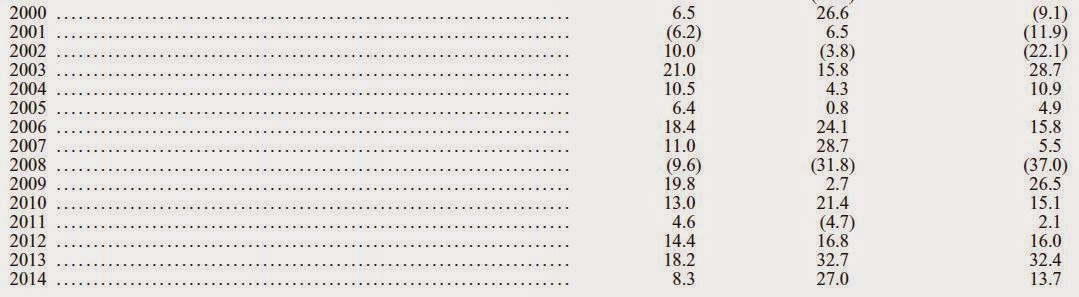

So the long awaited annual report came out last weekend. As usual, I thought it was a great report. For most Berk-heads, though, it’s mostly the usual same old, same old. There was one big difference, though, this year. Buffett changed the performance page of the letter to include change in the stock…

Author: kk

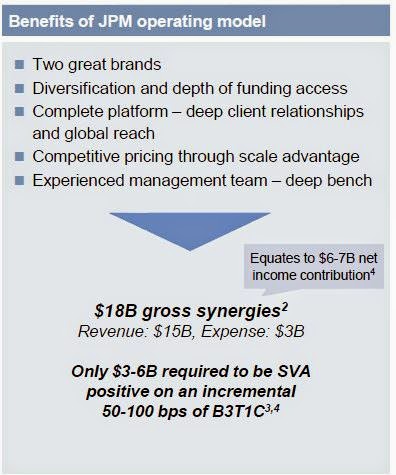

JPM Investor Day 2015

I spent yesterday listening to the JPM investor day on their website (replay). They have a bunch of great slides so if you are interested in JPM at all, I would highly recommend at least flipping through them. There is a lot going on there that looks really interesting. Anyway, as usual, this is not…

Loews 4Q 2014 Conference Call

I don’t normally make posts about conference calls as I tend to look at things over the long term and things don’t change much from quarter to quarter or even year to year. If I look at something and like it, it is probably because I looked at how someone has done over a long…

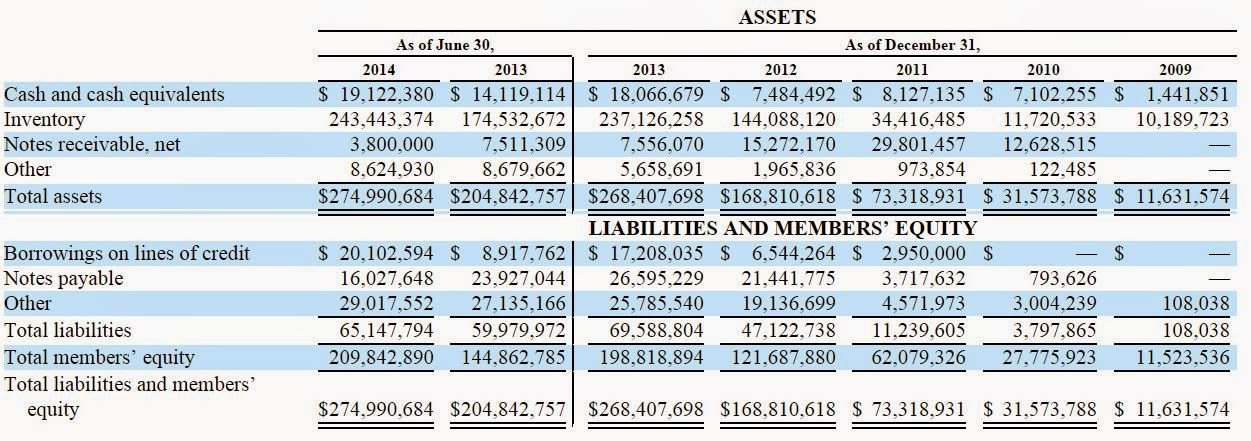

Green Brick Partners, Inc. (GRBK)

So here’s an interesting situation. Some people just have a knack for getting out of bad situations. I remember when Leucadia got out of their WilTel. It was a disaster, but they got out at break-even and walked away with a big tax asset. It sort of reminds me of a silent movie scene where…

