So the 2012 annual report is up on the website. They revamped it and Loews even has a new logo. Here is the new logo: I’m not an art major or anything like that so I don’t know anything about it but my first impression was that this looks a little retro, even Art Deco-ish. …

Category: Uncategorized

Markel 2012 Annual Report

The Markel (MKL) results have been out, but I just noticed that the annual report is out too (I don’t check so it may have been out for a while). The MKL annual report is a very good read of you have the time to check it out. We know this from the earnings release, but…

More Adjustment to Loews Book Value

So I made a post about the adjusted book value per share of Loews (L) and someone kindly responded that there are publicly listed MLP general partnership (GP) interests that I can use to value L’s GP interest and IDR (incentive distribution rights) in Boardwalk Pipeline (BWP). The thing to do, of course, would be to calculate the…

Value of Investments per Share (Berkshire Hathaway)

So I explained in my most recent post (Buffett Letter 2012) on Berkshire Hathaway (BRK) why investments per share is not worth investment per share to me. I know this makes no sense to many, and even Buffett would say it makes no sense. Cash is worth what it’s worth. No more, no less. I don’t have…

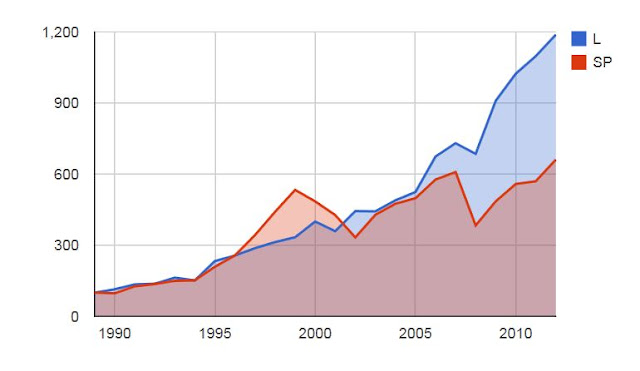

Loews Adjusted Book Value Update

I may be jumping the gun here as Loews (L) annual report hasn’t come out yet, but since the 10-K is out I figured I would just update some numbers. Last year I made a post about adjusting L’s book value by adding or subtracting the difference between the market value of publicly listed holdings…

Buffett Letter 2012

OK, so there are a lot of comments about the Berkshire Hathaway letter to shareholders all over the place and I really don’t have too much to add, but I thought I’d post some comments for the people I tell to read these every year (and I know they don’t). So consider this just a…

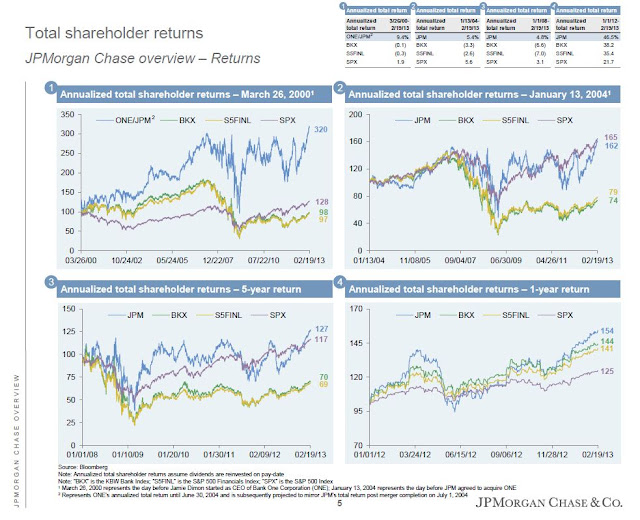

JPM Investor Day 2013

So I listened to the JPM investor day via the internet today. My internet connection, or the PC or something somewhere kept dropping out so I missed a lot, but that’s OK. Anyway, I know I do talk an awful lot about financials and banks. That’s partly because I do tend to have a sort of comfort level…

What GLRE is Worth to Einhorn

This post is a sort of footnote to my previous post on GLRE. Think of it as sort of a meditation on the value of incentive fees. I’m just going to think out loud here so I may have some things that may or may not make sense. I don’t claim that anything here is more…

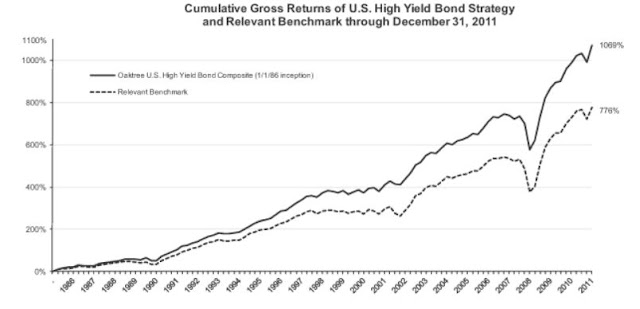

Memo from Brooklyn (OAK’s Preferred Rate)

Howard Marks released another memo the other day talking about the state of the high yield bond market today. This is very relevant as I mentioned it as being a concern for Oaktree Capital (OAK) unitholders. Anyway, here is the memo: High Yield Bonds Today There are some interesting points here, and for OAK unitholders,…

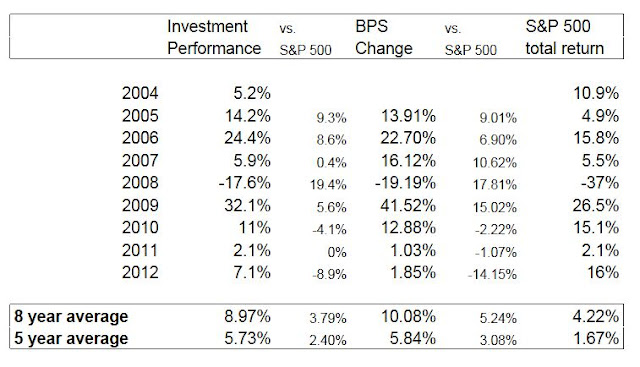

Greenlight 2012 Results

So, Greenlight Capital Re (GLRE) announced a not so good quarter/year. Investment performance came in at +7.1% which is not very good given a +16% stock market last year. In 2011, the return was 2.1%, same as the S&P index, and 2010 was +11% versus the S&P’s +15%. So that’s three years in a row that Einhorn…