So, one of the great things about writing a blog is that I get feedback from some pretty intelligent people. Most of us don’t have a Munger to call, but a blog works well too. If I say something wrong, I’m sure someone would jump in to point it out. 10% Pretax for Stocks Too?…

Tag: investing

Buffett the Market Timer? Part 4: The Berkshire Years 1991-2004

So we continue. Let’s see what he says in 1991: BRK LTS 1991 Our outsized gain in book value in 1991 resulted from a phenomenon not apt to be repeated: a dramatic rise in the price-earnings ratios of Coca-Cola and Gillette. These two stocks accounted for nearly $1.6 billion of our $2.1 billion…

Buffett the Market Timer? Part 3: The Berkshire Years 1981-1990

OK, so this was a little longer than I thought, so I will make Part 3 1981-1990. There’s more stuff here than I thought. Anyway, let’s see what Buffett has to say: BRK LTS 1981 Buffett talks about trying to find whole businesses to buy but sees better opportunities in the stock market: Currently, we…

Buffett the Market Timer? Part 2: The Berkshire Years 1965-1980

I know I’m preaching to the choir here for the most part, and others will disagree completely and say that always being invested in stocks is reckless. But still, I thought it would be interesting to look at how Buffett viewed the market over the years, and what he did about it. We can…

Buffett the Market Timer? Part 1: The Partnership Years

OK, so I know this thing about not timing the market leads to a lot of debate. One thing you always hear when talking about this is that Warren Buffett himself is a market-timer. Well, yes, he has made comments on the market over the years; in 1999/2000 warning of a high market cap to…

Perils of Trying to Time the Market II

My last post reminded me of the second post I ever made on this blog back in 2011. I didn’t know it was my second post until I just looked back and checked. There are some prominent commentators these days, even an economist that runs a mutual fund based on his econometric analysis. The newsletter…

Greenblatt on CNBC: Market Reasonably Valued

So Joel Greenblatt was just on CNBC and said some interesting things. I don’t intend to post every time someone I respect shows up on TV, but this appearance was especially interesting to me for a couple of reasons. One major reason is, of course, market valuation. I don’t really care about the many folks…

The Greatest Investment Book Ever Written

No, I’m not talking about Security Analysis or Intelligent Investor by Benjamin Graham or even Greenblatt’s You Can Be a Stock Market Genius. I’m talking about Doyle Brunson’s Super System: A Course in Power Poker. OK, so the title of this post is a bit of an exaggeration and yes, there are probably tons of better…

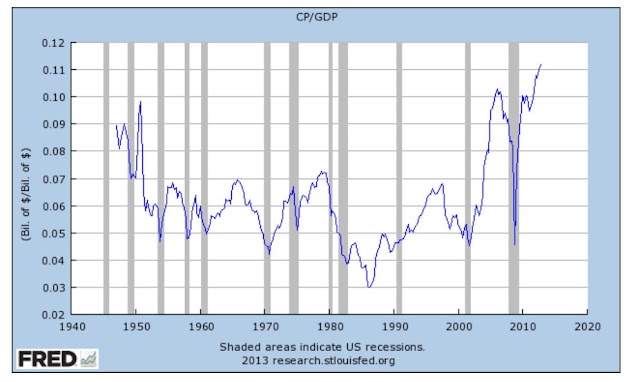

Corporate Profits-to-GDP: Why Doesn’t Buffett Care?

I haven’t posted in a while but that’s because I was busy with all the conference calls, annual reports, and of course, keeping up with all the stuff coming out of the Berkshire Hathaway annual meeting. Anyway, there is plenty of stuff out there on the annual meeting and I don’t have much to say…

Fiscal Cliff Doesn’t Matter

So the markets now are driven by the fiscal cliff. What will happen? If they don’t do something, the markets will plunge. If they come to some sort of agreement, the Dow would be up 1,000 points. Nobody wants to be long on a failure to come up with a solution, and nobody wants to…