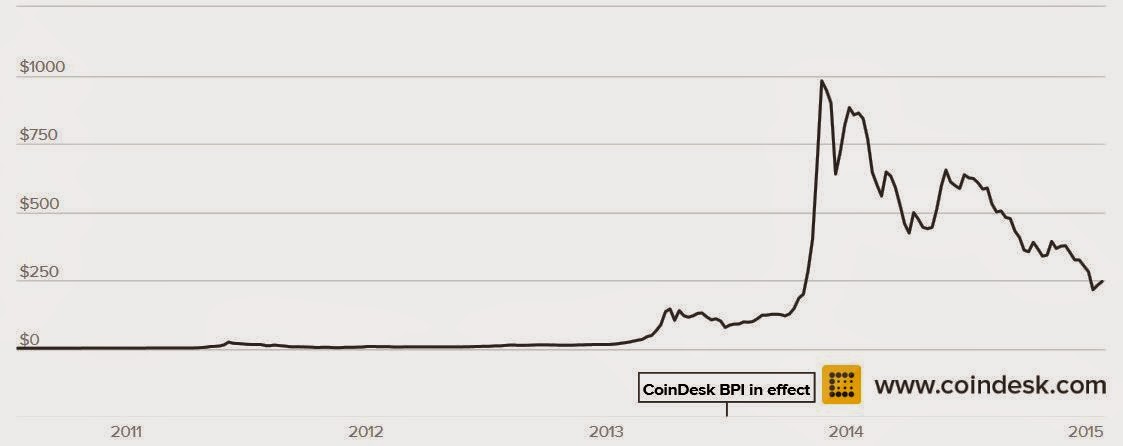

Buffett is Right! (About Bitcoin)

Every now and then, people do ask me about Bitcoin. And my usual response is, I have no idea what that’s about. But if they are interested in buying some so they can make money, I tell them don’t do it. If there are other reasons (like arms or drug dealing), then it might be…

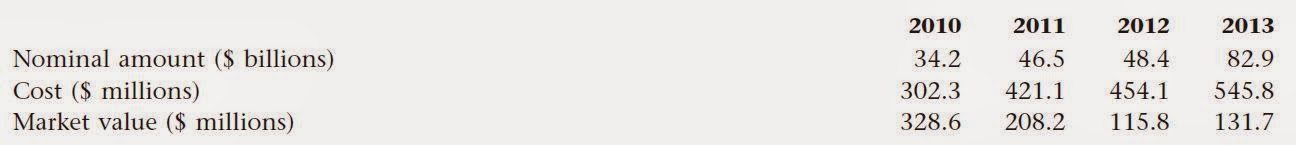

Watsa’s Massive Bet

All this talk of deflate-gate got me thinking about another kind of deflation. No, Prem Watsa (Chairman and CEO of Fairfax Financial Holdings (FRFHF)) doesn’t have a put option on air pressures of footballs, but he does have a massive bet on global deflation. It’s scary how big the bet has become. Check this out,…

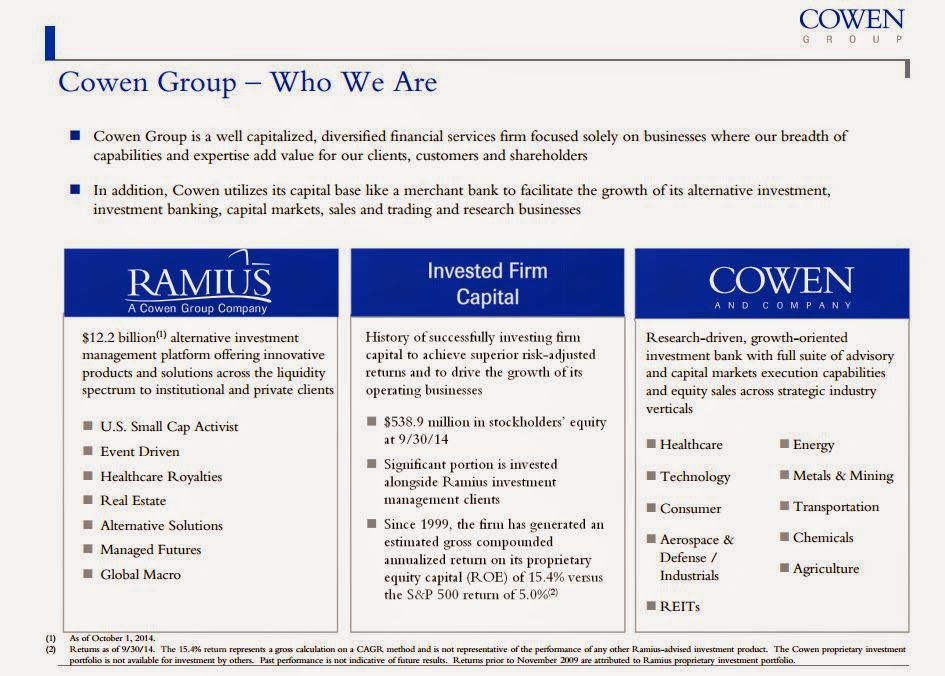

Cowen Group, Inc. (COWN)

I was always curious about COWN; it did an interesting merger with Ramius, an alternative asset management company run by some stars from the 1980’s. I have taken a look at it a few times over the years but never really thought much of it. I don’t know what I think of it now, but…

Dimon is Right!!

Dimon sounded a bit frustrated on the 4Q 2014 conference call the other day and it is totally understandable. Yes, JPM and other banks made some mistakes, but it’s really strange how regulators are jumping on JPM. Just like they jumped on Goldman Sachs too, when they were one of the better operators (Fabulous Fab…

Market Timers vs. Macro Hedge Funds

OK, so this is another post that follows a discussion in the comments section (of previous posts). I think it’s pretty important so I thought I’d expand on a comment I made and turn it into a post. Halo Effect No, not the book. But the same idea. I think some of these top-down, market-timing…

What to Do in this Market: Gotham Funds Update

So my posts about the perils of market timing and market valuation have led to some interesting discussions in the comments section. Anyway, I wrote about the Gotham funds last year and since a little more time has passed, I thought I’d look at their performance to see what’s going on. But first, let me…