OK, so here we go. Hopefully this will be the last part in this marathon series. BRK LTS 2005 So 2005 turns out to be an interesting year. After years of not doing much in the stock market, Buffett initiates positions in Anheuser-Busch, Walmart, and “substantially” increases his position in Wells Fargo. It’s been a…

Tag: BRK

Buffett the Market Timer? Part 4: The Berkshire Years 1991-2004

So we continue. Let’s see what he says in 1991: BRK LTS 1991 Our outsized gain in book value in 1991 resulted from a phenomenon not apt to be repeated: a dramatic rise in the price-earnings ratios of Coca-Cola and Gillette. These two stocks accounted for nearly $1.6 billion of our $2.1 billion…

Buffett the Market Timer? Part 3: The Berkshire Years 1981-1990

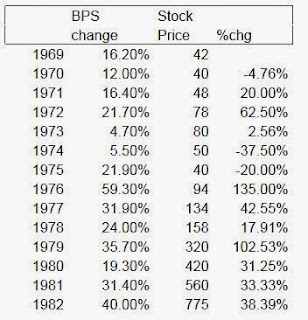

OK, so this was a little longer than I thought, so I will make Part 3 1981-1990. There’s more stuff here than I thought. Anyway, let’s see what Buffett has to say: BRK LTS 1981 Buffett talks about trying to find whole businesses to buy but sees better opportunities in the stock market: Currently, we…

Buffett the Market Timer? Part 2: The Berkshire Years 1965-1980

I know I’m preaching to the choir here for the most part, and others will disagree completely and say that always being invested in stocks is reckless. But still, I thought it would be interesting to look at how Buffett viewed the market over the years, and what he did about it. We can…

Buffett the Market Timer? Part 1: The Partnership Years

OK, so I know this thing about not timing the market leads to a lot of debate. One thing you always hear when talking about this is that Warren Buffett himself is a market-timer. Well, yes, he has made comments on the market over the years; in 1999/2000 warning of a high market cap to…

Buffett on CNBC with 3T’s

Buffett spent three hours on CNBC yesterday (March 3, 2014). Here are some notes, not necessarily comprehensive. I flipped through some transcripts too to help me remember what he said. Two most interesting things for me was Weschler’s comment on DaVita, and Comb’s comment that he reads 500 pages per week (which I think…

Berkshire Hathaway Annual Report 2013

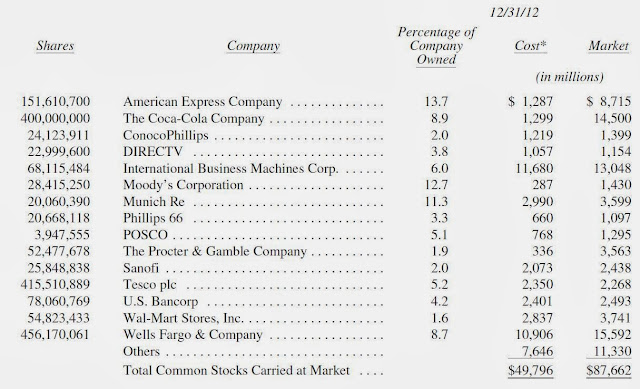

So, Buffett’s annual letter to shareholders came out. What can I say? Berkshire (BRK) is an incredible money making machine. They grew book 18.2% after some meaningless charges. Yes, that’s not so exciting compared to the S&P 500 index, but for a $200+ billion giant, it’s pretty darn good. And this is not too far…

Graham Holdings Split-Off

So Berkshire Hathaway (BRK) made an interesting 13D/A filing: The Issuer is discussing with Berkshire the possibility of Berkshire acquiring an as yet unformed subsidiary of the Issuer, which would own a business and would own certain other assets to be determined but which may include shares of Berkshire common stock owned by the Issuer, in…

DaVita HealthCare Partners (DVA)

So Ted Weschler, one of Berkshire Hathaway’s (BRK) new investment managers made some news recently. He bought 3.7 million shares of DaVita HealthCare Partners (DVA) after their dreadful 3Q conference call in which Thiry (DVA’s current and long time CEO) said that the outlook for 2014 is worse than they had anticipated, and the hit to…

What To Do In This Market

After such a huge rally since the great recession, and now after a huge runup this year people are wondering what to do with their money. Many are afraid that the markets will tank as they are getting bubbly and there will eventually be tapering that will most certainly be devastating to the markets. But…