Yes, it’s a tsunami. Tsunami of liquidity. A fiscal tsunami. Both at the same time. People seem baffled at the strength of the stock market; they keep saying the market is ‘divorced from economic reality’ and things like that. Others say this is a big bubble waiting to implode. I don’t mean to argue that…

Tag: investing

China Crash -> U.S. Crash?! and Great Book

A lot of people are talking about how bad China is. It’s worse than the U.S. 2007, it’s worse than Greece, it’s worse than this or that. It seems like the big China bubble is blowing up. But so what, right? Who cares what happens over there. Yes, the prices got crazy, but as long…

In Search of a Stock Market Bubble

So, (the sentence starts with “so” because this is a sort of ongoing discussion that’s been going on here for years) I’ve been thinking about the overall market again. Despite my telling people to ignore this and ignore that, I can’t help it; sometimes I think about this stuff. Well, it’s OK to think about…

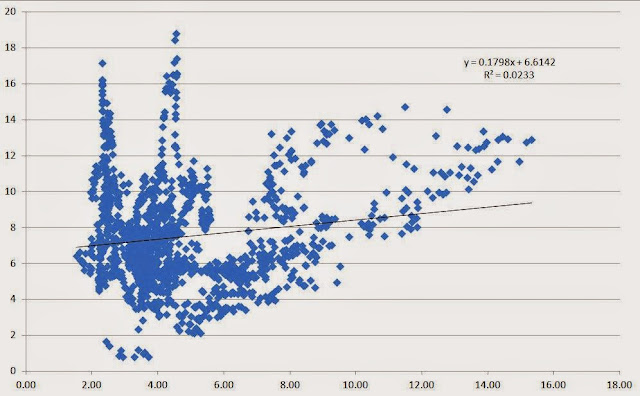

Market Valuation (Scatter Plot)

So, Buffett’s response (at the 2015 annual meeting) to questions regarding the valuation of the stock market was interesting. He used to just say it’s in a “zone of reasonableness”, but this time said that if interest rates stay at current low levels, the stock market is cheap, and if interest rates normalize, it is…

Market Timers vs. Macro Hedge Funds

OK, so this is another post that follows a discussion in the comments section (of previous posts). I think it’s pretty important so I thought I’d expand on a comment I made and turn it into a post. Halo Effect No, not the book. But the same idea. I think some of these top-down, market-timing…

What to Do in this Market: Gotham Funds Update

So my posts about the perils of market timing and market valuation have led to some interesting discussions in the comments section. Anyway, I wrote about the Gotham funds last year and since a little more time has passed, I thought I’d look at their performance to see what’s going on. But first, let me…

Overvalued Market!?

This is sort of a followup to my last post; it’s just another thought that came to mind as I was typing up a response to someone in the comment section, and I thought I’d expand the thought into a quick post as I think it’s pretty important. (Blog readers take note: This is my…

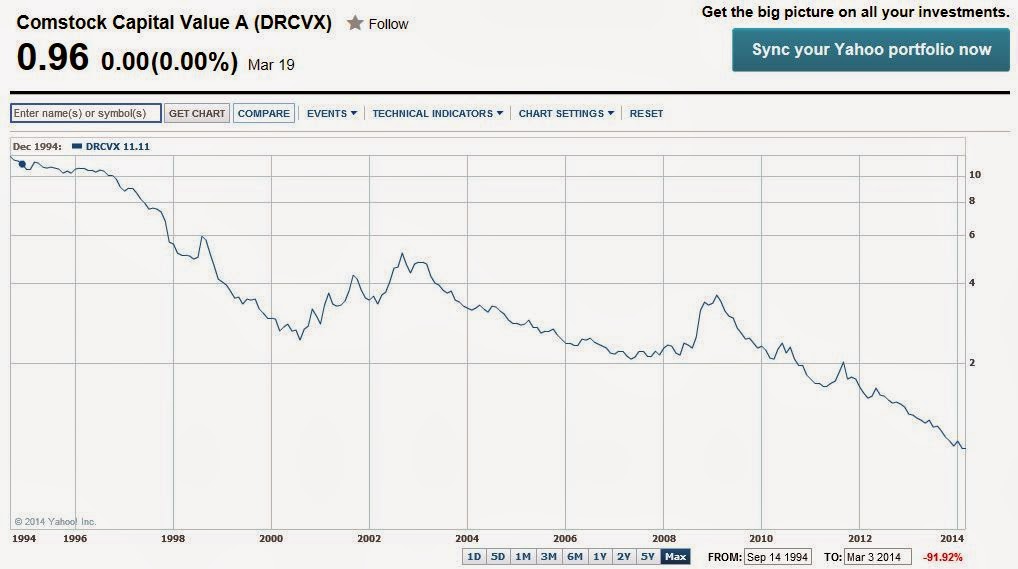

The Perils of Trying to Time the Market III

I just read an article about a big alternative mutual fund that is facing redemptions due to poor performance last year. And it got me thinking again about a recurring theme on this blog about the perils of trying to time the markets. I know it’s preaching to the choir here, but it is something…

The Halo Effect

After posting about the Collins book, Good to Great, some people mentioned the book The Halo Effect: . . . and the Eight Other Business Delusions That Deceive Managers by Phil Rosenzweig as a counter to it. So of course, I got it and read it right away. And it’s a really good book. I agree with a…

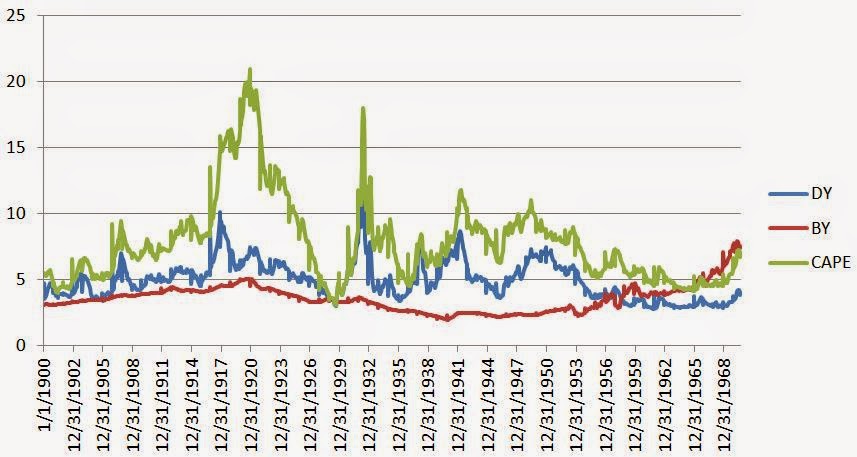

Buffett on Market Valuation

I don’t really spend too much time on market valuation, but I do think about it and post about it every now and then. Of course, debate about market valuation is pretty heated these days due to the super-high looking Shiller p/e ratio, high profit margins etc. I was reading through some old Buffett annual…