Whenever I read about Buffett and other great managers, what I tend to see all the time are things like, “xx has beaten the market y out of z years; the odds of that happening are 1 in 5,000!” or some such thing. Not too long ago, there was an article about managers with outstanding…

Tag: BRK

13F Fun

So, for fun, I wrote a script that grabs manager holdings and compares the portfolio since the last time a 13F was filed. This is available at places like dataroma.com but I wanted to be able to check out my own institutions that may not be superinvestors. When I wanted to diff the 13F files, I…

Kraft-Heinz

So 3G/BRK made their move and Kraft it is. Buffett was on CNBC this morning and he said that BRK paid $4.25 billion for common stock in Heinz initially and will pay another $5.2 billion to get this deal done for a total common equity investment of around $9.5 billion. After this deal…

Berkshire Hathaway Annual Report 2014

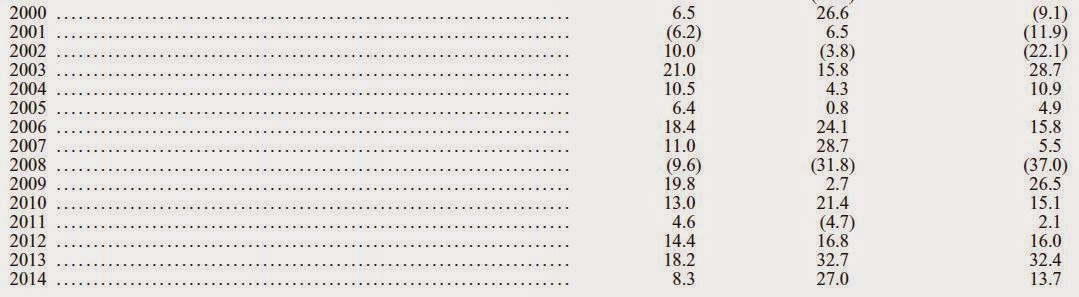

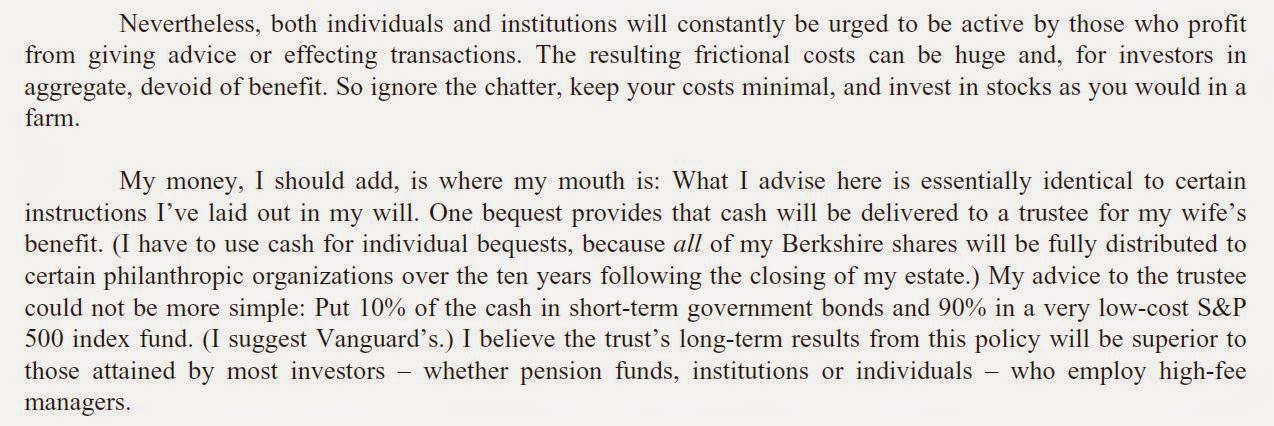

So the long awaited annual report came out last weekend. As usual, I thought it was a great report. For most Berk-heads, though, it’s mostly the usual same old, same old. There was one big difference, though, this year. Buffett changed the performance page of the letter to include change in the stock…

Loews 4Q 2014 Conference Call

I don’t normally make posts about conference calls as I tend to look at things over the long term and things don’t change much from quarter to quarter or even year to year. If I look at something and like it, it is probably because I looked at how someone has done over a long…

Buffett on Market Valuation

I don’t really spend too much time on market valuation, but I do think about it and post about it every now and then. Of course, debate about market valuation is pretty heated these days due to the super-high looking Shiller p/e ratio, high profit margins etc. I was reading through some old Buffett annual…

Value Stocks In Market Corrections

So with all of this talk of a market correction coming and people wondering what to do in this toppy market, Pzena put out an interesting newsletter back in June. It looks at value stocks and how they performed in market corrections in the past. They define value stocks as the lowest quintile of stocks…

Heinz Update: Who’s Next?

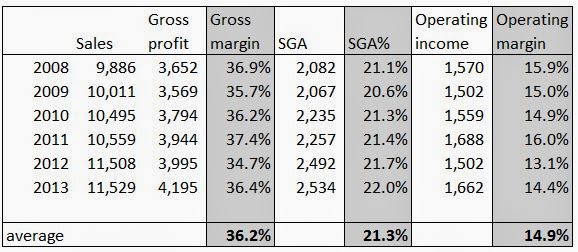

So it’s been about a year since BRK and 3G Capital acquired Heinz (HNZ). This is old news to most of you as the 10-Q for the first quarter was posted more than a month ago. It is pretty amazing to read and you will see how incredible the 3G folks really are. To find…

Big Dream: Anheuser-Busch InBev (BUD) / Coca-Cola (KO) Merger

This morning KO’s stock price popped up on a comment by David Winters that Buffett and 3G are planning to take KO private. He said that there are indications that something is going on, including press reports in Brazil regarding something related to 3G, KO and Buffett. Now, I don’t want to speculate on mergers…

10x Pretax Earnings! Case Studies: KO, BNI etc.

So, one of the great things about writing a blog is that I get feedback from some pretty intelligent people. Most of us don’t have a Munger to call, but a blog works well too. If I say something wrong, I’m sure someone would jump in to point it out. 10% Pretax for Stocks Too?…