This is one of those things that I looked at before and never posted, so here it is. Actually, I didn’t write much about it, it was just sitting in my queue. I know Munger likes China more than India, but I think India is very interesting. I don’t think I have to say much…

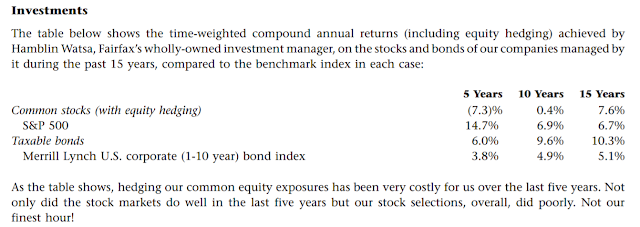

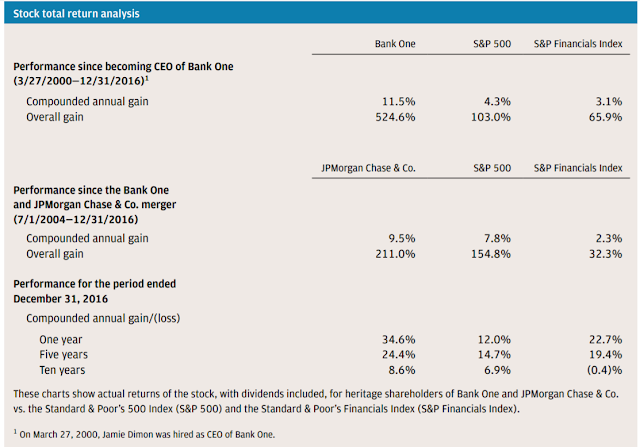

JP Morgan 2016 Annual Report (JPM)

I haven’t posted much about JPM recently as it’s still basically the same story. Great CEO building an awesome company performing really well etc. After even a couple of posts, they are basically the same. But since I haven’t been too active here recently, I figured why not? Let’s take a look at this. There…

Buffett on Valuation

Buffett was on CNBC the other day and it was very interesting as usual. Well, most of what he says is not new. Not in Bubble Territory Anyway, he was asked about the stock market and since so many people keep saying that the stock market is overvalued or that it’s in a bubble, I…

Six Sigma Buffett, Taxes, Fund Returns etc.

Whenever I read about Buffett and other great managers, what I tend to see all the time are things like, “xx has beaten the market y out of z years; the odds of that happening are 1 in 5,000!” or some such thing. Not too long ago, there was an article about managers with outstanding…

Bogle Book, Indexing etc.

I have watched and listened to John Bogle for years and always thought he was great, but I never read any of his books. I understand his message and agree with him for the most part. But the other day while I was browsing the library, I came across this book and just grabbed it…

Overbought!!?

So, the market has been going crazy after the election and people keep talking about how ‘overbought’ the market is. Well, the market certainly has gone up a lot in a short time. But is this important or relevant? Back in my technical days when I was doing a lot of research on technical indicators,…

