I was going through my stack of unread magazines, newspapers, newsletters, notes etc… and came across a Nikkei Weekly from November, when Buffett was in Japan. He has said before that Japan is getting interesting because it is getting cheap. After the earthquake/tsunami in March 2011, he also said it’s a time to buy Japan,…

Happy New Year! (and resolutions)

So, here is my new year’s resolution: turn over more rocks this year. A LOT more. The process of investing is pretty much just looking for interesting things to do. The more situations you look at, the more chance you have of running into an interesting idea. I have to admit that in the past…

YHOO Deal?

There is talk out there that Softbank and Alibaba is going to bid $17 billion for Yahoo’s Asian holdings in some sort of tax free deal. I don’t know what the real term sheet looks like, it was just on CNBC. But let’s take a quick look to jot down some of th facts. Here’s…

JEF Up 20%

So it’s nice to see Jefferies Group (JEF) stock up 20% today to just over $14.00 after dipping below $10.00 at one point in November. Despite the panic and near-run on JEF due to a faulty report be Egan-Jones, JEF managed to make money in the quarter. The market is relieved and the stock price…

BRK at a Discount?

Every once in a while, I hear this idea where you can buy Berkshire Hathaway stock at a discount. There are apparently some closed-end funds (CEF) that own a lot of Berkshire Hathway (BRK) stock and they trade at large discounts to net asset value (NAV), so therefore you can buy BRK at a discount….

FOFI: Hedge Funds at a Discount?

I am not a big fan of closed end funds, but if something is trading at a steep discount, we have to take a look. In general, a lot of funds have expense ratios in the 1%-2% range, sometimes higher. So in my mind, they deserve to trade at a discount to net asset value…

So What is BRK Really Worth? (Part 4)

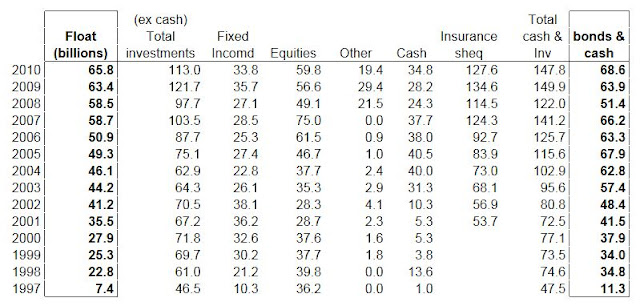

In Search of Premium to Book Value So in the last post, we found that the deferred tax assets (unrealized capital gains on stock holdings) is deducted from BRK’s total shareholders’ equity and not from the insurance segment shareholders’ equity. So when figuring the total value of BRK, the deferred taxes can be added back….

So What is BRK Really Worth? (Part 3)

In Search of a Premium to Book Value We looked at the two column method of BRK valuation and saw that yes, BRK is in fact cheap trading at 20-30% less than something like $150,000/share in intrinsic value. However, we also noticed that if you value the investments held on BRK’s books dollar for dollar,…

So What is BRK Really Worth? (Part 2)

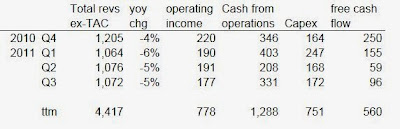

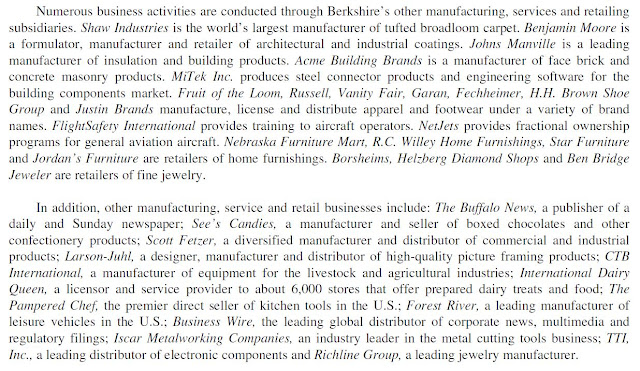

Let’s look at the basic model for valuing Berkshire Hathaway. It’s the model that is endorsed by Buffett himself in his annual reports. BRK basically breaks down into two basic components: An insurance company A bunch of wholly owned operating businesses. In what is usually called the two column valuation method, the insurance…

So What is Berkshire Hathaway Really Worth? (Part 1)

I’ve been thinking a lot about Berkshire Hathaway (BRK) lately. It’s still one of the best investments out there for most people. I don’t think it’s the highest return investment around, but an investment in Berkshire Hathaway at the current price is far better in my mind than owning the S&P 500 index or most…