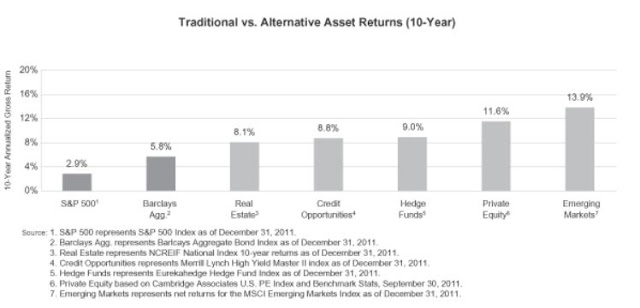

Howard Marks released another memo the other day talking about the state of the high yield bond market today. This is very relevant as I mentioned it as being a concern for Oaktree Capital (OAK) unitholders. Anyway, here is the memo: High Yield Bonds Today There are some interesting points here, and for OAK unitholders,…

Tag: OAK

Solid Results at Oaktree, But…

Oaktree Capital Group (OAK) announced pretty good earnings for the full year of 2012. The funds, across the board, returned around 15%. For those who don’t know, OAK is co-founded and run by Howard Marks, a legendary Buffett-like figure in the fixed income world. It would be well worth your time to google Howard Marks and…

DoubleLine Capital Valuation Hint

So here’s another followup post, this time for my OAK/DoubleLine post (here). Jeffrey Gundlach was on CNBC yesterday and talked about the markets and surprisingly talked about what he sees for the future of DoubleLine. Gary Kaminsky conducted the interview and he asked a really good question that lead to Gundlach’s discussion of DoubleLine’s future…

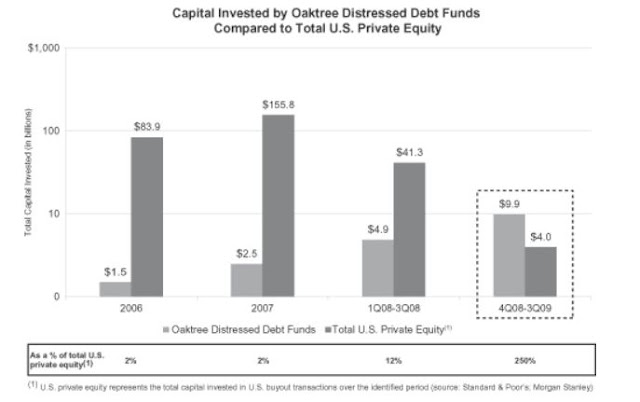

Oaktree’s Grand Slam

I don’t plan on updating things every quarter on companies I mention here; figures will go up and down over the short term due to markets and AUM changes due new fund launches and returning of capital to investors (due to realizations) etc. But anyway, one of the interesting things about OAK is the off-balance…

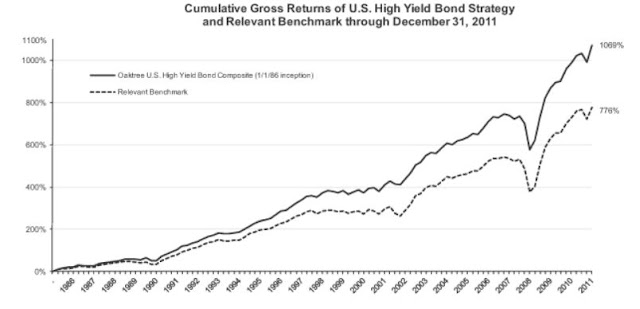

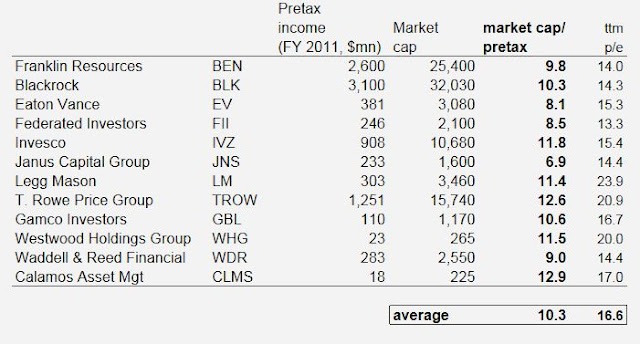

OAK: Oaktree Capital Management IPO

Oaktree Capital Managment had their IPO recently (April 12?); the stock was offered at $43.00/share but is now trading at $39.41 (today’s close). The price range for the offering was $43-46 so it came it at the lower end, and the planned 10,295,841 share offering was reduced to 7,888,864 shares (excluding the shares sold by…