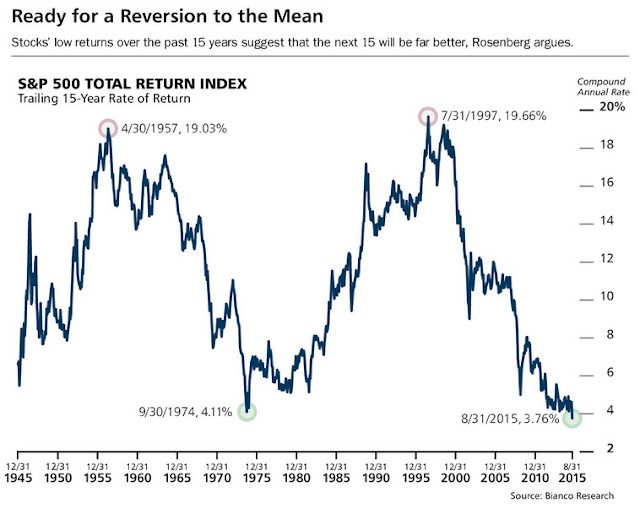

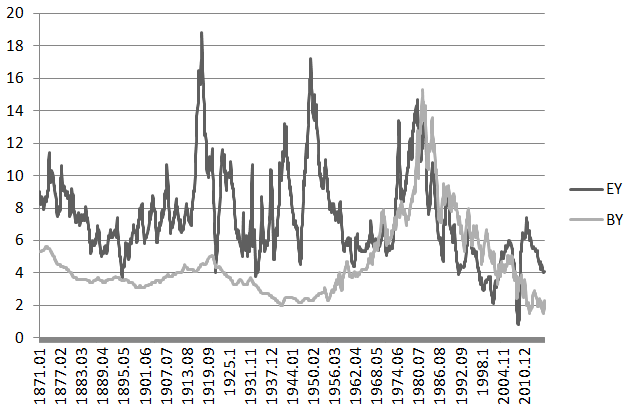

Bonds Down, Stocks Up!

So bonds are ‘crashing’ and stocks are going up. Some say that this can’t continue; you can’t have stocks and bonds go in opposite directions for long before something snaps. Well, this is true to some extent. But it sort of depends on which way the ‘snap’ is happening. What if bonds were way overvalued…

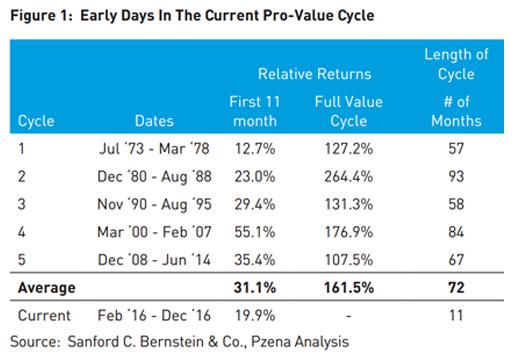

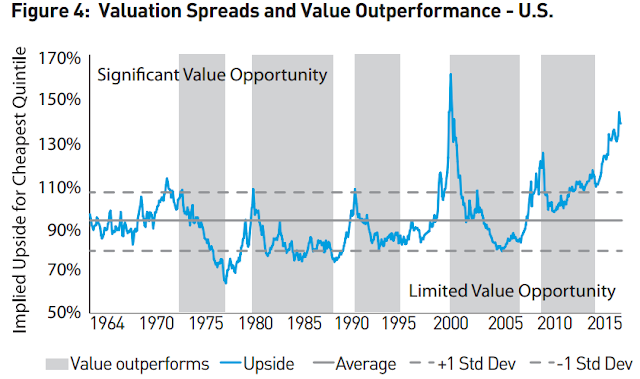

Active Play: Pzena Investment Management Inc. (PZN)

So, continuing with the theme of active investing, I decided to take a look at Pzena Investment Management again. I’ve been watching it for a while and have posted about it in the past, but the stars are lining up more now than before. I think the sentiment against active investing is at sort of…

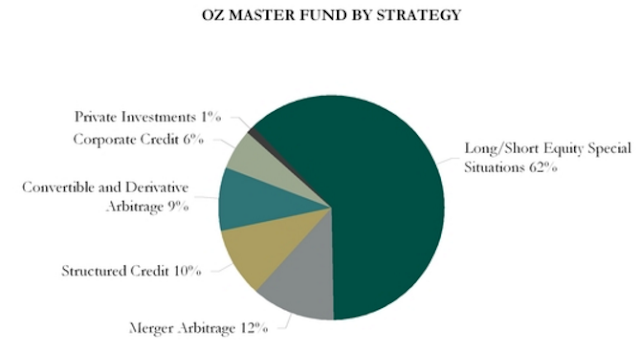

Perpetual Option: Och-Ziff Capital Management Group (OZM)

In his book, You Can Be a Stock Market Genius, Greenblatt talks about using LEAPs to make leveraged bets. The book included his trade in Wells Fargo (WFC, another topic for a future post, I suppose). But sometimes, stocks get down so cheap that they become priced like options. In the Genius book, the WFC LEAPs…

Gotham’s New Fund

Joel Greenblatt was in Barron’s recently. He is one of my favorite investors so maybe it’s a good time for another post. Anyway, this new fund is kind of interesting as I am sort of a tinkerer; this is like the product of some financial tinkering. I don’t know if it’s the right product for…