This is just a quick follow-up to my LUK posts; today Fortescue and Leucadia came to an agreement on the 4% notes. People who follow LUK know that FMG insisted that they had a right to issue more royalty notes and dilute LUK and they have been in court fighting this out. Today LUK announced…

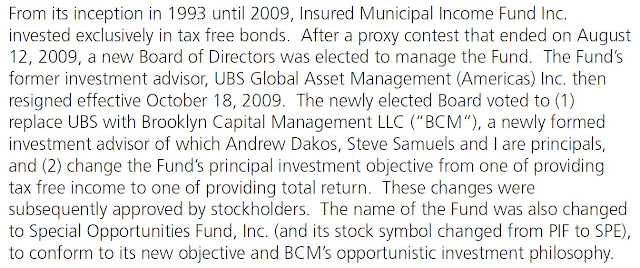

Special Opportunities Fund (SPE)

So someone posted a recommendation for SPE in a comment on this blog so I decided to take a look. As I posted before, I am not a big fan of closed-end funds, and it turns out this is a closed-end fund that invests in other closed-end funds (and other things). So my initial reaction, of…

Quick Comment on Fundamental Analysis

So the conversation I overheard this weekend that I mentioned in the previous post reminded me of something. Back when I used to talk a lot more to ‘trader’ types many of them used technical analysis, macro-forecasting, astrology and all sorts of other things because they claimed that fundamental analysis of stocks just doesn’t work. Part of…

DF Spinoff, Mr. Market, When to Sell etc.

So it’s been a while since I posted. Some late summer, beginning of the school-year business, some laziness and some dead-ends is my excuse. Dean Foods / WhiteWave Foods Spinoff I spent some time digging into the Dean Foods (DF) WhiteWave spinoff but couldn’t get over the fact that it just looks like a really crappy…

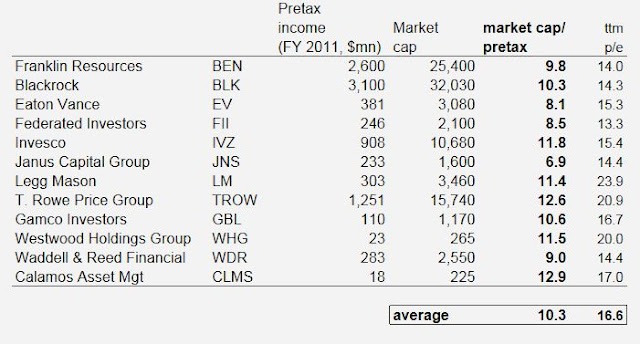

Oaktree’s Grand Slam

I don’t plan on updating things every quarter on companies I mention here; figures will go up and down over the short term due to markets and AUM changes due new fund launches and returning of capital to investors (due to realizations) etc. But anyway, one of the interesting things about OAK is the off-balance…

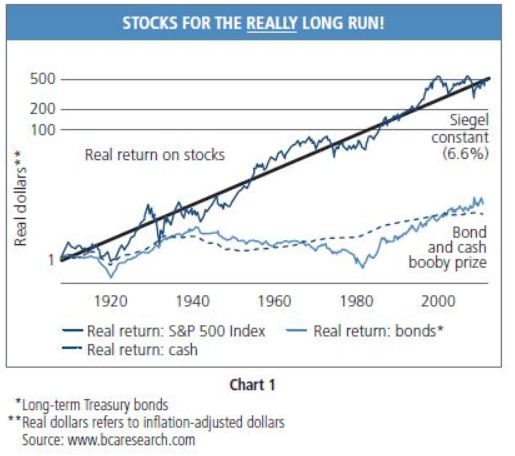

World War III and the Stock Market (and other random thoughts)

I’ve read the 1934, 1940 and 1988 editions of Securities Analysis but haven’t read the 1951 and 1962 editions. For whatever reason, they slipped through the cracks. I really love the 1934 edition because it is the first edition and really digs into what went wrong in the 1920s and early 1930s (sounds exactly like the…

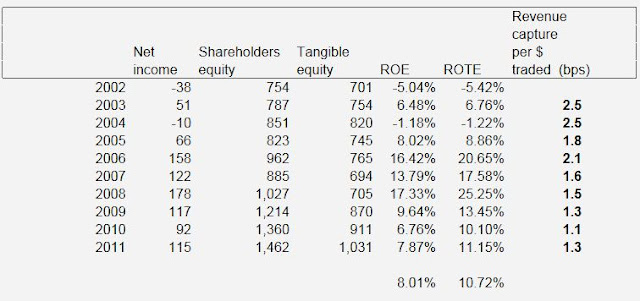

Knight Capital Group

As a long time Wall Street apologist, how can I not comment on this Knightmare (KCG)? Here are some of my quick thoughts on this. HFT, Trading Bots Killing Markets First of all, there is a lot of commentary about how the HFTs and algorithms are killing the markets and scaring investors away from the…

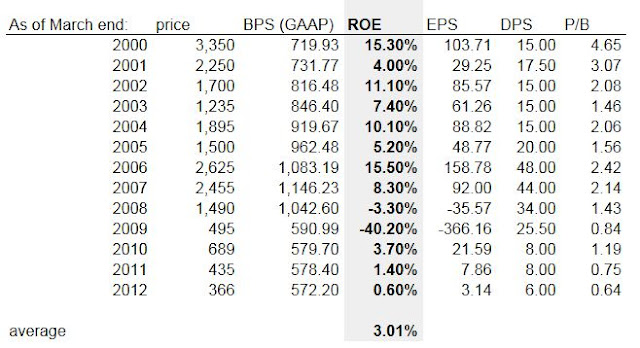

Nomura Update

Last November, I wondered if Nomura should abandon their global ambition and just focus on their domestic business. I have thought that for a long time since they have run into problem after problem over the years in their overseas business. The recent insider trading scandal forced the resignations of the CEO and COO and…

Sony Disaster Continues

So I was travelling a little bit and wandered around in a large mall nearby (living in NYC, I don’t do malls that often) and took some interesting pictures. OK, maybe not so intesting to most of you. There is nothing new here as this is something we all know: Apple stores are always packed and…

Wells Fargo-Goldman Sachs Merger

(Warning: The above title is a title of a blog post, not a news headline!) OK, so I asked in my last post if GS would be better off as part of a bigger bank and I couldn’t put that thought away. In the past there were rumored merger partners like Wachovia (that was just…