Interest rates are plunging yet again in the U.S., and there is talk now of QE3 again. I’m happy to see things being done to help the economy, but one thing I fear about QE3 is that it will destroy the banking industry. What Worrys Me Most About Banks The JPM trading loss doesn’t worry…

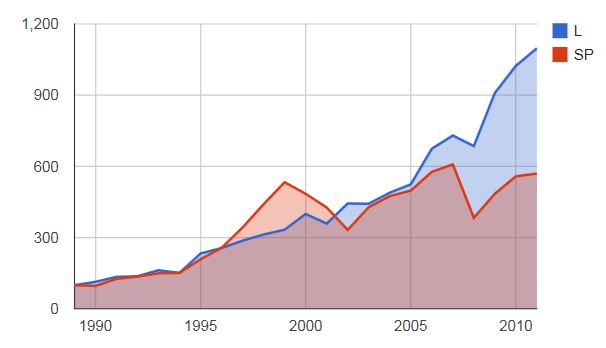

Loews Corp: Recent Returns, Adjusted Book Value etc.

People always talk about L in terms of sum-of-the-parts and whatnot, and I just realized that I never really looked at their returns over time and in different time periods. This may not be necessary as you know the Tischs’ have created value over time as they usually illustrate in their annual reports, and if…

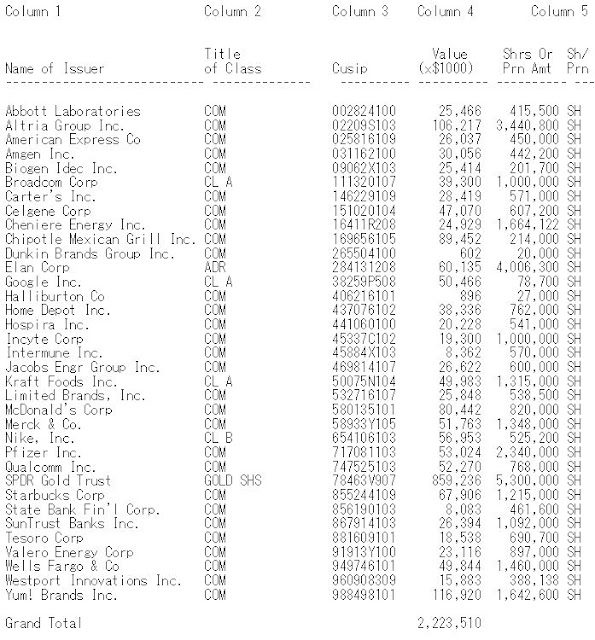

Duquesne Family Office Gold Correction

Someone pointed out that the $859 million GLD position was in the form of call options; I missed that (don’t go through filings late at night!) So the increase in the 13F portfolio from $1 billion to $2.2 billion is largely not ‘real’; just an increase due to the reporting of the notional amount of the…

Duquesne Family Office: Druckenmiller Likes Gold

This is not a blog that tracks the buys and sells of hedge funds or anything like that, but I just stumbled on this so I thought I’d post it. (Of course, a hedge fund manager liking gold is hardly breaking news, but…) We all know Stanley Druckenmiller; he needs no introduction (if you do,…

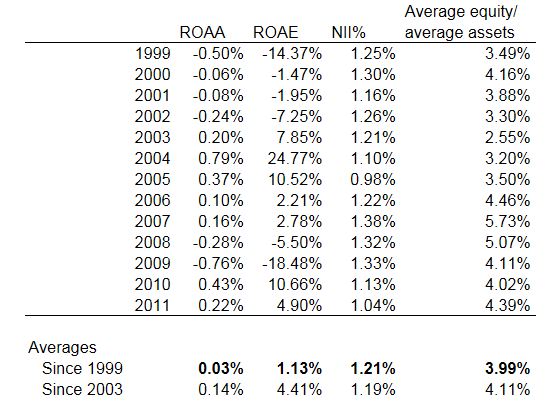

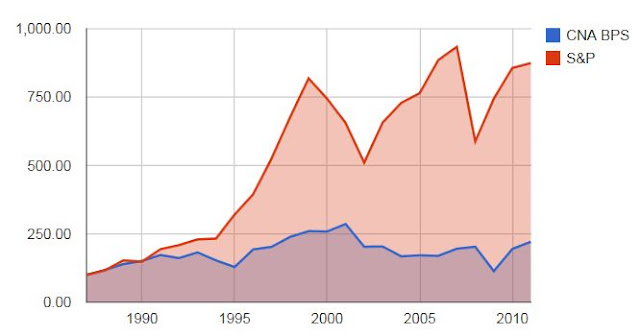

CNA: One-of-the-Parts (of Loews)

