Oaktree Capital Managment had their IPO recently (April 12?); the stock was offered at $43.00/share but is now trading at $39.41 (today’s close). The price range for the offering was $43-46 so it came it at the lower end, and the planned 10,295,841 share offering was reduced to 7,888,864 shares (excluding the shares sold by…

Biglari Holdings Annual Meeting

So I did something unusual and went to an annual meeting last week. I am usually not interested in annual meetings as they seem to be sort of love fests or promotional events and most of them seem to be rubber stamp events with no real substance. Of course, the glaring exception is the Berkshire…

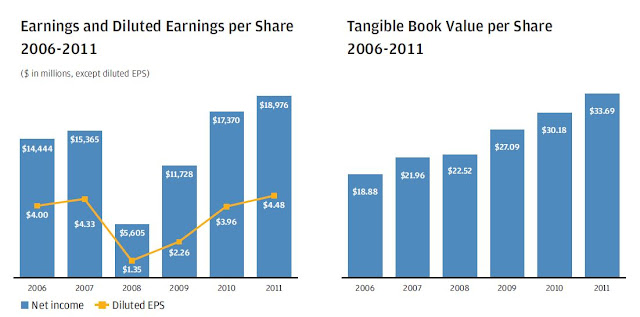

JPM Annual Report 2011

JPM posted their 2011 annual report last night and as usual it’s a great read. It’s probably the best annual report written out there (other than Warren Buffett’s). I know a lot of people are skeptical of what corporate executives say. They say, “you actually believe what these CEOs tell you?!”. Good point. But what…

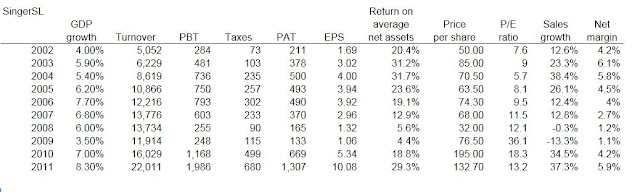

Bangladesh and Sri Lanka

OK, so I took a closer look at the Singer operations in Bangladesh and Sri Lanka (this is a post-script to the Retail Holdings post). Sum of the parts is a good and fine, but if the underlying stocks are overvalued or trading at silly levels, then it doesn’t matter if something is trading at a…

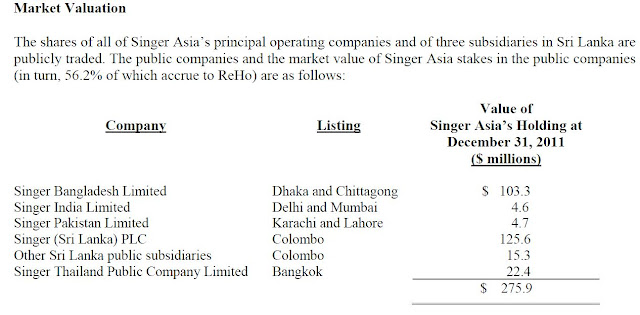

Retail Holdings

Here’s an interesting ‘liquidation play’ I’ve had for a while (paid $10/share or so a while back) but still might look pretty interesting. Retail Holdings (ReHo/ RHDGF) is just a holding company that owns 56.2% of Singer Asia, which is just another holding company that holds shares in Singer Bangladesh, Singer Sri Lanka, Singer Pakistan,…

