So, I was taking to a friend who has a million dollars in a large cap stock fund. The fund happens to be the Fidelity Magellan fund. The fund is very famous for being the ship that Peter Lynch navigated. But years later, it’s just another generic, closet-index/large cap fund. I don’t follow mutual funds…

Tag: KO

Heinz Update: Who’s Next?

So it’s been about a year since BRK and 3G Capital acquired Heinz (HNZ). This is old news to most of you as the 10-Q for the first quarter was posted more than a month ago. It is pretty amazing to read and you will see how incredible the 3G folks really are. To find…

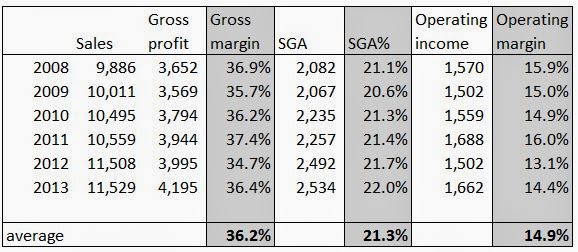

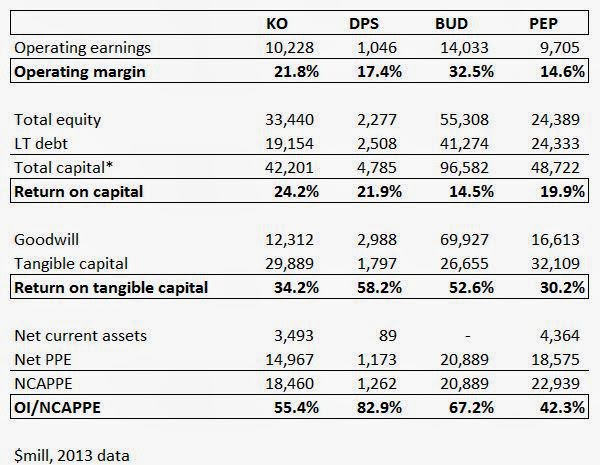

Is Coke Undermanaged?!

OK, now that’s a silly idea. Coke (KO) is one of the most respected companies and known to be very well managed. It is an excellent company for sure. One great thing about running a blog is that I can just think out loud here and sometimes someone pulls on a thread and gets…

Big Dream: Anheuser-Busch InBev (BUD) / Coca-Cola (KO) Merger

This morning KO’s stock price popped up on a comment by David Winters that Buffett and 3G are planning to take KO private. He said that there are indications that something is going on, including press reports in Brazil regarding something related to 3G, KO and Buffett. Now, I don’t want to speculate on mergers…

$24 Billion Wealth Transfer?!

So David Winters is upset about the “biggest transfer of wealth from shareholders to management” in history. According to Winters Coke’s (KO) new 2014 Equity Plan may cause 14.2% dilution to shareholders over the next four years. His calculation is that there are 4.4 billion shares outstanding so 14.2% of that is 625 million shares,…

10x Pretax Earnings! Case Studies: KO, BNI etc.

So, one of the great things about writing a blog is that I get feedback from some pretty intelligent people. Most of us don’t have a Munger to call, but a blog works well too. If I say something wrong, I’m sure someone would jump in to point it out. 10% Pretax for Stocks Too?…

On Gold and Inflation

I typed this up in late February and just found it as a ‘draft’ in my blogger. I thought I posted it already but didn’t. So here it is: So Buffett has a nice tutorial on investing in the most recent letter to shareholders (2011), available for free at the Berkshire Hathaway website. He says…