Shiller said the other day that the market can go up 50% from here. OK, so I fell for it and clicked to watch the CNBC video. This was sort of a surprising comment coming from the creator of the CAPE ratio, one of the main indicators bears use to argue that the market is…

Author: kk

High Fees

So, I was taking to a friend who has a million dollars in a large cap stock fund. The fund happens to be the Fidelity Magellan fund. The fund is very famous for being the ship that Peter Lynch navigated. But years later, it’s just another generic, closet-index/large cap fund. I don’t follow mutual funds…

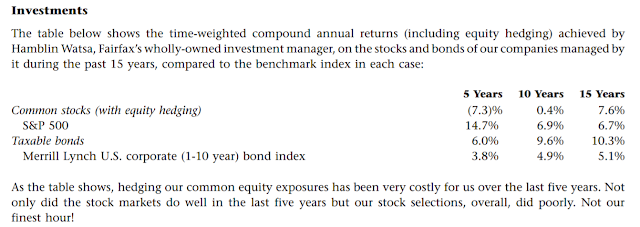

Fairfax India Holdings (FFXDF)

This is one of those things that I looked at before and never posted, so here it is. Actually, I didn’t write much about it, it was just sitting in my queue. I know Munger likes China more than India, but I think India is very interesting. I don’t think I have to say much…

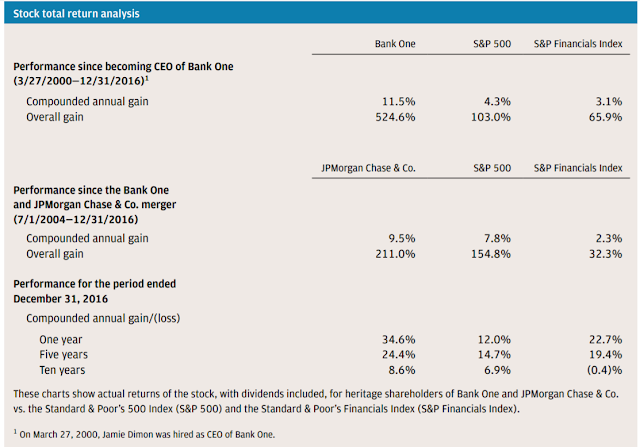

JP Morgan 2016 Annual Report (JPM)

I haven’t posted much about JPM recently as it’s still basically the same story. Great CEO building an awesome company performing really well etc. After even a couple of posts, they are basically the same. But since I haven’t been too active here recently, I figured why not? Let’s take a look at this. There…

Buffett on Valuation

Buffett was on CNBC the other day and it was very interesting as usual. Well, most of what he says is not new. Not in Bubble Territory Anyway, he was asked about the stock market and since so many people keep saying that the stock market is overvalued or that it’s in a bubble, I…

Six Sigma Buffett, Taxes, Fund Returns etc.

Whenever I read about Buffett and other great managers, what I tend to see all the time are things like, “xx has beaten the market y out of z years; the odds of that happening are 1 in 5,000!” or some such thing. Not too long ago, there was an article about managers with outstanding…

Bogle Book, Indexing etc.

I have watched and listened to John Bogle for years and always thought he was great, but I never read any of his books. I understand his message and agree with him for the most part. But the other day while I was browsing the library, I came across this book and just grabbed it…

Overbought!!?

So, the market has been going crazy after the election and people keep talking about how ‘overbought’ the market is. Well, the market certainly has gone up a lot in a short time. But is this important or relevant? Back in my technical days when I was doing a lot of research on technical indicators,…

Bonds Down, Stocks Up!

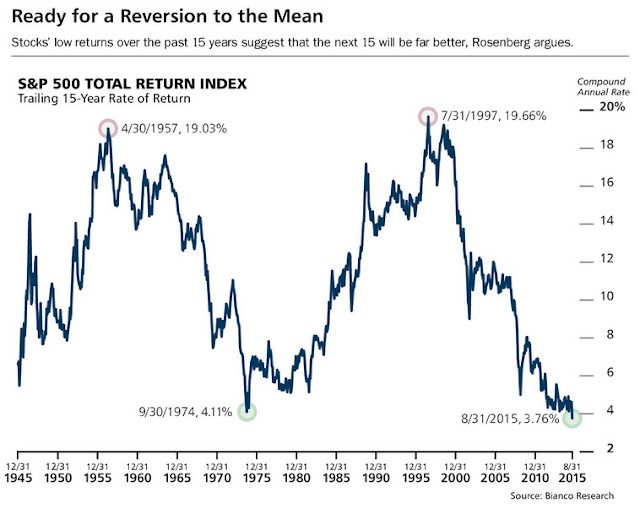

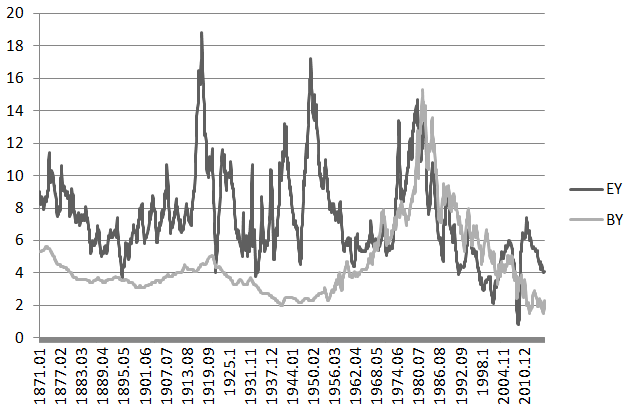

So bonds are ‘crashing’ and stocks are going up. Some say that this can’t continue; you can’t have stocks and bonds go in opposite directions for long before something snaps. Well, this is true to some extent. But it sort of depends on which way the ‘snap’ is happening. What if bonds were way overvalued…

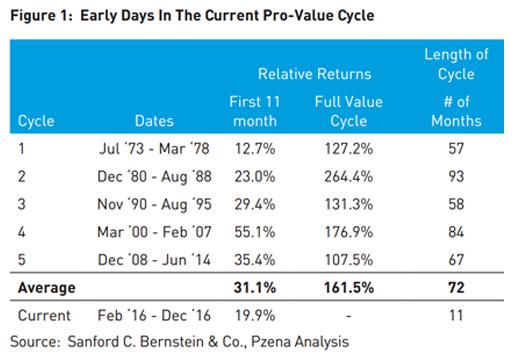

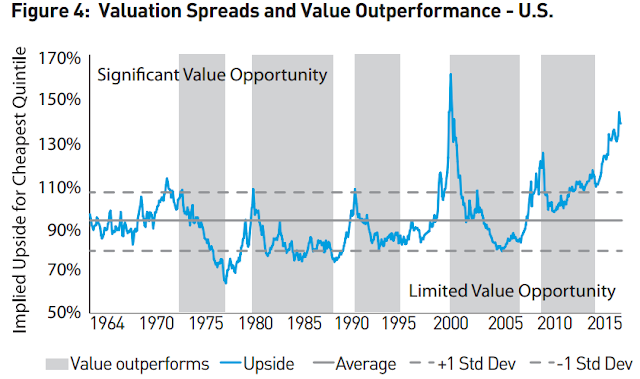

Active Play: Pzena Investment Management Inc. (PZN)

So, continuing with the theme of active investing, I decided to take a look at Pzena Investment Management again. I’ve been watching it for a while and have posted about it in the past, but the stars are lining up more now than before. I think the sentiment against active investing is at sort of…