Loews (L) has been, for years, a popular sum-of-the-parts play by value investors and it seems that’s it’s always trading at a discount. I suppose that’s normal for a conglomerate. I am a big fan of L and have a lot of confidence in the Tisch family but one thing has always been nagging me about…

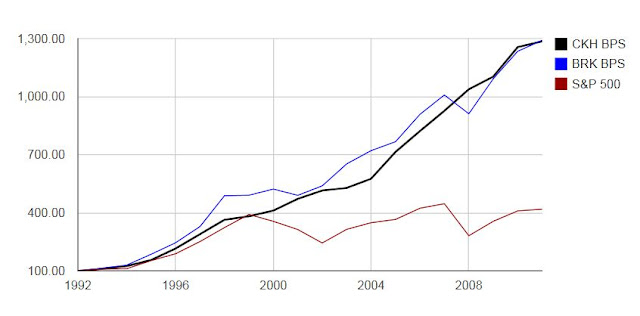

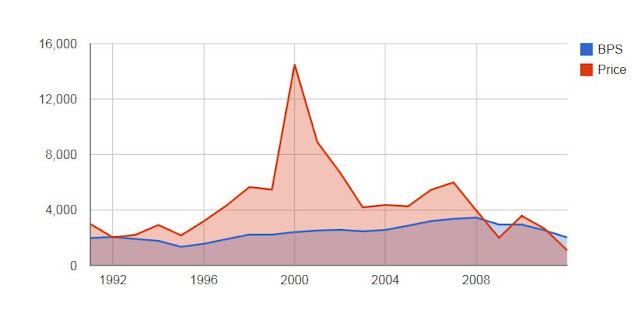

CKH: Seacor Holdings Inc. Annual Report 2011

So this annual report recently came in the mail. It’s another great read; a no-nonsense manager that has a great long term track record etc… But then as I was reading this, I realized it sits on a common thread of this blog recently (inflation, too much debt, dollar destined to go down, manage capital…

Deconstructing Sony: Some-of-the-Parts Have Value

OK, so this is a company I really, really would love to love. I grew up with their products and thought they were great. But things haven’t gone well there. I’ve been short this stock for a while, but without too much research. It was just a short on Japan in general and Sony’s (SNE) total…

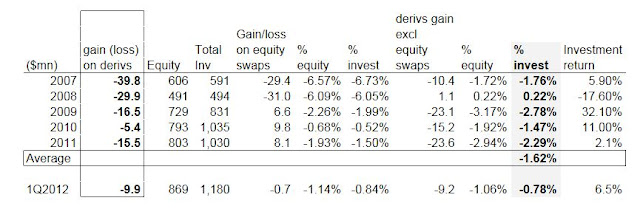

Einhorn’s Macro Trades

We know that Einhorn has taken a view on some sovereign credit, Japanese yen and gold etc. So I thought I’d take a quick look at his macro positions. First of all, for reference, at the end of the first quarter total investments were $1.18 billion and shareholders’ equity was $869 million. Positions This is…

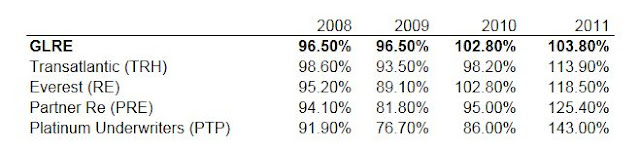

Greenlight Re Investor Meeting Notes 2012

I attended this event today and here are some notes. As usual, this is not intended to be a comprehensive summary at all so I won’t get into every detail. Also, there may be mistakes. Reading through the many Berkshire Hathaway annual meeting notes, we know that many people can hear the same thing and…

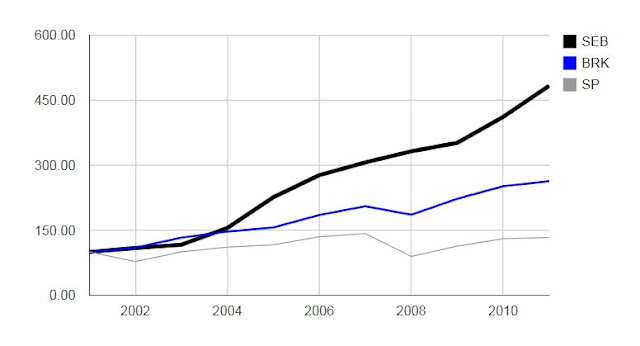

SEB: Seaboard Corporation

Not to get too caught up with Leucadia and what the smart folks there say, but this “wind at your back” and “protein” talk reminded me of a nice little company that may also be a protein play. LUK bought National Beef partly because it’s a play on the rising consumption of beef around the…