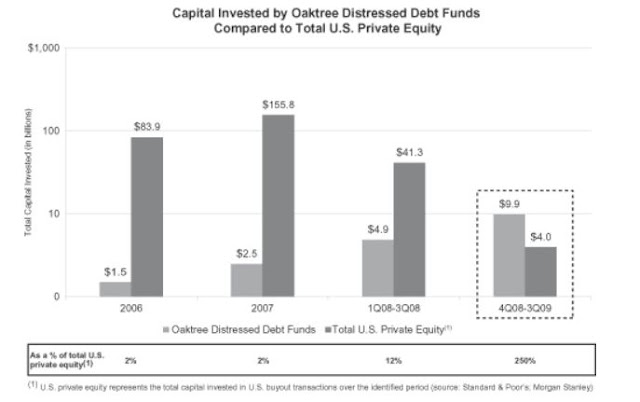

Oaktree Capital Group (OAK) announced pretty good earnings for the full year of 2012. The funds, across the board, returned around 15%. For those who don’t know, OAK is co-founded and run by Howard Marks, a legendary Buffett-like figure in the fixed income world. It would be well worth your time to google Howard Marks and…

Create Your Own Apple Stub

Einhorn is unhappy with Apple’s $137 billion cash hoard on the balance sheet and wants Apple to issue perpetual preferred shares to enhance shareholder value. He said in an open letter that every $50 billion of preferred shares it distributes (at 4% rate) will increase value to Apple shareholders by $32/AAPL share. First of all,…

Mr. Market versus Mr. Buffett

Not to beat a dead horse, but this Wells Fargo situation kept lingering in my mind so I thought I’d make this followup post. It is well understood by value investors but since I have a pretty wide readership in terms of stock market experience, I thought I’d post this because there is something to…

Wells Fargo is Cheap!

OK, so in my last post I commented that WFC is a great bank but is fully valued. This thought stuck to my mind over the weekend. Sometimes when I write something (whether blog or email), what I write bounces around in my head and I have second thoughts about it long after I hit…

Financials Still Look Good: Part 2

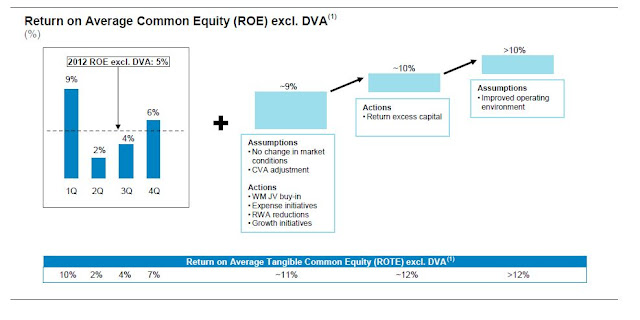

Bank of America (BAC) BAC announced earnings too, and things there are looking interesting. Like other banks, there is a problem with NIM pressure. But the investment bank / brokerage business seems to have done really well. I won’t go into any details here, but I just want to jot down what I was looking…

Financials Still Look Good: Part 1

JP Morgan Earnings So JPM announced earnings and things look pretty good to me. Sure, there is still steady NIM pressure and this will be an issue this year too. I think they said it will be a $400 million or so headwind in 2013. But otherwise, things look pretty good. I know people say…

Apple is No Polarioid, But…

I spent the last couple of weeks reading some books on Polaroid and took some notes that I thought were interesting and goes to the heart of my problem with Apple stock. Of course, Apple is not Polaroid. Polaroid was ‘just’ an instant camera, made irrelevant by digital technology. Apple has a deep eco-system and…

Why I Left Apple (Apple is a Speculation)

OK, this title is meant to mock the book about Goldman Sachs with a similar title. I have never worked for Apple, so this is misleading. Warning: This post has no data or any analysis. It’s just opinion, like a dinner table conversation with family on what worries me as an Apple shareholder (or…

Markel – Alterra Merger

So, Markel (MKL) is buying Alterra (ALTE). We know Markel is acquisitive and is looking for opportunities. So here it is. Of course Markel shareholders might have gotten sticker shock from the stock being down so much. If the deal is accretive to book value, then why the heck does the stock price have to…

Fiscal Cliff Doesn’t Matter

So the markets now are driven by the fiscal cliff. What will happen? If they don’t do something, the markets will plunge. If they come to some sort of agreement, the Dow would be up 1,000 points. Nobody wants to be long on a failure to come up with a solution, and nobody wants to…