This post is a sort of footnote to my previous post on GLRE. Think of it as sort of a meditation on the value of incentive fees. I’m just going to think out loud here so I may have some things that may or may not make sense. I don’t claim that anything here is more…

Tag: GLRE

Greenlight 2012 Results

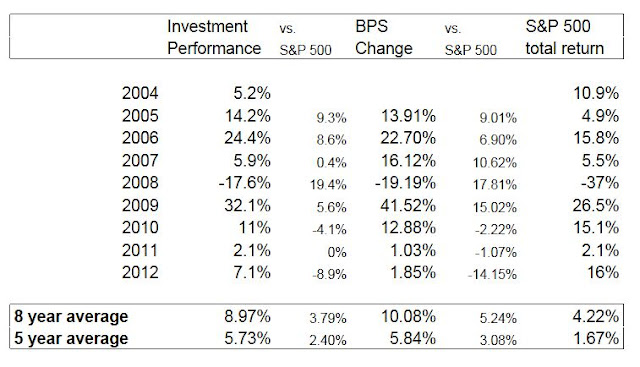

So, Greenlight Capital Re (GLRE) announced a not so good quarter/year. Investment performance came in at +7.1% which is not very good given a +16% stock market last year. In 2011, the return was 2.1%, same as the S&P index, and 2010 was +11% versus the S&P’s +15%. So that’s three years in a row that Einhorn…

Einhorn’s Macro Trades

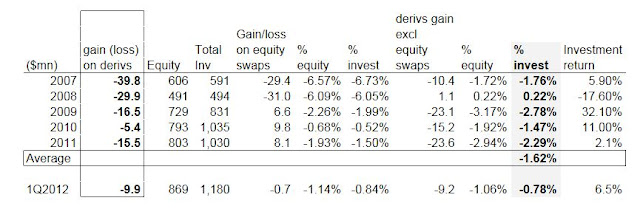

We know that Einhorn has taken a view on some sovereign credit, Japanese yen and gold etc. So I thought I’d take a quick look at his macro positions. First of all, for reference, at the end of the first quarter total investments were $1.18 billion and shareholders’ equity was $869 million. Positions This is…

Greenlight Re Investor Meeting Notes 2012

I attended this event today and here are some notes. As usual, this is not intended to be a comprehensive summary at all so I won’t get into every detail. Also, there may be mistakes. Reading through the many Berkshire Hathaway annual meeting notes, we know that many people can hear the same thing and…

GLRE: David Einhorn at Book

So David Einhorn is in the news again lately and I do notice that GLRE is trading around book value so I thought I’d post an update on this. I posted before that GLRE is a way to get hedge fund exposure at book value. I did say then that this is the same as…

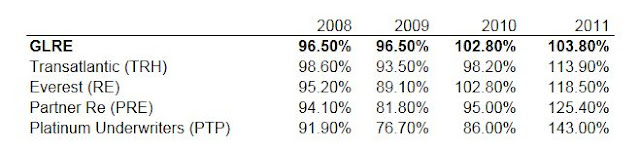

GLRE: Hedge Fund Exposure at Book

Greenlight Capital Re is a reinsurance company that was started up by David Einhorn of Greenlight Capital. Einhorn is one of the new generation hedge fund managers putting up impressive figures (along with Bill Ackman of Pershing Square) as a deep research, focused (concentrated) equity hedge fund. Einhorn does short stocks too so it is…