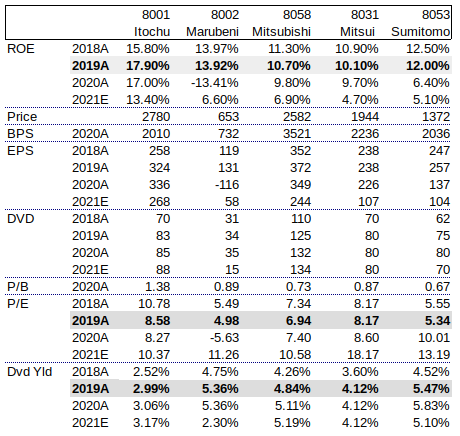

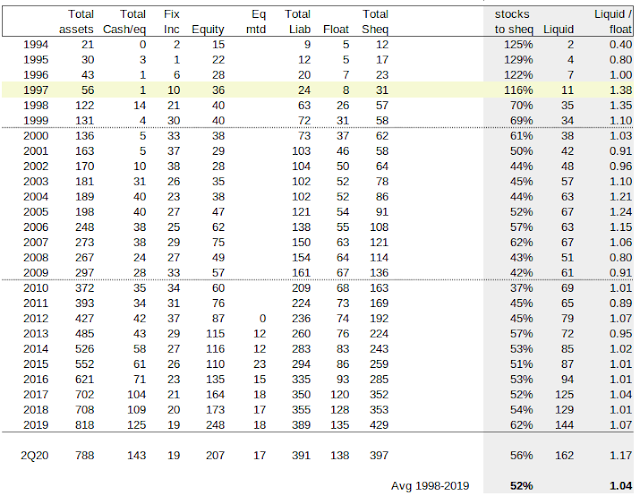

Not quite a whale, and pretty small investment, but interesting nonetheless. As usual, people are trying to read all sorts of things into this investment, from bullishness on Japan, bearishness on the U.S., the U.S. dollar, inflation hedge / exposure to natural resources etc. It almost feels like nobody ever reads anything Buffett writes. He…

Is Buffett Really Bearish?!

So, with Buffett dumping airlines, JPM and not jumping into the markets in March, is he really all that bearish? His cash keeps piling up to the frustration of long time Buffett fans. March Decline First, I would have to say that the March decline was pretty quick. It crashed, and the market bounced back…

Tsunami etc.

Yes, it’s a tsunami. Tsunami of liquidity. A fiscal tsunami. Both at the same time. People seem baffled at the strength of the stock market; they keep saying the market is ‘divorced from economic reality’ and things like that. Others say this is a big bubble waiting to implode. I don’t mean to argue that…

Wow!

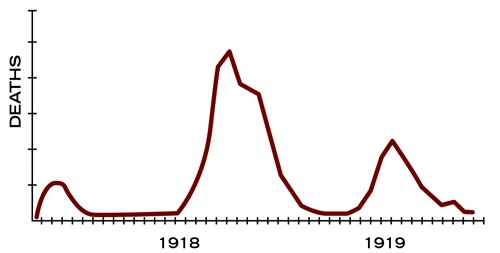

It’s been quite a few weeks since my last post. I haven’t really changed my thoughts since then, but maybe the economic impact of this will have more than a blip on the long term charts after all. So far, the economy seems to be doing much worse (or will soon) than the stock market….

Who Cares What Mr. Market Thinks!

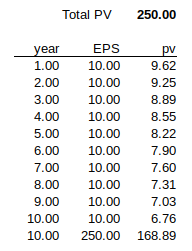

So, the market has gone crazy. People ask me about the market and the impact of the COVID-19 and I keep saying it doesn’t matter. But with the market acting like this, it’s hard for people to agree with me. The markets make the news, the market creates the sentiment etc. and I can’t fight…

Coronavirus, Munger etc.

Munger Munger is looking and sounding great at the DJ annual meeting (I wasn’t there; just watched the video). His ‘wretched excess’ seems to be more about private equity and venture capital than the public stock market. In fact, he said that tech stocks now are not like the Nifty Fifty stocks (he mentioned Home…

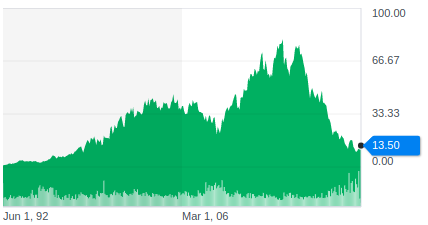

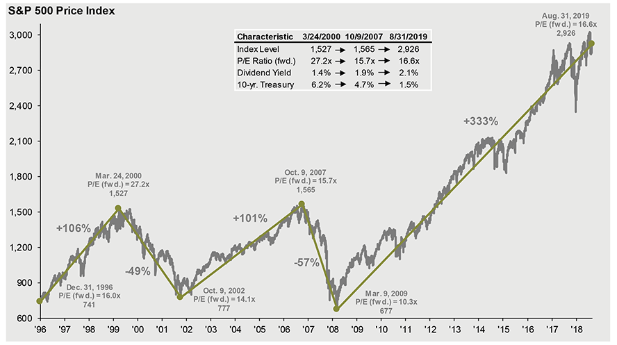

Malone Interview (CNBC), Iger Book, Bubble Watch

People keep talking about how crazy the market is, up more than 25% this year. It’s a big year to be sure. But on the the other hand, even though the market has been decent in recent years, it hasn’t been particularly bubblicious. To put the 25% return into context, I think it’s a good…

What It Takes, Dimon, Twitter etc.

Recently, I’ve gotten some emails asking about the blogger email updates. I googled around (again) recently for a solution and couldn’t find one, and also looked at some mass email services and they aren’t free over a certain number of subscribers. So, as has been suggested here by some over the years, I just set…

Bubble Yet?

Bubblicious? People still speak of bubbles a lot, bubble in the bond market, stock market, unicorns etc. But I still don’t really see a bubble except in certain areas of technology. Otherwise, things seem to be in a normal range to me, except interest rates. They do seem a bit low, but having said that,…

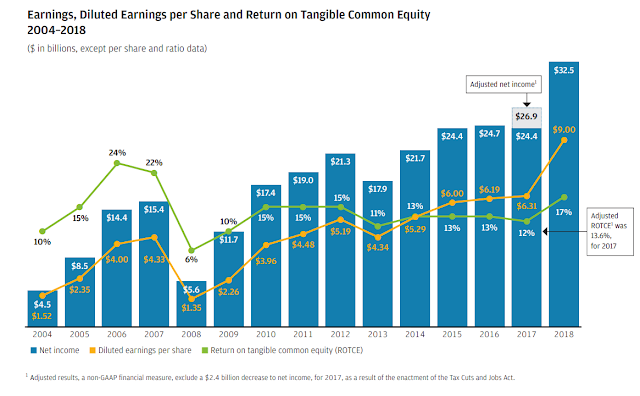

JPM 2018 Annual Report, Website etc.

JPM’s annual report is out, and maybe a good time for another post here. I know it’s been a few months. Honestly, I have been coasting recently on what’s been working and haven’t been digging around too much in the stock market. Most of my time recently has been spent on programming, having taken on…