Having browsed some of the conference presentations from the Value Investor Congress, I noticed that Leon Cooperman of Omega Advisors likes KKR at 5x p/e ratio. That’s interesting because I too happen to be looking at some of the private equity houses (I recently posted about Blackstone). I did spend some time with the financials…

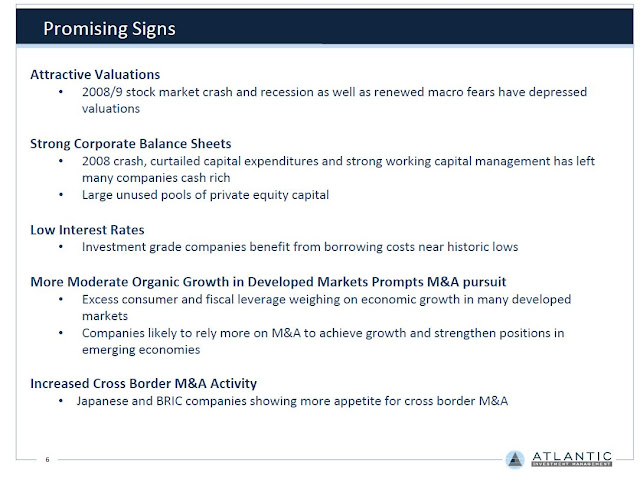

Some More Bullish Stuff

The Value Investors Congress was held in Mid-October. This is a conference run by Whitney Tilson of Value Investor Insight and it features some of the best value investors as speakers. After the conference, notes and presentations float around the internet and they make very interesting reading. Anyway, I was browsing through some of these…

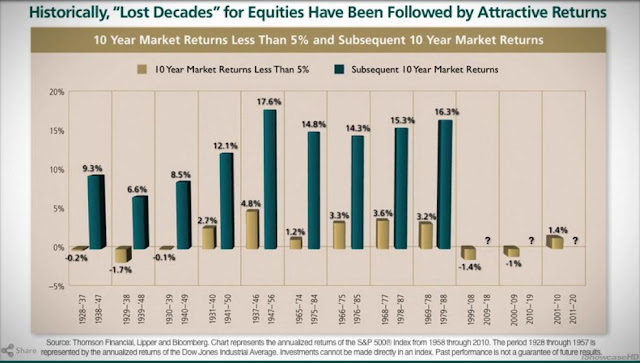

Bullish For Next Ten Years?

I just found this chart in a promotional video from Davis Funds and I thought it was interesting in that it illustrates what I tell people about dumping stocks because they say stocks are no good. The chart below shows every ten-year period since 1928 that the market rose less than 5%. The gold bars…

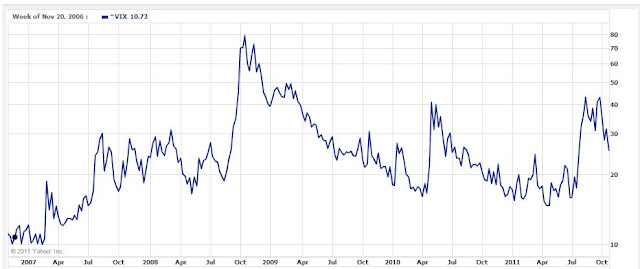

VIX: Fear Index Update

VIX Index, Last Five Years Wow, so that was quite a rally since my recent post(s). I am tempted to list up the things that I’ve mentioned in the past month and how well it’s done, but I won’t. I didn’t make those comments as a short term call on the market. But the fact…

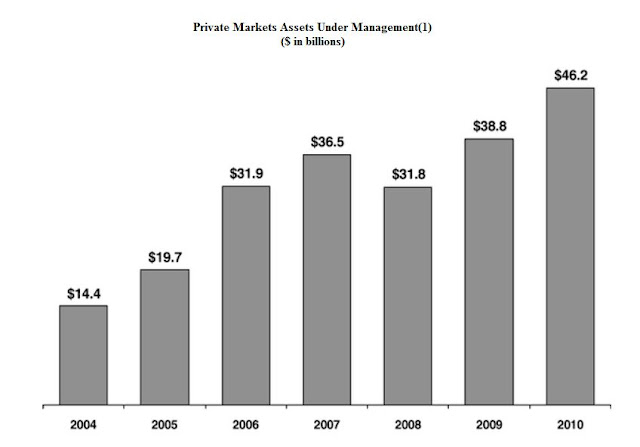

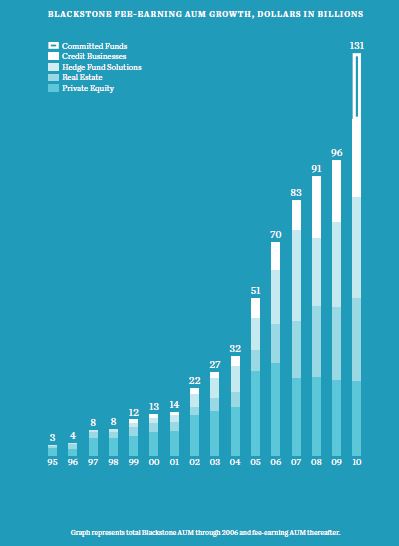

BX: Blackstone Group

I was going to pick this apart to see what it is worth and all that, but a few things about this is bugging me so I will hold off on looking at this in too much detail for now. Anyway, just some quick thoughts. I do like the idea of private equity. I am…

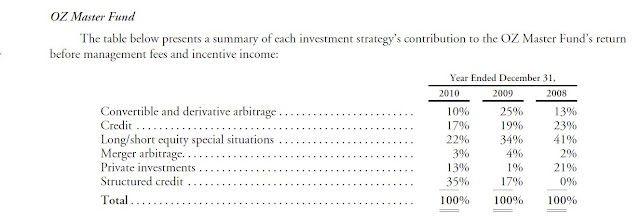

OZM: Och-Ziff Capital Management Group

Listed Hedge Fund Company Here’s a listed hedge fund that looks interesting although I don’t own it at the moment. A few hedge funds and private equity houses went public in the past few years and it is pretty interesting because you get to invest with some pretty amazing people. Of course, the performance in…

BPS Growth at Banks versus the S&P 500 Index

OK, I keep saying I won’t do something and then go ahead and do it a post or two later. One thing interesting to notice about these bank earnings announcements is how solid they are despite the horrible environment (or so it seems when you read the newspaper). For example, the S&P 500 index has…

Real Economy OK?

Earnings conference calls are great because you really get a feel for what is going on in the economy more so than macro announcements and economist opinions, market expectations and things like that. Of course, there are companies that are always upbeat so are totally useless in gauging the economy; Starbucks, Yum Brands, Cisco and…

Earnings Season

Just a quick note that this blog is still alive and well. It’s earnings/conference call season so I will be spending most of my day for the next week or two reading earnings announcements and listening to conference calls. I won’t be making comments on quarterly earnings as I only look at stocks from a…

CRESY: Emerging Market, Farmland, Real Estate

This is a stock that Leucadia owned for a brief time. I think they paid around $15/share for it and even participated in a global offering of the stock at $17 (per U.S. ADR) back in 2008. Asked at the annual meeting whether they were worried about the populist policies of the Argentina government, Leucadia…