meetings that was just uploaded to the CNBC archive (I think it was the 1994 meeting, but I don't recall), a similar question was asked about what the float could be used for and Buffett said that it could be used for anything because they have so much equity. This (in conjunction with recent comments about being able to partner with other firms for a $100B deal) makes me think he is maybe justified in viewing the bonds and cash as actual cash equivalents (that could be used to buy back stock, for example) rather than funds that have to always remain in the form of cash or bonds; if a deal comes along, he can just use the cash and bonds on the books to secure the deal immediately, if necessary, and subsequently (because of the non-zero duration of the float liabilities) raise the needed capital for the float liability in the debt market.

If this reasoning holds up, then it would make sense to view the cash and bonds on the books as actual cash. If Berkshire were more levered, however, I don't think this line of thought works.

This view, though, implies that float and cash/cash equivalents should track one another, and this would have to be a somewhat deliberate effort Buffett's part, even if they don't track each other exactly.

Yes, he has said in the past that float can be used for anything, but history shows that it just hasn't, and it's not just because prices are high now. I showed that this has been the case since the 1990's, and when he had to sell JNJ and other things to raise funds to buy BNSF, for example, I think this float/cash correlation still held.

One of the surprising things for me was how closely they matched regardless of the market price level and Buffett's investment activity.

Having said that, yes, if Buffett says he can use $100 bn to shoot an elephant, I'm sure he will do it. But then my bet would be, as you say, cash/bonds will get back up to matching float eventually…

This is just one of those things, I guess, where Buffett says one thing, and you observe another thing…

An important key to investing is to remember that stocks are not lottery tickets.intraday Stock Tips