So, continuing with the theme of active investing, I decided to take a look at Pzena Investment Management again. I’ve been watching it for a while and have posted about it in the past, but the stars are lining up more now than before. I think the sentiment against active investing is at sort of…

Tag: PZN

The Perils of Trying to Time the Market III

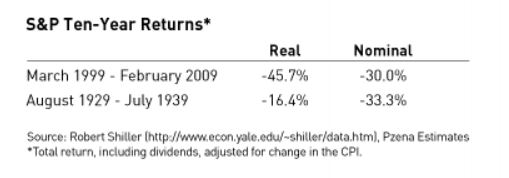

I just read an article about a big alternative mutual fund that is facing redemptions due to poor performance last year. And it got me thinking again about a recurring theme on this blog about the perils of trying to time the markets. I know it’s preaching to the choir here, but it is something…

Value Stocks In Market Corrections

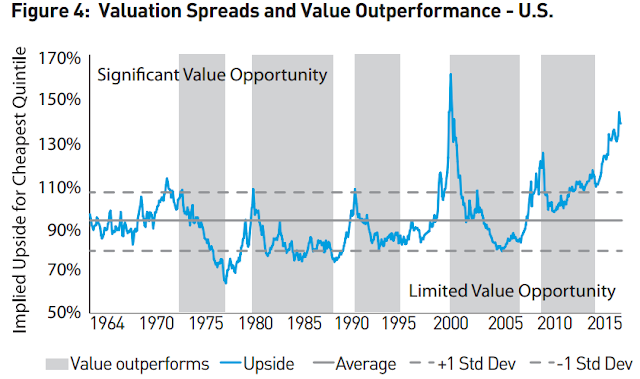

So with all of this talk of a market correction coming and people wondering what to do in this toppy market, Pzena put out an interesting newsletter back in June. It looks at value stocks and how they performed in market corrections in the past. They define value stocks as the lowest quintile of stocks…

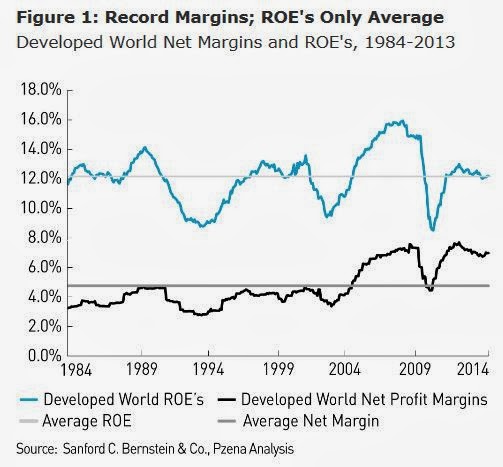

Pzena Quarterly Newsletter: Record Profit Margins?

I just listened to the fourth quarter earnings conference call for Pzena (PZN) and Richard Pzena said something interesting. He does a lot of work on deep value cycles and things like that so even if you don’t own the stock, it’s a good conference call to listen to. He is the only pure…

The Deep Value Cycle (and the Case for Value Investing)

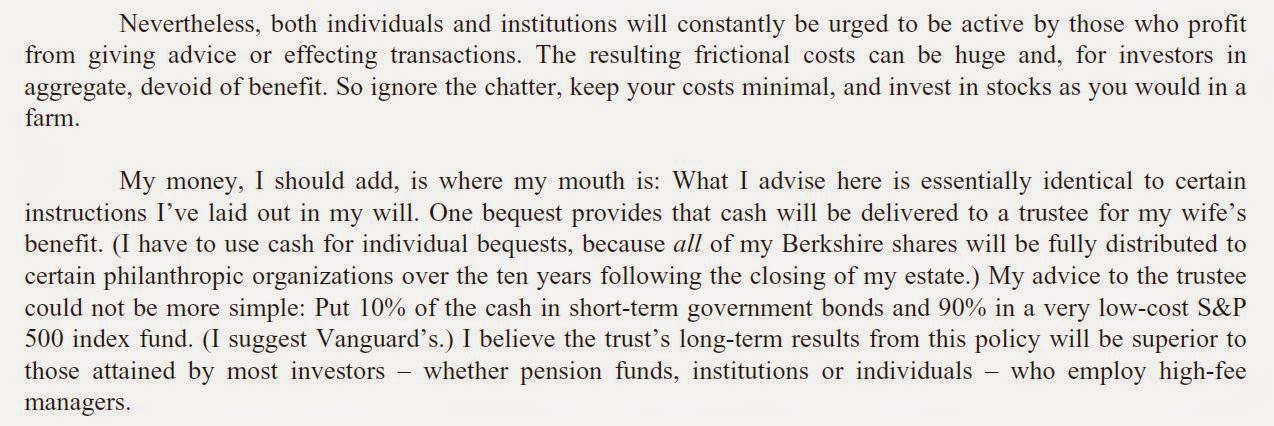

OK, so this is sort of a continuation of my PZN post. Listening to conference calls, you can tell that Pzena spends a lot of time thinking about value and deep value investing. I guess that’s because he spends a lot of time talking to potential clients and he has to sell them on the…

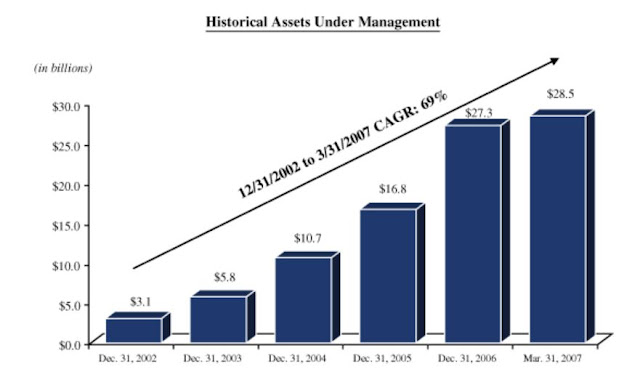

Pzena Investment Management (PZN)

OK, so here’s another nail that we can hammer down with our asset management company valuation model. I have been following this company since the IPO but haven’t really taken a close look at it recently. This is a pure, deep-value investment company run by Richard Pzena. In case you are wondering, this is the…