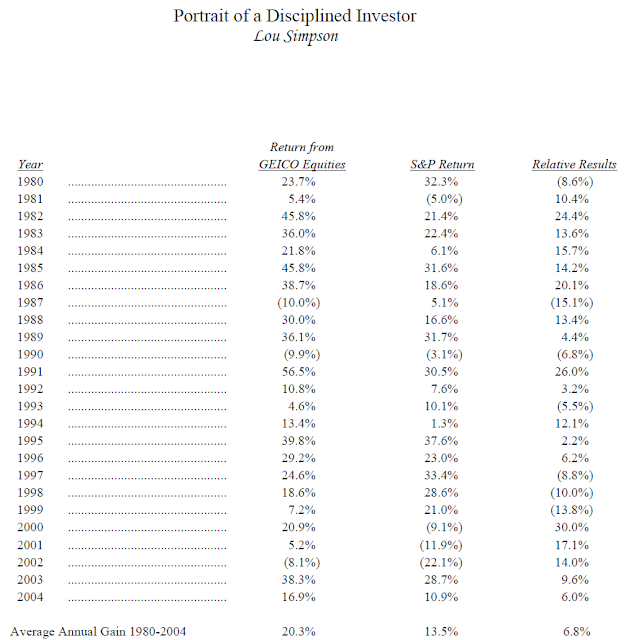

So, it looks like Lou Simpson added a bunch of Charles Schwab (SCHW) to his portfolio, making it the top holding as of the end of June; he increased his position almost 50%. I am not stalking Simpson in particular, but I just happened to notice this and SCHW is a name that I am…

Category: Uncategorized

Mondelez International (MDLZ)

Bill Ackman apparently took a humongous position in MDLZ. The stock price popped up 5%-7% at first but went back to unchanged as the market tanked. And today, the stock is actually down a little. I guess it popped up on comments that Kraft-Heinz/3G would be interested in making a bid for MDLZ, and…

China Crash -> U.S. Crash?! and Great Book

A lot of people are talking about how bad China is. It’s worse than the U.S. 2007, it’s worse than Greece, it’s worse than this or that. It seems like the big China bubble is blowing up. But so what, right? Who cares what happens over there. Yes, the prices got crazy, but as long…

Brookfield Asset Management (BAM)

This name has been mentioned on this blog a few times in the comments section, but I never wrote about it. It is well known in the value investing community and I said I’ll make a post about it in the near future so here it is. First of all, BAM is sort of an…

Quick Update on SuperPortfolios

In my previous post, I put a link to stock screens of Superinvestor stock holdings. Initially, I just sloppily cut and paste out of a spreadsheet directly into the blogger and it was a mess. So I redid it all and embedded spreadsheets instead. It is now much easier to look through, and looks much…

In Search of Value

So we have seen how the stock market is not really as bubbled up as it seems looking at it from 30,000 feet. What are we to do, though? What are we supposed to buy? Where are we to look? I mentioned that I would do a close-up look at the components of the…

In Search of a Stock Market Bubble

So, (the sentence starts with “so” because this is a sort of ongoing discussion that’s been going on here for years) I’ve been thinking about the overall market again. Despite my telling people to ignore this and ignore that, I can’t help it; sometimes I think about this stuff. Well, it’s OK to think about…

Jamie Dimon for Dummies

Oops, I did it again. When I made the Missing Manual cover for Berkshire Hathaway, I told myself that it would be the last time I would do that. Things like that can be fun the first time but can get pretty old pretty fast. But, sorry, I couldn’t resist this time. When the news…

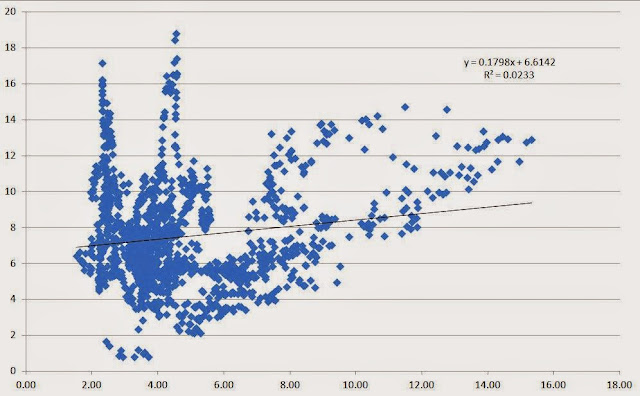

Market Valuation (Scatter Plot)

So, Buffett’s response (at the 2015 annual meeting) to questions regarding the valuation of the stock market was interesting. He used to just say it’s in a “zone of reasonableness”, but this time said that if interest rates stay at current low levels, the stock market is cheap, and if interest rates normalize, it is…

the missing manual: Berkshire Hathaway / Warren Buffett

New Book?! OK, so there isn’t really a book with this title. I was just having some fun. Don’t waste your time Googling or Amazoning it. It doesn’t exist. In this day and age, you can’t always believe what you see. But you know, this is exactly what I was thinking as I was reading…