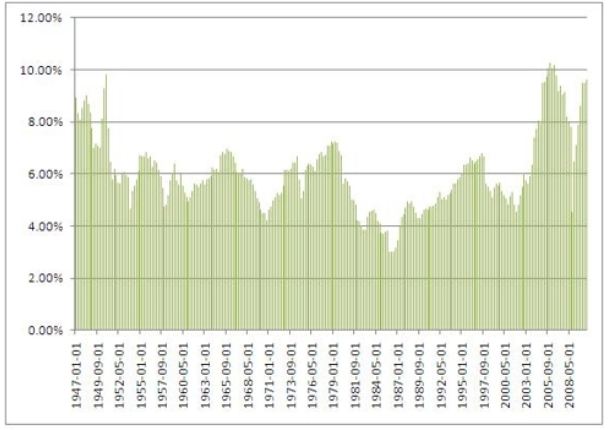

I don’t want to spend too much time thinking about where the markets are going to go, either up or down, but I do pay attention to what people say and see if there is anything useful in it. There are all sorts of reasons why the market will be flat for the next decade…

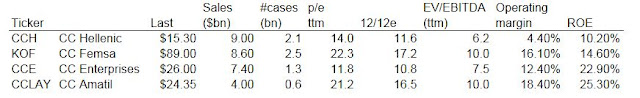

Coca-Cola Hellenic Bottling Co

As usual, I was browsing the new lows list and noticed that Coca-Cola Hellenic (CCH) was hitting new lows every day. Well, of course it’s hitting new lows every day. This is a Greek company. But since it kept hitting new lows every single day, I decided to take a quick look as I really…

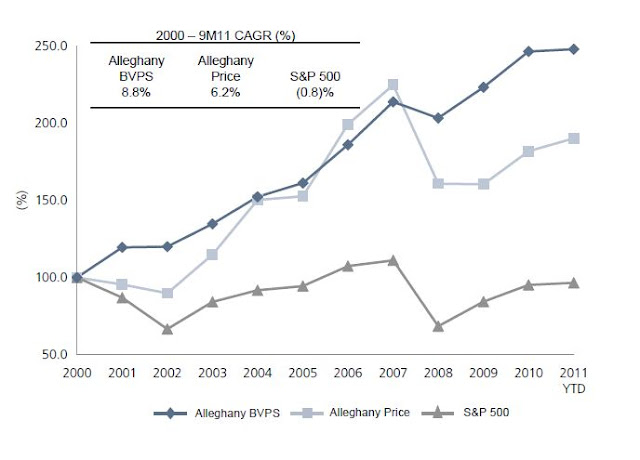

Alleghany – Transatlantic Merger

On November 21, Alleghany (Y) and Transatlantic (TRH) announced a merger. Since I mentioned Y here, I feel obliged to make a comment. I haven’t really ever looked at TRH in detail so I don’t know, but assuming that the folks at Y know what they’re doing (which has been my contention) then this is probably a…

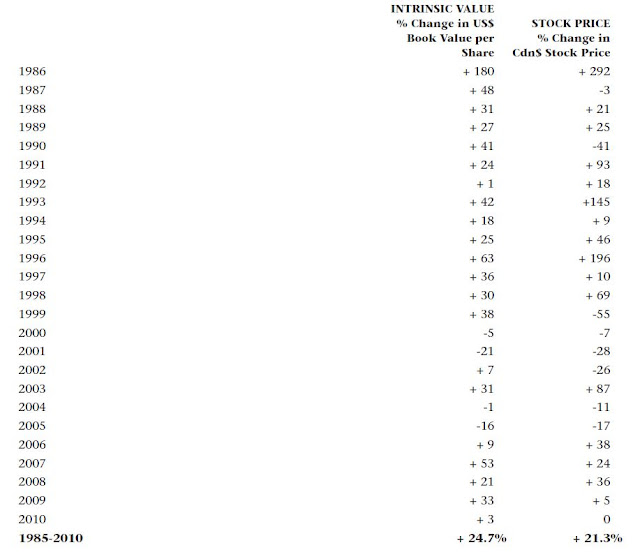

Fairfax Financial’s Interesting Bet

Fairfax Financial Holdings is yet another financial company (insurance) that is run by an incredible manager that has done really well over the years. I know, I know. This is getting boring. Just talking about well-run financial institutions trading at book value is not interesting or exciting at all. I’d rather write about some interesting…

The Problem with Sony

There was a decent article on Sony in Businessweek this week (read here). As I said before in another post, Sony is a company/stock that I would love to love. I grew up with the brand and I think it still has a very strong presence in Japan and globally and does have strong brand…

Seth Klarman Buys Hewlett Packard?

Seth Klarman is definitely one of the all time great investors so people should definitely pay attention to what he does. He has a great track record over a long period of time and has written one of the great books on investing (“Margin of Safety”, which is out of print). He is also a hard…

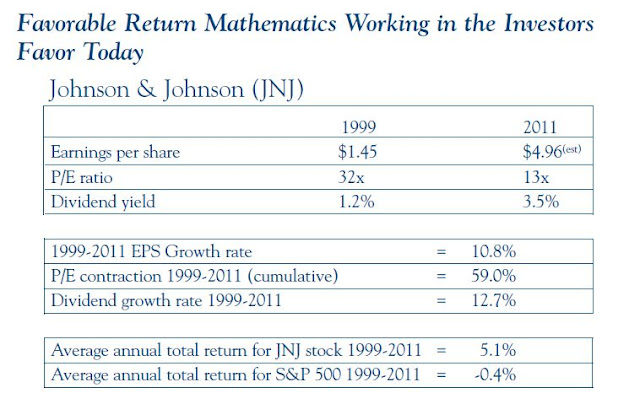

Tweedy Browne on Johnson & Johnson

Tweedy Browne is an old school value investing shop that goes way back. I really do respect them even though their performance recently hasn’t been the best. They are a low turnover fund investing with old-fashioned value investing principles and they are very fad-proof; they don’t jump on the latest investment fads. That alone may…

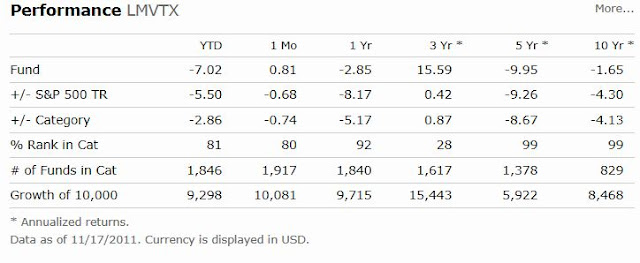

Bill Miller Steps Down

I can already hear it: “Value investing doesn’t work! Look at Bill Miller! Told ya so!”. Yes, Bill Miller does look sort of like a bull market genius. He was a mutual fund hero for outperforming the S&P 500 index for 15 years in a row from 1990 through 2005. I was never a big…

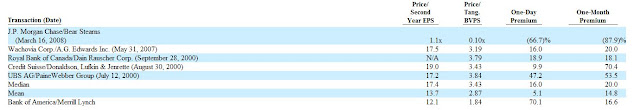

Cheap and Cheaper

I know, this is a broken record blog. We all know financials are cheap and we all know there are plenty of reasons why they are cheap and why they might be right to be priced cheap. However, I tend to still like the well-managed financials. This is laughable and I don’t mean to suggest…

Olympus Continued

So the story continues to unfold and it doens’t sound too good. In my earlier post, I said that on the face of it there might be 459 billion yen or 1,700/yen per share in value at Olympus just by valuing the medical equipment business at 8.0x EBITDA, adding up the cash and securities and…