What’s Important

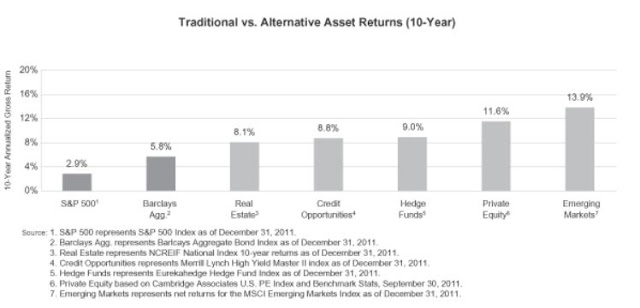

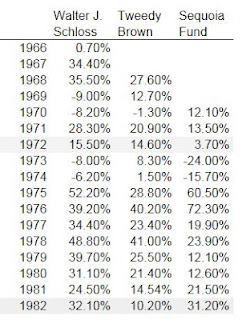

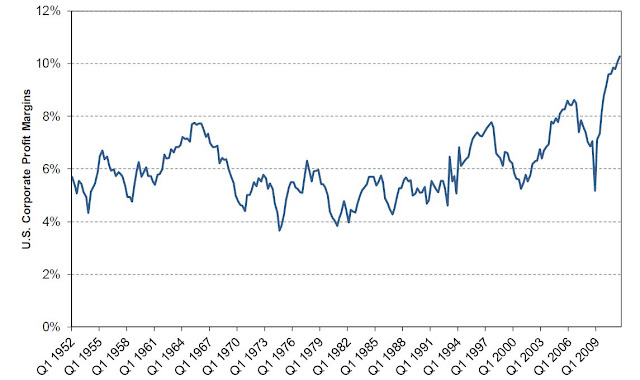

Goldman Sachs published a lengthy report recently saying that the stock market is a buying opportunity of a lifetime. Of course, the bears are out tearing apart the argument piece by piece. I’ve read the report and some of the very well articulated counter-arguments. First of all, some are laughing at Goldman Sachs’ report saying that it’s…

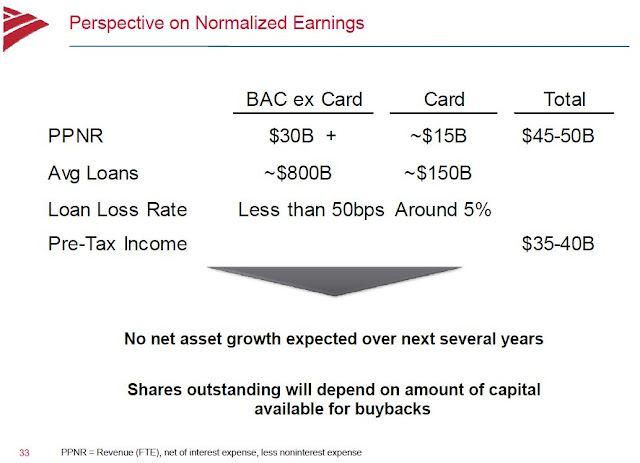

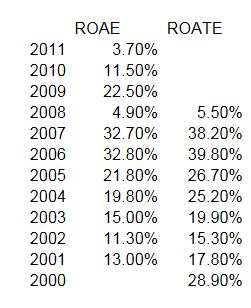

Taking a LEAP into BAC

So I did mention that I bought BAC (Bank of America) LEAPs earlier this month. I am a big fan of financials at these prices but haven’t been the biggest fan of BAC. Goldman Sachs (GS), JP Morgan (JPM) and Wells Fargo (WFC) are much better managed, much solider firms and are very cheap (especially GS now…

On Gold and Inflation

I typed this up in late February and just found it as a ‘draft’ in my blogger. I thought I posted it already but didn’t. So here it is: So Buffett has a nice tutorial on investing in the most recent letter to shareholders (2011), available for free at the Berkshire Hathaway website. He says…

Financials Still Cheap

The financials have really exploded this year as unemployment and other economic figures continue to show some decent recovery. Europe doesn’t seem like it’s going to blow up tommorow. China seems to be going into a hard landing but China might be a laggard to what has happened in the U.S. and Europe in the…

Quick Comment on the Market

So the market has come up quite a bit since last fall when I made a bunch of posts showing that the market was reasonably valued and there was too much pessimism. I think the market still looks and feels fine. There are people who say it’s getting bubbly and bullish consensus is too high,…