Value Funds Holy cow, I haven’t been reading or keeping up with much in the value investing world. As part of my catch up, I plan on reading letters from the various value funds and things like that. One of the first ones, of course, was Sequoia Fund, and I was shocked at how poorly…

Mac Conversion

Oh, one thing that changed since the last time I was more active here is that I am now a complete Apple fanboy. OK, maybe not really, as I don’t wait in line for hours for anything. But I used to be 100% Windows but now I am sort of all mixed up. I have…

The Markets, BRK Annual Meeting, AI Mania etc..

The Markets OK, so let’s talk about stocks. I will look into things a little more later, but for now, I will just let you guys know that not much has changed in my thinking. As long as the market is within what Buffett years ago called the “zone of reasonableness”, I don’t worry too…

Blog Migration!

So, I have migrated the blog from Blogger to this new WordPress blog. I know, it’s 2023, and here I am with a WordPress website. How do you spell Luddite? Nowadays, people just put up a Youtube channel or podcast. I know that too, but you won’t ever get me to do that, lol… I…

BRK 2021 Annual Meeting

So, like many of you, I watched the BRK annual meeting (replay) as usual. It was nice to have Ajit and Greg join Buffett and Munger on the stage. Buffett and Munger both looked great, and it was good to see that duo in action again. There were a few interesting things this time. This…

Happy New Year! Bubble Yet?

What a year it’s been. Crazy. And what a crazy year it already is so far. I haven’t been posting much because there hasn’t really been much to say. Like everyone else, I am doom-scrolling and wondering when this nightmare will end. I have no particular view on how Covid will play out, so…

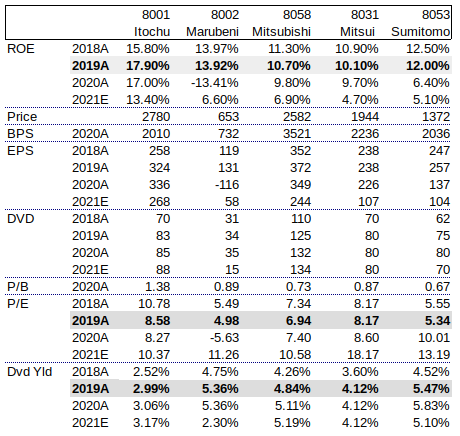

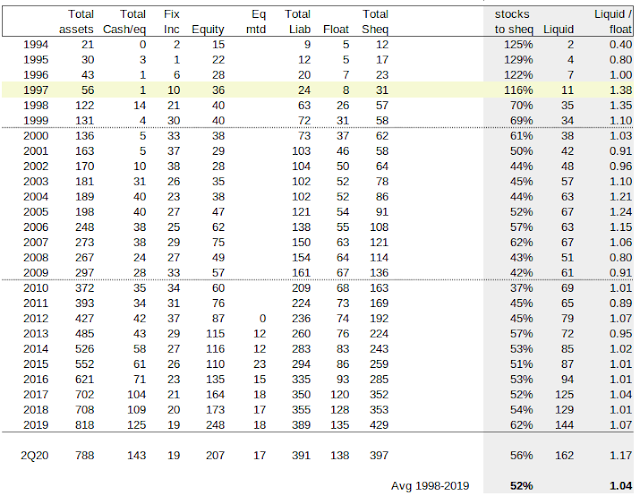

Sogo Shosha

Not quite a whale, and pretty small investment, but interesting nonetheless. As usual, people are trying to read all sorts of things into this investment, from bullishness on Japan, bearishness on the U.S., the U.S. dollar, inflation hedge / exposure to natural resources etc. It almost feels like nobody ever reads anything Buffett writes. He…

Is Buffett Really Bearish?!

So, with Buffett dumping airlines, JPM and not jumping into the markets in March, is he really all that bearish? His cash keeps piling up to the frustration of long time Buffett fans. March Decline First, I would have to say that the March decline was pretty quick. It crashed, and the market bounced back…

Tsunami etc.

Yes, it’s a tsunami. Tsunami of liquidity. A fiscal tsunami. Both at the same time. People seem baffled at the strength of the stock market; they keep saying the market is ‘divorced from economic reality’ and things like that. Others say this is a big bubble waiting to implode. I don’t mean to argue that…

Wow!

It’s been quite a few weeks since my last post. I haven’t really changed my thoughts since then, but maybe the economic impact of this will have more than a blip on the long term charts after all. So far, the economy seems to be doing much worse (or will soon) than the stock market….